Complete guide to holding airline award tickets

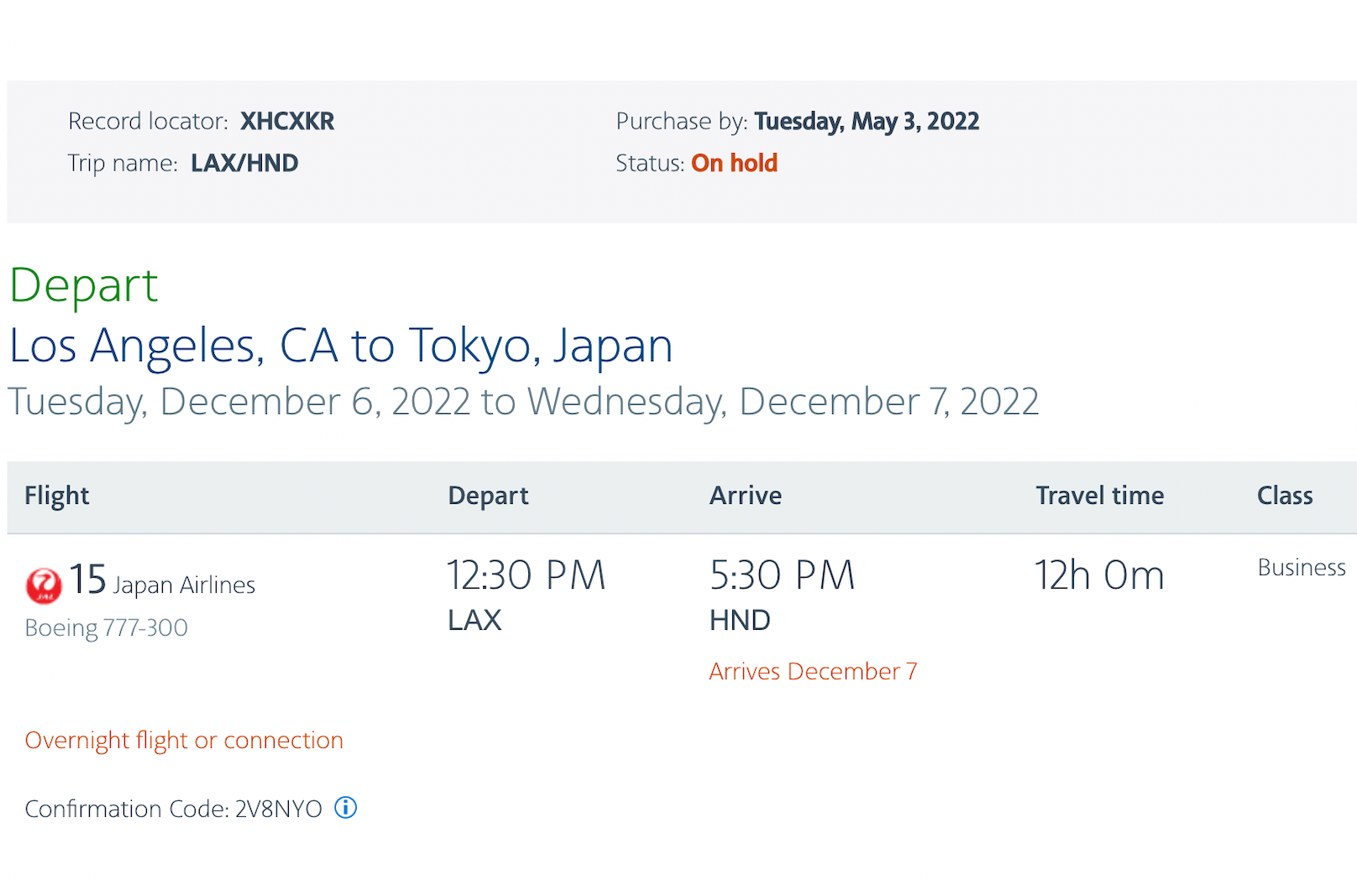

Some airlines let you put award tickets on hold before booking. This lets you lock in award space while you wait to finalize travel plans or for points to arrive from a transferable points credit card.

This flexibility is a huge perk when planning award travel, especially for premium cabins. It makes it much less likely for your seat(s) to be snagged by another traveler before you have the chance to book.

Unfortunately, not all airlines offer award holds — so you should be aware of the programs that do.

In this article, I'll walk you through what an award ticket hold is, highlight when you should put a ticket on hold and list the airlines that let you hold award tickets. You'll have everything you need to know about award ticket holds by the end of the article.

What is an award ticket hold?

As discussed, an award ticket hold lets you reserve award space before actually booking it.

This removes the award space from public booking for a set period of time, effectively "holding" it so that only you can actually ticket the award. Some airlines offer these holds for as little as 48 hours, while others offer longer hold times.

The benefit here is twofold. First, you have extra time to transfer points from a credit card. Second, you have a chance to finalize your other travel plans.

Not getting a hold means another traveler could scoop up your award ticket before you have the chance to book. This could leave you stranded with miles you can't use if the award space is booked after you transfer miles from a credit card.

Related: 6 reasons why now is the time to book travel with points and miles

When you should put an award ticket on hold

One of the most common reasons you'll want to put an award ticket on hold is when you transfer points from a credit card to an airline to book a ticket. These often process instantly, but there are some exceptions.

For example, transfers to Singapore KrisFlyer can take 48+ hours to process. Likewise, transfers from Marriott Bonvoy to any airline partner take at least 24 hours to process — and I've personally experienced transfer times as long as 96 hours. Thankfully, we've tested all of these programs and published guides so you know what to expect:

- How long do American Express Membership Rewards transfers take?

- How long do Bilt Rewards points take to transfer?

- How long do Chase Ultimate Rewards take to transfer?

- Here's how long Citi ThankYou point transfers take

- How long do Capital One miles take to transfer?

- Here's what you should know before transferring Marriott points to airline miles

If you're eyeing a program that doesn't transfer instantly — like the sweet spot of booking round-trip flights to Europe for 88,000 points through ANA Mileage Club — you could lose out on your award space and be stuck with miles you can't use. So if your airline partner allows it, always hold award space before you transfer points.

You'll also want to put awards on hold when planning trips that aren't set in stone. This gives you extra time to plan your trip without worrying about losing your award space.

That said, remove your hold if you decide not to book a trip to reopen that award space to other travelers.

Finally, it's worth noting that holding an award should prevent it from slipping through your fingers. However, nothing is final until you have a confirmation email with a fully ticketed reservation. An airline could suddenly decide to change a flight or otherwise adjust availability. If a flight is canceled or the flight number changes, you may lose your hold. Since a hold isn't a guarantee, you should try to finalize the award as soon as possible.

Related: Waiting to ticket an award hold — Reader Mistake Story

Airlines that allow award ticket holds

Here's a look at all of the airlines that currently offer award ticket holds, along with an overview of the fees involved, how to put an award on hold and whether you can hold partner awards.

| Airline/program | Hold length | Can you hold partner awards? | Fee | How to request a hold |

|---|---|---|---|---|

48-72 hours. | Yes, though partner award space may not be guaranteed. | $0. | Call Flying Blue reservations line. | |

5 days. | Yes. | $0. | Select "AAdvantage Hold" on the online checkout page. | |

Up to three weeks.* | Yes, but seats for partners can still disappear; only Cathay Pacific seats are truly "on hold." | $39. | Call Asia Miles reservations line. | |

Up to six days, depending on phone agent. | Select Star Alliance carriers and all Miles & More airlines (Austrian, Brussels, Swiss and Lufthansa). | $0.** | Call Lufthansa Miles & More reservations line. | |

Up to four months. | No. | $25.*** | Call Singapore KrisFlyer reservations line. | |

48 hours (if booking seven or more days in advance), reports of longer holds depending on phone agent. | Yes. | $0. | Call Turkish Miles & Smiles reservations line. | |

24 hours. | Yes. | $0. | Call Virgin Atlantic Flying Club reservations line. |

Notes:

* There is no written policy on award holds with Asia Miles, and a supervisor must approve all holds. Most people who manage to secure a hold have 70% or more of the miles needed for the redemption already in their accounts, and fees can vary by phone agent. $39 is the most common.

** Previously, Lufthansa Miles & More charged a $20 hold fee. This has disappeared during the COVID-19 pandemic, and we don't know if this fee will return in the future.

*** Phone fees vary by agent. Some agents will ask for a $25 fee, while others won't mention any fee. Hanging up and calling again might help you avoid this fee.

Related: The cheapest business-class awards across all three alliances

Tips for putting an award ticket on hold

Keep these tips in mind before you call in for an award hold. They will make your experience more seamless and ensure you can hold (and eventually book) the perfect award ticket.

Find open award space before you call

The most important thing to do before calling in for an award ticket hold is to find the award space you'd like to book. Some phone agents with certain airlines may not be adept at locating award inventory, particularly for partner carriers. As a result, do your research ahead of time.

Most of the time, you can do this online using an alliance search tool — for example, using united.com to search for Star Alliance awards. Check out our guides to finding award space with the three major alliances for more info:

- The best websites for searching Oneworld award availability

- The best websites for searching SkyTeam award availability

- The best websites for searching Star Alliance award availability

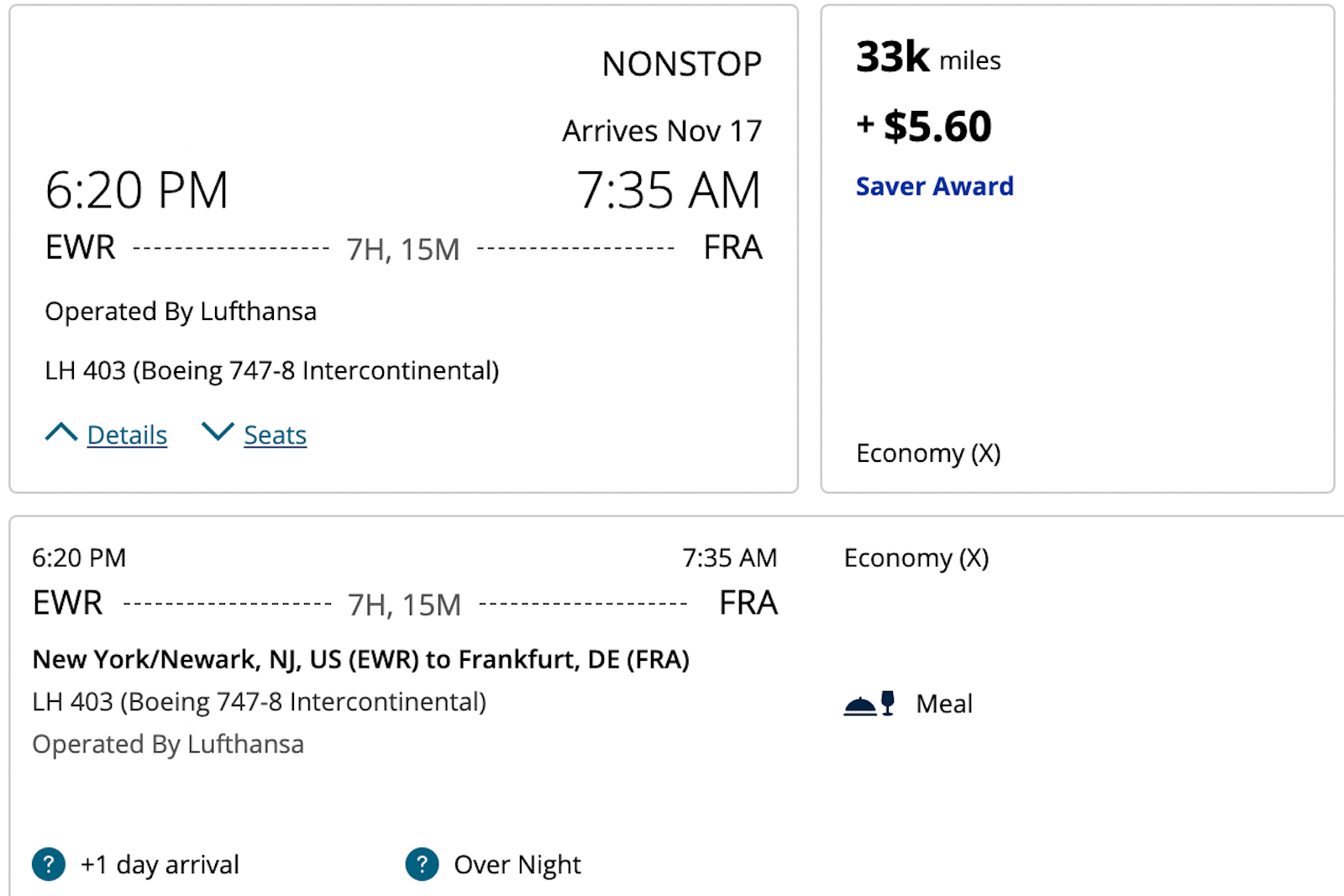

Once you find the flight you'd like to book, note the date, operating airline, flight number and class of service (including the lettered fare class). For example, this flight departs on Aug. 19, is operated by Lufthansa as flight number LH403 and it's in the economy cabin with the "X" fare class.

Then, call the reward program through which you'd like to put your award ticket on hold. Ask the phone agent if you can put an award ticket on hold and tell them the above details.

Note that the airline you call may differ from the airline operating the flight. All holds for award tickets must be done with the airline whose points or miles you're going to use. For example, the above flight is operated by Lufthansa, but you'd only call Lufthansa for the hold if you're booking through its Miles & More program. If you're planning to redeem Turkish miles, you'd call Turkish for the hold. And if you're looking to use Singapore miles, you'd call the Singapore KrisFlyer team.

Read more: What are codeshare flights and how do they work?

The process should be quick and easy from here. Once the hold is secured, the phone agent will give you a confirmation number and the date and time of when your hold expires.

Once you've confirmed your travel plans, call the airline back and confirm the hold by telling the agent your confirmation number.

Don't be afraid to hang up and call again

As with many things in the points and miles world, your mileage may vary when requesting an award hold.

Some phone representatives may not be aware of the airline's hold policy. If this happens to you, politely end the call and call back.

After a call or two, you should have your hold secured.

Related: How to avoid airline change and cancellation fees

Add a reminder to your calendar

Finally, you may want to add a reminder to your calendar, once you have details, on when the hold expires. We all lead busy lives, and you'd hate to get caught up with other commitments, lose track of time and miss out on that coveted award seat.

Bottom line

Booking an award ticket can be complicated — and, unfortunately, only a handful of airlines allow you to temporarily hold such tickets. The option can be extremely useful when planning award travel with transferable points or when piecing together a trip that isn't set in stone.

Bookmark this article and refer to it the next time you're planning a trip — it could save you a massive headache.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app