500-plus benefits for $595 a year — is FoundersCard worth it?

Editor's Note

Surprisingly, I pay an annual fee for one card that is not a credit card: FoundersCard.

FoundersCard provides access to a membership community offering discounts and benefits in many different lifestyle categories. The card has many benefits, discounts and amenities that make travel easier and enhance my lifestyle, including unmatched airline discounts and up to 50% off on shipping at FedEx and UPS.

You can get these benefits without applying for a credit card — but is the card worth the membership fee? Let's investigate.

The information for the FoundersCard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

What is FoundersCard?

FoundersCard is a membership program that offers elite status, travel discounts, complimentary subscriptions and special pricing with lifestyle brands. It is not a credit card, and you can't make any purchases with it.

Despite the name, you don't have to be a "founder" or entrepreneur to have this card; anyone is welcome to apply. The application process is short, and a decision is usually provided within two days (though some can be approved instantly).

How much does a FoundersCard membership cost?

There are two membership tiers:

- Standard: $595 a year

- All Access Elite: $995 a year

You must also pay an additional $95 initiation fee.

Occasionally, discounted membership offers are available. I've seen the standard membership go for as low as $295 a year for life. In fact, I was able to secure that rate.

TPG credit cards writer Augusta Stone received a one-year trial membership through Clear+. This trial membership, which she was targeted for via email, offers fewer perks than the Elite membership.

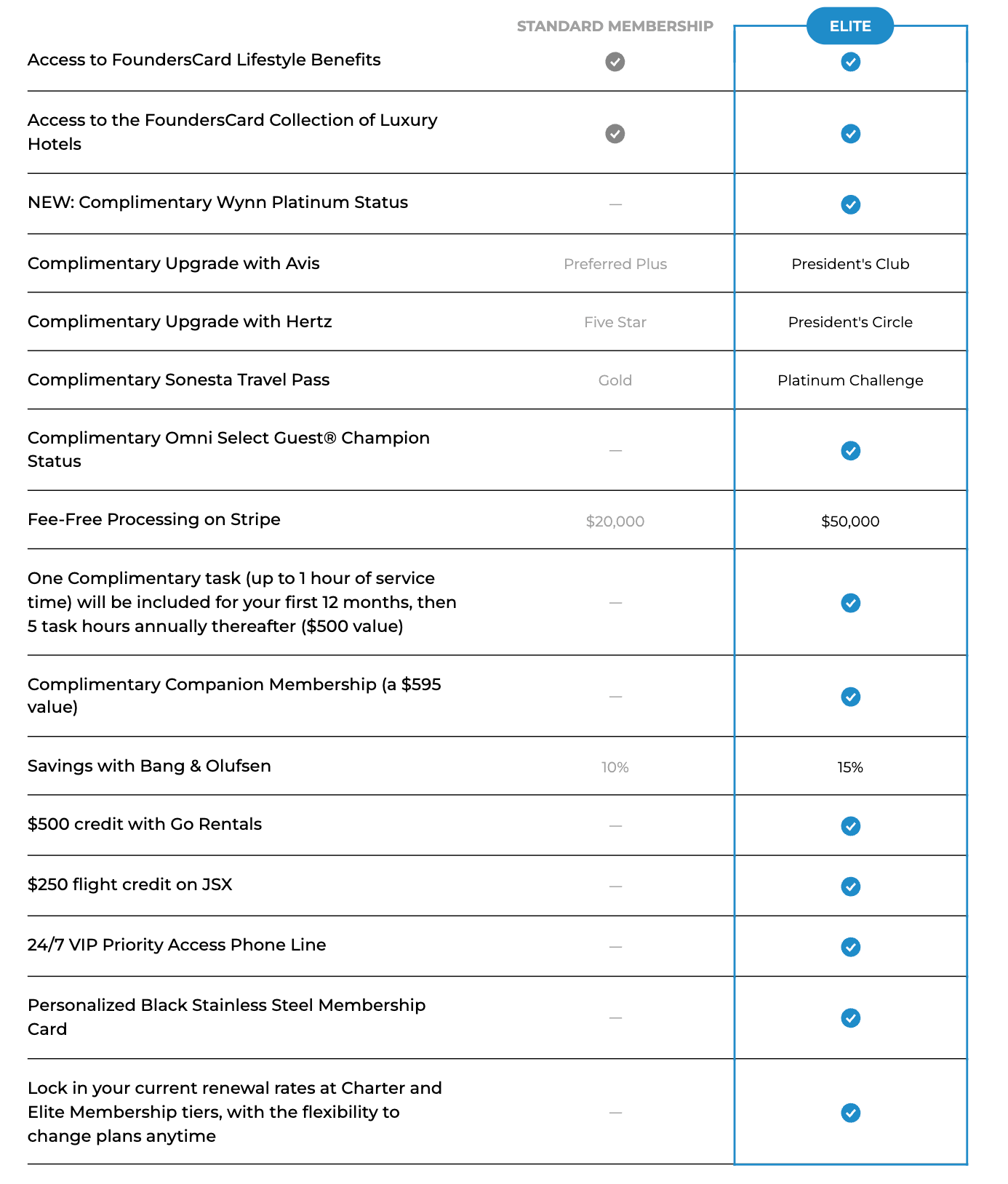

Here are the differences between the two membership tiers:

The standard membership is more than adequate for my needs, and all the benefits, credits and discounts I receive more than cover the annual membership fee.

However, I have also been offered an upgrade to elite membership for just $100. I am considering the upgrade, since elite membership includes a $250 JSX flight credit, which I can use to book a semiprivate flight on one of JSX's many routes. Upgrading would essentially save me $150 on any JSX flight.

Related: Complete guide to current hotel elite status match and challenge offers

Benefits of FoundersCard

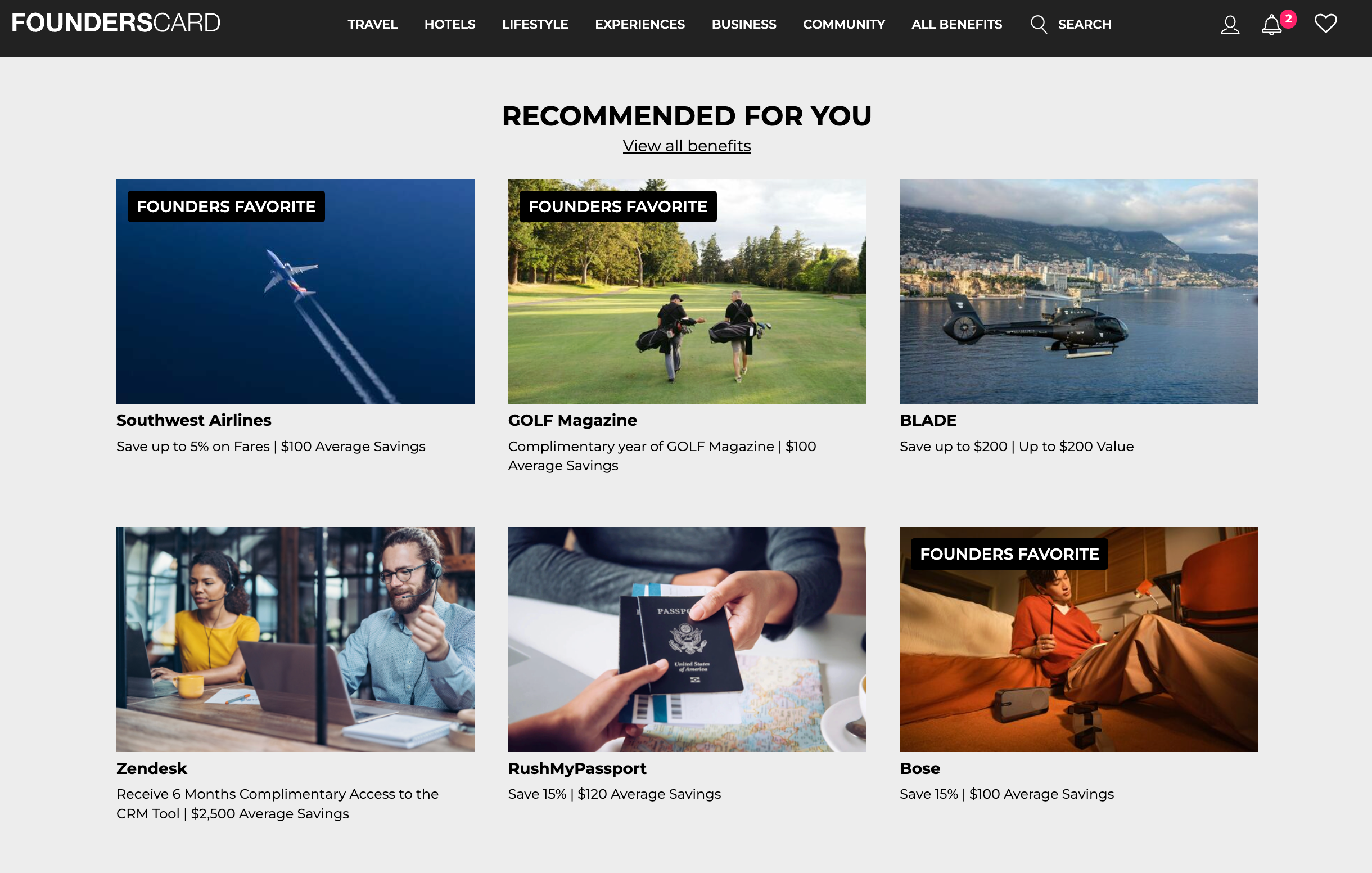

FoundersCard has more than 500 benefits that are broken into categories such as travel, shopping subscriptions and business services. Membership gives you elite status and benefits similar to those offered by premium travel rewards credit cards, without adding another credit card to your wallet.

It's worth noting that many FoundersCard benefits overlap with benefits I receive from The Business Platinum Card® from American Express, such as Hilton Honors Gold status (enrollment is required) and Hertz Five Star status (enrollment is required) — but there are distinct benefits I use that are only available with FoundersCard.

My favorite benefits

Out of the 500-plus benefits on the FoundersCard, a few of my favorites include:

- Complimentary TripIt Pro membership: A useful app for planning a trip and keeping your itinerary all in one place, this flight-tracking feature comes in handy for frequent flyers like me.

- Discounts on Alaska Airlines, Southwest Airlines and United Airlines: Depending on which airline I book with, I can receive between 5% and 20% off my purchase.

- Preferred pricing on Dell: I often stack this discount with the Amex Business Platinum card's up to $150 in statement credits on U.S. purchases made directly at Dell and an additional up to $1,000 statement credit after spending $5,000 or more at Dell each calendar year. This also helps offset the Amex Business Platinum's $895 annual fee (see rates and fees; enrollment required).

- Preferred pricing on Equinox: I used to be an Equinox member, and this preferred pricing saved me around $100 off my monthly membership. If you have the American Express Platinum Card®, you could pair this discount with the up-to-$300 Equinox statement credit you receive each calendar year (subject to auto-renewal; enrollment required).

- Shipping discounts at FedEx and UPS

- Sonesta Travel Pass Gold status: I have stayed at a few Sonesta hotels, but I am not a frequent visitor, so having some extra perks for these occasional stays is an added benefit for me.

- Tickets by FoundersCard: Members receive access to preferred pricing on sports and live event tickets with no service fees. I used this once to buy football tickets and saved nearly $50 by avoiding service fees.

Some other notable FoundersCard benefits include discounts on business services, elite status with Hilton and Marriott, shopping discounts and discounts for select luxury hotels.

Pairing FoundersCard with credit cards is where you can really get outstanding value. Some credit cards offer automatic elite status or corresponding perks, which you can then pair with FoundersCard's airline and hotel discounts.

Airline discounts and perks

In addition to the airline discounts I mentioned above, FoundersCard offers airfare discounts and special offers with many airlines around the world, including:

- Air France and KLM Royal Dutch Airlines: Up to 10% off fares originating from the U.S., Canada and Mexico

- Air New Zealand: Up to 11% off most fares

- Etihad Airways: Up to 5% off select fares

- JSX: $250 flight credit (requires elite membership)

- Qantas: Up to 15% off fares between the U.S., Australia, Canada and New Zealand (in both directions)

- Qatar Airways: Up to 7% off flights originating from the U.S. and Canada

- Virgin Atlantic: Flying Club Silver Elite Status upgrade after completing one round-trip flight, and a fast track to Gold Status (earn 500 Tier Points within six months)

You can book any cabin for these airlines and receive a discount. It's important to note that, with these discounts, you will still earn miles and meet spending requirements toward elite status with the airline.

If you frequently fly one of these airlines and book expensive fares, you could easily recoup the cost of a FoundersCard membership with just one flight purchase. For example, United is my preferred airline, and I hold United MileagePlus Premier Gold status with the carrier. Every time I use my FoundersCard discount, I get 20% off flights.

You can further maximize this discount by using a cobranded airline credit card to earn miles.

Related: United unveils huge MileagePlus shakeup, rewarding cardholders with higher earn rates

Downsides of FoundersCard

Despite FoundersCard having many great perks and benefits, there are some downsides, including:

- FoundersCard is not a credit card: Since it is not a credit card, you can't make purchases or earn any miles while still paying a hefty annual fee.

- Many benefits are very niche: Despite FoundersCard having over 500 benefits, most are highly targeted, so the average person will not benefit from them. For example, the card offers many discounts at less popular retailers. While the discounts can be quite substantial, I won't shop at most of these stores, so they're useless to me.

- Offers many benefits that credit cards offer: If you have a premium travel card like the Amex Platinum, you might notice that some of the benefits overlap.

- Some benefits require a FoundersCard Elite membership. The Elite plan includes benefits like Omni Select Guest® Champion Status, Wynn Rewards Platinum status, higher savings with select brands and higher-tier elite rental car and hotel status.

- Steep annual fees: The card has an annual fee similar to that of premium credit cards.

- The full list of benefits isn't viewable before membership: You have to sign up for membership and pay before you can get the full list of benefits and features, so it can be tough to determine how much value you will get from each benefit.

FoundersCard is best paired with a travel rewards card to maximize its discounts while earning points and miles.

Related: How to choose the best credit card for you

My verdict on FoundersCard

While many FoundersCard benefits can be accessed with premium cards like the Amex Platinum or the Amex Business Platinum, the program's lifestyle and travel benefits still provide outsize value worth the $295 I pay annually.

You may also find great value in having the card if you run a business and can take advantage of the various business discounts and benefits.

That said, I would not recommend relying on FoundersCard in a strictly non-business capacity unless you spend a lot at some of the retailers that offer a substantial discount. Otherwise, you're better off saving the annual fee to get a premium credit card.

If you feel FoundersCard is right for you, I recommend aiming for a rate under the standard membership cost.

Related: The best no-annual-fee business credit cards

Bottom line

FoundersCard is a membership card that provides many benefits and discounts for travel and retail. Top benefits include automatic elite status with hotels and rental car companies and discounts with major airlines, retailers and luxury hotels around the globe.

If you're a business owner or someone who can make use of many of FoundersCard's benefits, you might want to consider adding this membership card to your wallet.

Related: The best premium credit cards: A side-by-side comparison

For rates and fees of the Amex Business Platinum, click here.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app