Is the Delta Gold Amex annual fee worth it?

Editor's Note

As a points and miles enthusiast, I have over 10 cards from four issuers. Many of these cards have annual fees, and every year, a few days before that annual fee posts to my account, I have to decide if that card is worth it or if I should downgrade it.

Even if the card charges a low annual fee, you still need to get more value from its benefits than the cost of the annual fee. This can be an especially tough decision for those with cobranded airline cards.

This begs the question: Is the entry-level Delta SkyMiles® Gold American Express Card with its $150 annual fee — $0 introductory annual fee the first year (see rates and fees) — worth it? Let's jump into it.

Welcome offer

The Delta SkyMiles Gold card offers new cardmembers the chance to earn up to 90,000 bonus miles: 70,000 bonus miles after spending $3,000 on purchases in the first six months of card membership, plus earn 20,000 bonus miles after spending an additional $2,000 on purchases (for a total of $5,000) in the first six months of card membership.

TPG's October 2025 valuations peg Delta SkyMiles at 1.25 cents apiece, making this offer worth up to $1,125.

Note that you may not be eligible for this welcome offer if you have or previously had a different Delta SkyMiles Amex card. Fortunately, American Express will let you know ahead of performing a hard pull on your credit if you aren't eligible to receive a welcome offer for this card.

Related: The best time to apply for these popular American Express cards based on offer history

Earning rates

With the Delta Gold Amex, cardmembers are limited to earning Delta SkyMiles. This card earns 2 miles per dollar spent on all Delta purchases and dining at restaurants worldwide and on groceries at U.S. supermarkets. It earns 1 mile per dollar spent on all other purchases.

Based on TPG's October 2025 valuations, this is a 2.4% and 1.2% return on spending, respectively.

There are other cards with higher returns on spending, even within the Delta Amex portfolio, but if you're looking for a card in the SkyMiles family with a low annual fee, this is a reasonable option.

Flight credit

With this card, you'll receive a $200 Delta flight credit after spending $10,000 or more on qualifying purchases in a calendar year. This spending requirement is steep — especially considering it would only earn you $120-$240 in value in SkyMiles on top of the flight credit, depending on which category in which you're spending.

If you spend large amounts with Delta, this can be an added perk, but there are better cards that earn more. One example is the American Express® Gold Card, which earns 3 Membership Rewards points per dollar spent on flights booked directly with the airline or through amextravel.com.

Since Delta is a transfer partner of Amex, you can then take those (more valuable) Membership Rewards points and transfer them to Delta.

Realistically, most cardmembers won't spend that much on their Delta Gold Amex each calendar year, so I don't recommend considering this benefit when calculating the value you can get out of this card.

Related: The top 11 credit cards with annual travel statement credits

Award flight discount

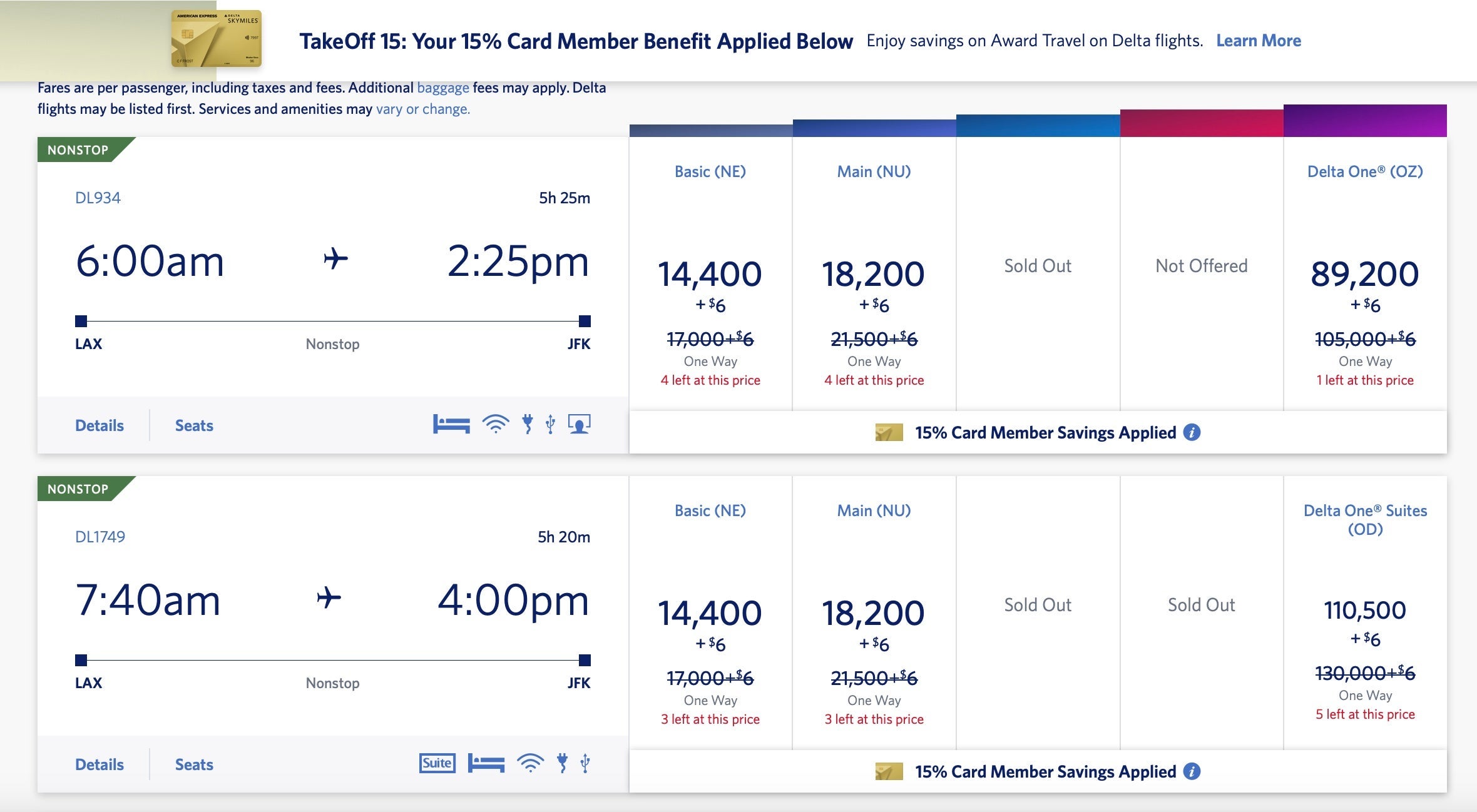

Delta Gold cardmembers receive 15% off the cost of all award flights operated by Delta (but not partner airlines). This is known as the TakeOff 15 benefit and is my favorite perk of this card.

The nice thing about this 15% off an award flight is that it is valid on all cabins. I have used this card perk many times to take 15% off last-minute transcontinental flights and flights to Central America.

Related: How to use and maximize Delta's TakeOff 15 feature to save on Delta award tickets

Delta travel perks

Free checked bag

With the Delta Gold card, the cardmember and up to eight people in their party on the same reservation get their first checked bag free. This benefit of the card nets me great value as I am a chronic overpacker.

Given that it usually costs up to $35 each way to check a bag, this benefit easily covers the annual fee if you have multiple people on the same reservation or you fly with Delta multiple times each year.

Related: I always check a bag — and I'm proud to admit it

Priority boarding

The Delta Gold card comes with priority boarding, which is a great way to ensure there's enough overhead bin space for your carry-on bag.

20% inflight discount

Cardmembers also receive 20% back as a statement credit on prepurchased meals and inflight purchases of food and drinks (excluding Wi-Fi purchases).

Delta Stays statement credit

Delta Gold cardmembers receive an annual up-to-$100 statement credit each calendar year for Delta Stays reservations. This is an online travel agency powered by Expedia that you can use to book hotels and vacation rentals. This is essentially a free night if you can find a room under $100.

Related: Delta Vacations enhances earning rates and redemption value for SkyMiles members

Bottom line

The Delta Gold card is an entry-level credit card in the SkyMiles Amex family that cardmembers can receive outsize value from if they utilize the free checked bag perk, the inflight discounts and the Delta Stays credit. Plus, the perk of 15% off award flights is a solid benefit and can make devalued SkyMiles go slightly further.

However, if you don't fly Delta at least twice a year or check bags when you fly with this airline, it is difficult to justify the $150 annual fee. Instead, you might want to consider the no-annual-fee Delta SkyMiles® Blue American Express Card (see rates and fees) instead.

To learn more, read our full review of the Delta Gold Amex card.

Apply here: Delta SkyMiles Gold

Related: How to choose an airline credit card

For rates and fees of the Delta Gold Amex, click here.

For rates and fees of the Amex Gold Card, click here.

For rates and fees of the Delta Blue Amex click here.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app