Capital One Shopping portal: What is it and how to use it to earn rewards

Online shopping portals allow you to earn bonus points, miles or cash back when you shop at select retailers. By logging in to your preferred portal, clicking on a store and making a purchase as usual, you can earn these bonuses on top of the rewards you get from your credit card.

Capital One Shopping is one such portal that helps you find deals and save money, even if you don't have a Capital One credit card. It offers targeted deals that differ from the Capital One Offers found in your account, and it will automatically add coupons to your shopping cart.

In this guide, we'll cover everything you need to know about using Capital One Shopping to save money on purchases.

Related: The beginners guide to airline shopping portals: How to earn bonus points and miles

What is Capital One Shopping?

Capital One Shopping is an online shopping portal that can save you money on your purchases. It's free and available to everyone, even if you don't have a Capital One credit card or bank account. However, features may be limited if you're based outside the U.S.

Unlike other shopping portals that give you points, miles or cash back, Capital One Shopping earns you credits that can be redeemed for gift cards. Although it's not the same as getting cash, many merchants are available for your gift card redemptions, including Walmart and eBay.

Capital One Shopping also provides a browser extension you can easily download after logging in. Once installed, the extension will prompt you to activate any available Capital One Shopping offers while you search online.

To use it, visit your desired retailer. You'll be prompted to activate the available offers in the top right corner of your screen. This extension is a convenient solution for simplifying the rewards-finding process and avoiding the need to manually search for them.

Related: Best credit cards for everyday spending

How to use Capital One Shopping

To use Capital One Shopping, start by visiting capitaloneshopping.com and creating an account. You can set up your own credentials or choose to log in via Capital One (if you're already a Capital One customer).

Alternatively, you might be able to use a referral to jump-start your earnings. Capital One Shopping has been known to offer referral bonuses when you join using a friend or family member's referral link. For instance, when you create an account using the referral link and download the browser extension, then spend $10 in the first 30 days, you and your referrer will both earn a one-time bonus of $40 in rewards.

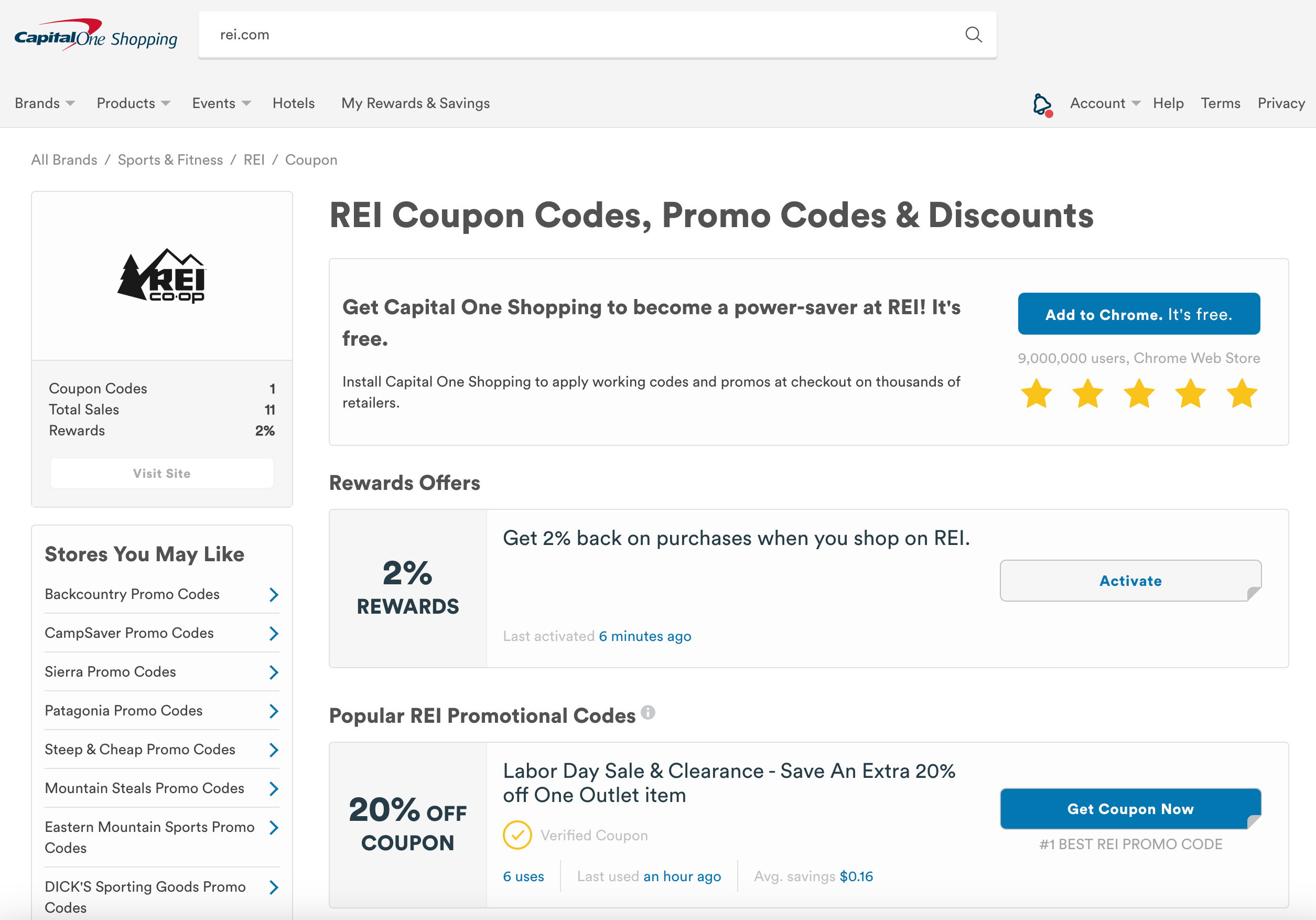

Once you have an account, you can find what you're looking for using the search bar at the top of the page. From the individual merchant page, click "Visit Site" in the upper left box. You can also click "Activate" or "Get Coupon" on one of the offers below. You'll be redirected to the merchant's site to complete the purchase.

Like other shopping portals, you must click through the portal to receive rewards (unless you have the browser extension, which will prompt you to activate rewards when you open an eligible merchant's site). You should avoid navigating to other websites or shopping portals during the process and using coupon codes that aren't listed on Capital One Shopping, as this may cause your purchase to not be tracked properly with Capital One Shopping.

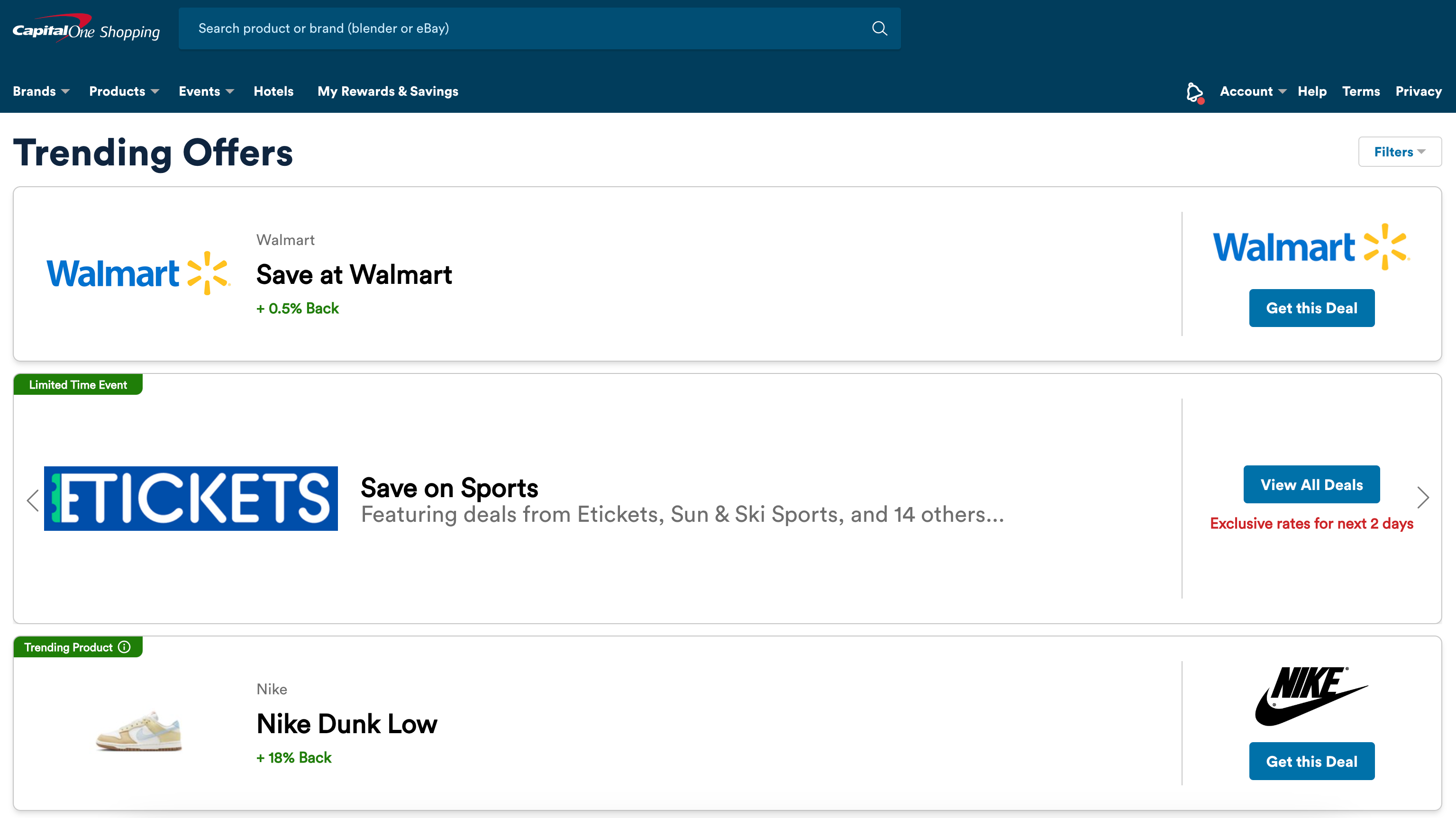

If you're not sure exactly what you're looking for, you can browse options by clicking the "Brands" or "Products" tab at the top or choose the "Events" tab to search current deals. Capital One Shopping now offers a wide variety of merchants, ranging from pet supplies and electronics to hotels and concert tickets.

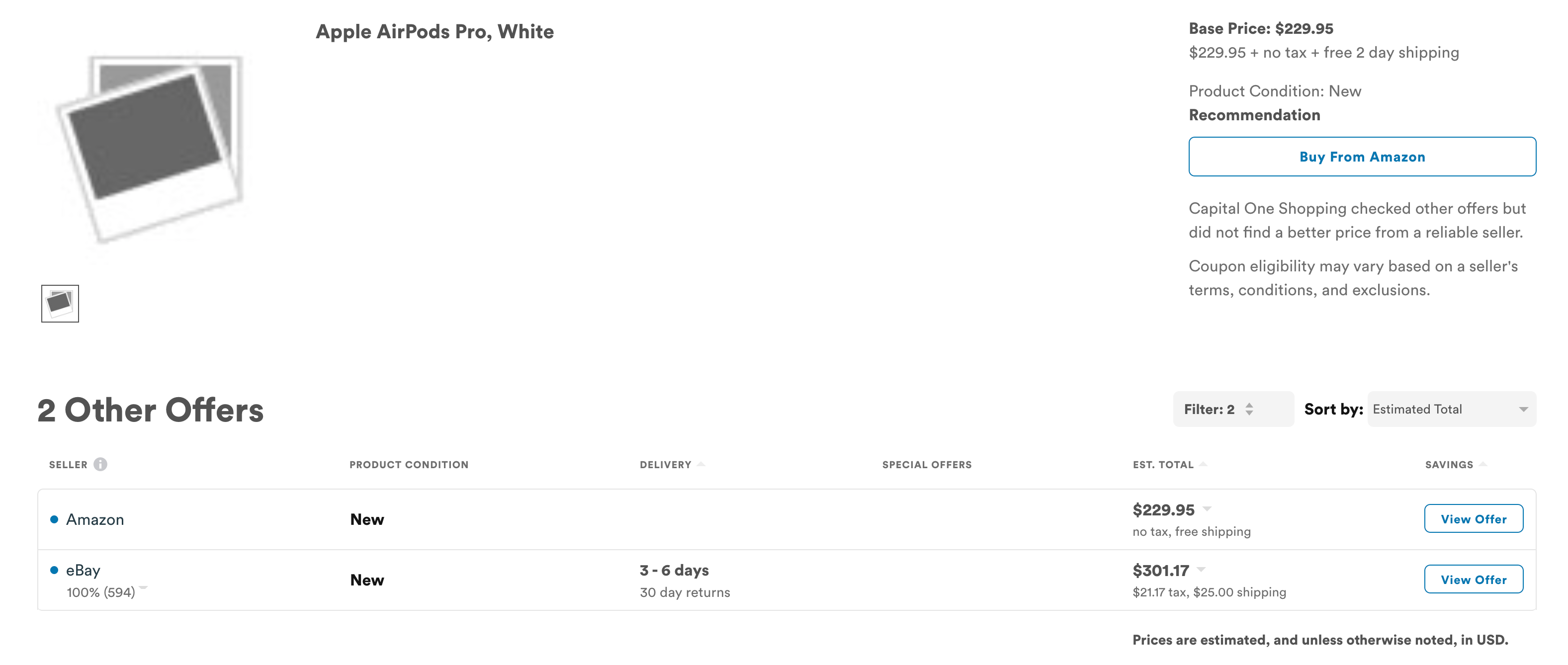

When you search by product, Capital One Shopping will display the various merchants that sell your item, including the product condition, the estimated delivery time, the potential rewards and the final out-of-pocket cost after rewards. For example, when I searched for Apple AirPods Pro, I could save over $70 when buying them from Amazon instead of eBay.

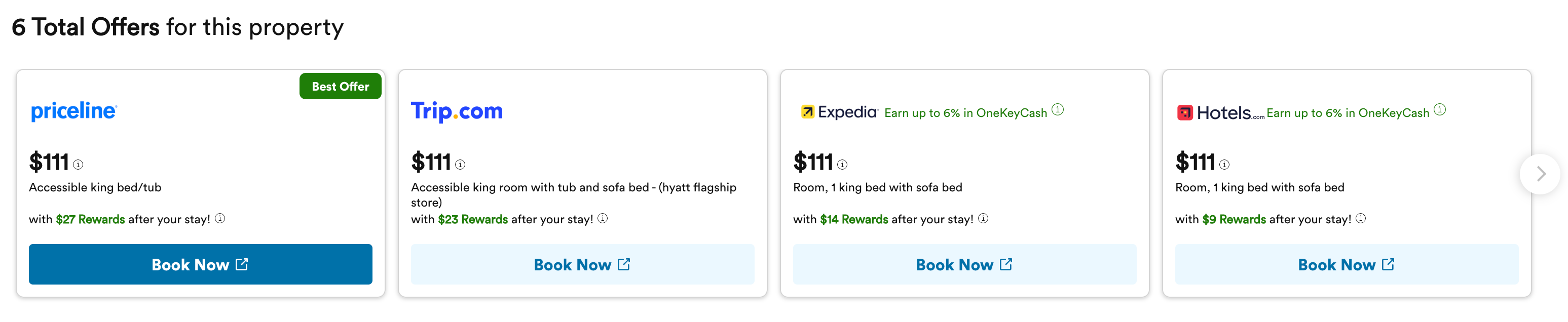

Capital One Shopping has a similar price comparison tool for hotel reservations. Start by searching for your destination and dates, then click on a hotel that interests you and scroll down to see the available offers.

As you can see, booking with certain online travel agencies can save you money on your hotel stay. But remember that you generally won't receive elite status benefits or earn elite-qualifying points or nights unless you book directly with the hotel. If you find a lower rate at a Marriott, Hyatt, Hilton or IHG property than what's available by booking directly, you can submit a price match/best-rate guarantee request, and if approved, the lower rate will be honored.

Related: 9 things to consider when choosing to book via a portal vs. booking directly

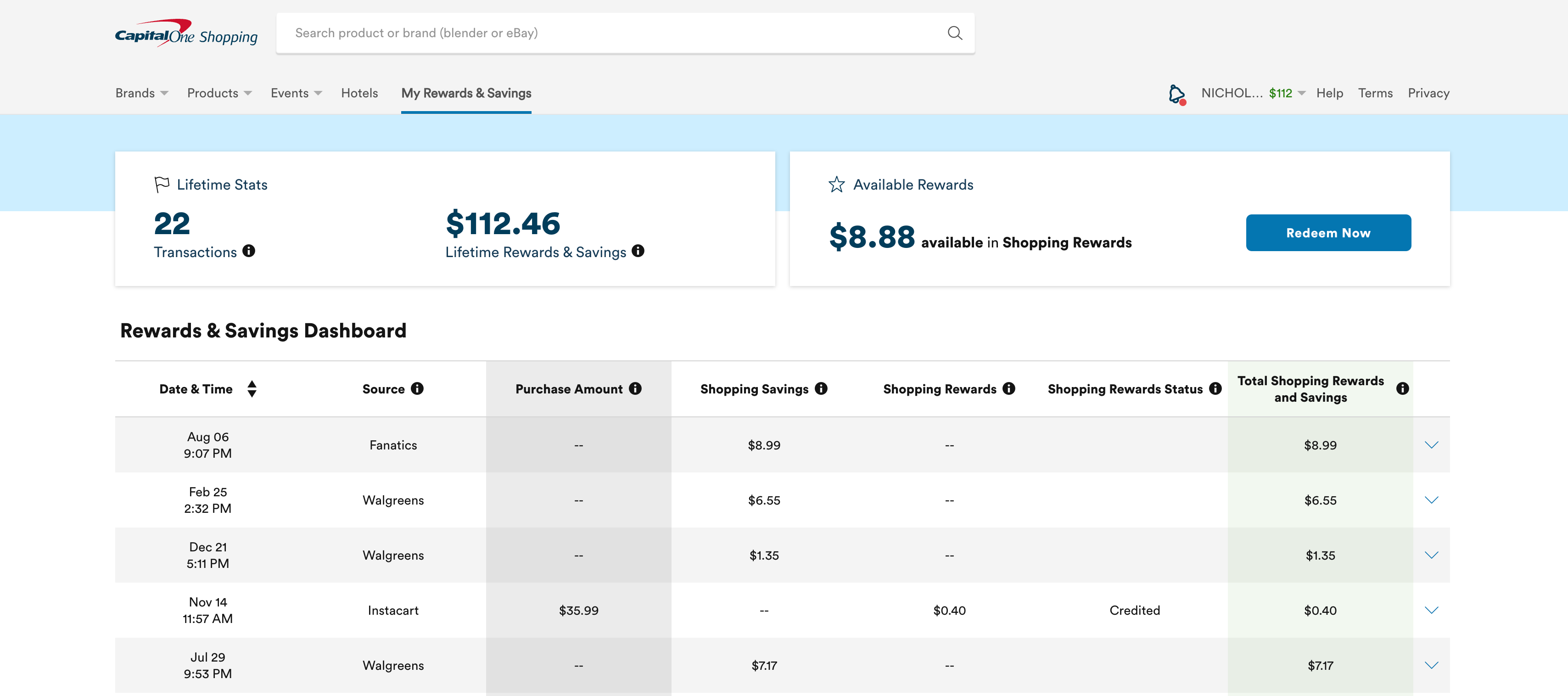

How to redeem Capital One Shopping rewards

As mentioned, Capital One Shopping provides rewards in the form of credits that can be redeemed for gift cards at select retailers. This is different from programs like Rakuten, Dosh and TopCashback, which allow you to earn cash rewards (typically distributed via PayPal, check, automated clearing house service or Venmo transfers).

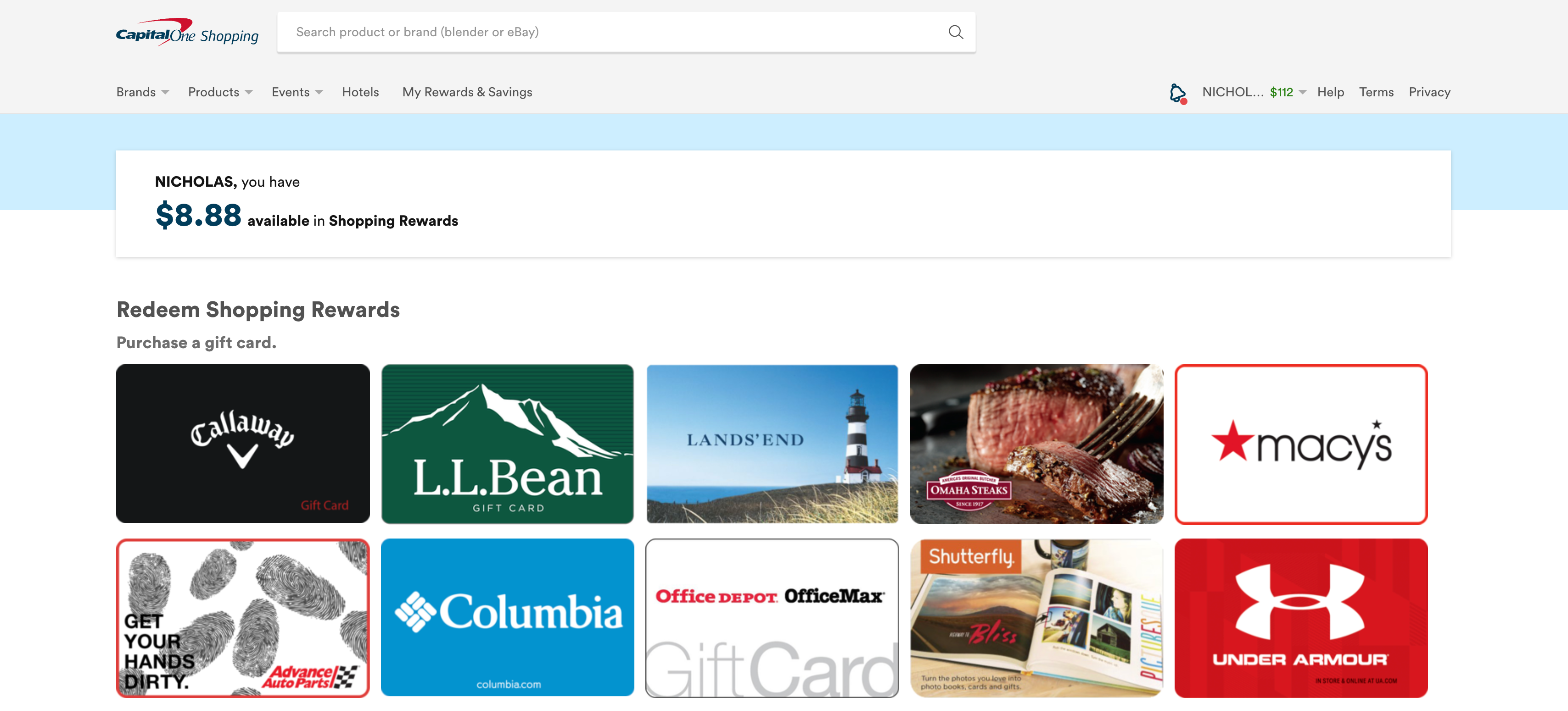

When you're ready to redeem your Capital One Shopping rewards, you can order gift cards by selecting "Redeem Now" under the "My Rewards & Savings" tab.

From there, you can see your redemption options. There are currently over 50 retailers to choose from.

Related: Use a shopping portal aggregator to maximize online purchases

What credit card should you use with Capital One Shopping?

You can use Capital One Shopping without using a Capital One card. However, many Capital One cards can be great options for these types of purchases, including:

- Capital One Venture Rewards Credit Card: Earn 2 Capital One miles per dollar spent on every purchase.

- Capital One Venture X Rewards Credit Card: Earn 2 miles per dollar spent on every purchase.

- Capital One Spark Miles for Business: Earn 2 miles per dollar spent on every purchase.

- Capital One Quicksilver Cash Rewards Credit Card: Earn an unlimited 1.5% cash back on every purchase.

For additional suggestions, check out our list of the best cards for online shopping.

Related: Capital One miles: How to earn, redeem and transfer rewards

Bottom line

The Capital One Shopping portal can help you save money, even if you don't have a Capital One credit card. Although it falls short of offering cash back, it rewards you with gift cards at various merchants, and it sets itself apart from many shopping portals with valuable price comparison functionality and the ability to search for and apply coupon codes to your transactions. Plus, the Capital One Shopping browser extension makes it easy to activate available offers and earn rewards while shopping online.

Overall, using Capital One Shopping is a simple and effective way to maximize savings on your purchases — so sign up today.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app