American AAdvantage miles vs. Loyalty Points: What's the difference?

Editor's Note

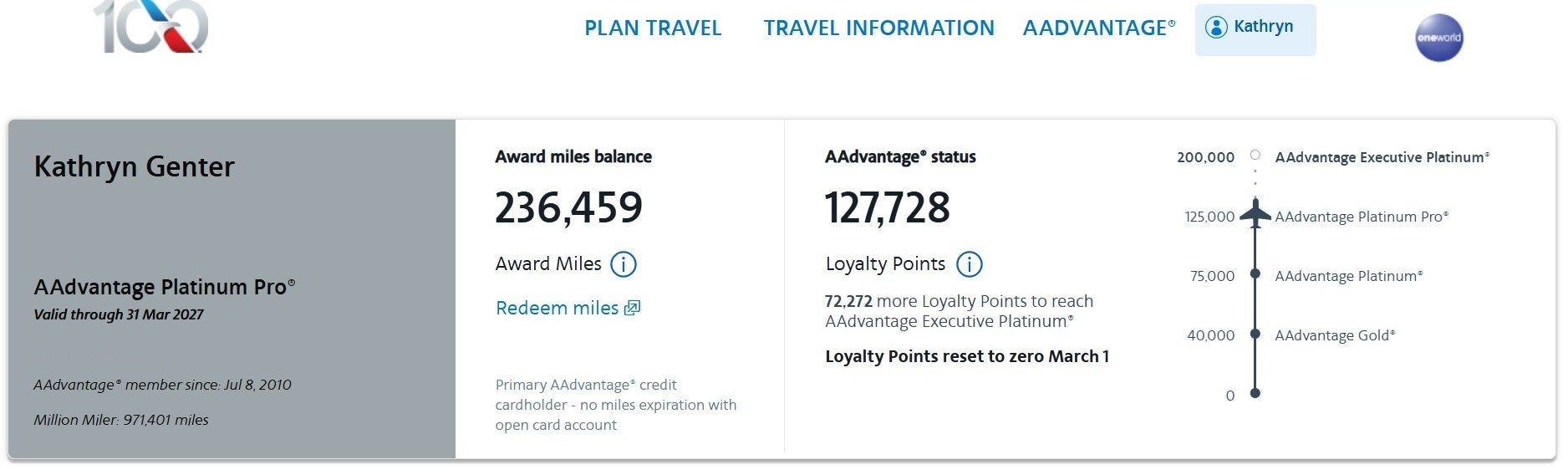

If you've looked at your American Airlines account recently, you've likely seen two numbers: miles and Loyalty Points. Although Loyalty Points and American Airlines AAdvantage miles are related, they differ greatly — and since Loyalty Points reset to zero every year on March 1, it's important to know the difference.

So, here's what you need to know.

American Airlines miles vs. Loyalty Points

When you open the American Airlines mobile app or log in to your account online, you'll see two prominent numbers: award miles and Loyalty Points.

In short, award miles are what you can redeem for flights, upgrades and seats, while Loyalty Points are the metric by which American Airlines awards elite status and Loyalty Point Rewards. Let's take a closer look at each.

Related: Why American Airlines AAdvantage has become my most valuable rewards currency

What are American miles?

You earn award miles — also called American miles or AAdvantage miles — when you credit paid flights on American Airlines and select partner airlines (including Oneworld alliance partners like Alaska Airlines and British Airways) to the AAdvantage program. You can also earn American miles through other avenues, including using the AAdvantage eShopping portal and taking advantage of SimplyMiles shopping offers.

You can redeem American miles for flights, upgrades, seats and more. Award miles don't reset to zero or expire as long as you are the primary cardmember of an open AAdvantage credit card, you are under 21 years old, or you earn or redeem miles on American or with an AAdvantage partner at least once every 24 months.

What are Loyalty Points?

Loyalty Points, on the other hand, are the metric by which you earn American Airlines elite status and Loyalty Point Rewards. Some, but not all, award miles you earn give you Loyalty Points. You can also occasionally earn Loyalty Points through promotions or by holding select AAdvantage credit cards and meeting specific spending or Loyalty Point thresholds.

You can't redeem Loyalty Points for award flights; they're only good for earning American Airlines elite status and Loyalty Point Rewards. As a reminder, Loyalty Point Rewards are extra benefits you earn as you reach specific amounts of Loyalty Points throughout your qualification period.

Each year, you must requalify for American Airlines elite status and work toward earning new Loyalty Point Rewards during the airline's elite qualification period. Instead of the calendar year qualification period used by most other programs, American AAdvantage uses a March 1 to Feb. 28 (or Feb. 29 in leap years) period. So, just as your Marriott elite night credits reset to zero Jan. 1 each year, Loyalty Points reset to zero every March 1.

Related: How I earned 29,000 Loyalty Points and 23,000 AAdvantage miles on a single $800 hotel stay

Bottom line

Your Loyalty Points balance — the metric American Airlines uses for elite status qualification and Loyalty Point Rewards — will reset on March 1. But your award miles — the ones you can redeem to book flights — won't reset then. You'll keep your American Airlines miles as long as your account is active, you're under 21 or you're the primary cardmember on an AAdvantage credit card.

Related reading:

- How to redeem American Airlines AAdvantage miles for maximum value

- 9 times you won't earn American Airlines Loyalty Points, even if you earn miles

- 8 methods that earned American AAdvantage Executive Platinum for 2025 and my strategy for 2026

- My strategy now that the Barclays Aviator cards will turn into Citi cards

- Last-minute strategies for earning American Airlines elite status

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app