Get Three Free Hotel Nights Each Year With This $75 Annual Fee Card

In 2017, Wyndham Rewards first partnered with Caesars Entertainment's Total Rewards (now known as Caesars Rewards) to offer status matches and the ability to redeem for free nights at hotels across both programs. Through this partnership, members of both programs have been able to access additional redemption options. Plus, Wyndham Platinum and Diamond members have been able to get free nights each year at Atlantis in the Bahamas.

How does this work? Well, thanks to the partnership, Wyndham Rewards Platinum members can receive a status match to Platinum in the Caesars Rewards program through a web form. Caesars Rewards Platinum includes, among other benefits, a complimentary three-night stay in the Beach Tower at Atlantis, plus access to the resort's Aquaventure water park.

Best of all, this complimentary trip is available each year (assuming the program continues to be offered, which it has every year since 2017), so you're not just looking at a one-off freebie. However, the resort fees of $55.95 per night, housekeeping fees of $5 per person per night, airfare, airport transfers and other on-site expense aren't included -- so the complimentary trip isn't exactly free.

Historically, Wyndham Diamond members were able to match to Total Rewards Diamond and also get a complimentary stay at Atlantis. However, reports indicate that with the rebrand to Caesars Rewards, Diamond elites that get the status through a status match may not be eligible for complimentary stays at Atlantis. But, your mileage may vary since the booking process over the phone seems to be extremely manual. If you already have Wyndham Diamond status you might as well go ahead and match to Caesars Diamond and attempt to book a stay -- reports on Doctor of Credit note mixed results.

So, you may actually have a better chance at a complimentary Atlantis stay with Platinum status. It takes 15 nights to earn Wyndham Rewards Platinum status through stays, which may not be reasonable depending on your travel habits and preferred destinations. Luckily, there's a workaround: the annual-fee version of the Wyndham Rewards Visa Card.

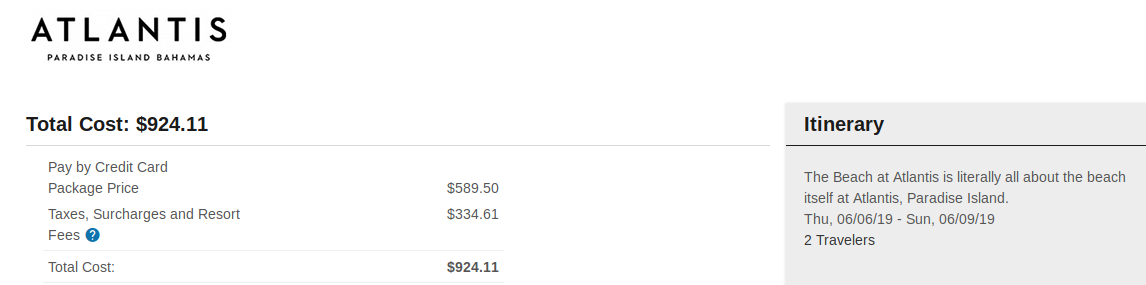

The more premium of the two cards in Wyndham's co-branded lineup, the annual-fee version of the Wyndham Rewards Visa Card carries a $75 annual fee and grants you automatic Platinum elite status. So if you hold this card, you'll be able to match to Caesars Rewards Platinum and take advantage of the complimentary three-night Atlantis stay. Not bad — especially considering that a similar three-night stay would cost $590 before adding in taxes and resort fees (some of which you'd still need to pay on a complimentary stay).

While the ability to obtain Platinum status with Wyndham and match to Caesars Rewards to get the free Atlantis trip is a top reason to consider this card, it could also make sense for you if you want to boost your Wyndham Rewards balance. The card is currently offering a sign-up bonus of up to 30,000 points — 15,000 after your first purchase, plus an additional 15,000 after you spend $1,000 within the first 90 days from account opening. If you meet the minimum spending requirement, you'll have enough points for up to four award nights at 7,500-point properties.

Other card benefits include 5x points on Wyndham stays, 2x points on gas, utility and grocery store purchases and 1x points on everything else. This card has no foreign transaction fees and you'll get 6,000 Wyndham points year account anniversary after paying the annual fee. Considering that TPG's latest valuations peg the value of Wyndham points at 1.1 cents each, these 6,000 points are valued at $66, which almost offsets the annual fee.

There is one important caveat though. TPG's Katie and JT Genter stayed at Atlantis for three-nights in Dec. 2018 using the Platinum status benefit. They didn't gamble during the stay, and didn't face any extra fees or issues at check-out. But, with the Caesars Rewards revamp, the Caesars Rewards page discussing the Atlantis benefit notes that "If you accept this offer and do not show any rated casino play, the Atlantis may charge you for some or all of your upfront complimentaries including rooms, food & drink, limos, etc" -- so it is probably wise to engage in some rated casino play if you accept the complimentary stay.

Bottom Line

The partnership between Wyndham Rewards and Caesars Rewards is powerful in part because you don't need to be a frequent visitor to either program's hotels to reap the benefits of the status match. Just by holding the Wyndham Rewards Visa, you'll get Platinum status with Wyndham — and by matching to Caesars Rewards Platinum you'll be entitled to a free stay in the Bahamas each year (in addition to other perks such as free parking and valet at participating properties). If you've been eyeing a trip to this family-friendly Bahamas resort, this offer is hard to beat.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app