How to use the $50 hotel credit on the Chase Sapphire Preferred

Editor's Note

If you're not using every perk on your credit card, you're leaving money on the table. And the $50 annual hotel statement credit on the Chase Sapphire Preferred® Card (see rates and fees) for reservations booked through Chase Travel℠ is one you shouldn't sleep on.

It may not be the flashiest perk to exist, but this benefit essentially knocks down the $95 annual fee to just $45. That's a solid win for a card that's packed with benefits.

At TPG, it's no secret we think the Sapphire Preferred is one of the best travel credit cards. If it's not already in your wallet, you should consider applying.

Here's how you can take advantage of this benefit with a quick one-night getaway.

How to use the $50 annual hotel credit on the Chase Sapphire Preferred

Booking a hotel through Chase Travel to unlock the $50 statement credit is relatively easy.

First, log in to your Chase account on your device.

If you're using a desktop, select "Travel" on the right-hand side of your screen. On the mobile app, select "Benefits & travel" on the bottom menu bar and then the "Book travel" icon on the next screen.

Once you're in the Chase Travel portal, check the drop-down feature on the top right-hand corner (desktop) or at the top (mobile app) to make sure your Sapphire Preferred is the card selected.

You can now enter a destination, pick your dates and browse options.

How I used my $50 hotel statement credit

I was booking my annual trip to visit a new MLB ballpark and remembered I hadn't yet used my Sapphire Preferred hotel credit. Since my account anniversary was coming up and this credit is based on your card anniversary year — meaning your account opening date — I knew it was time to cash in.

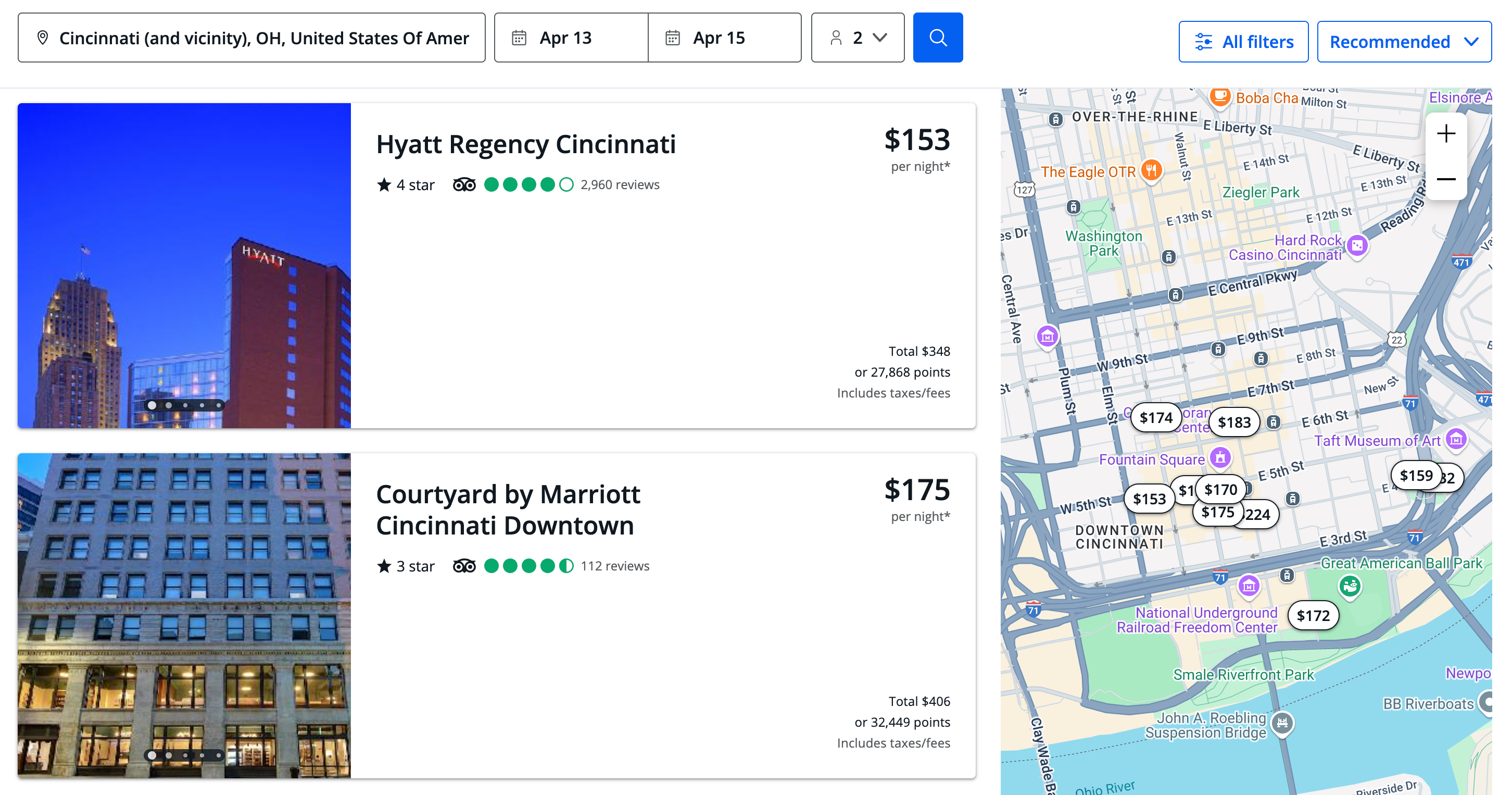

After checking my options in Cincinnati within walking distance of the ballpark, I zoomed in on the Hyatt Regency Cincinnati.

Since World of Hyatt is a Chase transfer partner, I compared booking with cash through the portal against redeeming my points through Hyatt. It happened to be peak pricing for the Category 3 property, costing 15,000 points per night. According to my calculations, using cash through the Chase portal was the better option.

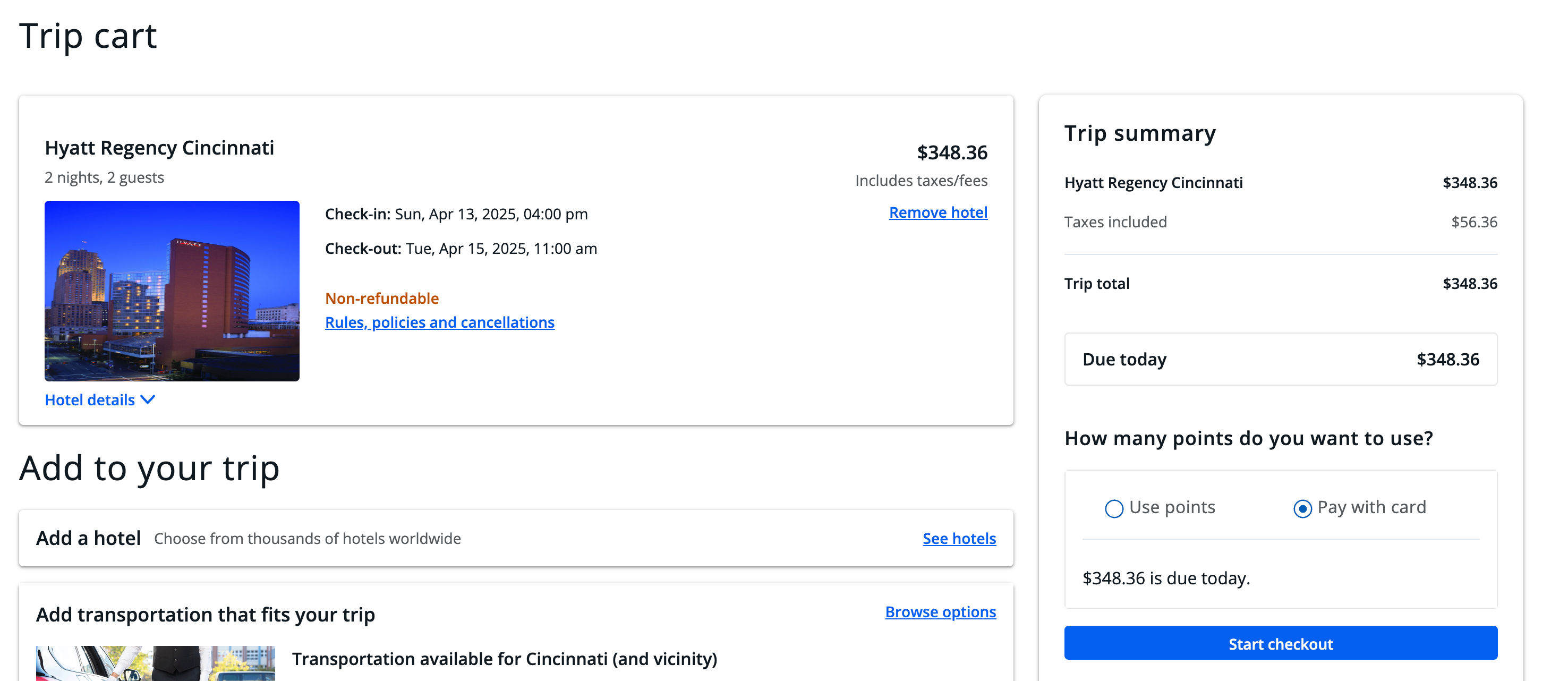

I selected my room and toggled to "Pay with card" versus sticking with the "Use points option" that was automatically selected. Then, I proceeded to check out.

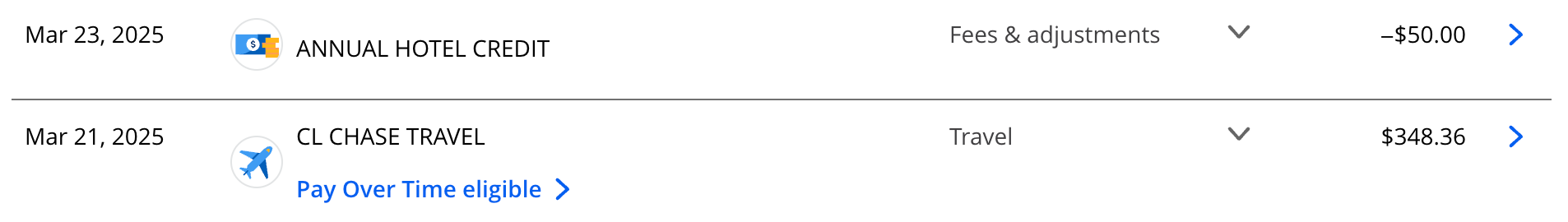

After inputting my personal information, my reservation was confirmed and the pending charge immediately popped up on my recent transactions.

Related: How to redeem Chase Ultimate Rewards points for maximum value

Tips for using the Sapphire Preferred hotel credit

You have to specifically book through the Chase Travel portal to receive this credit. You won't earn it if you book directly with the hotel or through another website.

The terms and conditions read:

- A statement credit (up to an annual maximum of $50) will automatically be applied when your card is used for hotel accommodation purchases made through Chase Travel.

- The first $50 in Chase Travel hotel purchases will not earn rewards points. (However, in my case, I earned the full 5 points per dollar spent on my purchase.)

- The statement credit will appear on your statement within one to two billing cycles after your purchase posts to your account. (However, I received mine in just two days.)

One-night and multinight stays are eligible.

To receive the full $50, you have to spend at least $50.

Keep in mind that you likely won't earn any hotel points or eligible elite night credits when booking through Chase Travel since it's considered an online travel agency. Of course, you can always call a participating property (or try to add it at check-in) after you've booked to add your loyalty program number, but you shouldn't expect to earn points or receive status benefits for your stay.

Many independent or boutique hotels without a loyalty program can be found on Chase's travel portal. Augusta Stone, a credit cards writer at TPG, enjoys leveraging this perk to book boutique hotels so she doesn't feel like she's missing out on any points by not booking directly.

Related: The most exciting hotel openings of 2025

How long does it take for the Chase Sapphire Preferred hotel credit to post?

According to the benefit terms, the $50 credit should hit your account within one to two billing cycles. However, in my experience, it took only two days.

Is the $50 Chase Sapphire Preferred hotel credit worth it?

Considering the $50 hotel credit has virtually no restrictions except that you need to book your stay on the Chase Travel portal, it's a no-brainer. It also effectively brings the card's annual fee down from $95 to $45.

Just remember that this credit is based on the account anniversary year versus the calendar year. Your account anniversary year begins with your account opening date through the next 12 billing cycles, so you'll want to keep track of when you opened the card.

Related: The 8 best credit cards with annual fees under $100

Bottom line

Make the most of your $50 hotel statement credit on the Chase Sapphire Preferred each year. Even a one-night booking is eligible.

Consider using it for a boutique or independent hotel so you don't forgo any qualifying elite nights or hotel points. Or, use it in a case like I did, where I was locked into a certain weekend and the credit proved valuable.

The $50 credit helps reduce the Sapphire Preferred's already low $95 annual fee to essentially just $45. Once you consider the card's other benefits, it's hard not to justify adding it to your wallet.

To learn more, read our full review of the Chase Sapphire Preferred.

Apply here: Chase Sapphire Preferred Card

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app