How to earn Southwest points with the Rapid Rewards Shopping portal

Editor's Note

One of the biggest misconceptions for people new to the loyalty world is that the only way to earn points and miles is by flying an airline regularly or carrying an airline credit card. But did you know you can earn points or miles for future travel from the comfort of your living room by adding one simple step to your online shopping routine?

This simple step is to visit an online shopping portal and click through to your merchant instead of going directly to your merchant's website. Most major airlines offer a shopping portal. But in this guide, I'll discuss how you can earn points on online purchases with the Southwest Airlines Rapid Rewards Shopping portal.

What is the Southwest Rapid Rewards Shopping portal?

You can earn points at hundreds of merchants through the Southwest Rapid Rewards Shopping portal.

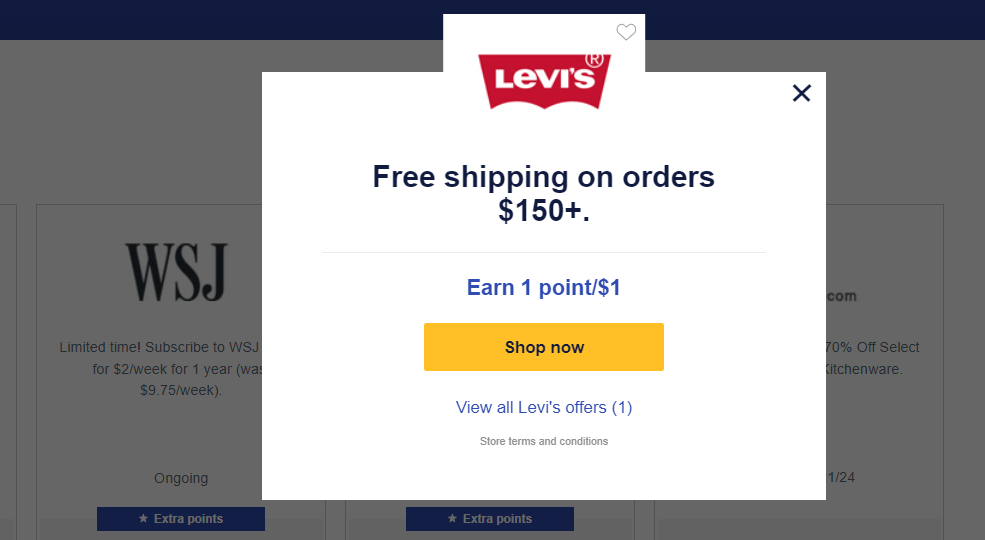

If you already have a Southwest Rapids Rewards account, you only need to sign in to the portal with the same username and password you use when booking flights. Then, you can use the search box to find your favorite stores or products. You can also compare prices and earning rates. Remember to look for stores offering higher-than-usual earning rates, featured deals or special offers.

After you've selected your merchant, click on the store, product or offer, and the portal will redirect you to the store's website. The store will alert the portal when you've made a purchase, and it will add points to your Southwest account. You'll receive an email to confirm when your points have been posted, which can take up to 15 days.

Related: How to redeem your points with the Southwest Rapid Rewards program

Earning rates through the Southwest Rapid Rewards Shopping portal

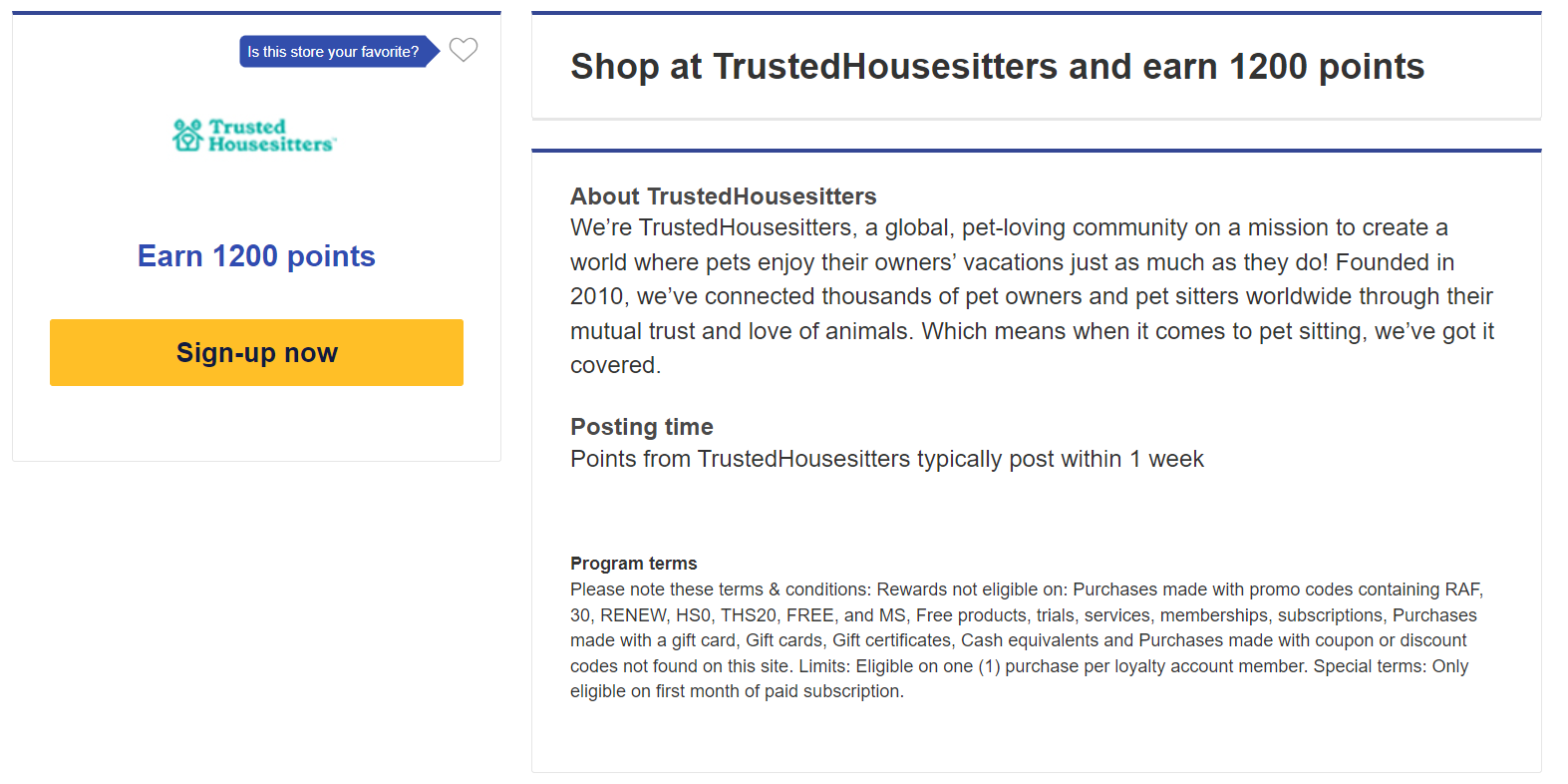

You'll find hundreds of stores in the Southwest Rapid Rewards Shopping portal. Earning rates for each merchant change frequently, but you'll usually see earning rates that range from 1 point per dollar to 20 points per dollar. Some merchants offer fixed points per eligible purchase, such as this 1,200-point offer for your first month of a paid TrustedHousesitters subscription.

Consider clicking the heart next to some of your favorite merchants. Once you do so, Southwest will email you when your favorite merchants offer higher-than-usual earning rates.

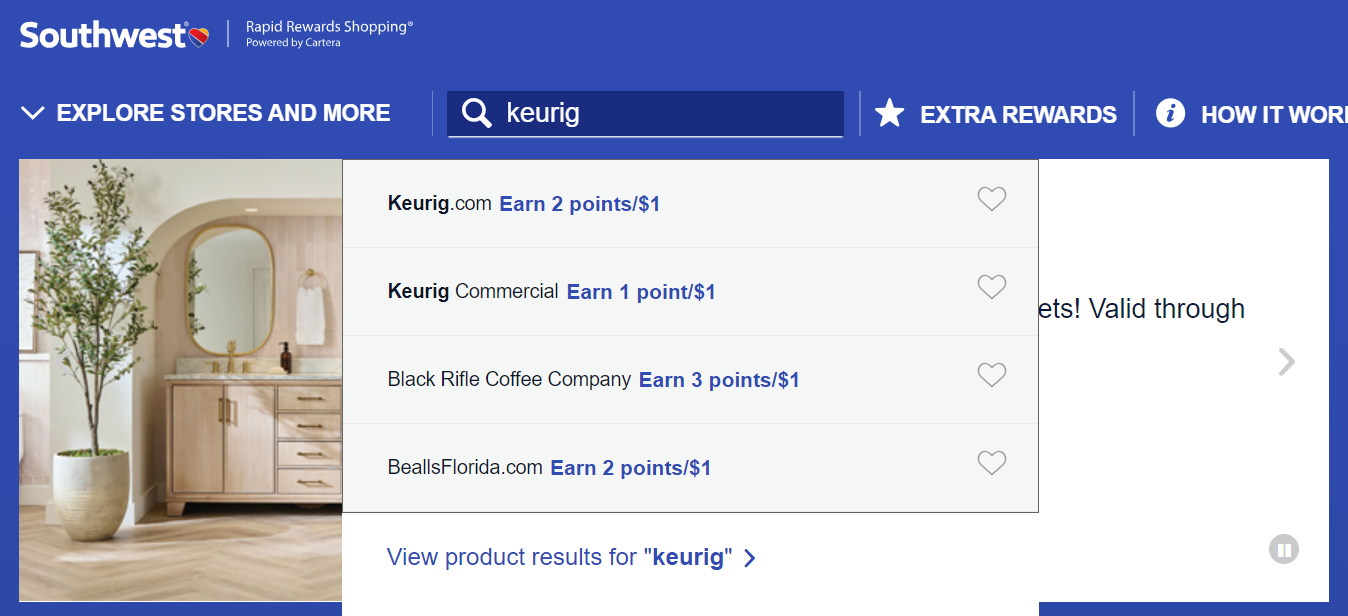

You can also search for a specific item or brand by clicking "Find a store or product" at the top of the page and typing in your request. Results should load as you type, so click on the most appealing result. For example, if I were in the market for a new Keurig, I could enter "Keurig."

I could shop through keurig.com, which currently offers 2 points per dollar. But, if Black Rifle Coffee Company offered the type of Keurig I wanted, I could earn 3 points per dollar on my purchase.

The Southwest Rapid Rewards Shopping portal calculates earnings based on the net amount of your eligible purchases. As such, you won't earn points on taxes, special handling charges, returns, freight costs, shipping costs or unshipped products.

Related: How to snag the best seats on Southwest Airlines

Southwest Rapid Rewards Shopping portal promotions

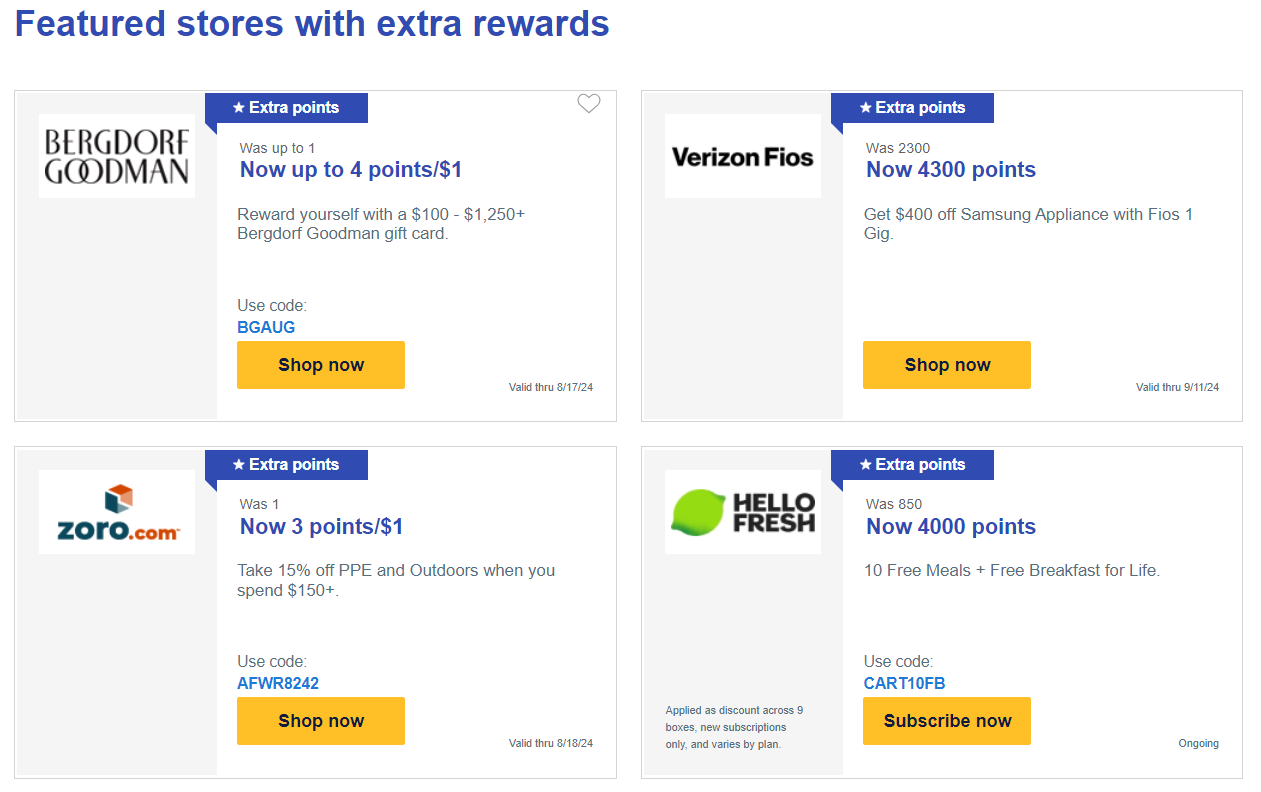

In addition to the standard earning rates, shopping portals like Southwest Rapid Rewards Shopping frequently run promotions to incentivize you to shop. Sometimes, these promotions are for specific merchants.

However, sometimes, the promotions are site-wide and apply to purchases you make with various merchants. Bookmark our permanent page for airline shopping portal promotions to learn about these offers as they occur throughout the year. Many of the best shopping portal promotions occur around the back-to-school season and Black Friday.

Related: I was anti-Southwest until I got one of its credit cards — now I'm a convert

Earn Southwest Companion Pass-qualifying points

If you're working toward earning the coveted Southwest Companion Pass, using the Southwest Rapid Rewards Shopping portal is an easy way to earn more qualifying points.

You must earn 135,000 qualifying points or take 100 flights in a calendar year to earn the Southwest Companion Pass. But once you have the pass, you can bring a friend or family member on paid and award tickets for just the cost of taxes and fees.

Base points earned from Rapid Rewards partners, including the Southwest Rapid Rewards Shopping portal, count as Companion Pass-qualifying points. However, if a Rapid Rewards Shopping portal offer says it earns "bonus points," these points won't be Companion Pass-qualifying points.

Related: 15 lessons from 15 years of having the Southwest Companion Pass

Best credit cards to use with Southwest Rapid Rewards Shopping

You'll usually want to use one of the best cards for online shopping for purchases once you click through the Southwest Rapid Rewards Shopping portal. But using a Southwest credit card can make sense if you're trying to earn the Southwest Companion Pass or earn Southwest points for an upcoming redemption.

Whatever card you choose, check which credit card merchant offers you are eligible for if you want to maximize your purchases even further. These programs give cardholders discounts or rewards when they make purchases with specific merchants, and you can potentially stack multiple offers.

Related: Comparing the Southwest Rapid Rewards Priority, Premier and Plus credit cards

Tips for using the Southwest Rapid Rewards Shopping portal

Using the Southwest Rapid Rewards Shopping portal is relatively straightforward. But here are a few essential things to keep in mind:

- Click through the Southwest Rapid Rewards Shopping portal website link and then purchase from the page that loads. Don't navigate away and return later, as then you may not earn Southwest points on your purchase.

- Ensure your web browser allows cookies. These cookies allow the Rapid Rewards Shopping portal to "track" your purchase and award points accordingly.

- Only use promotions or discount codes found on the Southwest Rapid Rewards Shopping portal. If you use other promotions or discounts, your purchase may become ineligible to earn points through Southwest Rapid Rewards Shopping.

- Read the restrictions in the Rapid Rewards Shopping portal for your specific merchant. Many merchants won't count gift cards as eligible purchases, and some exclude certain products.

You can download the Rapid Rewards Shopping browser extension to remind you anytime you're shopping on a website where you can earn Southwest points or get a discount. But if you prefer to compare your earning options, you should consider using a shopping portal aggregator like Cashback Monitor. Shopping portal aggregators let you quickly compare earning rates for a specific merchant across various online shopping portals.

Related: The beginners guide to airline shopping portals: How to earn bonus points and miles

Bottom line

The Rapid Rewards Shopping portal is a quick and easy way to earn Southwest Airlines points when you make online purchases with your favorite merchants. You can rack up points on your everyday spending, from clothes to shoes to electronics. Even if you only earn an extra point or 2 for every dollar you spend, these earnings can quickly add up and put you closer to your next Southwest award flight.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app