How I save money on expensive hotel stays by buying points

While many travelers will tell you to avoid buying points and miles, there are times when it can make a lot of sense.

If there's any way to earn points other than purchasing them, it's better to do that. For example, if you can open an IHG credit card and earn 140,000 points from a welcome offer, that usually makes more sense than buying points outright. But there are plenty of scenarios where buying rewards can save you hundreds — and even thousands — of dollars.

I've purchased points many times to save money on a hotel stay. The strategy generally works best for super expensive luxury hotels and cheap hotels alongside the highway. I'll give you some examples.

[table-of-contents /]

Buy points for expensive five-star hotels

Luxury hotels almost always cost a ton of points. You might think it's absurd to buy hundreds of thousands of points for a single stay at brands like Waldorf Astoria, Ritz-Carlton and Park Hyatt.

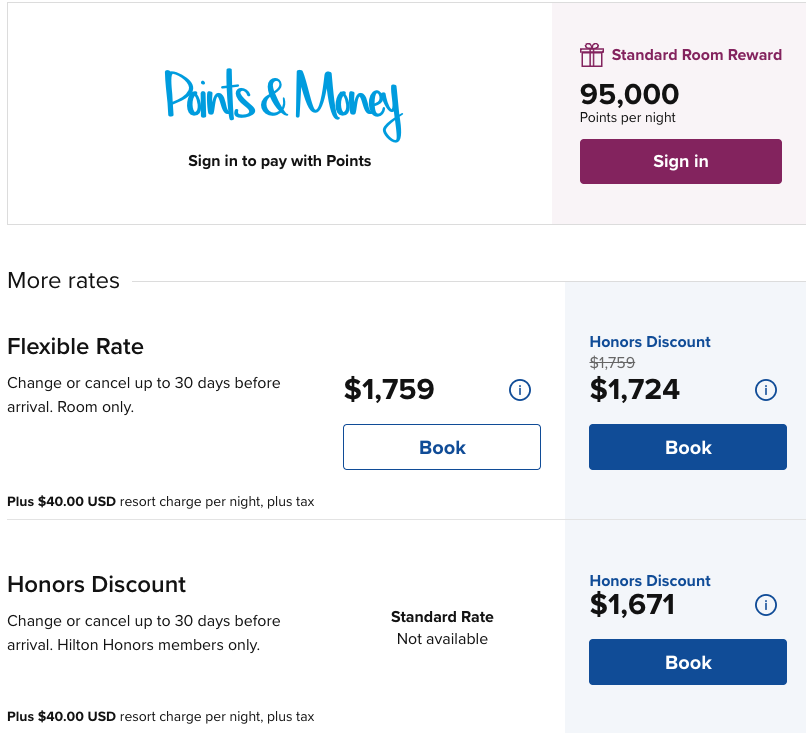

But room rates are also sky-high at properties such as these. Take the Waldorf Astoria Park City: Rooms during ski season at this hotel are nightmarish. After taxes, you can pay nearly $2,000 per night.

The above screenshot is for a room in early February. You'll pay $1,942.72 per night after taxes and fees. At the same time, it costs just 95,000 points per night.

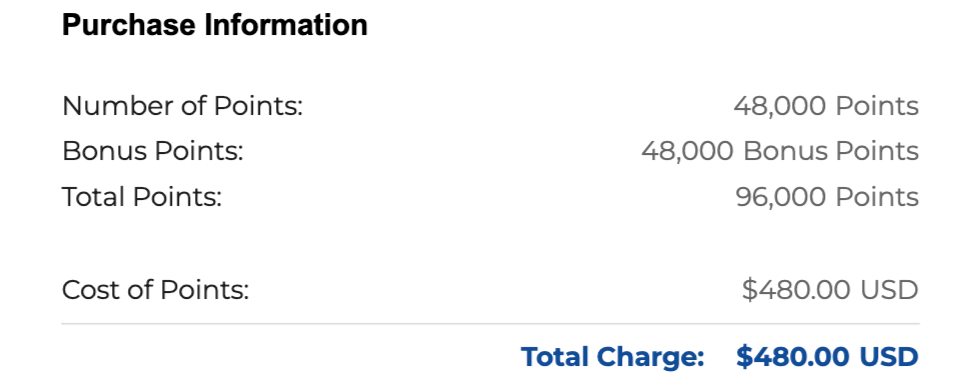

As you can see, you're currently able to buy enough points for the same night for $480 with Hilton's current points sale, which offers a 100% bonus. Note that this sale is active at the time of writing, but may have changed by the time you read the article.

Plus, if you've got Hilton elite status (which you can earn from opening any Hilton cobranded card), you'll get the fifth night free when booking five or more consecutive award nights. In other words, you'll pay effectively 76,000 points per night when staying at least five nights.

Note: This sale allows a maximum of 340,000 Hilton points. To book five nights at this particular hotel, you'll need 380,000 points. Fortunately, Hilton allows friends and family members to pool points for free, up to 500,000 points. So if you're booking with a friend, have them purchase the remaining points and then add them to the pool.

With this points sale, you'll have to spend a whopping $1,900 on points for a five-night stay. That sounds like a ton of money, but here's the thing: This exact same stay costs $9,713.63 in cash. By purchasing points, you can save more than $7,800 on this stay. You're spending $380 per night instead of $1,942 — an 80% discount!

Spending $380 per night is still a high price tag for many of us. But for a stay at a five-star ski lodge during peak ski season, that price is inconceivable.

Related: Get your 4th or 5th night free on award stays

Buy points for inexpensive awards at hotels along the highway

This strategy works at more than just expensive luxury resorts. It's a great way for road warriors or road-trippers to save lots of money on convenient roadside hotels with low points costs.

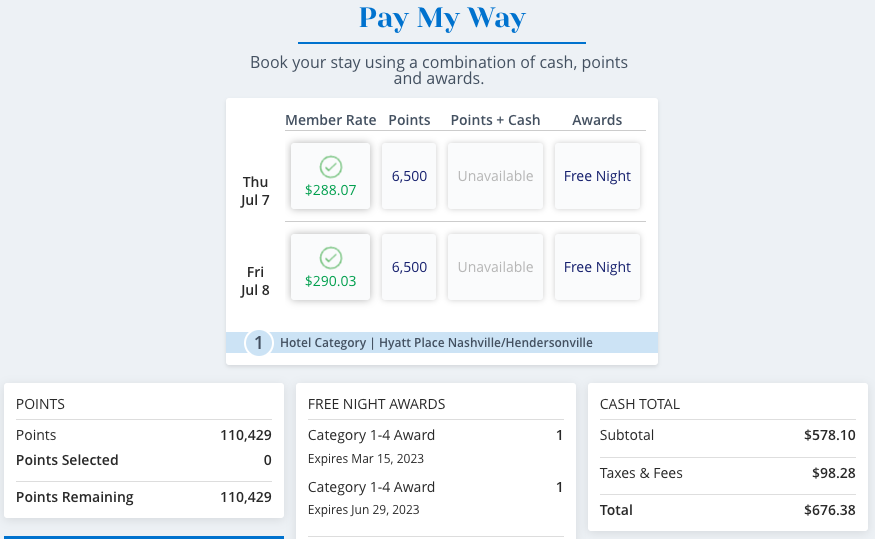

For example, the Hyatt Place Nashville/Hendersonville costs between 3,500 and 6,500 Hyatt points per night. But the hotel can cost over $300 per night.

As you can see, two nights would cost $676 on random dates in July.

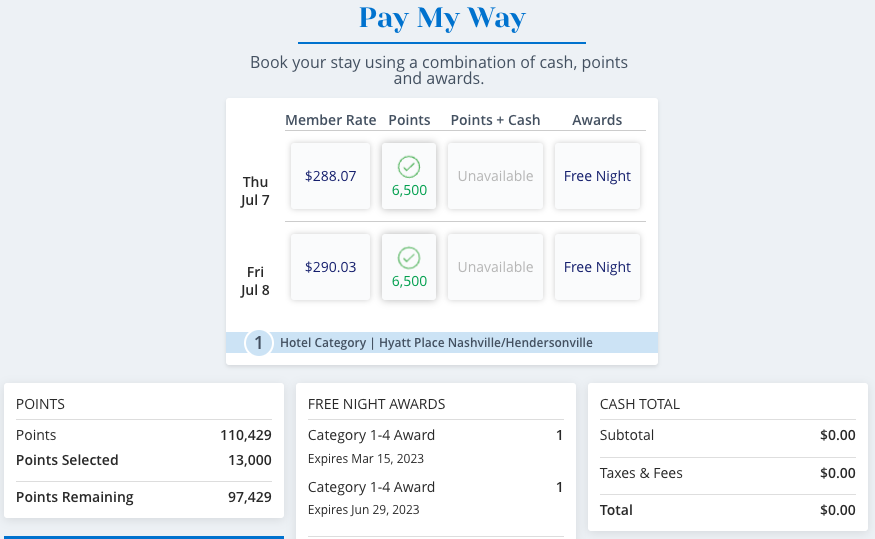

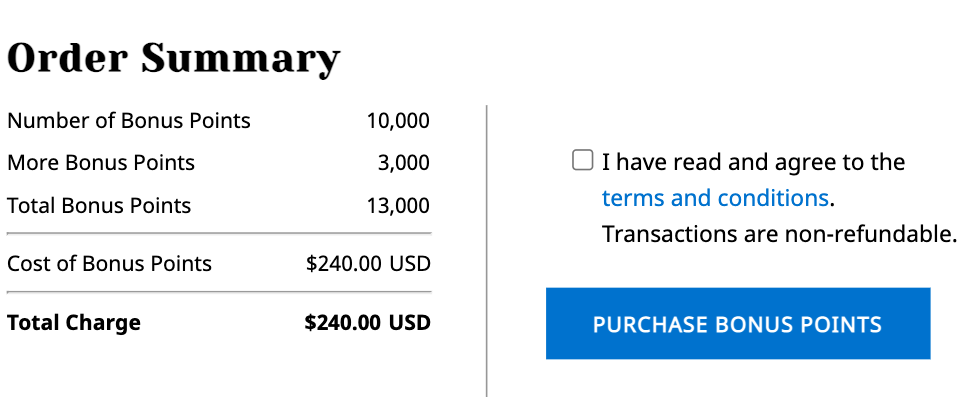

But you can use 13,000 Hyatt points and get the stay entirely "free" — you won't even have to pay taxes.

Hyatt currently has a modest promotion that offers 30% bonus points when you buy 5,000 or more Hyatt points. You could purchase 13,000 Hyatt points and reserve this stay for $240 instead of $676 — a savings of $436.

Related: When does it make sense to buy points and miles?

Bottom line

Hotel points are touted as the tools for "free" hotel stays. And they are — but they can also effectively reduce the cash rate of a hotel in a dramatic way.

If you're considering paying for an expensive hotel — or if you've written off a hotel because its cash rates are too high — calculate how much you'd pay if you simply purchased enough points for an award night. You'll often find that it places steeply priced hotels into your budget, especially if there's a points sale.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app