Just how risky is it to fly over vast oceans? A pilot explains

I was recently out for a walk with a friend of mine who used to be a flight attendant — we happened to be in New York at the same time. While catching up on life, the subject changed to flying and her experiences flying across the Atlantic. During her career as a flight attendant, she'd never really thought about how her aircraft crisscrossed the globe.

As the conversation progressed, she become more intrigued about how aircraft fly from Europe to the U.S. and in particular, how safe it is flying across large expanses of water.

Related: 'Turn left at that cloud' — how pilots do (and don't) navigate

If I'm honest, having spent nearly 10 years flying across the pond, I've never really considered this. We have procedures in place that we use every flight and then proceed to cross this expanse of water several times a month without giving it much more thought. Until now.

[table-of-contents /]

History of transatlantic flight

In the early 1900s, if you wanted to travel between Europe and North America, the only method was by boat. One of the most famous operators of these ocean liners was Cunard.

Its history dates back to 1839 when Canadian Samuel Cunard won the first British government contract to supply a regular mail delivery service across the Atlantic. Travel by Cunard ship quickly grew into one of the most popular ways to cross the Atlantic.

In the early days of the 20th century, its ocean liners such as the Lusitania were able to reach speeds of up to 24 knots, meaning that it would take around a week to complete the journey.

However, in the 1930s, aircraft were already beginning to be able to fly this route, albeit stopping along the way.

In 1939, Pan Am flew from New York to Southampton on its flying boat Yankee Clipper, dropping in at several airfields along the way, including Newfoundland in Canada and Foynes in Ireland.

Then, in 1958, British Overseas Airways Corporation become the first airline to operate a jet aircraft between London and New York with its de Havilland Comet. It took just 10 hours and 20 minutes to fly between the two cities, with a single refueling stop along the way at Gander, Newfoundland.

Related: 3 things you should know if you ever have to fly a plane in an emergency, according to a real pilot

On the way back, assisted by a favorable tailwind, the journey took just six hours and 12 minutes — an average speed of 580 mph. With this, the death of the ocean liner for long-haul travel rather than leisure cruises had begun.

Despite these new speeds, aircraft still needed to refuel along the way, meaning that their route required them to keep close to land. In addition, the reliability of engines at the time wasn't particularly good, so pilots always needed an airport close by where they could land in an emergency.

As the years progressed, technology improved and aircraft powered by four jet engines, such as the Boeing 707 and then the iconic 747, became the new ocean liners of the sky.

Even though they were fuel-thirsty machines, oil prices were low so airlines were able to turn a hefty profit when filling these giant aircraft as they flew between continents.

The beauty of these four-engine aircraft was that should one of the engines fail, there were still three more available to keep flying safely. Even if another engine was to fail, the aircraft could still divert and land safely.

Twin-engine aircraft were allowed to make the same journey but, due to their lack of engine redundancy, had to fly routes that kept them within 60 minutes of a diversion airport. Understandably, this added considerable distance to the route and as a result, time and fuel burn made their use less than ideal.

ETOPS flights

With the advances in engine and aircraft reliability since the first transatlantic crossing 100 years ago, regulators have allowed two-engine aircraft to fly farther and farther from the nearest adequate airfield in the event of an engine shutdown.

When limited to just 60-minute single-engine flying time from the nearest usable airfield, the routes that aircraft could fly were pretty limited. Nowadays, 180 minutes is the norm, allowing aircraft to cross the globe on almost any route they wish.

Extended-range twin-engine operations, or ETOPS, rules apply to any flight by a twin-engine aircraft that at any point during its journey is more than 60 minutes of flying time from a suitable airport. Even though most ETOPS flights are conducted over large expanses of water, such as the North Atlantic and the Pacific oceans, the rules can also apply for some flights over large expanses of land, such as over Africa and Russia.

The planning segment of an ETOPS flight is the most important part and is mostly performed by the airline's flight planning department.

Related: How aircraft are designed to operate during an engine failure

They must ensure that the flight complies with a number of different rules and laws, ensuring that the plan which they present to the operating crew is legal and safe for the trip.

As part of this process, they must check that the aircraft is certified airworthy to carry out an ETOPS flight, that the weather at the nominated airports along the way is satisfactory and that there will be enough fuel to divert to one of them should the need arise.

As a result, anytime a flight crosses an expanse of water, rigorous checks have been made to ensure that the aircraft can land safely at a suitable airport along its route.

Mid-Atlantic options

When looking out the window on a transatlantic flight, you may be forgiven for thinking that your aircraft is nowhere near land. To a certain extent, you'd be right.

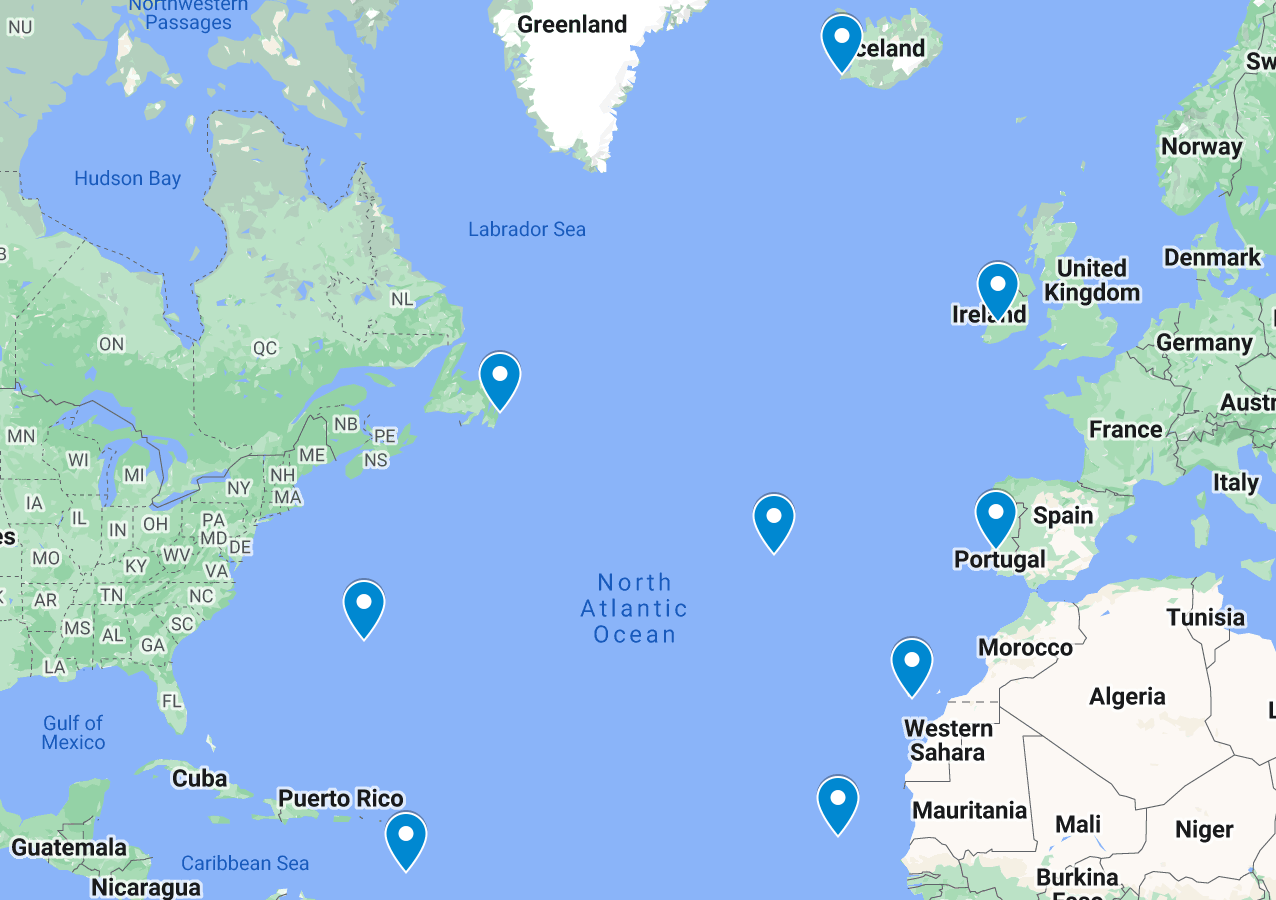

On some routes, we often make a beeline straight across the Atlantic. Miami and the Caribbean are good examples of this. For other destinations, such as Boston and New York, we take a more northerly route, over eastern Canada and then down into the U.S. For West Coast cities, such as San Francisco and Los Angeles, the route often takes us close to Iceland and then over Greenland.

However, these routes have little to do with our proximity to land and more to do with taking advantage of the geographic areas with the most beneficial wind conditions.

As global winds tend to travel from west to east, on westbound flights we will endeavor to fly routes where the winds are at their lightest — even if it means flying a longer track over the ground. As a result, our total flight time will be less, minimizing the fuel used.

However, even if we do blast straight across the Atlantic down to Miami, there are more airports available to divert to than you may think.

The northern part of the North Atlantic has multiple options. As we start our westbound crossing, one of the best options is Shannon, Ireland. This well-equipped airport has a 3,200-meter runway with approach aids that allow aircraft to land in fog with visibility down to 300 meters.

As we make our way across, the next option is normally Keflavik, Iceland. Despite being known for its strong winds, the airfield has two long runways that intersect each other. One runs north-south and the other east-west.

Related: 10 bizarre reasons why flights have been delayed

This means that should we have to land there, we can use a runway that has an element of headwind, instead of having to deal with a crosswind.

As we reach the Canadian side of the Atlantic, there are a number of good diversion options such as St. John's, Gander and Stephenville. If our route has us flying farther south in the Atlantic area, the Azores is another option. Both Santa Maria and Lajes have runways long enough on which to land the biggest of aircraft.

Along this more southerly route, the next option is Bermuda. Even though I've flown past Bermuda scores of times, it still surprises me just how far out in the Atlantic the islands are. With its 3,000-meter runway, the airport provides a perfect landing location should we need it.

Is flying over water risky?

At its very essence, life is a risk. Each day you face a whole host of scenarios that could be potentially hazardous to your health. Walking down the stairs poses a risk that you could trip and fall. When cooking your breakfast there's a risk that you might burn yourself.

It's the same with flying. Anytime you take a metal (or fiberglass) tube, fill its wings with fuel and accelerate it down a strip of concrete to 180 mph then climb it up to 7 miles above the ground, you're taking a risk. However, like all the scenarios in our everyday lives, the risks we take are calculated ones.

When descending stairs, we don't go too quickly and hold on to the handrail. When we use the oven, we use heatproof gloves to reduce our chances of being burned. All these actions reduce the chance of these events becoming a threat to our life.

Ever since the Wright brothers took to the sky, the aviation industry has learned from its incidents and mistakes to make it a safer place. In fact, commercial aviation is so good at learning from past mishaps and putting procedures in place to reduce the chances of them happening again, that other industries have adopted many of these same methods.

When flying over land, of course it is more likely that there will be more airfields closer to the aircraft at any given time. However, because of lessons learned from its history and the improvements in aircraft and engine reliability, crossing the oceans is deemed as safe as flying over land.

With the rules of ETOPS flying in place, the crew of an aircraft will always know where the nearest diversion airfield is. In practice, on most routes, this is rarely more than 90 minutes to two hours away.

Safety in aviation is all about planning for the worst-case scenario and expecting the best. That way, should it not be our day, we know that we have a contingency in our plan to deal with unexpected events. Fuel is a good example.

Airlines' flight planning software is very good at calculating how much fuel will be needed for a particular flight. It's so good, in fact, that it is often accurate to a couple of hundred kilograms. However, some days the winds aren't quite as forecast or air traffic control may change our route to a longer one.

To cover these unexpected events, we always carry a certain amount of extra fuel, known as our contingency fuel. So, should this happen mid-Atlantic, we can still continue safely on our way.

Bottom line

Anytime that we leave the house, we take a risk. However, throughout our daily lives, we make constant evaluations and decisions about these risks. It's the same with aviation. By planning for the worst-case scenario, should the unexpected happen, we know that the safety of the aircraft and its occupants will not be jeopardized. As a result, flying over water really is no riskier than flying over land.

So next time you take your seat for a flight across the Atlantic or Pacific, take comfort in knowing that rigorous plans have been put in place for the duration of your flight to ensure that you're kept safe.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app