If you've hit status for 2020, now is a great time to consider a challenge

It's November! If you're reading this, you've likely already solidified elite status with your preferred airline through 2020, and you're probably kicking your feet up. But how about matching your status with an airline you don't fly as much? Is it worth ditching your current airline for another if you can get status with another for the fraction of the price?

Most elites earn status from spending much time in the air and spending thousands on a single airline. However, there are ways to get around these requirements or leverage a soon-to-be-expiring status to jump ship to another carrier.

Why is elite status important, you might ask? It makes air travel more comfortable and affordable. From benefits like upgrades, lounge access, early boarding, free seat selection and waived baggage fees, these perks are desired by millions of travelers who fly each year, but only apply to the small percentage of flyers who hold elite status — or the right credit card.

Some TPG-ers have received status match challenges -- from TPG himself receiving a Delta status match to Editorial Director Scott Mayerowitz receiving one from United. I'll dive into each status match (some appear to be targeted) and then explain whether a status match is right for you.

Delta

If you currently have elite status with another airline, Delta says it will give you the equivalent Medallion status for three months, complimentary. For instance, if you're a United Premier Gold you can match status and earn Platinum Medallion status with Delta.

Related: What is Delta elite status worth?

You'll need to first determine if you're eligible.

Delta says you are eligible to challenge if you have not received a status match or complimentary Medallion status in the past three years, unless the complimentary Medallion Status was through Million Miler Status.

You must currently have elite status with a qualifying airline. So if you earned complimentary status with another airline through a promotion, you aren't eligible. You will need to present both a valid, current elite physical or digital membership card or credential with your name on it and a statement showing your earned elite status with an airline and the corresponding activity with that airline that made you achieve that status, with your name on it.

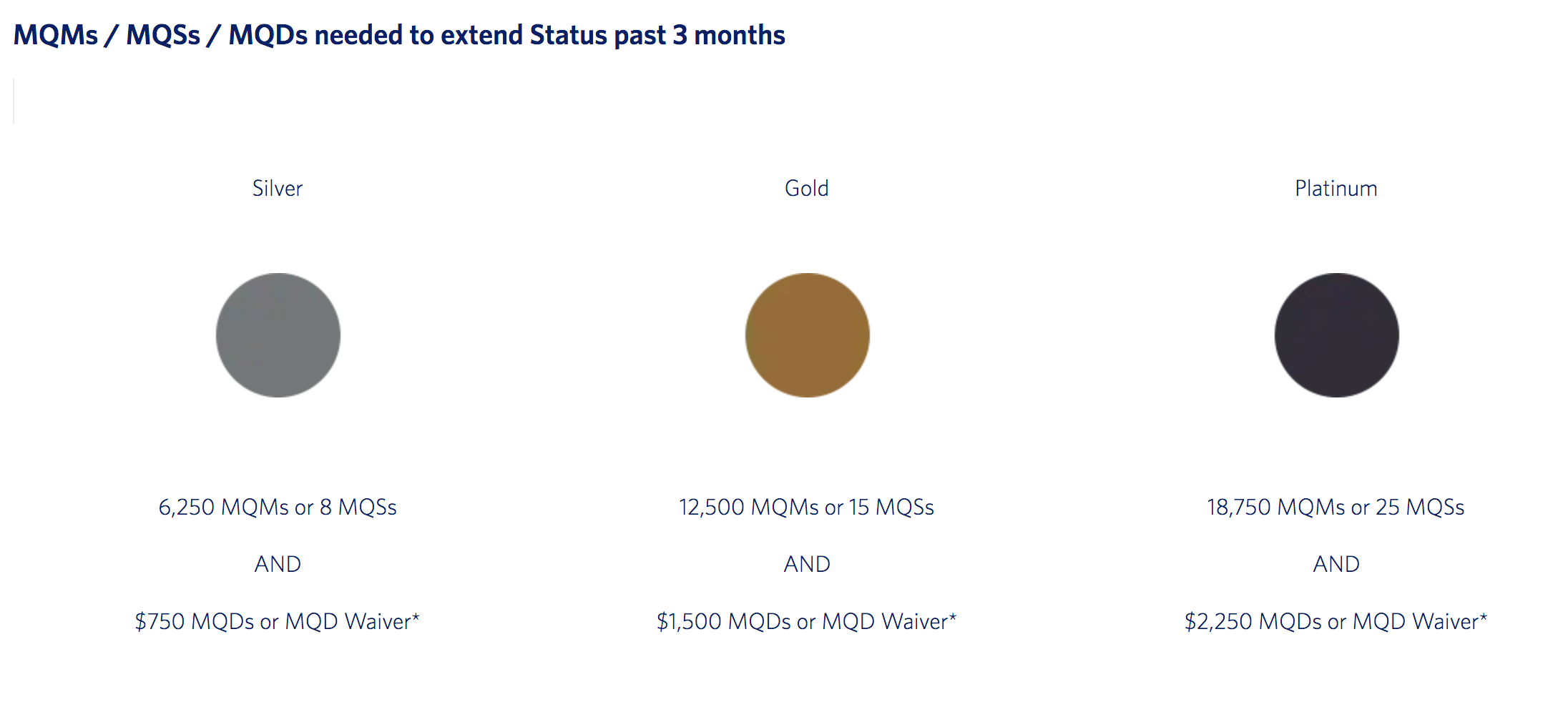

If you find yourself liking Delta more, the airline also says that you'll even have the opportunity to extend your status past three months if you successfully complete the challenge by flying a certain amount, which you can find below.

That's a fraction of what it normally takes to achieve status through Delta. Silver Medallion status normally requires 25,000 MQMs or 30 Medallion Qualification segments plus $3,000 Medallion Qualification Dollars (MQDs). Gold requires 50,000 MQMs or 60 Medallion Qualification Segments plus $6,000 MQDs while Platinum Medallion status requires 75,000 MQMs or 100 Medallion Qualification Segments plus $9,000 MQDs.

If you meet the requirements, you'll keep status through January 2021.

United

United is offering an interesting targeted promotion that differs from Delta's offer.

TPG's Scott Mayerowitz received a targeted offer to upgrade to Premier Gold, Platinum or 1K status after flying a certain amount in business class between Newark (EWR) and London (LHR). For Gold status, if targeted, you'll need to complete one qualifying round-trip between the two cities in United Polaris business class. For Platinum status, you'll need to take two qualifying round-trips and for 1K, you'll need to four qualifying round-trips in Polaris.

Related: What is United Airlines elite status worth?

For this challenge, you have until Dec. 15, 2019, to register, book and travel on qualifying United flights. You'll keep status through 2020 if you meet all requirements.

Is jumping ship right for you?

The two examples from United and Delta are different, but they are easier than chasing status outright through the normal channels. And with United making huge changes in the way you can earn elite status, for instance, finding shortcuts to get elite perks can make your life easier.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app