Why Air Canada Aeroplan has become my favorite Star Alliance loyalty program

Even if you travel on many different airlines, it makes sense to focus on just one loyalty program in each of the Big Three airline alliances: Oneworld, Star Alliance and SkyTeam.

By focusing on one program per alliance, you can earn rewards faster by crediting everything to one program, as your points and miles won't be spread across multiple programs within the same alliance. If you fly enough (or hold the right credit card), you might earn elite status in the program, making your travel more comfortable, convenient and rewarding.

Given that I live in the United Kingdom, I've largely focused on British Airways Executive Club as my Oneworld loyalty program of choice. Avios can be transferred between five loyalty programs, and Executive Club elite status is quite easy to earn. For the SkyTeam alliance, I was previously a fan of Virgin Atlantic's Flying Club program; however, Air France-KLM's Flying Blue program has steadily risen to become my SkyTeam program of choice.

But what about Star Alliance?

Here's why Aeroplan has become my favorite Star Alliance loyalty program despite my rarely setting foot in Canada.

Related: Air Canada's Aeroplan program: The ultimate guide to earning and redeeming points

Aeroplan partners with most major credit card currencies

Aeroplan partners directly with four of the six major programs with transferable currencies:

Many of these programs offer cards that feature generous welcome bonuses. Here's just a sample of the travel rewards credit cards that earn transferable points or miles that can be converted to Aeroplan points at a 1:1 rate:

- The Platinum Card® from American Express: Find out your offer and see if you are eligible for as high as 175,000 Membership Rewards points after spending $12,000 on purchases in your first six months of card membership. Welcome offers vary and you may not be eligible for an offer.

- The Business Platinum Card® from American Express: Earn 200,000 Membership Rewards points after you spend $20,000 on eligible purchases within the first three months of card membership.

- American Express® Gold Card: Find out your offer and see if you are eligible to earn as high as 100,000 Membership Rewards points after spending $6,000 on purchases within the first six months of card membership. Welcome offers vary and you may not be eligible for an offer.

- Capital One Venture Rewards Credit Card: Earn 75,000 bonus miles when you spend $4,000 on purchases within the first three months from account opening. Plus, upon approval, you'll receive a $250 Capital One Travel credit to use during your first year.

- Capital One Venture X Rewards Credit Card: Earn 75,000 bonus miles after spending $4,000 on purchases in the first three months from account opening.

- Ink Business Preferred® Credit Card (see rates and fees): Earn 100,000 bonus points after you spend $8,000 on purchases in the first three months from account opening.

- Chase Sapphire Preferred® Card (see rates and fees): Earn 75,000 points after spending $5,000 in the first three months of account opening.

Related: Why transferable points are worth more than other rewards

Aeroplan transfer bonuses

Card issuers, especially American Express and Chase, have offered occasional transfer bonuses, usually around 20%, when transferring credit card points to Aeroplan.

This means you'll receive even more than a 1:1 transfer rate during these limited-time promotions, boosting your Aeroplan points balance and making earning the points for that dream redemption easier.

Related: A complete list of transfer bonuses over the past decade — which issuer is the most generous?

Earn and redeem Aeroplan points on many different airlines

The best feature of the Aeroplan program is the jaw-dropping number of airlines on which you can earn and redeem Aeroplan points. At the time of writing, there are 50 different airline redemption partners. I can't think of another airline loyalty program with this many partners, and most are bookable online.

You can earn and redeem Aeroplan points on the following Star Alliance members:

- Aegean Airlines

- Air Canada

- Air China

- Air India

- Air New Zealand

- All Nippon Airways

- Asiana Airlines

- Austrian Airlines

- Avianca

- Brussels Airlines

- Copa Airlines

- Croatia Airlines

- Egyptair

- Ethiopian Airlines

- EVA Airways

- LOT Polish Airlines

- Lufthansa

- Shenzhen Airlines

- Singapore Airlines

- South African Airways

- Swiss

- TAP Air Portugal

- Thai Airways

- Turkish Airlines

- United Airlines

Related: Is Air Canada premium economy worth it on the Boeing 777-300ER from Amsterdam to Toronto?

You can also earn and redeem Aeroplan points on the following nonalliance airlines:

- Air Creebec

- Air Dolomiti (Star Alliance affiliate)

- Air Mauritius

- Air Serbia

- Azul Brazilian Airlines

- Bamboo Airways

- Calm Air

- Canadian North

- Cathay Pacific

- Central Mountain Air

- Discover Airlines (Star Alliance affiliate)

- Edelweiss

- Emirates

- Etihad Airways

- Eurowings (Star Alliance affiliate)

- Flydubai

- Gol Airlines

- Gulf Air

- Juneyao Air (Star Alliance connecting partner)

- Olympic Air

- Oman Air

- PAL Airlines

- SunExpress

- Virgin Australia

- Vistara

Sure, I have no plans to fly Calm Air or Air Creebec, but having Emirates and Etihad — with their massive route networks — as partners is amazing.

Related: A review of Emirates business class on the Airbus A380 from New York to Milan

You can earn and redeem Aeroplan points on all of the above airlines as well as four additional earn-only airlines:

- Aer Lingus

- Central Mountain Air

- Middle East Airlines

- SriLankan Airlines

Aeroplan partner awards follow an award chart with no surcharges

While redeeming Aeroplan points for flights operated by Air Canada is now priced dynamically, often at absurd rates like 550,000 points for a single flight, fortunately, redemptions for flights operated by partner airlines are priced using a unique and generous hybrid award chart.

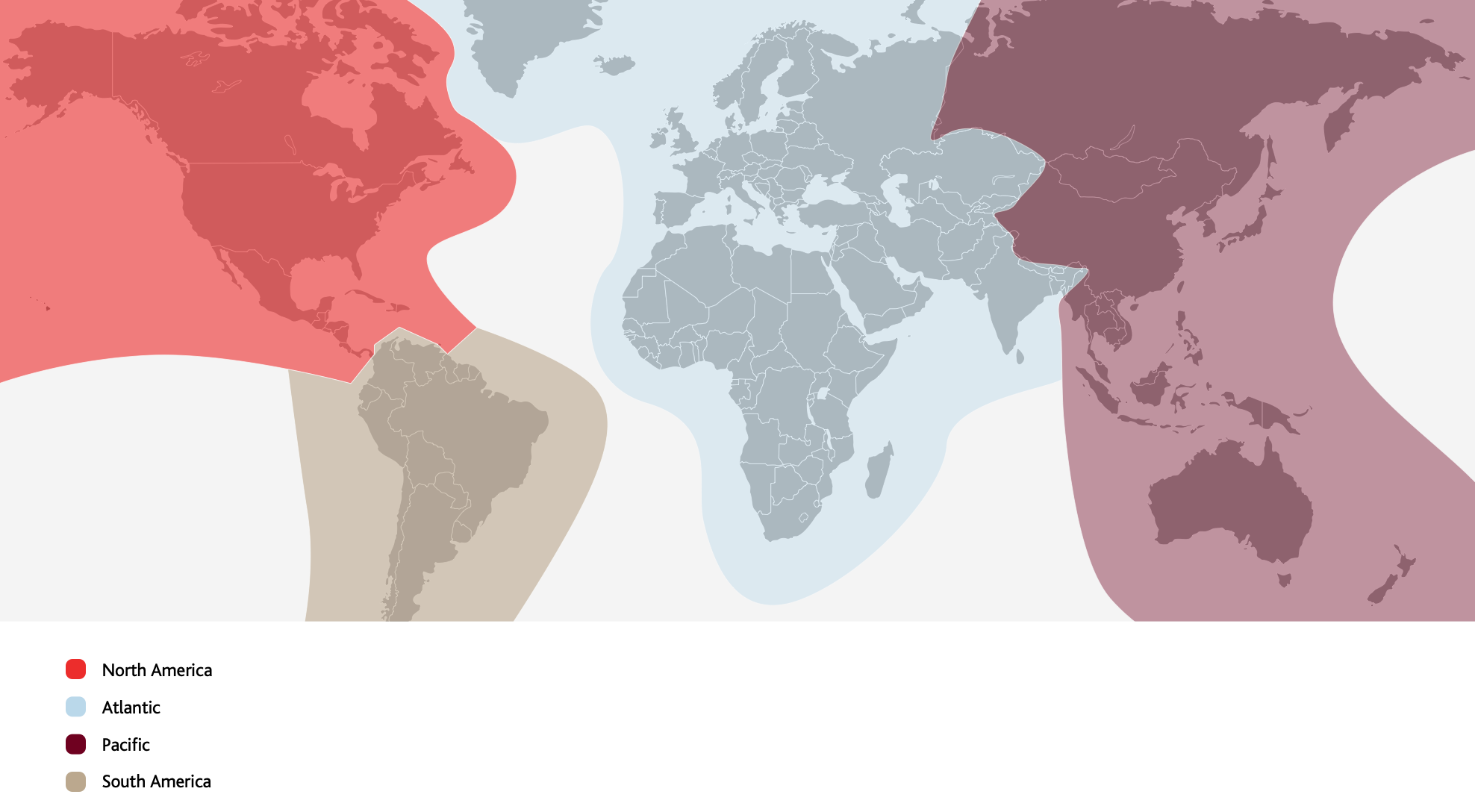

You'll pay based on your flight length, but pricing varies based on the regions you fly to and from, with regions being very broadly defined. For example, the "Atlantic" region covers everything from Norway to South Africa to India.

Once you have decided which region(s) you want to travel to, you can check the distance of your itinerary (using a tool like Great Circle Mapper). Then, based on the award charts, you can determine how many Aeroplan points you will need to redeem for the flight.

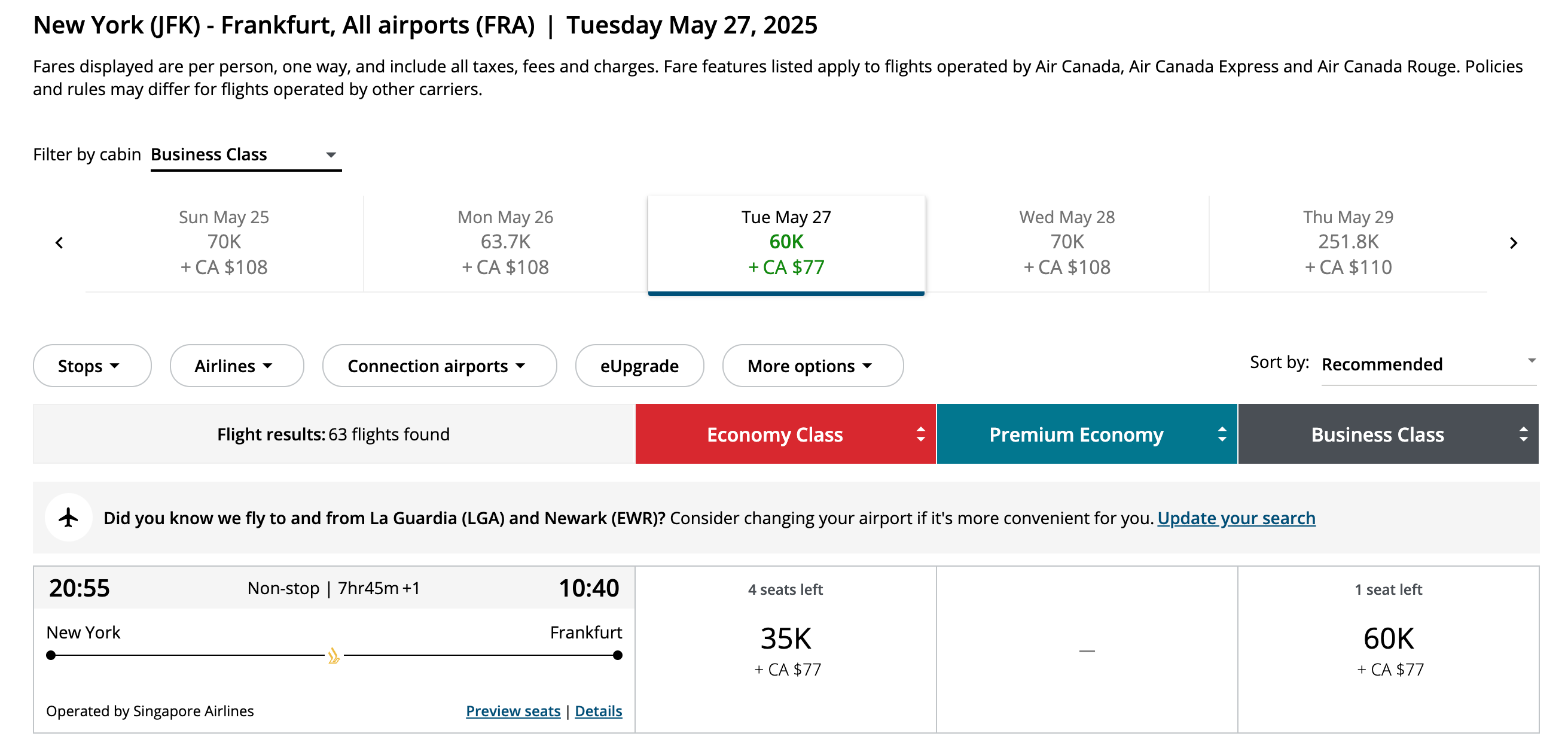

For example, you could fly on Singapore Airlines' fifth-freedom route from John F. Kennedy International Airport (JFK) to Frankfurt Airport (FRA) in Germany for just 60,000 Aeroplan points in business class plus about $57 in taxes and fees.

This is an incredible deal on one of the world's best airlines in business class to Europe.

You can also book economy flights on United Airlines within the continental U.S. and Canada from just 6,000 Aeroplan points for flights up to 500 miles in length, such as from Dulles International Airport (IAD) to many Northeast destinations.

Aeroplan also does not have carrier-imposed surcharges, which can save you hundreds of dollars compared with redeeming through a program that does impose these surcharges.

Related: 7 takeaways from my first Singapore Airlines business-class experience

Add a stopover for just 5,000 extra Aeroplan points

The Aeroplan loyalty program has a lesser-known but valuable perk that allows you to add a stopover on the way to your destination for just 5,000 additional points. For round-trip Aeroplan redemptions, you can add a stopover on your outbound flight and another stopover on your return flight for 5,000 points each.

There are some stopover rules to keep in mind; however, I do not consider them to be onerous:

- You can't include a stopover in Canada or the U.S.

- The distance you fly between your origin and destination in one direction must be less than double the nonstop distance.

- You cannot backtrack through the same airport, city or country when traveling in one direction.

- Your stopover cannot exceed 45 days.

Related: Add a stopover to your Aeroplan award ticket for just 5,000 points

Best way to book Lufthansa first class with points and miles

Following Avianca LifeMiles' unexpected increase of redemption rates to Europe, Aeroplan is now the cheapest option to book Lufthansa's famous first-class product to Europe and beyond.

Compared with 130,000 LifeMiles, Aeroplan charges just 90,000 points from the East Coast to Europe in Lufthansa first class, or 100,000 points from the West Coast to Europe each way, plus minimal taxes and fees of around $50.

Related: On board the first Lufthansa Allegris flight — was the new cabin worth the wait?

The Aeroplan credit card is seriously underrated

Air Canada's Aeroplan® Credit Card(see rates and fees) from Chase is one of my favorite cobranded airline credit cards.

You may not realize just how many benefits this card has, including some rarely seen on an airline-branded credit card. Here are some of the best benefits of this card:

- Earn a welcome bonus of 60,000 points: New Air Canada Aeroplan credit card applicants can earn 60,000 bonus points after spending $3,000 on purchases in the first three months from account opening.

- Earn triple points in key categories: Cardholders earn 3 Aeroplan points per dollar spent at grocery stores, on dining (including takeout and delivery) and on purchases made directly with Air Canada, and 1 point per dollar spent on all other purchases.

- Monthly bonus points: For every $2,000 spent on the card, cardholders receive up to a 500-point bonus — up to 1,500 points per month.

- Redeem points for any travel purchase: Cardholders can redeem Aeroplan points toward any airline, hotel or car rental at a rate of 1.25 cents each.

- Statement credits: Cardholders receive up to $120 in statement credits for Global Entry, TSA PreCheck or Nexus applications every four years.

- Aeroplan elite status: Cardholders receive automatic Aeroplan 25K elite status in the calendar year the cardmember opens the card and the following year. Benefits include priority check-in and boarding, discounted pricing on some award redemptions when flying with Air Canada, a 50% discount on Preferred Seats, two one-time guest passes to Air Canada's Maple Leaf Lounges located in the domestic and U.S. zones of Canadian airports, and 20 eUpgrade credits each year.

Related: Incredible benefits of the Air Canada Aeroplan credit card

Bottom line

No airline program is perfect in the ever-changing world of customer loyalty. But while 2024 has seen other popular programs increase redemption rates without notice, Air Canada's Aeroplan program has remained a solid choice for my Star Alliance loyalty.

Not only are Aeroplan points easy to earn, but the redemption rates across many partner airlines have helped me obtain real value from this loyalty program.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app