Free Spirit Dining program: Earn easy points and keep your account active

Editor's Note

Update: Some offers mentioned below are no longer available. View the current offers here.

Points earned through the Free Spirit loyalty program expire if you don't have any qualifying earning or redeeming activity within 12 months. But, even if you don't fly with Spirit frequently, you can keep your Spirit points from expiring by earning through the Free Spirit Dining program at least once a year.

Free Spirit Dining is a dining rewards program that lets you earn Spirit points when you dine at participating restaurants, bars and clubs. These points are in addition to the rewards you'd normally earn with your rewards card and the restaurant's rewards program. Now, let's take a closer look at the Free Spirit Dining program so you can decide whether it's a good fit for you.

How to join Free Spirit Dining

Free Spirit Dining is available to all Free Spirit members. You must enroll in Free Spirit Dining, but it's free to join; your membership will stay active as long as you have at least one qualifying dining activity with the program every 36 months.

To join, go to the Free Spirit Dining website, enter your email address and click the "Get Started" button. You'll need to provide your Free Spirit number, name and ZIP code, plus set up a password for your Free Spirit Dining account.

You'll also be asked if you would like to receive email communications. Although no one likes unnecessary marketing emails, you should do so as it will boost your earning rate with the Free Spirit Dining program significantly.

You can often earn a new member bonus when you sign up for the Free Spirit Dining program and spend $30 or more at a participating restaurant within the first 30 days of joining. So, check whether there is an offer when you sign up. However, you must write an online review within 30 days of your visit and remain opted in to receive emails to earn the bonus.

Finally, before heading out to a participating restaurant, bar or club, you must link at least one credit or debit card to your Free Spirit Dining account. We recommend linking one of the best cards for dining, although you can link almost any card. However, you can only link each card to one dining program. So, for example, if your Chase Sapphire Reserve card is already linked to AAdvantage Dining, linking it to Free Spirit Dining will unlink it from AAdvantage Dining.

Related: Spirit baggage fees and how to avoid paying them

How to earn points with Free Spirit Dining

Free Spirit Dining requires you to link at least one card to your account; this is how it determines when you visit a participating restaurant, bar or club and how much you spend. Since your account is linked to your payment method, you'll automatically earn points when you visit a participating establishment and pay with a linked card. You don't need to give the restaurant your frequent flyer number or submit photos of receipts.

Your standard earning rate with the Free Spirit Dining program depends on your membership tier within the program:

- Basic members: Earn 1 point per $2 if you don't opt in to email communications from Free Spirit Dining

- Select members: Earn 3 points per dollar if you opt in to email communications from Free Spirit Dining

- VIP members: Earn 5 points per dollar if you opt in to email communications from Free Spirit Dining and have already completed 11 qualified transactions in the current or previous calendar year

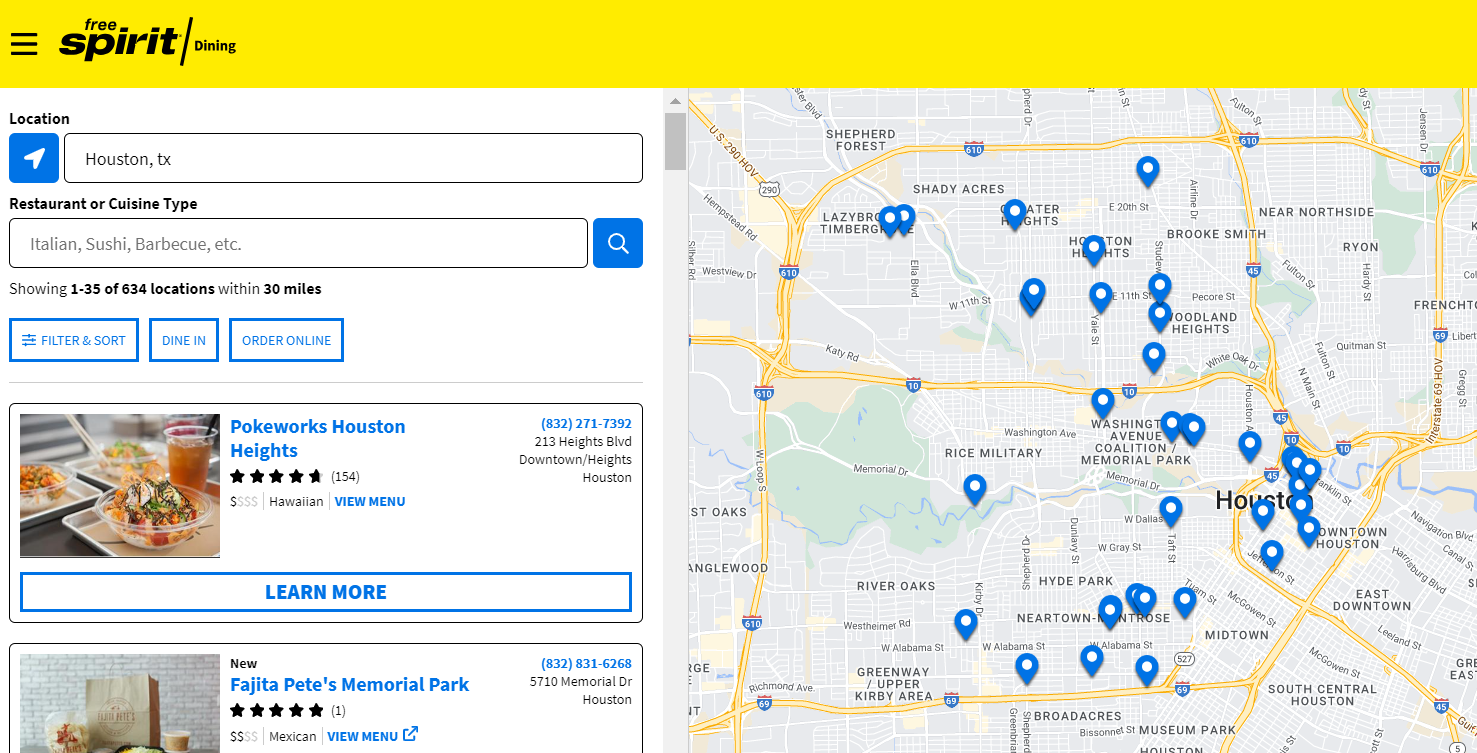

You can find participating restaurants by searching on the Free Spirit website. Enter your city or ZIP code to see participating restaurants, bars and clubs near you.

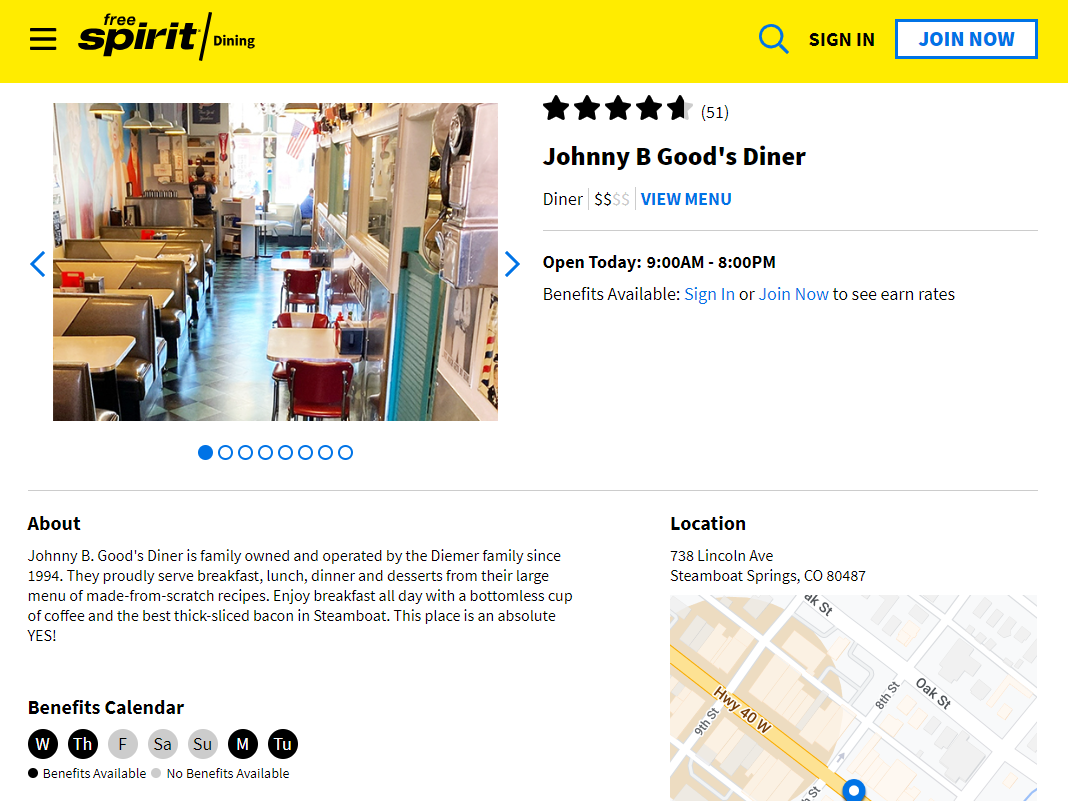

However, note that some restaurants do not participate in the rewards program every day of the week. Some may even limit the points you can earn by dining at their establishment within a month. You can find this information on each venue's Free Spirit Dining page.

Points will appear in your Free Spirit Dining account within three to five days of your visit and will be transferred to your Free Spirit account within one to two weeks.

Related: How to change or cancel a Spirit Airlines flight

Best cards for Free Spirit Dining

Since the points you earn with the Free Spirit Dining program are in addition to the rewards you earn from the card you use to purchase, you'll want to use one of the best cards for dining.

Fortunately, there are lots of cards that offer bonus points at restaurants. A popular option is the American Express® Gold Card, which earns 4 Membership Rewards points per dollar spent at restaurants worldwide (on up to $50,000 in purchases per calendar year, then 1 point per dollar). The Chase Sapphire Reserve and the Chase Sapphire Preferred Card are also good options that earn 3 Ultimate Rewards points per dollar spent at restaurants, including eligible delivery services, takeout and dining out.

Related: How to upgrade your seat on Spirit Airlines

Bottom line

Joining a dining rewards program like Free Spirit Dining is an easy way to earn rewards without traveling. You can set up your account, forget about it and reap the rewards whenever you dine at a participating restaurant. Or, you can actively seek out restaurants, bars and clubs that participate in your favorite dining rewards program.

Other dining rewards programs may provide more valuable rewards. For example, AAdvantage Dining is popular since the rewards are more valuable, and you can earn Loyalty Points to help you qualify for American Airlines elite status. Also, the Marriott Bonvoy Eat Around Town program provides elevated earning rates for Marriott Bonvoy elite members. But if Spirit is your go-to airline or you need account activity to keep your Free Spirit points from expiring, then the Free Spirit Dining program may be best for you.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app