How to enroll in Priority Pass with eligible credit cards

Editor's Note

A Priority Pass Select membership has long been a valuable perk included with certain travel rewards cards. There are now more than 1,700 Priority Pass lounges worldwide, and the lounge network is still growing.

While Priority Pass membership is provided as a benefit of select premium credit cards, you won't be able to access Priority Pass lounges by simply showing your credit card. Instead, you'll need to enroll your credit card before you can start visiting Priority Pass lounge locations.

Although some lounges will accept a digital card, some lounges require a physical card, so you'll want to enroll your card well before your first lounge visit, if possible.

Luckily, enrolling your card is a relatively simple process that can be done online or by calling your card issuer. Let's walk through the steps you need to take to do this so you can begin enjoying your Priority Pass membership. Enrollment is required for select benefits.

American Express

Once you're logged into your Amex online account, you'll want to ensure you've selected the right card. As you can see from the top right portion of the image below, I'm currently viewing the page for The Platinum Card® from American Express — but multiple other Amex cards also offer Priority Pass Select membership.

Click on "Benefits & Rewards" to see all the perks that come with your card.

Given the sheer number of perks that come with the Amex Platinum, which has an annual fee of $895 (see rates and fees), you might have to scroll down a little until you find "The American Express Global Lounge Collection."

From there, you'll see a full description of the incredibly comprehensive lounge access that comes with the Amex Platinum, including access to Amex Centurion lounges and Delta SkyClubs when flying Delta*. Note that you can also enroll in Priority Pass by calling the number on the back of your eligible American Express card. Enrollment required for select benefits; terms apply.

If you add Platinum Card authorized users to your card, they must call the number on the back of their card to enroll in Priority Pass.

Remind them to also enroll in their other authorized user benefits, including Marriott Gold Elite, Hilton Gold, Hertz Gold Plus Rewards, Avis Preferred and National Car Rental Emerald Club Executive status. Enrollment is required for select benefits.

*Access to the Delta Sky Club is limited to 10 annual visits.

Related reading: Choosing the best American Express credit card for you

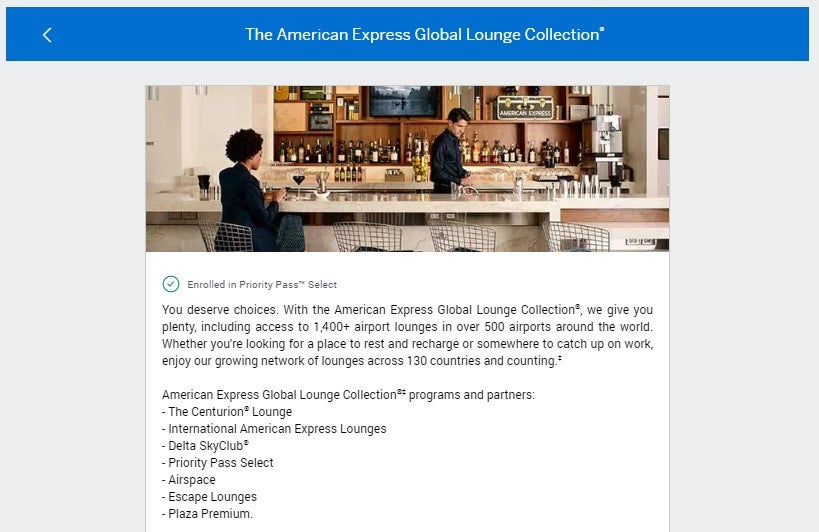

Bank of America

The only Bank of America credit card that offers Priority Pass lounge access is the Bank of America® Premium Rewards® Elite Credit Card. The neat perk about this card is that it offers up to four complimentary Priority Pass Select memberships, one for the cardholder and then up to three additional memberships. To enroll, simply visit the Bank of America Priority Pass page to start the sign-up process.

The information for the Bank of America Premium Rewards Elite credit card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

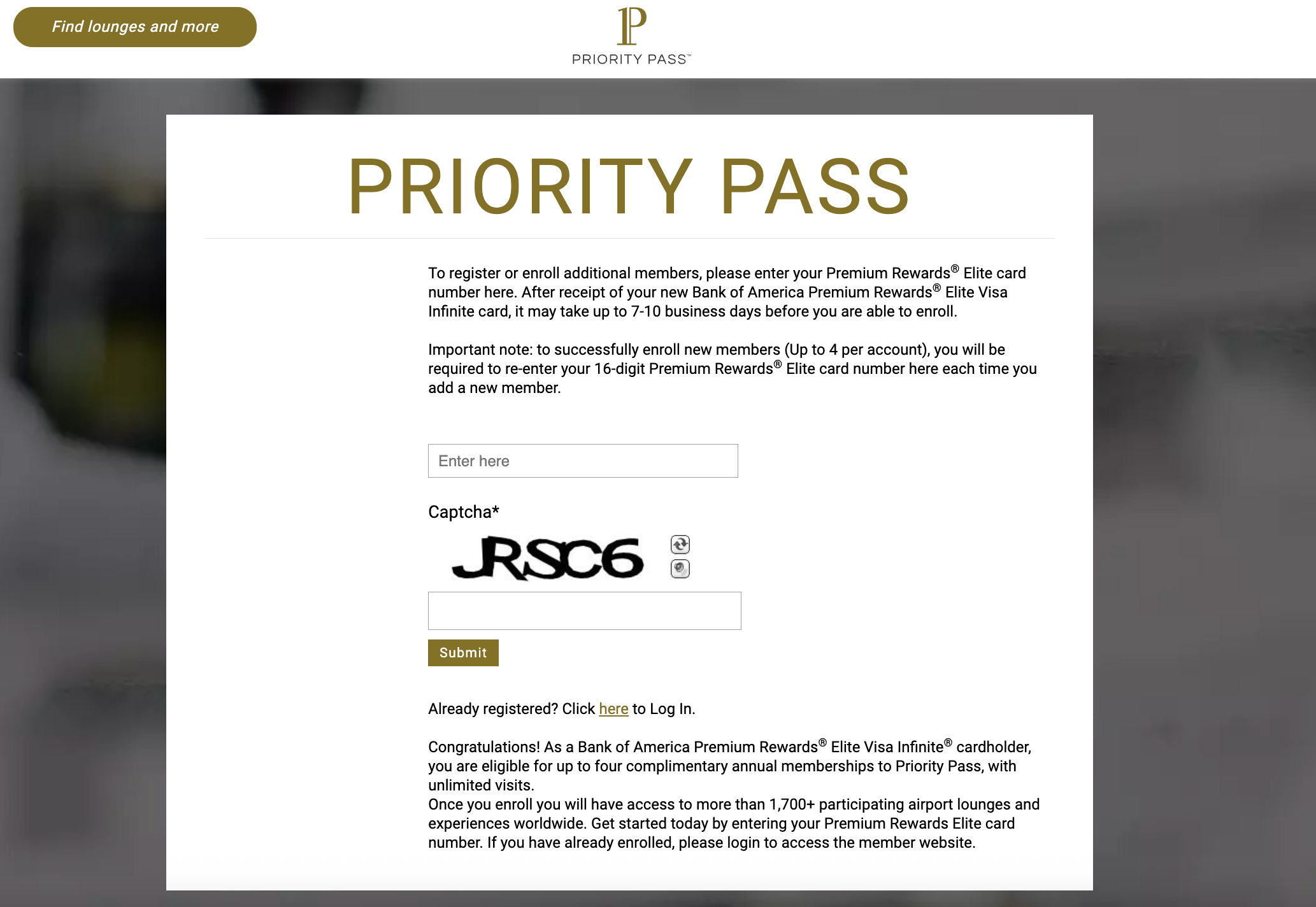

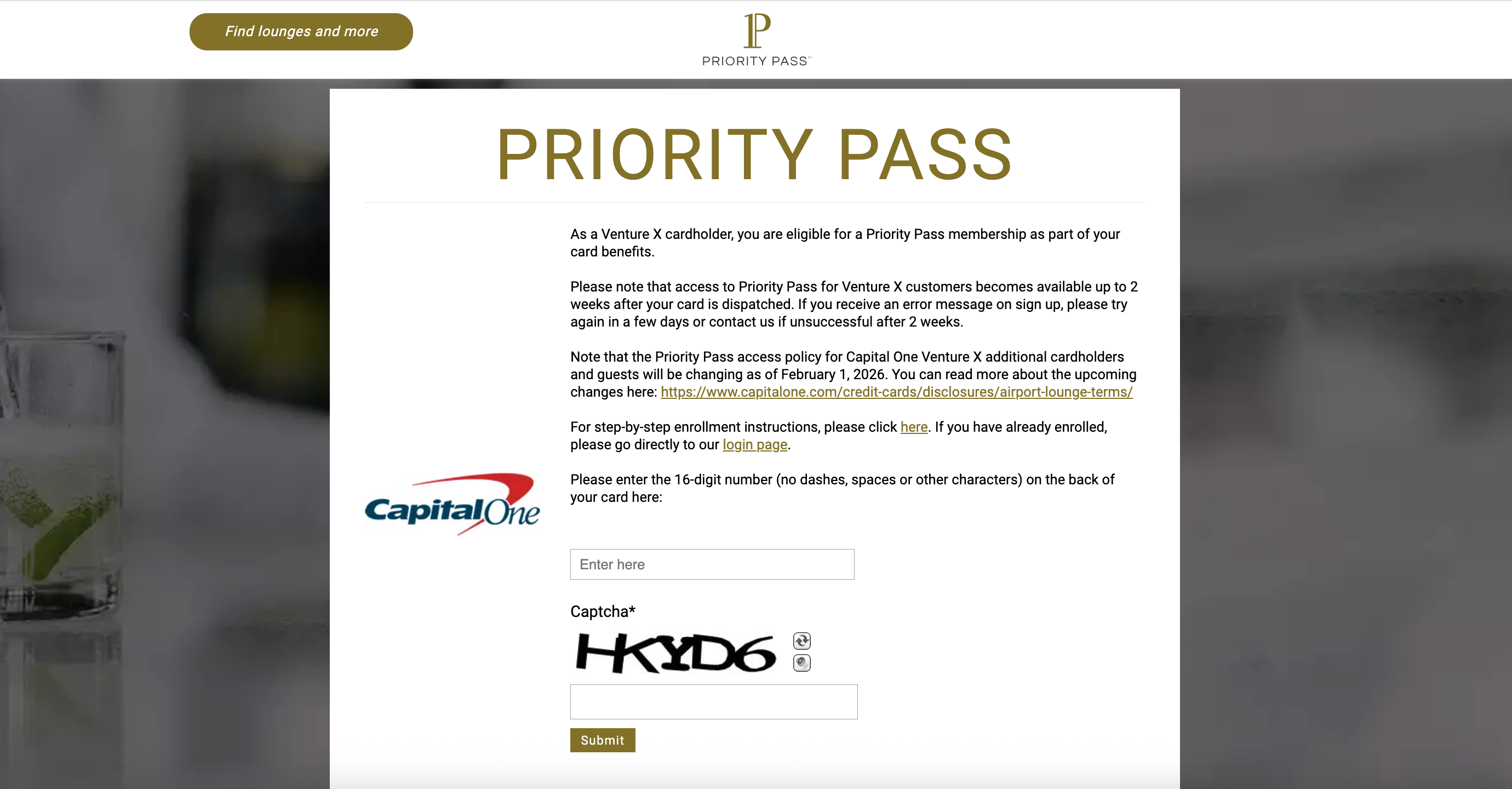

Capital One

To activate a Priority Pass membership with an eligible Capital One card, such as the Capital One Venture X Rewards Credit Card, visit the Capital One Priority Pass page to start the sign-up process.

The Venture X card provides Priority Pass membership to the primary cardmember and authorized users, who can bring up to two guests with each visit to a Priority Pass lounge. However, complimentary lounge access for additional cardmembers will end on Feb. 1, 2026.

If you're an account holder, you can also follow the link from your Capital One Priority Pass welcome email. Next, you will enter your 16-digit Venture X card number and then click "Submit." Be sure to select your country of residence to continue. The next few prompts will ask you to create an account by providing your address and billing details (for identification purposes) before clicking "Join."Once enrolled, log in to your account through the Priority Pass website or mobile app to access a list of eligible lounges and to view your digital membership card.

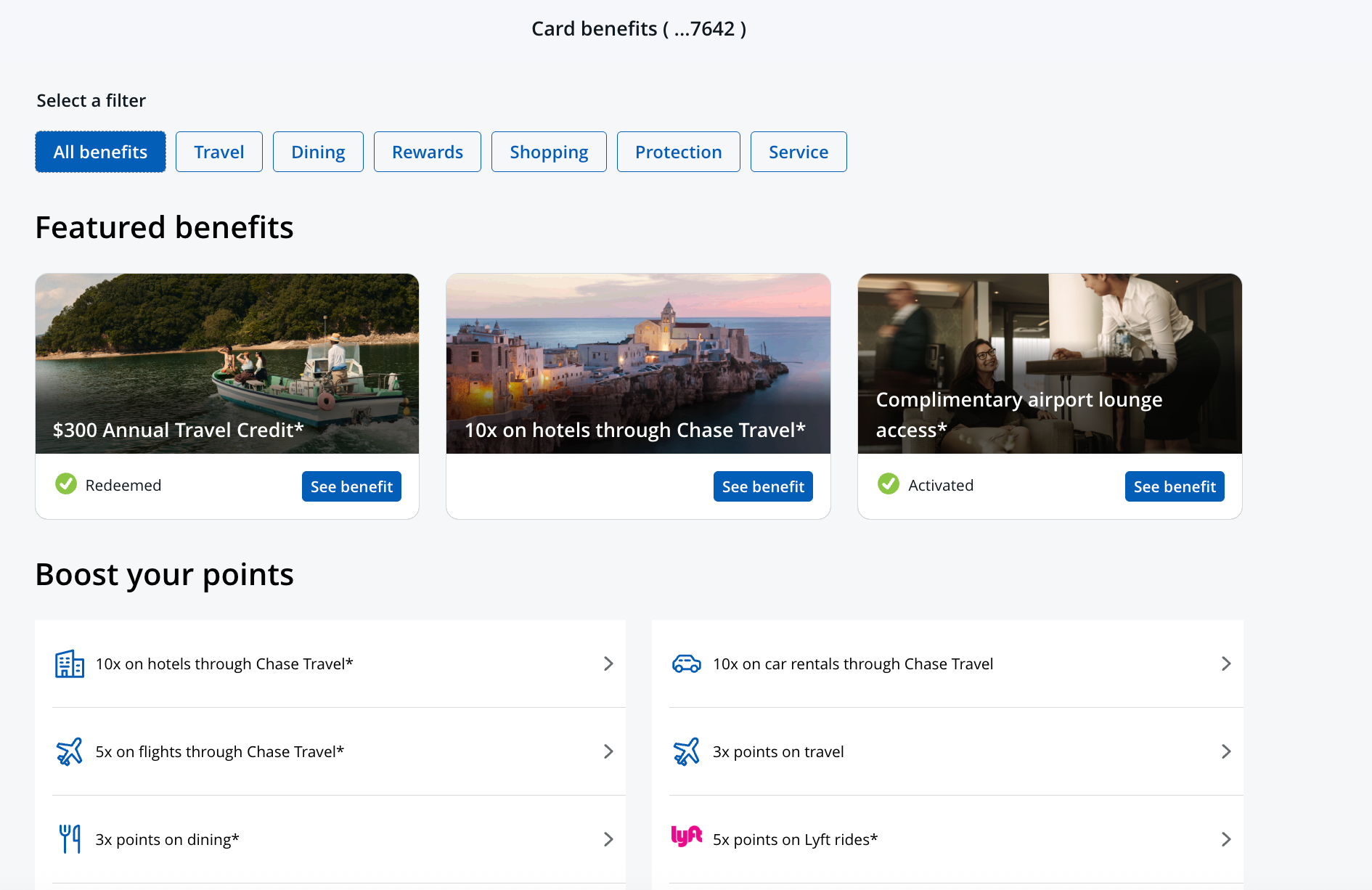

Chase

To activate a Priority Pass membership with an eligible Chase card, such as the Chase Sapphire Reserve® (see rates and fees), you'll want to make sure you're on the Ultimate Rewards area of the Chase website. You'll then want to click on the card you're trying to enroll in.

Now, click on "Card Benefits" in the top left corner.

Scroll down until you see boxes with all of your card's benefits. Click "Travel" to see a box for "Complimentary Airport Lounge Access." As you can see, I've already activated my membership — but if you hadn't, you'd click the "activate now" button and follow the instructions on the screen.

If you add an authorized user to your account before activating your Priority Pass membership online, that user will also be enrolled. Otherwise, you'll need to call the number on the back of your card to enroll your authorized user in Priority Pass. Enrollment is required for select benefits.

Related: Chase Sapphire Reserve credit card review

Citi

The only Citi credit card to offer a Priority Pass membership is the Citi Prestige® Card (no longer accepting applications).

It had the most customer-friendly policy of all regarding Priority Pass enrollment. Citi Prestige cardholders were automatically enrolled in Priority Pass, so they could sit tight and wait for their card to arrive in the mail. Enrollment required for select benefits.

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

U.S. Bank

The U.S. Bank Altitude® Reserve Visa Infinite® Card offers a 12-month Priority Pass Select membership.

One cardmember per account can enroll, and their first four visits and four individual accompanying guest visits are waived during the first Priority Pass Select membership year. Enrollment is required for select benefits. You can log in to the U.S. Bank Altitude Reserve Card Benefit site to enroll.

The information for the U.S. Bank Altitude Reserve card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Valuable perks such as airport lounge access are the easiest ways to justify paying $350+ annual fees for premium credit cards, but if you forget to take advantage of them, the math starts to work against you.

Enrolling in your Priority Pass membership should take no more than five minutes and it can save you the inconvenience of arriving at an airport with a long layover only to realize that you don't have the lounge access you expected.

Related: The 10 best Priority Pass lounges around the world

For rates and fees of the Amex Platinum Card, please click here.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app