Marriott Bonvoy Business Amex review: Valuable perks for the Bonvoy loyalist

Editor's Note

Marriott Bonvoy Business American Express Card overview

The Marriott Bonvoy Business® American Express® Card is a solid small-business card for Marriott Bonvoy fans. It comes with useful perks, such as an annual free night worth up to 35,000 points — resort fees may apply. This card also offers the ability to boost your Marriott elite status by offering 15 elite night credits every year. Card Rating*: ⭐⭐⭐½

*Card rating is based on the opinion of TPG's editors and is not influenced by the card issuer.

This Marriott Bonvoy Business Card comes with most of the same features and benefits as the Marriott Bonvoy consumer cards, but it happens to include generous bonus reward categories that are well suited to small-business owners.

With a reasonable annual fee of $125 (see rates and fees) and a TPG recommends a good to excellent credit score, this card also offers plenty of extra benefits that make it a solid hotel business card option.

Here's everything you need to know about the only Marriott business credit card still open to new applicants.

Bonvoy Business Amex pros and cons

| Pros | Cons |

|---|---|

|

|

Bonvoy Business Amex welcome offer

Right now, with the Bonvoy Business Amex, new cardmembers can earn three free night awards (valued at up to 50,000 points each) after spending $6,000 on purchases in the first six months of card membership. Certain hotels have resort fees.

THE POINTS GUY

TPG's March 2025 valuations peg Marriott points at 0.7 cents apiece, making the bonus worth up to $1,050. That's a good value value considering this card's annual fee, but we have seen higher offers in the past.

Bonvoy Business Amex benefits

One primary reason to consider this card is the extra perks. Enrollment is required for select benefits.

First, it offers automatic Marriott Gold Elite status, which includes 25% bonus points on paid stays, late checkout, premium internet, a welcome gift of points on each stay and room upgrades (based on availability at check-in).

Cardholders also receive 15 elite night credits toward the next level of elite status (which can be stacked with a Marriott Bonvoy consumer card) and a free night award each card anniversary year. Resort fees may apply.

The free night can be spent at properties at or under 35,000 points per night. You can top off your 35,000-point certificates with up to 15,000 points from your Bonvoy account. You can also earn a second free night award (up to 35,000 points per night) after spending $60,000 in a calendar year. Resort fees may apply.

Other benefits include access to Amex Offers and no foreign transaction fees (see rates and fees).

Plus, you can enjoy an automatic 7% discount on standard room rates when you book an eligible room directly through Marriott at participating properties under the Amex Business Card Rate.

Earning points on the Bonvoy Business Amex

This card offers 6 points per dollar spent on eligible purchases at hotels participating in the Marriott Bonvoy program.

You also receive 4 points per dollar spent on the following:

- Restaurants worldwide

- At U.S. gas stations

- On wireless telephone services purchased directly from U.S. service providers

- On purchases made from merchants in the U.S. for shipping

You'll earn 2 Bonvoy points per dollar spent on all other eligible purchases.

Marriott Gold Elite members and above can earn even more Marriott points on every purchase made at eligible Marriott Bonvoy properties; these points can be stacked with what you earn on the Bonvoy Business Amex.

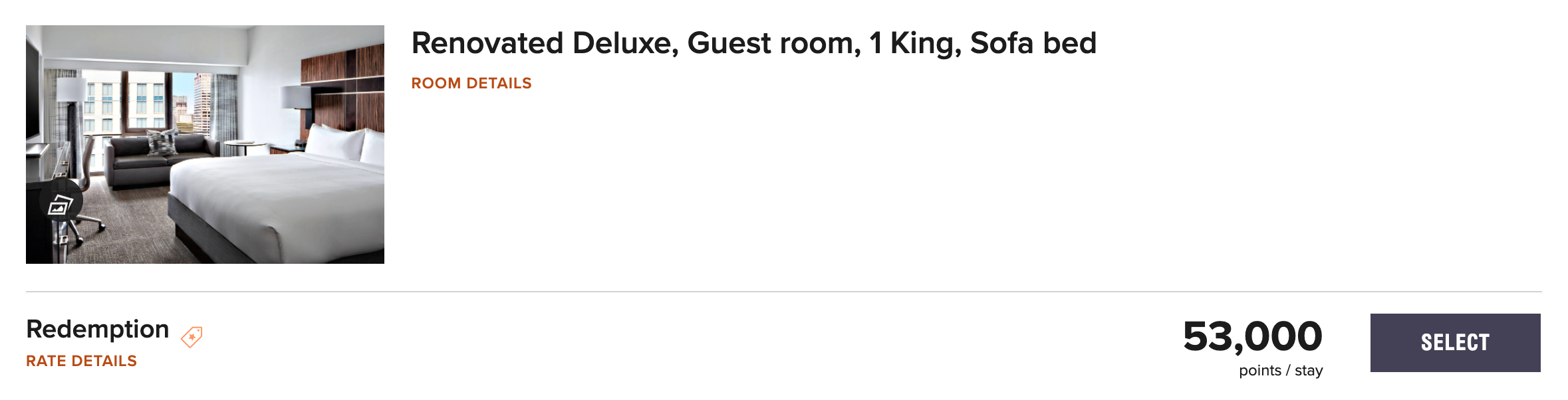

Redeeming points on the Bonvoy Business Amex

Of course, the most obvious way to redeem Marriott Bonvoy points is for hotel stays. Bonvoy uses dynamic pricing, meaning the required points for a stay are lower outside peak travel periods.

Take advantage of the fifth night free on award stays whenever possible. The fifth-night benefit is an easy way to get up to a 20% discount on your redemption and stretch your points further.

TPG credit cards writer Chris Nelson's sweet spot for redeeming free night certificates is at luxury properties in Eastern Europe, such as The Ritz-Carlton in Budapest and Vienna, as these properties can routinely be redeemed for 45,000 points a night.

Transferring points on the Bonvoy Business Amex

You can convert your Marriott Bonvoy points into airline miles, typically at a 3:1 ratio (which isn't a great transfer ratio) — though you can get a 5,000-mile bonus for every 60,000 points you transfer. Plus, when you transfer points to United Airlines, you'll receive a 10,000-mile bonus for every 60,000 points transferred.

Bonvoy points can be especially useful for certain award flights because they transfer to airlines that don't partner with other transferable points programs, such as Alaska Airlines, Japan Airlines and Asiana. This opens up all sorts of options for booking sweet spots with difficult-to-earn miles.

Marriott also has some of the most liberal policies for points transfers between accounts while also being free and easy to do online. With all that said, redeeming your points for stays with Marriott is still going to give you the most value for your points.

Which cards compete with the Bonvoy Business Amex?

While this is Marriott's only small-business card available to new applicants, there are personal Marriott Bonvoy cards that offer similar (or better) perks.

- If you want automatic Platinum Elite status: The Marriott Bonvoy Brilliant® American Express® Card comes with it, plus an annual free night at Marriott hotels up to 85,000 points per night (certain hotels have resort fees) and up to $300 in statement credits every calendar year (up to $25 per month) when you use your card at eligible restaurants worldwide. These benefits can help offset the card's hefty $650 annual fee (see rates and fees). To learn more, read our full review of the Bonvoy Brilliant.

- If you want a different hotel brand: Try the Hilton Honors American Express Business Card. This card offers Hilton Gold status and 12 points per dollar spent at eligible Hilton portfolio properties; terms apply. To learn more, read our full review of the Hilton Honors Amex Business.

- If you want more general rewards: Go for The Business Platinum Card® from American Express. It offers 5 points per dollar spent on flights and prepaid hotels booked on Amex Travel. Among its numerous other benefits and fee credits, you also receive Gold status with both Marriott and Hilton. Enrollment is required for select benefits; terms apply. To learn more, read our full review of the Amex Business Platinum.

For additional options, check out our full list of the best hotel cards.

Read more: Is the Hilton Business Amex worth it?

Bottom line

The Marriott Bonvoy Business Amex is a solid small-business card offering valuable benefits at thousands of properties worldwide. With a free night award and decent earning categories and perks, it's one of the better hotel credit cards suited for small-business owners and could be well worth it if you stay with Marriott frequently enough to take advantage of its benefits.

The card is also a great option for anyone interested in opening valuable Chase credit cards because, as an Amex business card, it won't add to your Chase 5/24 count.

Apply here: Marriott Bonvoy Business American Express Card

For rates and fees of the Marriott Bonvoy Business Card, click here.

For rates and fees of the Marriott Bonvoy Brilliant Amex, click here.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app