8 reasons why your credit card application was denied

Editor's Note

Having your credit card application denied can come as a shock. It's important to know that there are a few factors that go into the issuer's decision to say no.

Although it can be discouraging, remember that it can happen to anyone. Even some TPGers have been rejected for at least one card.

Before applying again, it's best to understand the factors behind a denial. Danyal Ahmed, a credit cards writer at TPG, was denied once, and it only motivated him to figure out why and try again after addressing areas that required his attention.

Here are some reasons your credit card application was denied and how you can get approved next time.

What to know before applying for a credit card

Issuers review credit card applications holistically. That means that they look at a variety of factors, and each issuer may evaluate the same applicant differently.

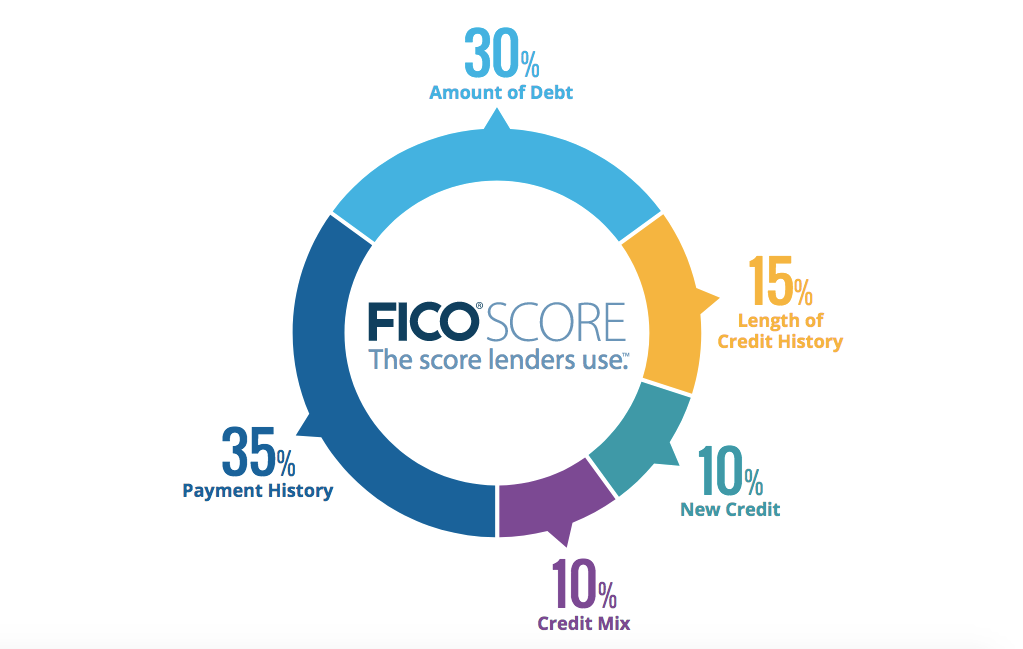

Applicants should aim to have both good credit and a long line of credit history. One of the most important factors is your payment history, which determines 35% of your overall score.

After submitting a credit card application, you'll typically find out that you were approved on the spot. However, if you're denied, you should receive a letter within seven to 10 business days of your application submission date.

If you're familiar with your personal credit history, you may be able to figure out why you were not approved before receiving your letter with one of the explanations below.

Credit report errors

The first step to take before applying for a credit card is to look at your credit report. Check the number of accounts in your name and ensure they're in good standing. If you notice a loan or credit line that you haven't consented to, you may be a victim of identity theft.

Be on the lookout for inaccurate personal information and reporting errors that are affecting your score. You can check your credit report for free at AnnualCreditReport.com and dispute any errors you find to prevent future credit rejections.

Related: Credit card fraud vs. identity theft — how to know the difference

Insufficient credit history

Having a short or nonexistent credit history can make you ineligible for certain credit cards. Your credit report should contain at least one active account to generate a FICO credit score. With no credit history, creditors cannot gauge your creditworthiness and the likelihood that you will pay off your balance.

A credit card isn't the only account type that can count toward your credit history. If you have a car payment or student loans, those can count toward building your credit history, too.

Credit card newbies should consider alternative options such as becoming an authorized user or applying for a secured card. These are excellent ways to build credit if you're under 18, as you're too young to apply for a card but can set yourself up for future success.

Related: Quick Points: Have good credit? Share it with an authorized user

Low income or unemployment

Credit card issuers don't publish minimum income requirements for their credit cards, but if you do not have sufficient income (or any at all), you could risk being denied. This is because the credit card company can't trust that you have the ability to repay all the debts you charge to the card.

Remember, you never want to lie about your income on a credit card application; doing so can jeopardize your application. An issuer may request that you submit a tax return or pay stubs to verify your income. If you're unable to prove that you earn what you claimed, you may even be blacklisted by that issuer.

That means you won't be approved for any new cards from the issuer, and your existing accounts may be shut down.

Related: Chosen for an American Express financial review? Here's what to expect

Missed payments

Having a poor payment history means you may not be able to repay an outstanding balance, which can drop your credit score considerably. Depending on the payment, it can potentially stay on your credit report for up to seven years. If you cannot make a payment or have credit card debt, consider applying for a balance transfer credit card to help manage your debt.

Related: How to save your credit score after a late payment

Credit utilization is too high

Carrying a balance from month to month indicates that you may not be able to pay your balance in full and may be at risk of defaulting. If your outstanding balances are too high, issuers may be hesitant to approve you.

Keeping your credit utilization rate below 30% is best for your credit score because it shows you're managing your credit cards well and avoiding overspending.

If you use more than 35% of your credit limit, consider requesting an increase from the issuer. Just know that in some cases, this can result in a hard inquiry on your credit report, but most times, it's a soft pull. Before requesting a credit line increase over the phone or online, you will be informed if it's a hard inquiry.

Related: Credit utilization ratio: What it is and how it affects your credit score

Too many recent credit inquiries

Having too many inquiries on your credit report within a short period of time can result in a credit card application denial. An issuer may view someone with many inquires in a short span of time as a risky borrower who is in need of money and perhaps unable to pay off debt responsibly.

There are two types of credit inquiries: a hard inquiry and a soft inquiry.

A hard inquiry (also known as a hard pull) means that a lender reviews your credit report to determine your creditworthiness for things like a credit card, auto loan or mortgage. It will usually affect your score.

A soft inquiry (also known as a soft pull) occurs when you check your own credit report or a creditor checks your credit report to gauge how well you manage your credit. Soft inquiries don't affect your credit score, but they are listed on your credit report.

There is no set number of inquiries that is considered too many, but we advise minimizing your inquiries before applying for a new credit card to raise your odds of approval.

You have account defaults

Account defaults result in major repercussions. Defaults indicate that you haven't paid your outstanding debt, which will limit you from obtaining new credit.

Some examples of defaults are bankruptcy, repossession, foreclosures and charge-offs. They will be visible on your credit report for up to seven years.

Newly opened accounts

Opening too many credit accounts within a short period can be a red flag. If you have opened a new credit card within the past several months, the credit card issuer may need to see more history with your new card before deciding whether to grant additional credit or not.

Waiting six months between credit card applications is generally recommended. Six months is enough time to prove a pattern of creditworthiness. If six months is too long, we recommend waiting three months at the bare minimum. Anything less than that, and you'll likely face rejection.

Some issuers also have stricter requirements for their credit cards. For example, Chase's infamous 5/24 rule states that an applicant will likely be denied for a card if they've opened five or more cards within the past 24 months.

Related: The ultimate guide to credit card application restrictions

How to get approved for your next credit card

There are many ways to build credit to improve your chances of approval.

Build your credit with Experian Boost

Experian Boost is a great way to build your credit. This feature uses your bank records to find on-time payments for monthly bills that are normally not reported on your credit report. For example, reporting on-time utility, rent and streaming service payments helps improve your FICO score.

Become an authorized user

Becoming an authorized user is a great tool for those building their credit from scratch, especially if the primary cardholder has a long history of on-time payments. In some cases, it can also help you repair your credit as a result of bankruptcy or multiple missed payments. Sometimes, the only requirement is that authorized users must be of a certain minimum age.

Get a starter credit card

Consider applying for a secured credit card to establish or build your credit. A secured credit card is a great option if you're building or repairing credit or if you're having trouble getting approved for a rewards card. Alternatively, you can opt for a beginner rewards card with a lower bar for approval.

- If you want a higher line of credit within the first year: Consider the Capital One Platinum Secured Credit Card. It has no annual fee and the potential to receive a credit line increase after six months. Upon opening any secured card, you'll need to pay a cash deposit that will determine your credit limit.

- If you prefer Capital One: The Capital One Savor Cash Rewards Credit Card earns 8% cash back on Capital One Entertainment purchases, 5% cash back on hotels, vacation rentals and rental cars booked through Capital One Travel and 3% cash back on dining, entertainment, popular streaming services and grocery stores (excluding superstores like Target and Walmart).

- If you prefer Chase: The Chase Freedom Unlimited® (see rates and fees) has impressive earning rates: 5% cash back on Chase Travel℠ purchases, 3% cash back on dining and drugstore purchases and 1.5% cash back on all other purchases. This card will pair well in the future with the Chase Sapphire Preferred® Card (see rates and fees), a more travel-oriented card that requires a higher credit score and established credit history.

Related: The power of the Chase Trifecta: Maximize your earnings with 3 cards

Bottom line

It can be disappointing to be denied for a credit card, but you can try again. Federal guidelines require issuers to give notice of approval or denial within 30 days of submission of an application. So, before anything, keep a lookout for a letter or e-mail detailing the issuer's decision.

If you're rejected, be patient and fix the problem before applying for another card.

If you happen to disagree with the issuer's decision, you may call its reconsideration phone line.

Related: How to apply for a credit card

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app