Reader Success Story: A Trip to the Primetime Emmy Awards

Update: Some offers mentioned below are no longer available. View the current offers here.

Here at TPG, we spotlight stories from our readers — fantastic travel made possible with some savvy tips and tricks. In our new lounge on Facebook, TPG Lounge member Shana Gainey shared her tips on maximizing reward travel — her points and miles took her far! Do you have any tips to share? If your story catches TPG’s eye and we publish it, we’ll send you a gift to jump-start your next adventure.

Thanks to The Points Guy I have had many valuable redemptions for fabulous vacations and experiences — from access to New York Fashion Week to my upcoming trip to the Maldives. But the one that stands out the most is my trip to the 67th Primetime Emmy Awards back in 2015. Attending a Hollywood awards ceremony had been on my bucket list for years.

In 2014 when I read that, unlike the Oscars, the Emmys made tickets available to the general public ($400 for orchestra seats and $750 for Governor's Ball tickets), I decided that I would save up (points, miles and cash) to attend in 2015. In early 2015, I predicted the date of the ceremony (since it had not yet been announced), and used 80k Marriott points that l earned from business travel to book a two-night stay at the JW Marriott in downtown Los Angeles, which is connected to L.A. Live where the ceremony is held each year. I then booked my Delta Airlines flight as a paid flight and used my Platinum Medallion certificates to upgrade to first class.

When TPG announced the increased 50k-point sign-up bonus on the Southwest credit card, I signed up and booked a nonstop, round-trip flight for my traveling companion between Chicago and LA using 18,151 Southwest points (which was better than the 25k miles Delta would have charged for a connecting flight).

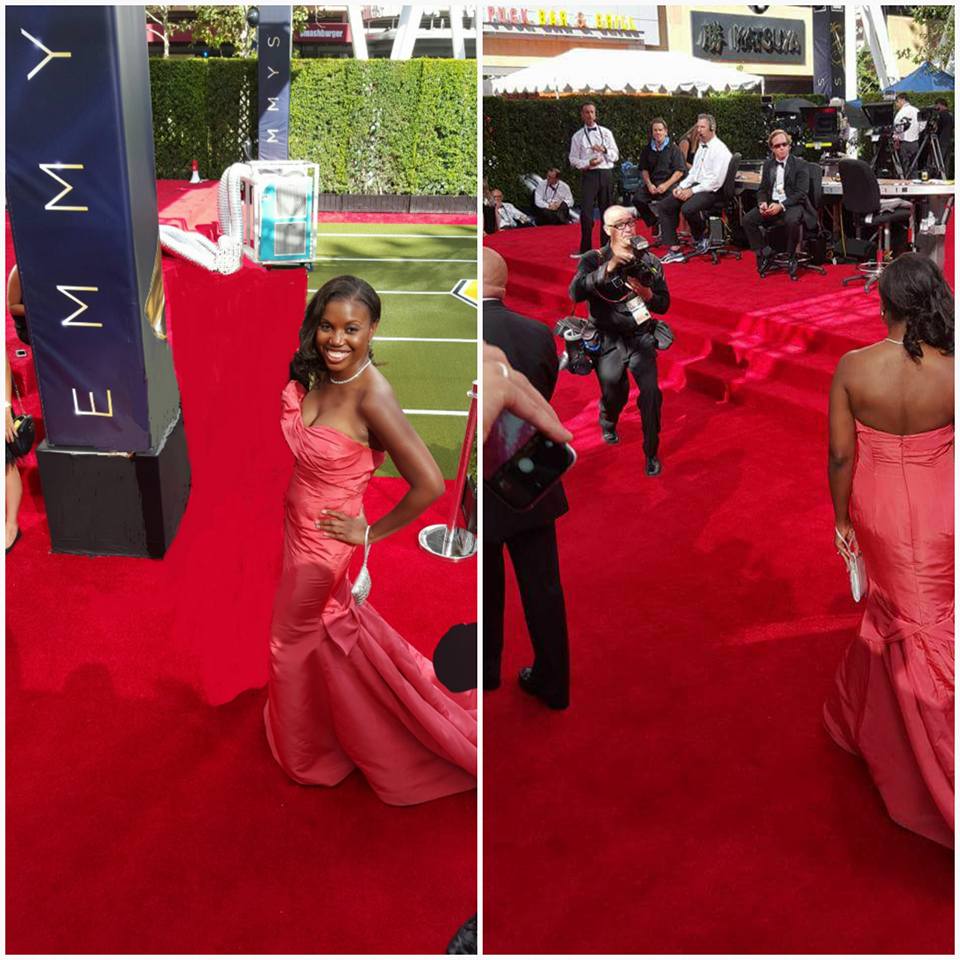

Next, I had to find my ensemble. I loved Oscar de la Renta's gowns and Jimmy Choo's sparkly shoes; however, they're so expensive that in order to buy them I'd have to get a huge discount. Imagine how ecstatic I was when I found both within walking distance of my apartment in Chicago at a consignment shop called Luxury Garage Sale. The gown was from the 2012 Resort Collection and the shoes were from the 2010 15th Anniversary Crystal Collection. The original prices were $5,990 for the gown, and $845 for the shoes, but I found them in excellent condition (probably only worn once) at prices I could afford: $1,495 and $195, respectively (and I knew that I could wear them once and then sell them for nearly the same price). I was also able to negotiate a lower price since the gown needed dry cleaning and alterations. For my accessories, I considered renting real diamonds, but decided against it since I was afraid of having to pay the huge deductible if they were lost or stolen, so I bought some nice costume jewelry and decided to carry a Swarovski crystal clutch, which I already owned.

Once I had my travel plans booked and my ensemble purchased, I needed to wait for the nominees to be announced in July and purchase my tickets. The Emmys website had been saying that shortly after the nominees were announced, they'd release information on purchasing tickets. Just after they announced the nominees imagine my shock/horror/dismay when they suddenly changed the language on their website to state that they would not offer tickets to the general public.

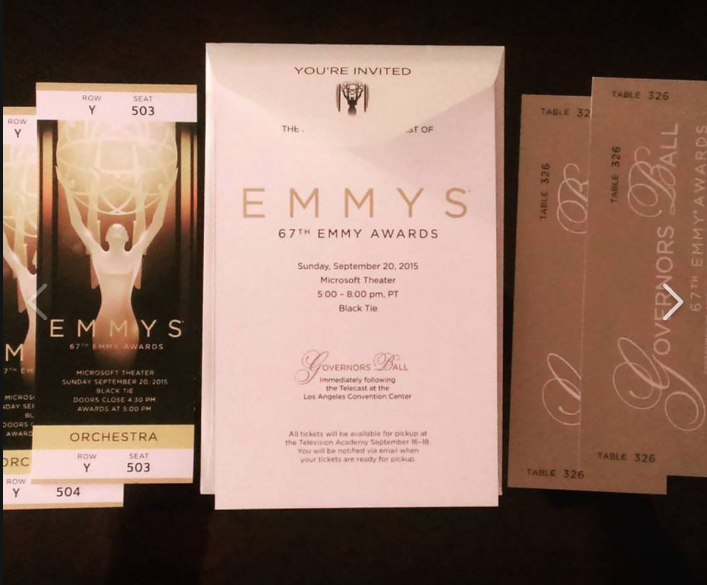

This is where TPG saved the day! In the midst of my panic, I browsed my favorite travel blog and saw the most wonderful announcement: Chase was offering red carpet access to the Emmys for their Chase Sapphire Preferred cardholders! Fortunately, I was a Sapphire cardholder — the first card TPG convinced me to open. I immediately called Chase to book tickets at $1,500 a ticket. I knew it was worth it because the price in 2014 for just the seats and ball was $1,150, so for $350 more, I would also get red carpet access. Fortunately, they had four tickets left so I was able to get two of them.

Then I called the Ritz-Carlton Spa at my hotel to book their "Red Carpet Ready" package and I also flew my makeup artist from Chicago to LA on Saturday night. I used 12,360 points from my Southwest card's sign-up bonus to book his flight, and just like TPG taught me, I rebooked my traveling companion's flight at the lower cost. (When Southwest has a fare sale, the cost of rewards redemptions drops too and the tickets can be rebooked without a change fee.) I also had a large stash of Hilton points from travel for business, so I used 40k of those to book him a one-night stay.

In addition to his fee to do my makeup and per diem for food/incidentals, I also bought my makeup artist a seat in the bleachers from Chase (so that he could take pictures of me on the red carpet...er...I mean as an extra thank you), which could have cost either 15k points or $150. TPG's valuations told me that the points were worth more, so I paid cash. I checked into the hotel, dropped my gown off to be pressed/steamed and the next morning my makeup artist arrived and did a great job on my makeup.

Then it was off to the big event. I wish we could have arrived in a limo and stepped out onto the red carpet, but that honor was pretty much reserved for the nominees. I took advantage of the hair and makeup refreshing stations while my companion took pictures with the actors. Finally, it was time to step out onto the red carpet. It was magical!

I watched as the actors were interviewed, and took a picture in front of the big Emmys wall. Meanwhile, my trusty makeup artist had things under control in the bleachers. He had already made friends with everyone in his vicinity and when my turn came, he screamed for me which prompted the other people to scream for me as well. They took pictures of me on their phones too, and even the professional photographer on the red carpet took pictures of me. I'm not sure who they thought I was. It would have been hilarious if it had not been so surreal!

Our seats in the auditorium were located close to the aisle and I actually sat next to a Chase executive who admitted that she thought I was a nominee. I assume this was because of the gown I was wearing (most non-nominees wore black cocktail dresses instead of long evening gowns). I had made a point to watch the Emmys the year before and to catch up on the nominated shows so that I could be prepared. The ceremony actually seemed to be more entertaining and to go by faster in person than on television; it was fun to watch the actors interact with each other and to watch the theater people direct seat fillers during commercial breaks.

Afterward, the Governor's Ball was fabulous. I can't remember what I ate and I forgot to get a copy of the menu, but I do remember liking the food and decorations and that there was a lot of mingling and networking going on. One of the servers asked my companion and me how he could get to our level. I gave him the TPG website.

What are your top tips for using points and miles? Let us know in the comments, below.

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.