Why one of my most-used cards when traveling abroad may surprise you

I'm always thinking about earning and redeeming points and miles and constantly asking myself, what's the best card to use?

Points and miles have helped me substantially fund my travels over the years, as I've traveled to nearly 90 countries.

Throughout my travels, there's one card I seem to use more frequently than expected. In fact, it's not a credit card — shocking, I know. It's actually a debit card.

The Schwab Bank Visa® Platinum Debit Card is my go-to card when traveling domestically and abroad for one sole reason: fee-free ATM withdrawals worldwide.

I travel to many destinations where cash is king. Not having to pay hefty ATM withdrawal fees offers me peace of mind, knowing that when I land, I can go straight through customs, immediately head to the ATM and then get started exploring.

Let's look at why the Schwab Platinum Debit Card will always have a slot in my wallet when traveling abroad.

The information for the Schwab Bank Visa Platinum Debit Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

What is the Schwab Platinum Debit Card?

The Schwab Platinum Debit Card is the debit card attached to the Investor checking account from Charles Schwab Bank.

The Schwab Platinum Debit Card will always have a place in my wallet, but not to make purchases. I only carry this card in the event I need to take money out of the ATM because Charles Schwab will reimburse unlimited ATM withdrawal fees worldwide at the end of each month.

Even better, there are no fees to open an account and no monthly maintenance fees.

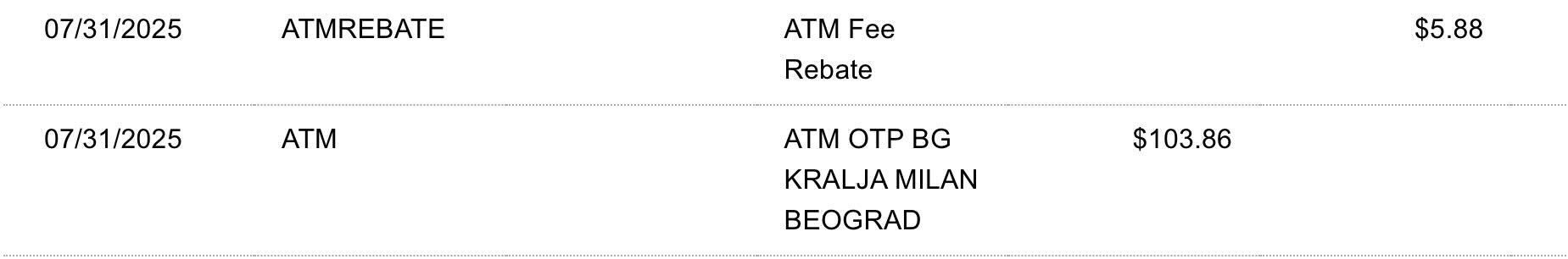

For instance, on my most recent international trip, I went to Serbia, which is a very cash-heavy country. I couldn't even leave the airport without having the local currency, as I needed to pay for a taxi.

Whether I was paying for public transit or buying sarma (stuffed cabbage rolls) from a food vendor, I needed cash on multiple occasions. I took out cash at least 10 times on this trip, and without the Schwab Platinum Debit Card, I would have spent close to $100 on fees.

And I can't lie—I do like to indulge in the occasional gambling at casinos. Often, when I go into a casino, I don't have any cash, so I have to go to the ATM to withdraw some. On this trip, I walked into a casino and saw a $20 ATM withdrawal fee that almost induced a mini-panic attack, but then I remembered my Schwab Platinum Debit card would reimburse me.

Pro tip: When withdrawing money or even paying for purchases abroad, always select the local currency and decline the dynamic currency conversion, as you will end up paying a conversion fee that won't be reimbursed.

Related: Credit vs. debit cards: Which is the smarter choice?

How the Schwab Platinum Debit Card fits into my overarching points and miles strategy abroad

Since I don't use the Schwab Platinum Debit Card for purchases, my credit cards are still the focal point for me to earn rewards when abroad. With most of my credit card rewards, I generally earn and burn them, so I always need to be spending on my cards to replace them.

My credit card lineup when traveling abroad

Four other cards — three travel rewards cards and one cash-back card — anchor my credit card strategy when traveling abroad:

- The Chase Sapphire Preferred® Card (see rates and fees)

- The American Express® Gold Card

- The Business Platinum Card® from American Express

- The Apple Card

Each card plays a pivotal role in my strategy, but the Sapphire Preferred and Amex Gold get the lion's share of my use. None of these cards has a foreign transaction fee (for rates and fees of the Amex Gold, click here; for rates and fees of the Amex Business Platinum, click here), so I will happy swipe them abroad. Plus, I diversify my rewards by earning different transferable rewards.

The information for the Apple Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Chase Sapphire Preferred

The Sapphire Preferred is my go-to card for hotel and all general travel purchases, as it earns 2 points per dollar spent on all travel.

I generally rely on my Amex Gold Card for dining purchases, but Amex isn't widely accepted in many countries (and even in some major cities abroad), so I turn to my Sapphire Preferred as my secondary dining card since it earns 3 points per dollar spent on dining.

Because my Sapphire is a Visa, it tends to see the most use abroad.

The card earns very valuable Ultimate Rewards points, which I transfer to one of Chase's 11 airline and three hotel partners. My go-to partners for transferring points are United MileagePlus and World of Hyatt. On the same trip to Serbia, I transferred 6,500 points to Hyatt for a brief overnight stay before my flight at the Hyatt Place Amsterdam Airport, where the cash price was slightly over $200 for the night.

Lastly, I make sure to use the Sapphire Preferred's annual $50 hotel credit for hotels booked through Chase Travel℠.

I always try to use this credit at a hotel not attached to a loyalty program since I would not get any hotel loyalty perks. Additionally, I like to save the credit for when I need an airport hotel or am in a city for just a night.

I view this credit as effectively a $50 discount on a one-night stay, and in the past years, I have even found a few hotels that cost under $50 per night (albeit these were in cheaper countries to visit), so it turned into a free night for me. It's important to note that you will not earn any points on the first $50 spent on hotel purchases on Chase Travel.

Related: Why I love my Chase Sapphire Preferred card — and will always keep it in my wallet

Amex Gold

I consider myself a foodie, and there is no better card for foodies than the Amex Gold. The $325 annual fee (see rates and fees) is worth all the points I can earn throughout the year on different bonus categories.

It's my go-to dining card as it earns 4 points per dollar spent on dining at restaurants worldwide (on up to $50,000 per calendar year, then 1 point per dollar).

Additionally, a lesser-known benefit of the Amex Gold is that it also earns 3 points per dollar spent on flights booked directly, so this card has become my default card for making airline purchases.

This card earns very valuable Membership Rewards points, which I can transfer to one of Amex's 17 airline and three hotel partners. My go-tos are Air Canada Aeroplan, Iberia Club and Virgin Atlantic Flying Club.

It's important to note that I fluctuate between using the Sapphire Preferred and the Amex Gold depending on which rewards currency I am short on. For example, on my most recent trip, I used a good chunk of my Chase points balance to fund the trip, so I needed to replenish my account. I used the Sapphire Preferred for all my purchases, despite the fact that I could have earned more points by using other cards.

Related: How to maximize Amex Gold credits when traveling abroad

Amex Business Platinum

My Amex Business Platinum Card doesn't see much use on a day-to-day basis when I'm traveling abroad. In fact, I only really use this card now for the statement credits and travel perks provided.

The main purpose of this card is to provide me with airport lounge access, allowing me access to the Global Lounge Collection. The card comes with a Priority Pass Select membership, which allows me to enter the majority of lounges I visit internationally (enrollment required).

These Priority Pass lounges abroad tend to be nicer than most domestic lounges, depending on the region of the world you're traveling in. This card has also granted me entry into some Centurion Lounges internationally, including locations in Mexico City International Airport (MEX), Ezeiza International Airport (EZE) and Stockholm Arlanda Airport (ARN).

Related: The 10 best Priority Pass lounges around the world

Apple Card

In what might be a surprise to many, the Apple Card plays a role in my international travel card lineup. If I have any nonbonus category spending, I may use my Apple Card with Apple Pay to earn 2% back on all purchases. Typically, I would use this card abroad at places like pharmacies or souvenir stores. However, this is usually the last card I will use when abroad; sometimes, I even settle for the 1 point per dollar spent on all other purchases my Sapphire Preferred or Amex Gold offers.

One benefit of using the Apple Card is that the cash back earned, known as Daily Cash, is available to use immediately instead of at the end of the billing cycle.

Related: 4 reasons to get the Apple Card

Bottom line

The Schwab Platinum Debit Card is a must-have for any traveler. Whether you're a beginner with credit cards or have 10-plus cards, like some of our staffers, this should be the next addition to your wallet, and the best part is that no hard inquiry is required.

When traveling, you never know when you'll need some cash. The Schwab Platinum Debit Card isn't a replacement for any credit cards, but it is a great card to consider if you travel often to places where cash is the main form of currency. Having this card can ensure you can withdraw cash from an ATM fee-free.

For rates and fees of the Amex Gold, click (see here)

For rates and fees of the Amex Business Platinum, click (see here).

Related: 9 types of cards you should pack for your next trip abroad

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app