You can get a complimentary weekend night through InterContinental Ambassador: Here’s how

Editor's Note

The InterContinental Ambassador program effectively lets you buy IHG elite status and get additional perks when you stay at select IHG One Rewards brands. InterContinental Ambassador members get many perks, but one of the most valuable is a complimentary weekend night at an InterContinental hotel or resort each membership year.

In this guide, we'll start with an overview of the InterContinental Ambassador program before discussing its complimentary weekend night benefit.

What is InterContinental Ambassador?

For $200 or 40,000 IHG points — which are worth $200 based on TPG's July 2024 valuations — you can purchase a 12-month InterContinental Ambassador membership. This membership provides perks when staying at InterContinental hotels and resorts, including:

- A one-category room upgrade

- 4 p.m. late checkout

- A $20 food and beverage credit per stay

InterContinental Ambassador perks generally aren't applicable when you stay at other IHG brands. However, when you book through eligible methods, InterContinental Ambassador members get a few extra perks at participating Six Senses and InterContinental Alliance Resorts properties.

InterContinental Ambassador membership also includes Platinum Elite status in the IHG One Rewards program. However, you likely won't want to pay for InterContinental Ambassador membership just for Platinum Elite status if you are eligible for the IHG One Rewards Premier Credit Card (see rates and fees) or IHG One Rewards Premier Business Credit Card (see rates and fees). After all, these IHG credit cards provide Platinum Elite status and access to the fourth reward night free benefit when redeeming IHG points for a lower annual fee than an InterContinental Ambassador membership.

Related: What credit card should you use for IHG stays?

InterContinental Ambassador weekend night

You get an InterContinental Ambassador weekend night each time you purchase or renew your membership. However, this complimentary weekend night works differently than the anniversary nights you can earn with some IHG credit cards. Instead of being worth up to a set number of points, the InterContinental Ambassador weekend night covers the room and tax on the second night of an eligible paid booking.

You may redeem the InterContinental Ambassador weekend night once before your 12-month membership expires. To use the complimentary weekend night, you must book a stay of two nights or longer using the Ambassador complimentary weekend night rate.

In most regions, this special rate is only available at InterContinental hotels and resorts for weekend stays, defined as Friday, Saturday and Sunday nights. So, you'd need to check in on a Friday or Saturday in most regions to book this rate and get a complimentary weekend night.

Before we look at the booking process, here are a few other things you should know about the InterContinental Ambassador complimentary weekend night:

- You can't use a complimentary weekend night in conjunction with reward nights or other IHG promotions. You must book online using the Ambassador complimentary weekend night rate.

- Only InterContinental Ambassador members can use the complimentary weekend night (proper identification is required at check-in).

- You must make an advance reservation, and you can only use one complimentary weekend night per stay. You can only have one reservation booked using the Ambassador complimentary weekend night rate; your bookings may be canceled if you have multiple reservations using this rate.

- When you check in to the hotel, you must have an unredeemed and valid complimentary weekend night in your account. If you don't, you'll need to pay the hotel's best flexible rate for all nights of your stay.

Related: The top InterContinental hotels across the world

How to book your complimentary weekend night

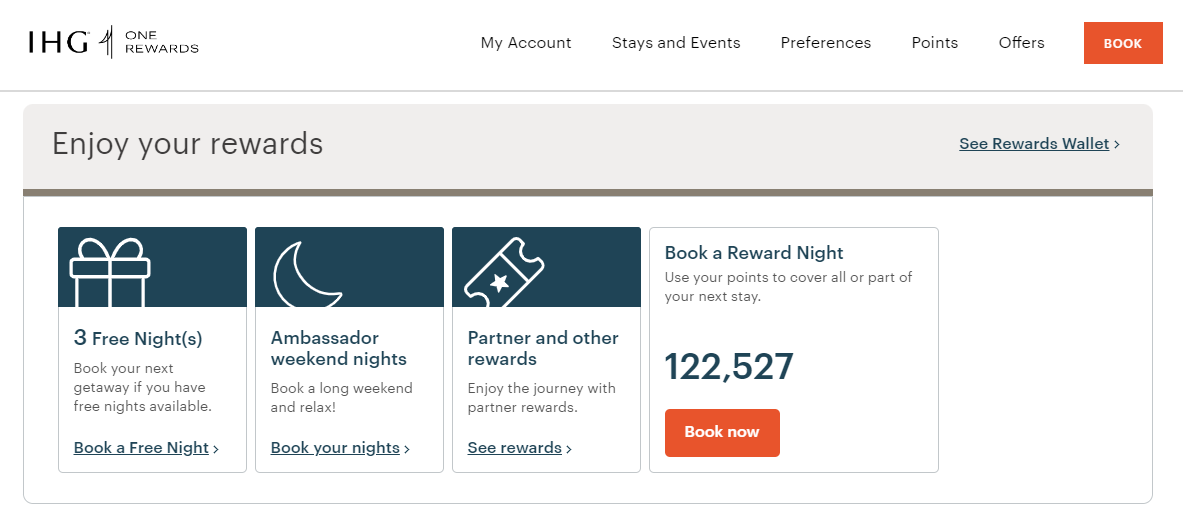

To book your InterContinental Ambassador complimentary weekend night, go to your IHG One Rewards account homepage, scroll down to the "Enjoy your rewards" section, find the "Ambassador weekend nights" tile and click the "Book your nights" link.

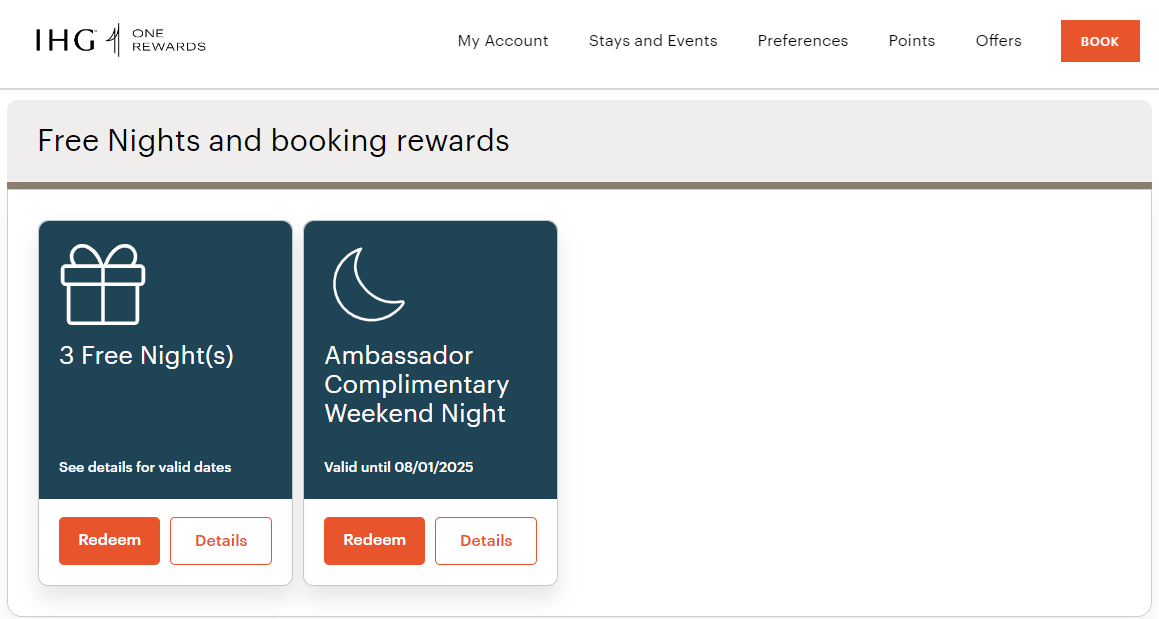

Then, under "Free Nights and booking rewards," find the "Ambassador Complimentary Weekend Night" tile and click "Redeem."

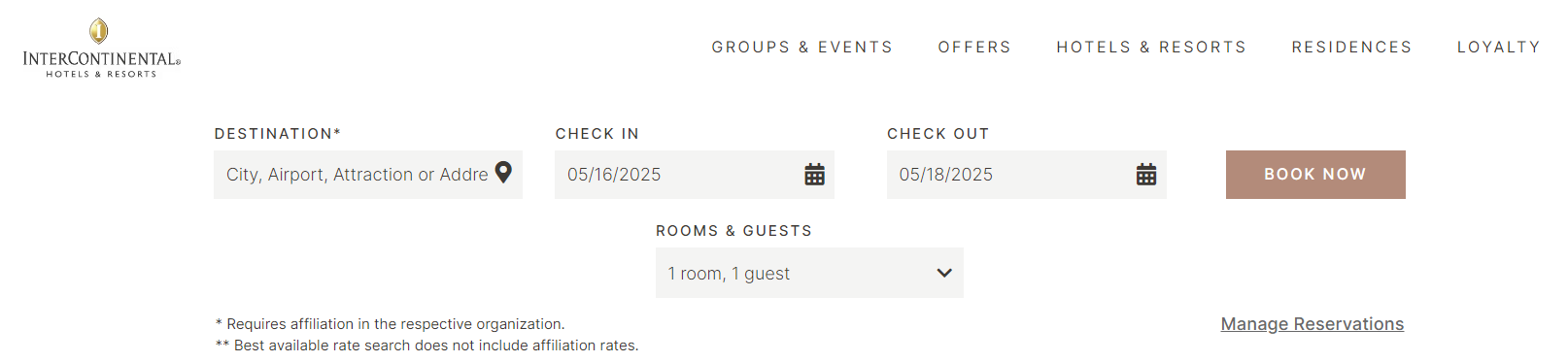

Alternatively, you can shorten this process by searching through this specific link. This link is useful to bookmark, as you can check the Ambassador complimentary weekend night rate from this page even if you don't currently have an eligible complimentary weekend night in your account.

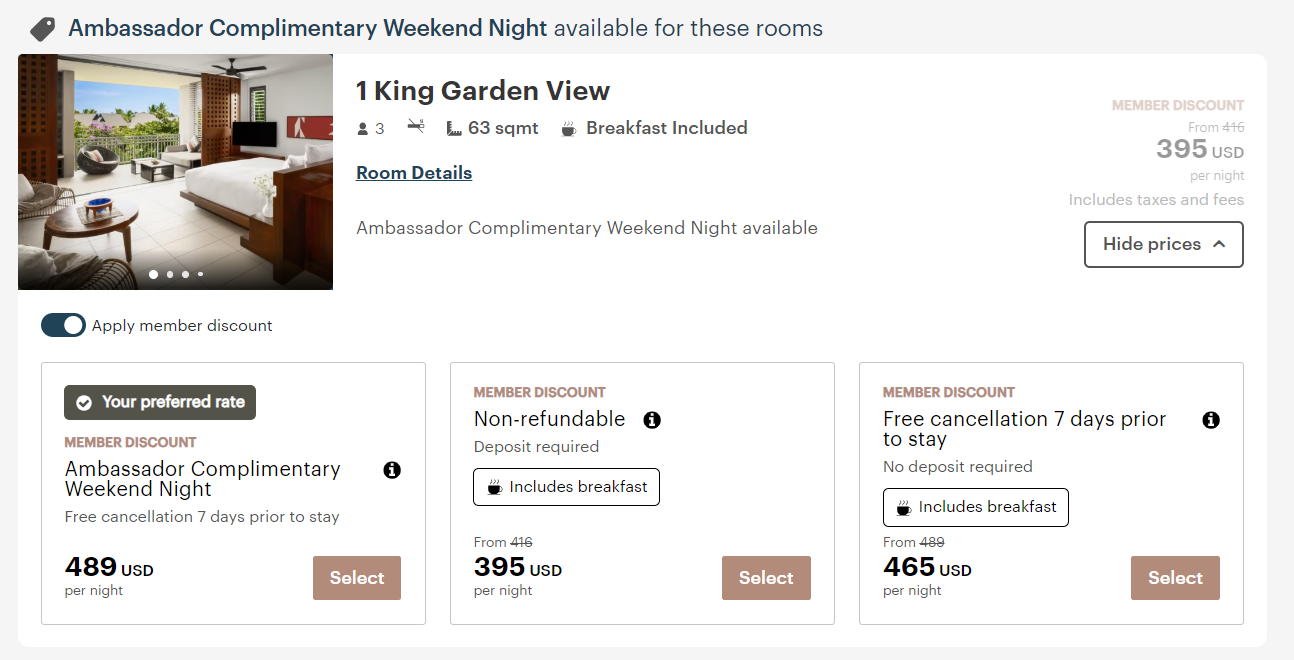

As you look at your search results, pay attention to the Ambassador complimentary weekend night rate. Unfortunately, this rate is often not the least expensive flexible rate.

For example, here are the rates at both the Ambassador complimentary weekend level and the least expensive flexible level for a two-night stay on May 9-11, 2025, at the InterContinental New York Times Square:

| Rates for the 2-night stay, including taxes and fees | Classic low floor | Premium midtown view | Classic corner | Premium skyline view | Junior suite midtown view |

|---|---|---|---|---|---|

Ambassador complimentary weekend night rate | $957.22, with $438.44 credited at check-in, for a net cost of $518.78 | $1,071.98, with $495.82 credited at check-in, for a net cost of $576.16 | $1,083.46, with $501.56 credited at check-in, for a net cost of $581.9 | $1,117.88, with $518.77 credited at check-in, for a net cost of $599.11 | $1,645.78, with $782.72 credited at check-in, for a net cost of $863.06 |

Cheapest flexible rate | $931.12 | $1,042.44 | $1,053.58 | $1,086.96 | $1,599.02 |

Savings | $412.34 | $466.28 | $471.68 | $487.85 | $735.96 |

And here are the rates at both the Ambassador complimentary weekend level and the least expensive flexible level for a two-night stay on May 9-11, 2025, at the InterContinental Fiji Golf Resort & Spa:

| Rates for the 2-night stay, including taxes and fees | Garden view | Pool view balcony | Lagoon view balcony | Beachfront balcony | Suite with club lounge access |

|---|---|---|---|---|---|

Ambassador complimentary weekend night rate | $978.72, with $430.33 credited at check-in, for a net cost of $548.39 | $1,024.48, with $452.65 credited at check-in, for a net cost of $571.83 | $1,161.74, with $519.60 credited at check-in, for a net cost of $642.14 | $1,344.77, with $608.89 credited at check-in, for a net cost of $735.88 | $1,527.79, with $698.16 credited at check-in, for a net cost of $829.63 |

Cheapest flexible rate | $929.79 | $973.25 | $1,103.66 | $1,277.53 | $1,451.40 |

Savings | $381.40 | $401.42 | $461.52 | $541.65 | $621.77 |

The above charts demonstrate the nightly premium you'll need to pay to use your complimentary weekend night. But since the room rate and taxes are covered on your second night when you use your Ambassador complimentary weekend night, this perk could more than pay for a year of Ambassador membership.

However, since the Ambassador complimentary weekend night rate before the second night credit is usually higher than the cheapest flexible rate, you'll usually get the best value when you make your complimentary weekend night stay just two nights long.

Finally, you'll see more savings when you use your Ambassador complimentary weekend night at more expensive properties. For example, here are the rates at both the Ambassador complimentary weekend level and the least expensive flexible level for a two-night stay on May 9-11, 2025, at the InterContinental Kuala Lumpur:

| Rates for the 2-night stay, including taxes and fees | Classic | Classic high floor | Super classic | Classic club access | Executive suite |

|---|---|---|---|---|---|

Ambassador complimentary weekend night rate | $265.17, with $131.96 credited at check-in, for a net cost of $133.21 | $290.36, with $144.54 credited at check-in, for a net cost of $145.82 | $315.54, with $157.14 credited at check-in, for a net cost of $158.40 | $416.27, with $207.51 credited at check-in, for a net cost of $208.76 | $693.28, with $346.02 credited at check-in, for a net cost of $347.26 |

Cheapest flexible rate | $257.22 | $281.65 | $306.07 | $403.78 | $672.48 |

Savings | $124.01 | $135.83 | $147.67 | $195.02 | $325.22 |

As you can see, the savings wouldn't completely cover your InterContinental Ambassador membership fee (unless you booked an executive suite) if you used your complimentary weekend night at the InterContinential Kuala Lumpur. But, even at one of the least expensive InterContinental hotels in the world, you'll still cover more than half of your annual membership fee on most weekend dates when you use your complimentary weekend night.

Related: The 19 best IHG hotels in the world

Bottom line

The InterContinental Ambassador weekend night perk has the potential to save you more than the program's membership fee each year. For example, we saved around $286 compared to the cheapest available rate during our two-night stay at the InterContinental Fiji in 2019. In addition, we knew going in that we'd get a room upgrade, 4 p.m. late checkout and a $20 food and beverage credit due to our InterContinental Ambassador membership. All of that adds up to $200 well invested in the InterContinental Ambassador program.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app