Don’t overlook Resy: How to maximize dining experiences and save money with this Amex benefit

I'll be the first to admit that many premium cards have gone overboard with the statement credits. Paying a sky-high annual fee to save money on certain purchases hasn't always made sense to me. You have to stay organized, or you may wind up losing out on value. It can be a lot for busy folks to manage.

However, one benefit of many American Express cards has completely won me over since its rollout: the easy-to-use and supremely valuable Resy credit.

I've sung Resy's praises since statement credits of up to $100 each calendar year at U.S. Resy restaurants (up to $50 semiannually; enrollment required) were added to my American Express® Gold Card in 2024.

When the refreshed American Express Platinum Card® tacked Resy statement credits onto its new list of benefits, I was persuaded to open the card myself.

With a credit this simple and valuable, it's worth taking a deeper look. Here's what you need to know to save money on your next meal out.

What is Resy?

Resy is a dining reservation platform owned by American Express. It functions similarly to OpenTable, allowing users to make reservations at various popular dining spots.

Resy flashed onto the radar of many Amex cardmembers when statement credits for purchases at Resy restaurants were added as a benefit to certain cards in the Delta Amex suite.

As of September 2025, Resy partners with some 10,000 restaurants across the U.S., according to its website. Anecdotally, I've found Resy restaurants are easy to find in multiple areas of the country, so I think it's worth searching Resy's website or app for your city (or a city nearby) to see what's included near you.

As a resident of Greenville, South Carolina, I was impressed by the number of options in my medium-size city. This extends to other smaller cities, too, such as Jacksonville, Florida, and Rochester, New York.

Related: How I get this monthly credit on my Delta Amex without even trying

Which cards have Resy credits?

Whether you're considering a card with Resy credits or already have a card that includes the benefit, here's the full list:

- American Express Gold Card: Up to $100 per calendar year (up to $50 in semiannual statement credits)*

- American Express Platinum Card: Up to $400 per calendar year (up to $100 in quarterly statement credits)*

- Delta SkyMiles® Platinum American Express Card: Up to $120 per calendar year (up to $10 in monthly statement credits)*

- Delta SkyMiles® Platinum Business American Express Card: Up to $120 per calendar year (up to $10 in monthly statement credits)*

- Delta SkyMiles® Reserve American Express Card: Up to $240 per calendar year (up to $20 in monthly statement credits)*

- Delta SkyMiles® Reserve Business American Express Card: Up to $240 per calendar year (up to $20 in monthly statement credits)*

*Statement credits are available when you use your card for Resy purchases in the U.S. Enrollment is required.

Related: Credit cards that can get you $1,000 or more in first-year value

How to use the Resy credit on Amex cards

The Resy credit truly couldn't be much easier to use.

All you have to do is log into your American Express account, navigate to your benefits page and enroll in the Resy credit.

Here's an example of how I navigated to the credit for my new Amex Platinum.

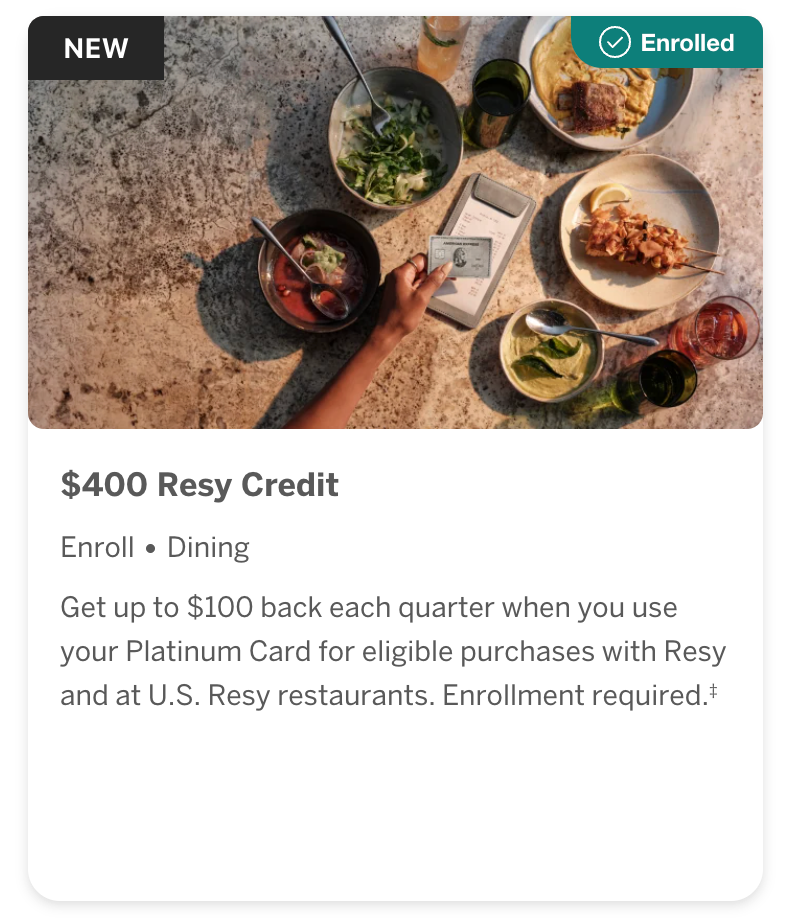

After selecting "Enroll in Benefits" on the front page, I found the $400 Resy credit and enrolled.

Once you're enrolled, you'll receive a statement credit any time you make a purchase on your eligible card at a U.S. restaurant affiliated with Resy. Many TPG staffers report the credit hitting their statement within days of purchase.

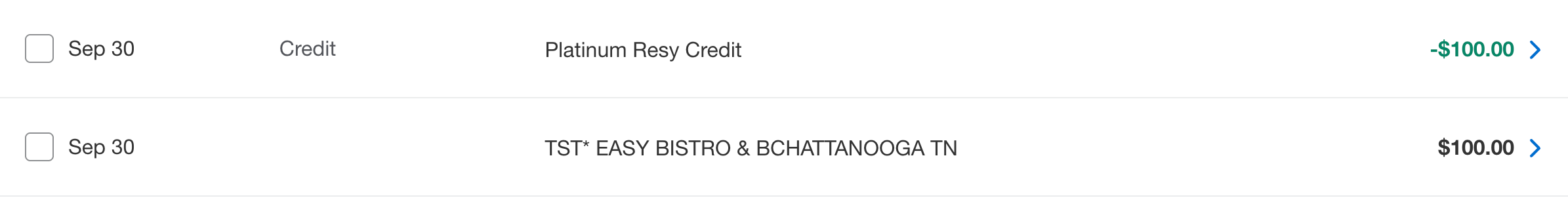

I recently received my new Amex Platinum just days before my quarterly credits reset, which meant I had only a few days to spend $100 to maximize this benefit.

I searched the Resy platform to find a restaurant my parents would enjoy for a night out in Chattanooga, Tennessee, near my hometown. I found a restaurant that I know they love and bought an online gift card for them as a gift.

The credit was processed as soon as the charge hit my account. I didn't even set foot in the restaurant.

I'll dive into some frequently asked questions soon, but for a quick rundown:

- You don't have to make a reservation at the restaurant.

- You don't have to have a Resy profile.

- There isn't any minimum spending requirement to trigger the credit.

- You can use the credit for gift cards or takeout orders made directly with the restaurant.

How our team maximizes Resy credits

I'm not the only TPG staffer who loves to use this credit to save money while dining out. Here are some examples of how our team has maximized the Resy credit on their American Express cards:

- Senior engineer Sami Wilensky purchased a $125 gift card on her Amex Platinum Card at a Resy restaurant in Tampa and plans to use it in the future or give it as a gift. Then, she went out to eat at a different Resy restaurant and used her Amex Gold Card to earn the other statement credit.**

- Credit cards editor Olivia Mittak used her Amex Platinum's Resy statement credit** to have dinner at a restaurant she couldn't otherwise afford. Thanks to the statement credit, she spent just $10 for the whole meal.

- Senior editorial director Nick Ewen recently used the Resy statement credit** on his Amex Platinum at a hotel restaurant in Miami. Even better? The restaurant was participating in Miami Spice, a monthlong dining promotion in September that offers tasting menus at a deep discount. He enjoyed a terrific meal at an affordable price and got $100 back since he paid the bill directly rather than charging it to the room.

- Senior travel editor Lyndsey Matthews and director of travel content Eric Rosen both used Resy to search for restaurants in their neighborhoods so they could use their statement credits** for dinner with friends.

- Managing editor for newsletters Becky Blaine splurged on a dinner and used $84.65 of her Resy statement credit.** She still has more to use for the rest of the quarter since you don't have to spend the full value of the credit on one transaction.

**Statement credits are available when you use your card for Resy purchases in the U.S. Enrollment is required.

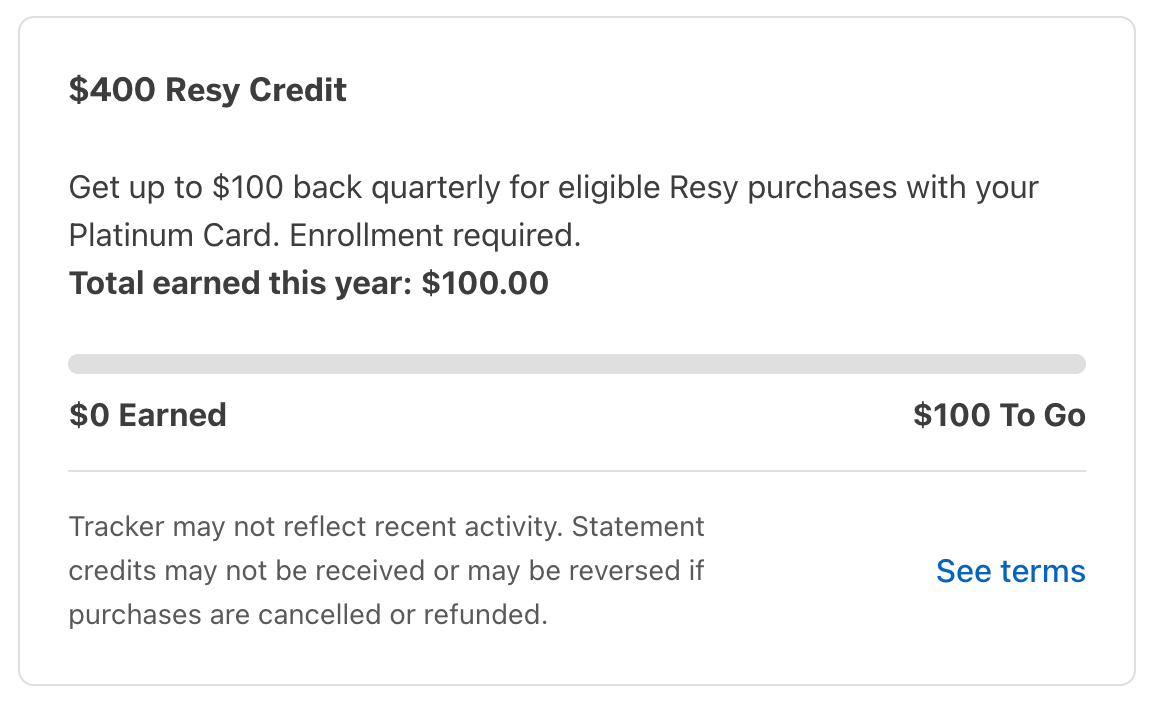

It's easy to track your progress with the Resy credit to ensure you aren't forgetting to use it.

Visit your Amex account and navigate to the "Benefits" tab. From there, scroll to "Benefits Activity" and find your Resy credit.

As you can see, I've already earned $100 for last quarter, and I have $100 left to earn for the final quarter of 2025.

Related: Best dining credit cards

Frequently asked questions

Do you have to make a Resy profile to use the credit?

No, you don't. Aside from enrolling in the credit through your Amex account, there's no additional registration required to use the Resy statement credit.

Do you need to make a reservation to use the Resy credit?

Not at all. While the restaurant must be affiliated with the Resy platform to trigger the statement credit, you can walk right in, dine and receive your credit. Keep in mind that you can only use this benefit at U.S. restaurants.

Can you earn the Resy credit on takeout orders and gift cards?

Absolutely. The main thing to remember here is that you have to make a purchase directly with the restaurant to earn the statement credit. So, if you order takeout through another platform such as DoorDash or Uber Eats, you may not receive your benefit. This is because it may code as a purchase with the third-party platform instead of the restaurant directly.

Senior web publisher Bhawna Khowal used the Resy statement credit on her Amex Gold Card to order takeout at a restaurant. She and her husband enjoyed a drink at the restaurant while they waited for their food to be packed. She saw the credit in her account the next day.

You can earn your Resy statement credit on gift card purchases by buying the gift card directly from the restaurant.

Are Resy restaurants limited to big cities?

Nope. This is one of my favorite aspects of Resy. Even though I don't live in a particularly large city, I still find it exceptionally easy to maximize the credit, whether while I'm traveling or trying a new spot not too far from where I live.

As mentioned above, you don't have to make one big purchase to use the credit all at once. Senior director of content Summer Hull recently used the Resy statement credit to get a Thai chicken salad lunch at a local restaurant for about $20. She'll be able to use the rest of the credit at another time.

Related: American Express Gold checklist: 5 things to do when you get the card

Bottom line

With premium cards adding more credits with every refresh, it can be overwhelming to maximize them all. I'm particularly fond of the Resy credit on eligible American Express cards because it's simple and easy to use amid a sea of complex benefits.

With so many ways to use it, the Resy credit should be at the forefront of cardmembers' minds. It's certainly at the center of mine.

Apply here: American Express Gold Card

Apply here: American Express Platinum Card

Apply here: Delta SkyMiles Platinum American Express Card

Apply here: Delta SkyMiles Platinum Business American Express Card

Apply here: Delta SkyMiles Reserve American Express Card

Apply here: Delta SkyMiles Reserve Business American Express Card