How Capital One miles can make your next trip to the Maldives close to free

One of the biggest annoyances about award travel to theMaldives is how pricey non-room expenses are. You may have enough points for a "free" room, but your vacation will still be far from complimentary.

Because of this, even many points and miles collectors consider the Maldives a once-in-a-lifetime trip. But if you can pair your hotel points with a healthy stash of Capital One miles, the Maldives can cost you almost nothing.

I'll show you why you shouldn't meander too deeply into the Maldives without a healthy stash of Capital One miles.

Erase pesky Maldives expenses with Capital One miles

Capital One miles have an advantage that most other travel rewards do not: They can reimburse just about any travel purchase.

You don't have to make your purchase through a special travel portal; simply use your Capital One miles-earning credit card for a travel-related purchase, and you can effectively "erase" the purchase from your transaction history (within 90 days after it posts) at a rate of 1 cent per point.

Do you know why that's a big deal? Almost everything in the Maldives can be charged to your hotel room. Things like food, fishing tours, massages, etc., magically turn into travel expenses when you charge them to your room.

Related: The secret to getting free food with Capital One miles

Capital One miles are critical for a cheap Maldives trip. Even if you book a "free" stay, the peripheral fees and expenses will drain your wallet.

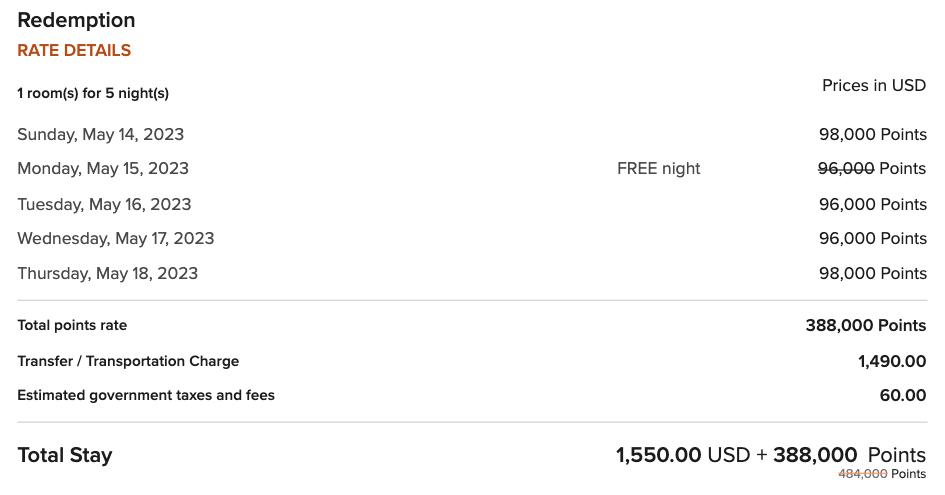

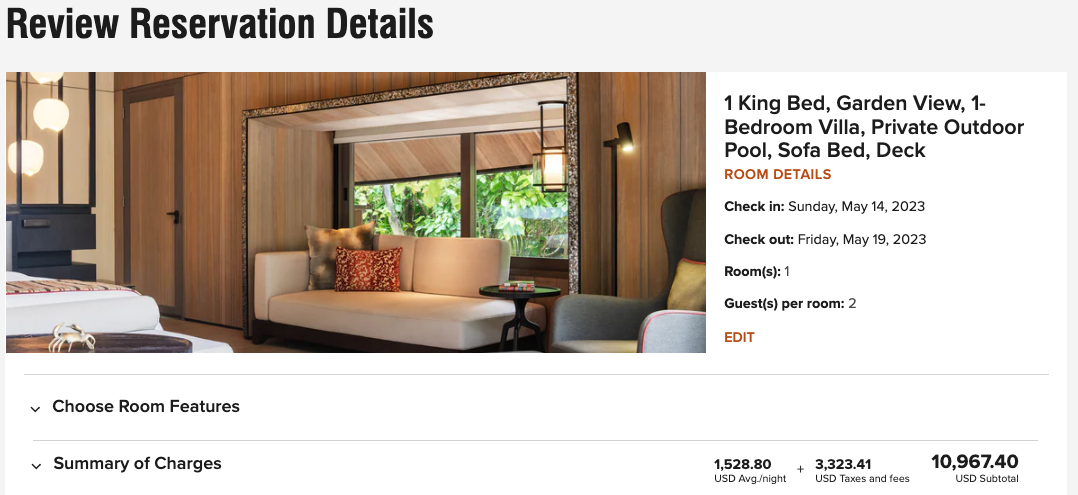

For example, here's the cash price for two guests for a five-night stay at The St. Regis Maldives next spring: a whopping $10,967.

You can book the same stay with 388,000 points. But even when paying $0 for the room, you'll still pay $1,550 in "fees" — $745 per person for the seaplane transfer to the island, plus taxes.

In other words, your "free" Maldives vacation requires you and a travel buddy to pay $1,550 before you even get to the hotel — where the real expenses begin to add up.

My husband and I visited The St. Regis Maldives a few years ago. Food prices in the Maldives are jarring — and there's nothing you can do but pay, since you're marooned on a luxury island far from local dives and cheap eateries.

During our trip, we spent over $100 per person per meal. Our Marriott elite status gave us free breakfast, but we still paid more than $400 per day for food.

Here are some other random things we paid for:

- Private (and brief) visit to a secluded sandbar: $300.

- One massage: $150.

- Jungle cinema: $750 (it included dinner).

All this to say, an award stay in the Maldives will still cost more than a paid stay in most other parts of the world. The sparkling archipelago isn't for budget travelers.

But by charging all these extracurricular activities to the room, you can simply pay with your Capital One miles-earning card at checkout and then use miles to "erase" the expenses.

The $750 price for the jungle cinema was unforgivable. But the experience was unforgettable, and it cost 75,000 Capital One points. I'd say that's worth it for the experience.

Note: Chase Ultimate Rewards points can technically serve a similar purpose. You can cash them out at a rate of 1 cent each, meaning you can simply redeem Chase points for cash to offset expenses. We value Chase points more highly than Capital One miles, however, and wouldn't recommend using them this way.

Related: What are points and miles worth? Here are TPG's monthly valuations

Bottom line

If you're planning an award trip to the Maldives, it will benefit you to collect Capital One miles alongside whichever hotel points currency you intend to use.

During your trip, try to charge everything to your room — food, massages, etc. If you're purchasing an activity, confirm that you can charge it to your room as well.

Then, at checkout, swipe your eligible Capital One credit card and offset the purchases with Capital One miles at your leisure. You'll have 90 days after the expenses post to your account to "erase" them with miles.

Feature photo by Mystockimages/Getty Images.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app