A show-stopping experience: What it's like to attend a Broadway show with young kids

In May, when former New York Gov. Andrew Cuomo announced Broadway would be returning and shows would start selling tickets, I looked at my "Wicked"-obsessed wife and daughters and said, "Want to go see Wicked on Broadway in September?"

After a blank-faced, silent shock at the question, there were scenes of jubilation in our living room and 10 minutes later, our tickets to see Wicked on Broadway were purchased and our plans were set.

But then, it hit me. My 8-year-old twins aren't vaccinated yet. Would vaccine restrictions force us to ax our trip to experience newly opened Broadway?

While parents await a universally approved vaccine for young children, Broadway has several shows that allow vaccinated adults to be accompanied by children under 12, if they're tested. Thankfully, Broadway has provided clear guidelines for showgoers to follow in order to catch their favorite shows live and in person.

This is what it was like to attend a show with kids in tow, now that Broadway has officially returned.

Related: Curtains up: TPG's guide to Broadway's fall reopening

[table-of-contents /]

Testing requirements

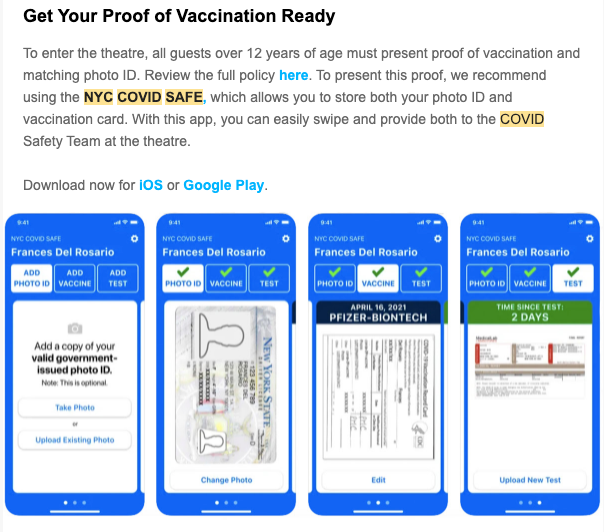

If you want to attend a Broadway show in New York City, you'll need to be vaccinated and show proof. While a picture of your vaccination card and photo identification works for admission, we chose to follow the Broadway direct guidelines as they specified to download the NYC Covid Safe app and upload your ID and vaccination card on the app.

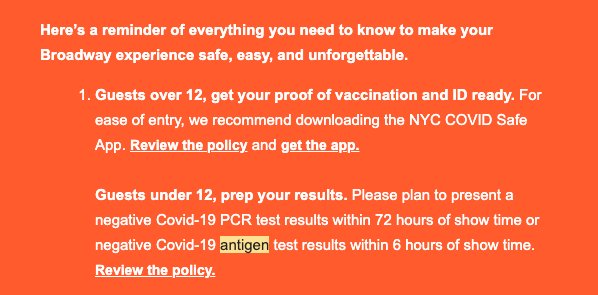

For children 12 and younger who aren't eligible to be vaccinated, they must provide proof of one of the following instead of evidence of vaccination:

- Negative COVID-19 PCR test performed by a medical provider within 72 hours of the performance start time. The test results must clearly show the date and time of the test

- Negative COVID-19 rapid antigen test taken within six hours of the performance start time. The test results must clearly show the date and time of the test. This test may be performed by a medical professional or by using an over-the-counter testing kit.

We purchased the two-kit Abbott's BinaxNow COVID-19 Home Tests via Optum for both our daughters and packed the kits in our carry-on bag. If you're attending a Broadway show in the near term with children under 12 years of age, you can choose to purchase a COVID-19 PCR test and furnish a negative test result 72 hours prior to the show or a rapid antigen test within six hours of showtime.

Before arrival

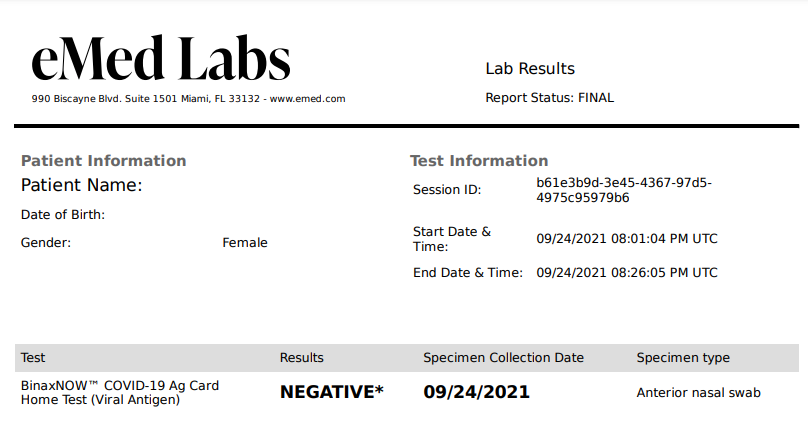

Because the show policy requires a negative COVID-19 antigen test result within six hours of show time, we returned to our hotel room in the late afternoon on the day of our show, to assure we were within the six-hour window for our 8 p.m. show.

From our cell phones in our hotel room, we followed directions on the test kit packet and proceeded with the nasal swab test, accompanied by a live, certified guide to proctor the test. After waiting 15 minutes, the guide came back to verify our negative test result and immediately I received an email confirmation which would be my proof at the theater.

At the theater

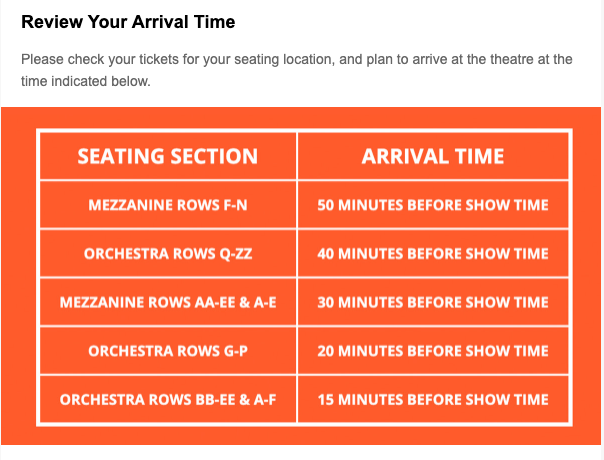

Once you've purchased your Broadway tickets, you'll receive an email with suggested arrival times based on your seat location for your particular show. This is done in order to stagger the admission process and to avoid large crowds forming at the entrance of the theater.

We arrived promptly at the Gershwin Theatre at our designated time, 15 minutes before the show was to start.

Immediately, we noticed there was a two-step admission process to enter the venue.

First, adults need to show vaccination cards (on your phone or in the NYC Covid Safe app) and proof of identification, along with the negative COVID-19 test results within the required time frame for any children under 12 in your party. I pulled up the email I received from eMed Labs with my daughters' negative COVID-19 antigen test results and showed it to the attendant just outside the theater entrance doors.

Once we relinquished proof of our vaccination status and satisfactory testing requirements for the kids, we were granted access and an usher scanned our tickets and directed us to our seats.

During the show

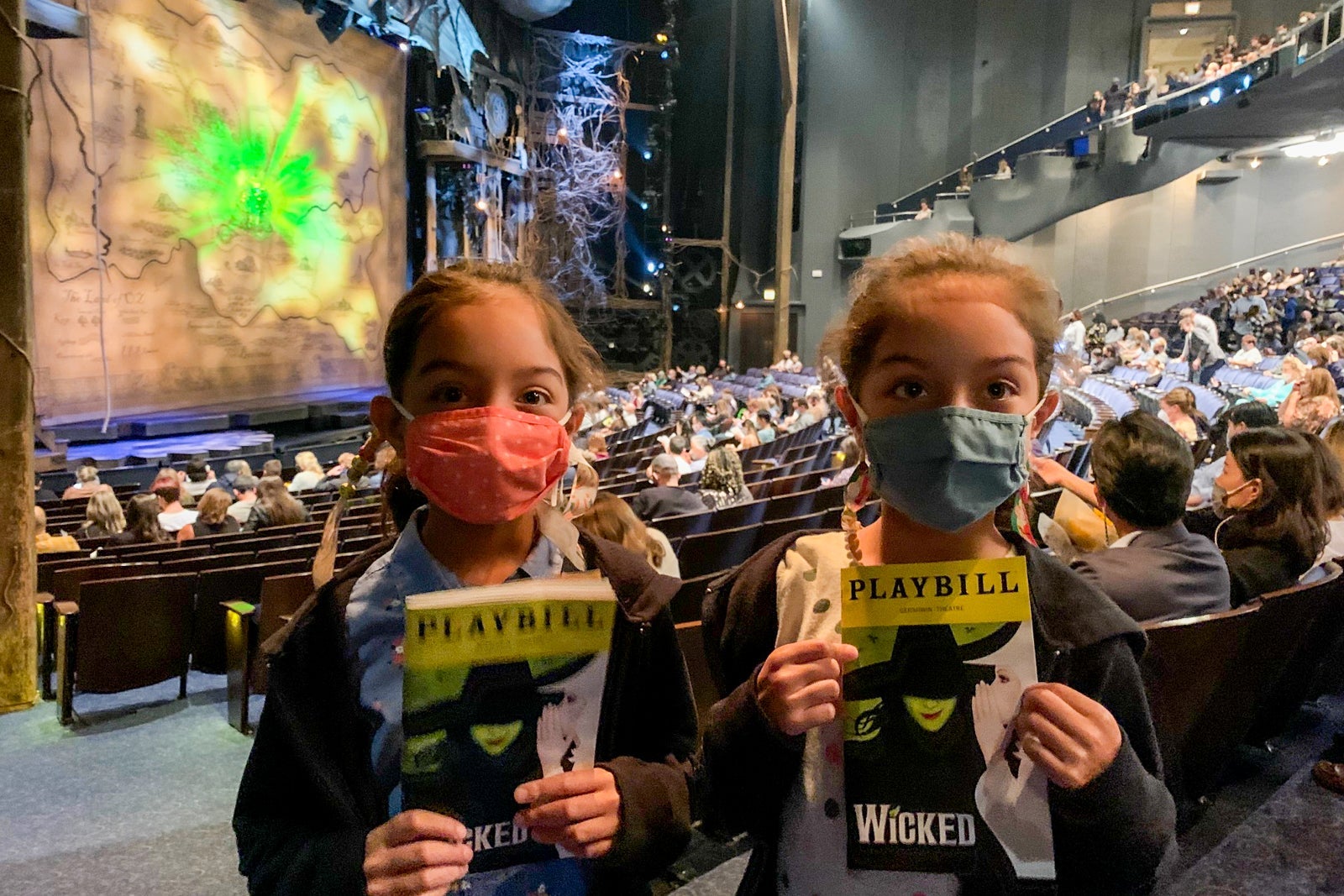

The eager crowd was energized and a packed house complied with the mask requirement, with ushers politely (but resoundingly) reminding show attendees of the theater's mask rule and etiquette.

Excitement filled the air, almost as if everyone in attendance understood the privilege of being back inside a theater, watching a Broadway show live and in color, with real actors on stage.

Bottom line

After a year-and-a-half-long hiatus, Broadway is back and better than ever.

Prior to the show, I was anxious about the extra hurdles required to witness a show in person with my kids, but thankfully, the process was easy. My daughters cheered and revered the brilliant actors onstage and as parents, we didn't have to worry about masking or vaccine requirements, since all in attendance needed to substantiate proof of vaccination or supply a negative COVID-19 test result in order to enter the theater.

Parents attending a Broadway show with children under 12 will need to have their child produce a negative COVID-19 PCR test result within 72 hours of show time or a negative COVID-19 antigen test within six hours of the performance start time. Then once your child's negative test result has arrived, follow the theater arrival guidelines and give yourself a standing ovation. You did it. You saw a show on Broadway again!

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app