Why You'll Want to Change Your Socks After Airport Security

There's only one thing that Mack, an emergency-room doctor in a major US city, always makes sure he brings with him to the airport, in addition to his passport: an extra pair of socks.

As soon as he passes through the TSA security screening, he picks up his stuff, sits down at a nearby bench and digs through his backpack for those socks. Then — before he slips his cordovan clogs back on — he takes off his old socks and puts on the new ones.

"You don't want to know what you can catch," Mack says when you ask him what the deal is. "You don't want to know."

(Mack, if it isn't obvious, isn't his real name. He asked that we use a pseudonym because of his position.)

Actually, we did want to know, so we asked around. What we found is enough to make your toes curl.

Fungi

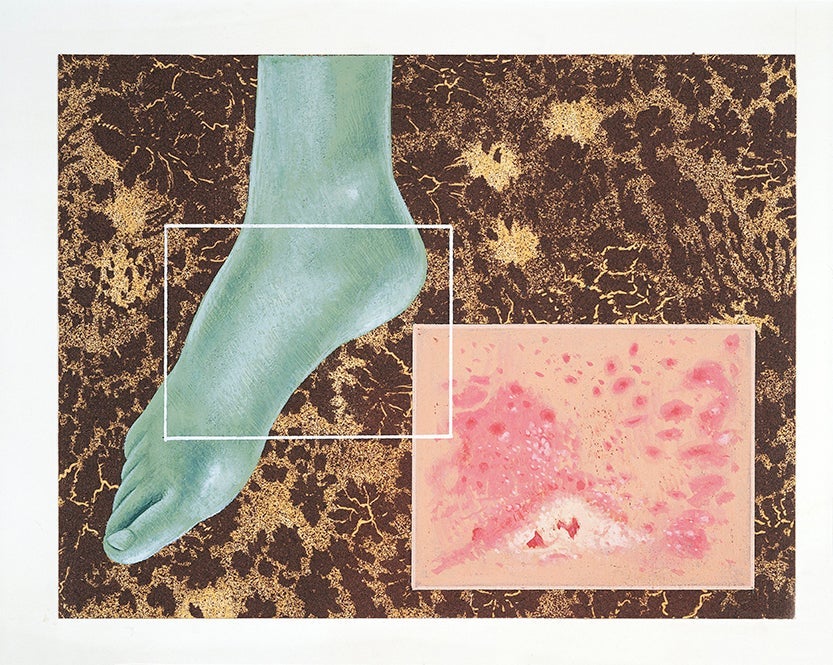

If you were to catch something walking shoeless through airport security, the most likely suspect is a fungal infection, specifically tinea pedis, better known as athlete's foot (on other parts of the body it's called ringworm). The invader is a fungus called Trichophyton rubrum, an organism native to Southeast Asia that didn't appear in the US until the 1920s in Birmingham, Alabama, when former doughboys back from World War I are believed to have brought the disease home from Europe. Now it's estimated that one in every five Americans is itching from it this very second.

There's a reason it's the most prevalent fungal infection among humans in the world: Given the right conditions, it's really easy to catch. Requiring only skin contact with an object that's been infected by another person with the fungus — a towel, clothing, carpet or damp floor — the fungal spores thrive in hot, humid places but can also survive long enough on surfaces with frequent foot traffic to infect unsuspecting people. (Some dermatophytes can survive for an entire year once they've established themselves in the right spot.)

"In a high-traffic area, the number of people per hour going through a checkpoint is greater at an airport than at a health club," Dr. Michael J. Trepal, vice president for academic affairs and dean at the New York College of Podiatric Medicine, said in a phone interview. "And, theoretically, the more you expose the skin to exogenous pathogens, the more likely you are to be infected. In some cases, you could realistically walk 30 to 40 feet [without shoes]."

Of course, if the airport's as hot and humid as a locker room, you may be doomed anyway: Socks won't necessarily protect you from the spores.

The result? Intensely itchy, burning, scaly skin, especially between the toes, sometimes leading to even more weeping blisters and painful fissures in the skin. It can be treated with widely available antifungal sprays and creams, but it's never fun to contract.

Viruses

The virus your feet should be most afraid of while walking through airport security bereft of protection is the one that causes plantar warts. Yes, certain strains of the human papilloma virus aren't just surprise gifts from the worst date you ever had. These forms of HPV enter the body through cuts and breaks in the skin (as opposed to through sexual contact, like the more infamous strains) and form unsightly warts on the bottom of the foot. Sometimes the warts are painful, sometimes they're merely irritating. Either way, they can take years to go away, and most treatments are only successful about half the time. If you're impatient, a doctor may try to freeze the wart off with liquid nitrogen.

As with Trichophyton rubrum, HPV doesn't live for long outside of a human host, but the unusual circumstances of a TSA checkpoint — a long line of shoeless strangers forced to walk in quick succession through the same narrow checkpoint over the same seedy-looking rectangle of floor — could turn an airport into HPV happy hour. (You can also get it at pools, locker rooms and the like.)

Bacteria

Here's where it gets really scary. People with compromised immune systems or with breaks in the skin on their feet could be vulnerable to some especially nasty stuff. The big concern? Methicillin-resistant Staphylococcus aureus, or MRSA (pronounced "mersa"), often nicknamed "the superbug" by the media. It's a kind of staph infection that's troublingly resistant to antibiotics and is becoming increasingly more common since the community-associated version first reared its ugly head in the 1990s.

Once again, it's people with breaks in the skin on their feet, those with immune deficiencies and those with poor circulation who are most at risk at the airport. Someone with a MRSA infection could pass the bacteria onto the floor or rug at a TSA checkpoint, where one of the people following him could pick up the bug through a cut.

A CA-MRSA infection normally looks like a boil or abscess and can be quite painful. In more serious cases, though, MRSA can lead to sepsis, bloodstream infections and pneumonia, all of them potentially fatal.

And MRSA's not the only foot-related bacteria to be worried about at airport security.

"Theoretically, you could pick up a wide variety of bacteria under the skin," Trepal said. "If you had a break in the skin, one of them could gain entry and set off an infection. And a skin infection of the foot could become a systemic infection, too."

How to Prevent All That Stuff

There hasn't been much in the way of published studies looking at disease transmission at airport security, though the TSA commissioned a 2003 study that said the chances of infection while walking through a checkpoint without shoes are "extremely small to remote" when the floor isn't moist. And Trepal emphasized that it's not really clear yet how easily an airport security checkpoint lends itself to transmitting diseases.

"You're probably at a bigger risk of contracting something on your hands, because you're touching stair rails, escalator rails and countertops at the airport for much longer than your feet are walking through security," he said.

But he also said the ways to prevent any infection, whether fungal, viral or bacterial, are largely the same and boil down to common sense and a little discipline.

"It just goes to good bodily hygiene, like washing your hands," he said. "Try to minimize barefoot contact with foreign surfaces, and try to wear socks [inside your shoes] if you want an extra level of precaution."

If you have an open wound or cut on your foot, take the same precautions walking through an airport that you would strolling through the park: Put a bandage on it and keep it clean.

And Dr. Mack's second pair of socks? They do make sense, Trepal said, if you're worried about an infected pair of socks transferring a harmful organism or virus onto your skin or the inside of your shoe.

"Theoretically, yes, the sock is a protective barrier and protects the skin, but if you wear the sock on the floor and it picks up something, yes," he said. "There's certainly no harm in changing your socks."

But Trepal said he himself practices the safest preventative measure of all.

"I have TSA PreCheck now," he said. "I don't have to take my shoes off."

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app