Your guide to United Million Miler status

Editor's Note

Whether you're a dedicated business traveler or a passionate jet-setter, reaching United Million Miler status is a testament to your loyalty. Although it requires a lot of flying on paid tickets, Million Miler members enjoy United Premier status for life.

In fairness, only a small percentage of United MileagePlus members will qualify for lifetime status, but you may still aspire to earn United Million Miler status and lock in benefits for life. So, here's what you need to know about lifetime elite status with United Airlines.

United lifetime miles

United awards Million Miler status based on the total distance you've flown on paid United — and United Express-operated flights credited to MileagePlus. So, while flyers must earn Premier qualifying points (or a combination of Premier qualifying points and Premier qualifying flights) each year to earn United Premier status, lifetime miles on eligible flights are what matter if you're interested in lifetime status.

United lifetime miles do not expire or reset. Most cash fares on United and United Express-operated flights, including United basic economy, count toward your United lifetime miles. Regardless of your cabin class, you earn a lifetime flight mile for each physical mile you fly (based on the miles scheduled for your flights, not the actual flight distance).

Although you can earn PQPs and PQFs on some award bookings, you won't earn lifetime flight miles on award flights. Likewise, paid flights operated by partner airlines don't count toward your United lifetime miles.

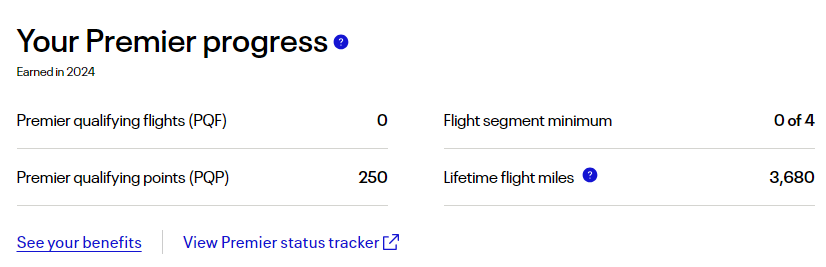

When you log in to your MileagePlus account, you'll see your lifetime flight miles under the "Your Premier progress" section.

Related: Is it worth pursuing lifetime elite status?

United Million Miler status

Here's what it takes to earn United Million Miler status:

| Eligible lifetime flight miles | Lifetime status level |

|---|---|

1 million | Premier Gold |

2 million | Premier Platinum |

3 million | Premier 1K |

4 million | Global Services |

United offers members mid-tier Premier Gold status for life when they reach 1 million lifetime flight miles. Premier Gold status includes many of the same perks as top-tier United status, including access to Economy Plus seating at the time of booking (granted, only for you and a companion at the Premier Gold tier), Marriott Bonvoy Gold Elite status and Star Alliance Gold status.

Then, for each additional million miles you fly, you'll boost your lifetime status. You can even earn lifetime Global Services — an invitation-only status tier for United's highest spenders — if you accrue 4 million eligible lifetime flight miles with United.

Million Milers receive PlusPoints for upgrades based on their lifetime Premier status level. As such, Million Milers with Premier Platinum status should get 40 PlusPoints each January, while those with Premier 1K status should get 280 PlusPoints each January.

But perhaps the best part of the United Million Miler program is the ability to share your current status with a spouse, significant other or individual who resides at your home address. For example, if you're a Million Miler with lifetime Premier Platinum status but currently hold Premier 1K status, you can designate one eligible companion to also hold Premier 1K status.

United members with 1 million lifetime flight miles or more can either select a companion or become the companion of another Million Miler. However, you can change or remove your United Million Miler companion (or decide to be selected as a companion of another Million Miler) each year between Sept. 1 and Nov. 30.

Related: United elite status is slipping further out of my reach — here's what I'm doing as a result

How long does it take to earn United Million Miler status?

Since United only credits lifetime flight miles on paid flights operated by United or United Express, earning 1 million lifetime flight miles (let alone 4 million) is not easy. If you earn 100,000 United lifetime miles each year, it'll take you a decade to earn 1 million lifetime flight miles.

If you qualify for United lifetime status entirely on one-way flights from San Francisco to Newark, here's what it would take to secure each tier of Million Miler status:

- Lifetime Premier Gold: 390 flights (around 2,150 inflight hours)

- Lifetime Premier Platinum: 780 flights (around 4,300 inflight hours)

- Lifetime Premier 1K: 1,170 flights (around 6,450 inflight hours)

- Lifetime Global Services: 1,560 flights (around 8,600 inflight hours)

Of course, if you travel frequently on eligible long-haul flights, you'll earn United Million Miler status with fewer flights.

Related: Best United Airlines credit cards

Bottom line

If you're a dedicated United flyer, consider checking your Million Miler balance to see how close you are to reaching one of the lifetime tiers.

Although we've seen passengers take mileage runs to earn more lifetime flight miles, we don't usually recommend doing so. That said, United Million Miler status is the only published route to locking in Premier status for life and not having to worry about requalifying year after year.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app