Here's a tip to prevent your Amex welcome bonus from being taken back

Update: Some offers mentioned below are no longer available. View the current offers here.

Each credit card issuer has its own unique policies to combat fraud and what it sees as churning practices.

Chase has its infamous 5/24 rule that prevents you from opening a new Chase card if you've opened five or more cards in the last 24 months. Amex has historically been laxer with card approvals but has been cracking down on welcome bonus eligibility by enforcing one of the lesser-known rules in its terms and conditions.

Here's a word to the wise: Amex can take back your welcome bonus -- or even close your account -- if you cancel or downgrade your account within 12 months of opening.

New to The Points Guy? Sign up for our daily newsletter and check out our beginner's guide.

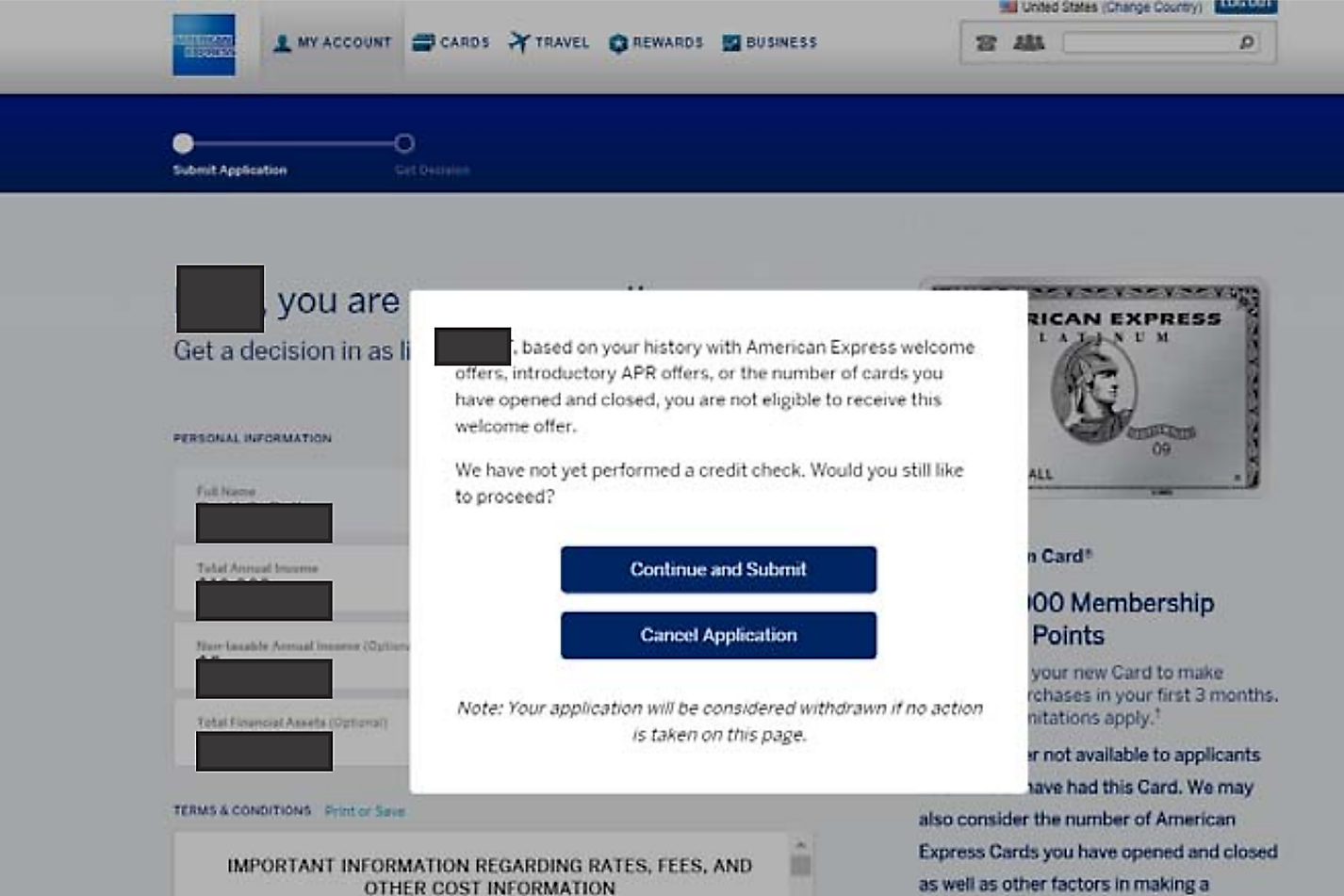

The Amex eligibility pop up

A couple of years ago, Amex added a pop-up screen that appears before you submit your application and warns you if you aren't eligible for a welcome bonus. There was no hard and fast rule as to what caused this ineligibility, other than Amex's long-standing policy that you can't earn a welcome bonus on a card if you've already had it before.

Additionally, it seems that most Amex cardholders will be restricted to at most four Amex consumer or business credit cards.

Still, many people found themselves being denied welcome bonuses on products they'd never had or hadn't hit these card limits.

The good news was that Amex gave this warning before you submitted your application, giving you a chance to exit out without having your credit report pulled, which can lead to a small dip in your credit score in the short term.

Related: The ultimate guide to credit card application restrictions

Amex can take back already-earned welcome bonuses

Most people assume that once the bonus on a new card posts to your account, you've checked your boxes and there's nothing else you need to do; the points or miles are yours.

However, we've received a number of tips from readers, in addition to more reports circulating on the internet, indicating that Amex could take back your welcome bonus -- or worse, cancel your account -- months after you've earned it if Amex believes that you've gamed or abused the system. The following text can be found in the terms and conditions for the welcome offer on nearly every Amex card:

"If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with the welcome offer in any way or that you intend to do so (for example, if you applied for one or more cards to obtain a welcome offer (s) that we did not intend for you; if you cancel or downgrade your account within 12 months after acquiring it; or if you cancel or return purchases you made to meet the Threshold Amount), we may not credit Membership Rewards points to, we may freeze Membership Rewards points credited to, or we may take away Membership Rewards points from your account. We may also cancel this Card account and other Card accounts you may have with us."

In both of the cases reported to us by TPG readers, the user canceled a new card within the first year after having already received the welcome bonus. In one case, a reader simply didn't want to pay the annual fee, while in another the account was hacked and the reader thought that closing the card would prevent further fraud.

Related: How to cancel a credit card

Let this serve as a very important reminder to anyone considering applying for an Amex credit card: You may forfeit your bonus if you close or downgrade your account within a year.

While these specific instances of welcome bonuses being clawed back involve Amex, this is a good practice to follow with all of your cards. If you're interested in opening a new credit card but hesitant about paying the annual fee, Amex gives you a 30-day grace period after the statement in which your annual fee posts. If you downgrade or cancel your card inside this window your annual fee will be refunded. If you product-change outside of this window, the annual fee will be prorated.

Related: Choosing the best American Express credit card for you

Bottom line

While Chase's 5/24 rule is a royal pain for most points and miles enthusiasts, at least it's clearly defined and you know exactly what you're up against.

Amex's language, specifically the statement that it has "sole discretion" to deny or take back your bonus, is much vaguer and harder to pre-empt. In order to steer clear of this and avoid any problems, including the closure of your accounts and forfeiture of your points, you should absolutely, unequivocally keep your cards open for at least one year.

This is especially true for taking advantage of generous welcome offers, such as on The Platinum Card® from American Express. Currently, that card is offering a welcome bonus of 100,000 Membership Rewards points after spending $6,000 on purchases in your first six months of card membership.

Additional reporting by Chris Dong.