Debunking credit card myths: Does canceling a card I don’t use help my credit score?

Editor's Note

It's no surprise that travel rewards credit cards get quite a bit of coverage here at TPG.

Taking advantage of top welcome bonuses and strategically using your cards for everyday purchases can unlock fantastic redemptions, such as premium cabin flights and luxurious hotel rooms. However, there are a number of misconceptions about credit cards.

Let's debunk one notable myth to hopefully help you avoid a credit score drop.

Related: How do credit scores work?

Myth: Closing a card I don't use will help my credit score

There are many reasons why you might have a credit card that you simply don't use anymore.

Maybe it was the very first one you opened as an adult, but you have since been replaced with a more valuable card. Maybe your priorities have shifted, and a certain card no longer fits into your strategy. Or maybe you have relocated to a new area of the country and found that your go-to card has less utility.

In these cases, you may think that you should cancel an unused card just sitting in your wallet (or sock drawer) to help your credit score. However, in reality, you may find the exact opposite to be true. Canceling a card can actually drop your credit score.

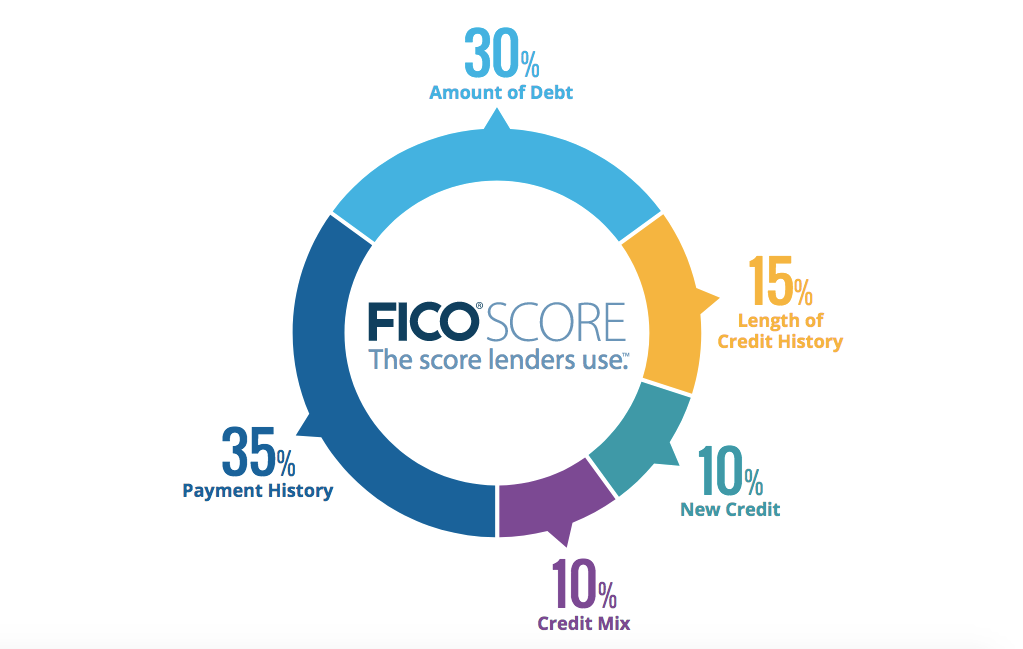

For this myth, it's essential to understand the different factors that contribute to your FICO score, the metric most frequently used to determine your creditworthiness for any new line of credit:

- Payment history

- Amounts owed

- Length of credit history

- New credit

- Types of credit used

However, not all factors are created equal. In the graphic below, these five factors are weighted based on how important they are to your score.

When it comes to closing a card you no longer use, there's one primary factor that can impact your score in a negative way: amounts owed.

Related: How to check your credit score

Amounts owed

The second most important factor in your FICO score is your amounts owed — commonly referred to as your credit utilization rate. This looks at how much of your credit you are actually using, and it's typically expressed as a percentage. Here's the calculation: Total balance on your account(s) divided by the total limit of account(s) equals utilization.

Keeping this number low shows issuers that you can effectively manage your credit lines and aren't at risk of overextending yourself.

An example

Let's say that you typically spend about $2,000 per month on your primary credit card with a $10,000 limit, and you currently have another unused card, also with a $10,000 limit. You thus have a utilization rate of 10% ($2,000 divided by $20,000).

However, if you then cancel that unused card, the monthly spending is now spread across a much lower credit line. By canceling the card, your utilization jumps to 20%. That number isn't too concerning, but you shouldn't take anything that impacts your score lightly.

Of course, that's not to say that you should never cancel a credit card. If you're no longer using a card that carries an annual fee, it may not make sense to keep that card open unless the benefits you're getting outweigh the fee. Just be sure to call the issuer and inquire about a retention bonus. The agent may even be willing to waive the annual fee.

Related: How canceling a credit card impacts your FICO score

Length of credit history

While the amounts owed are the primary factor affected by canceling a card you no longer use, it can also impact your credit history, which makes up 15% of your credit score.

If the unused card is your longest-tenured account, canceling it can negatively affect the average age of your accounts. However, this doesn't happen right away, as closed accounts (in good standing) will typically stay on your credit report for up to 10 years.

Nevertheless, canceling a card with no annual fee — especially one you've had for years — can ultimately impact your score.

This is a key reason why I always recommend opening and keeping at least one card with no annual fee. Just be sure to make a least a few purchases a year on the card to prevent the issuer from canceling it due to inactivity. This can also help prevent your points and miles from expiring.

Bottom line

There are many myths about credit cards, and one common misconception is that you should cancel a card that you don't use anymore to boost your credit score.

In reality, this can have a significant negative impact on your credit score, as it will lower your overall credit limit and thus increase your utilization rate. Over time, this could (potentially) decrease your average age of accounts as well. While there may be legitimate reasons to cancel a card, don't do it without first considering how it will affect your credit score.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app