American Airlines just expanded its cheapest, most restrictive fares to another region

It's been a little over two and a half years since American Airlines first introduced basic economy fares. After starting on just 10 domestic routes, it wasn't long before the airline's cheapest and most restrictive fares expanded nationwide. In spring 2018, AA added basic economy fares to Europe. Then, in September 2018, basic economy expanded to Hawaii and the Caribbean. But it's been relatively quiet since then.

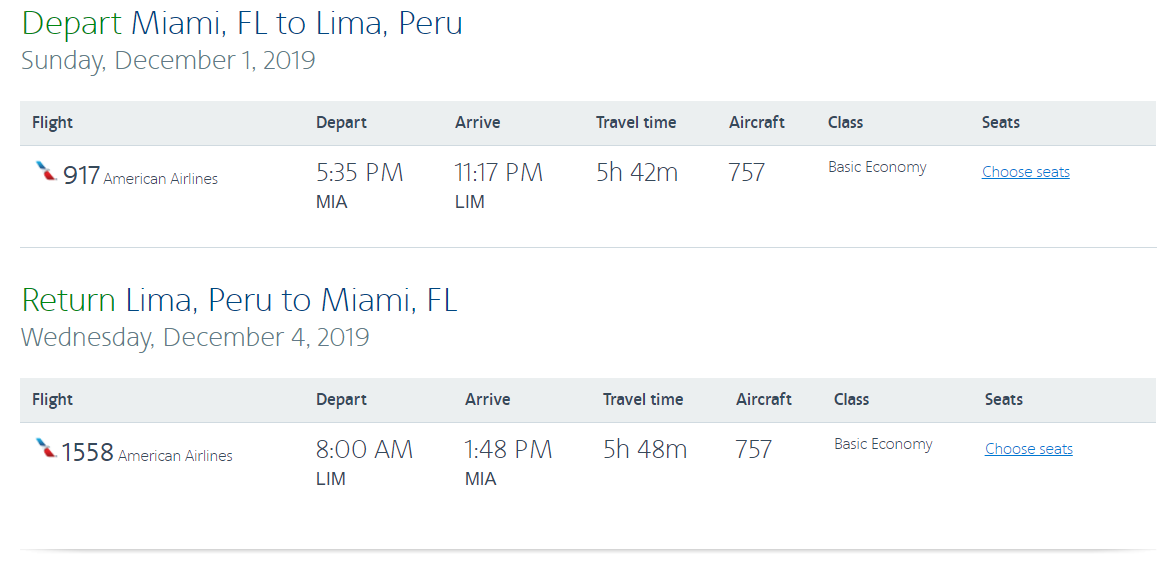

Unfortunately, that streak just ended. American Airlines confirmed to TPG that basic economy fares were added to select South America routes this week.

Basic economy fares are now available on both nonstop and connecting routes to Santiago, Chile (SCL) and Lima, Peru (LIM) from Chicago (ORD), Dallas/Fort Worth (DFW), Los Angeles (LAX), Miami (MIA) and New York City (JFK/LGA/EWR).

As far as expanding to other South American routes, an American Airlines spokesperson confirmed that the airline is "always evaluating new markets for Basic Economy but do not have any additional South America news to share at this time."

The basic economy restrictions on these South American routes match the restrictions on European basic economy fares. Passengers will be allowed to bring a carry-on bag as well as a personal item. However, basic economy fares won't be eligible for upgrades, advanced seat selection will be subject to a fee and passengers will be assigned group 8 boarding. As with other basic economy fares, American Airlines and Oneworld elites will retain their priority boarding and checked bag benefits.

While credit cards can help you defeat basic economy, the complimentary first checked bag benefit on American Airlines co-branded credit cards is limited to domestic itineraries. That means having a AA credit card won't help you gain back a checked bag benefit on these South American basic economy fares.

As basic economy theoretically allows legacy airlines to answer low-cost carriers, it's understandable to see American Airlines adding basic economy to Lima, Peru -- where it's facing stiff price competition from Spirit Airlines. The decision to add basic economy on routes to Santiago, Chile is less clear, but an AA spokesperson noted that American Airlines' major South America partner LATAM has offered its Promo product from time to time in that market, which is equivalent to American's Basic Economy offering. The addition comes shortly after LATAM announced that it's leaving AA's Oneworld alliance following an investment from Delta.

To learn more about basic economy restrictions, check out our guides on what you need to know about basic economy on American Airlines, Delta and United -- as well as our survival guides to flying Spirit and Frontier.

TPG featured card

Rewards

| 2X miles | 2 miles per dollar on every purchase |

| 5X miles | 5 miles per dollar on flights and vacation rentals booked through Capital One Business Travel |

| 10X miles | 10 miles per dollar on hotels and rental cars booked through Capital One Business Travel |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

The Capital One Venture X Business Card has all the Capital One Venture X Rewards Credit Card has to offer and more. It offers an incredible welcome bonus and requires an equally impressive spend to qualify. In addition, the card comes with premium travel perks like annual travel credit. (Partner offer)Pros

- The Capital One Venture X business card has a very lucrative welcome offer.

- In addition, the card comes with many premium travel perks such as an annual $300 credit for bookings through Capital One Business Travel.

- Business owners are also able to add employee cards for free.

Cons

- The card requires significant spending to earn the welcome offer.

- Another drawback is that the annual travel credit can only be used on bookings made through Capital One Business Travel.

- LIMITED-TIME OFFER: Earn up to 400K bonus miles: 200K miles when you spend $30K in the first 3 months, and an additional 200k miles when you spend $150k in the first 6 months

- Earn unlimited 2X miles on every purchase, everywhere—with no limits or category restrictions

- Earn 10X miles on hotels and rental cars and 5X miles on flights and vacation rentals booked through Capital One Business Travel

- With no preset spending limit, enjoy big purchasing power that adapts so you can spend more and earn more rewards

- Empower your teams to make business purchases while earning rewards on their transactions, with free employee and virtual cards. Plus, automatically sync your transaction data with your accounting software and pay your vendors with ease

- Redeem your miles on flights, hotels and more. Plus, transfer your miles to any of the 15+ travel loyalty programs

- Every year, you'll get 10,000 bonus miles after your account anniversary date. Plus, receive an annual $300 credit for bookings made through Capital One Business Travel

- Receive up to a $120 credit for Global Entry or TSA PreCheck®. Enjoy access to 1,300+ airport lounges worldwide, including Capital One Lounge locations and Priority Pass™ lounges, after enrollment

- Enjoy a $100 experience credit and other premium benefits with every hotel and vacation rental booked from the Premier Collection

- This is a pay-in-full card, so your balance is due in full every month

- Top rated mobile app

Rewards Rate

| 2X miles | 2 miles per dollar on every purchase |

| 5X miles | 5 miles per dollar on flights and vacation rentals booked through Capital One Business Travel |

| 10X miles | 10 miles per dollar on hotels and rental cars booked through Capital One Business Travel |

Intro Offer

Earn 200K miles when you spend $30K in the first 3 months, and an additional 200K miles when you spend $150K in the first 6 monthsLIMITED-TIME OFFER: Earn up to 400K bonus milesAnnual Fee

$395Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.740-850Excellent

Why We Chose It

The Capital One Venture X Business Card has all the Capital One Venture X Rewards Credit Card has to offer and more. It offers an incredible welcome bonus and requires an equally impressive spend to qualify. In addition, the card comes with premium travel perks like annual travel credit. (Partner offer)Pros

- The Capital One Venture X business card has a very lucrative welcome offer.

- In addition, the card comes with many premium travel perks such as an annual $300 credit for bookings through Capital One Business Travel.

- Business owners are also able to add employee cards for free.

Cons

- The card requires significant spending to earn the welcome offer.

- Another drawback is that the annual travel credit can only be used on bookings made through Capital One Business Travel.

- LIMITED-TIME OFFER: Earn up to 400K bonus miles: 200K miles when you spend $30K in the first 3 months, and an additional 200k miles when you spend $150k in the first 6 months

- Earn unlimited 2X miles on every purchase, everywhere—with no limits or category restrictions

- Earn 10X miles on hotels and rental cars and 5X miles on flights and vacation rentals booked through Capital One Business Travel

- With no preset spending limit, enjoy big purchasing power that adapts so you can spend more and earn more rewards

- Empower your teams to make business purchases while earning rewards on their transactions, with free employee and virtual cards. Plus, automatically sync your transaction data with your accounting software and pay your vendors with ease

- Redeem your miles on flights, hotels and more. Plus, transfer your miles to any of the 15+ travel loyalty programs

- Every year, you'll get 10,000 bonus miles after your account anniversary date. Plus, receive an annual $300 credit for bookings made through Capital One Business Travel

- Receive up to a $120 credit for Global Entry or TSA PreCheck®. Enjoy access to 1,300+ airport lounges worldwide, including Capital One Lounge locations and Priority Pass™ lounges, after enrollment

- Enjoy a $100 experience credit and other premium benefits with every hotel and vacation rental booked from the Premier Collection

- This is a pay-in-full card, so your balance is due in full every month

- Top rated mobile app