5 Easy Ways for Beginners to Jump-Start Points and Miles Earning

Update: Some offers mentioned below are no longer available. View the current offers here.

With so many airline, hotel and credit card loyalty programs to keep track of, it takes time to become a true award travel expert. But even if you're just getting started with earning miles and points, a few key tips can help you reach your goal in no time. Below, TPG Points & Miles Editor Sarah Silbert outlines five great beginner tips.

Even if you're new to the points and miles hobby, the benefits of collecting travel rewards are readily apparent. After all, who wouldn't want an award flight in first class or a free hotel stay made even better by a suite upgrade? Still, getting from point A to point B can seem daunting, especially with so many loyalty programs and credit card sign-up bonuses to stay on top of. TPG offers a beginner's guide to help get you up to speed on the many steps you should take to start earning and redeeming, but if you're looking for a quick refresher, the tips below should come in handy as well. Here are five simple ways to begin earning rewards toward your next trip:

1. Sign Up for (And Use) the Right Credit Cards

Travel rewards cards are an important part of any award traveler's strategy for earning points and miles, not only because many of them offer incredibly lucrative sign-up bonuses, but because they offer you a return on everyday purchases you'd be making anyway.

Each month TPG publishes a list of the top 10 sign-up bonuses — this is a great way to keep on top of the currently available offers and evaluate which of them align with your travel goals and plans. Before you start applying, though, make sure you're familiar with the four transferable point programs: American Express Membership Rewards, Chase Ultimate Rewards, Citi ThankYou Rewards and Starwood Preferred Guest. Each of these programs partners with a selection of airlines and hotels, giving you various options for redeeming your points. You can earn points in each of these programs through credit cards (with SPG, you can also earn points through hotel stays) — see the link for each program for more info.

After you settle on the cards that earn you the points in your preferred programs (or that earn you transferable points that can be redeemed with your travel partners of choice), consider which ones offer you the best return on any given purchase. For example, if you often shop at office supply stores like Office Depot and Staples, you might want to sign up for the Chase Ink Plus Business Card, which earns you 5x Ultimate Rewards points on the first $50,000 spent in combined purchases each year at office supply stores and on cellular phone, landline, internet and cable TV services each account anniversary year. Based on TPG's valuations, that's a return of 10.5% — and you can redeem those points with a number of great transfer partners including British Airways and Hyatt.

One final aspect to consider when it comes to choosing and using the best travel rewards credit cards is the variety of benefits on offer. For example, if you want complimentary airport lounge access, look for a card like the Citi AAdvantage Executive World Elite Mastercard, which offers Admirals Club membership. There are also several cards that get you elite-like airline benefits.

2. Rethink Where You're Crediting Miles

American recently announced that it will add a spending requirement to elite status qualification starting in January 2017, making it the last major US airline to add this revenue requirement. This means if you want to earn elite status with American, Delta or United, you'll have to shell out a minimum of $3,000 (for the lowest elite tier).

Delta and United do let you waive the elite-qualifying dollars requirement if you spend at least $25,000 in a year on one of their co-branded credit cards like the Platinum Delta SkyMiles Credit Card from American Express or the United MileagePlus Explorer Card, though for United this only applies up to Premier Platinum status). It's still unclear if American will offer a similar credit card waiver once its requirement is in place next year, though it's possible given the recently announced partnership with Barclaycard and Citi. In any case, though, earning elite status with these spending requirements may be out of reach — and if you don't think you'll qualify for your desired tier, it could be worth crediting your flights to another program that offers cheaper redemptions and/or more redeemable miles for your travel.

For example, if you usually fly United, you might want to look into crediting your flights to Star Alliance partner Singapore Airlines, since you can only book the carrier's sought-after Singapore Suites first class using KrisFlyer miles, and Singapore also offers lower redemption rates for flights from the US to Hawaii. Similarly, you might want to credit your Delta flights to Flying Blue or your American flights to British Airways or Alaska Airlines.

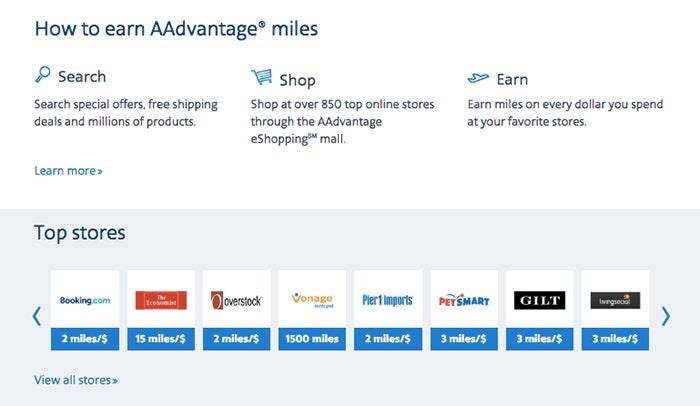

3. Always Go Through Shopping Portals

Whenever you make an online purchase, make sure you check and see if you can earn extra points or miles by going through a shopping portal. These are essentially online shopping gateways run in partnership with most major loyalty programs that offer you extra points or miles when you click through instead of going straight to a store's website.

For example, with the Delta SkyMiles Shopping site, clicking through to the Staples site will currently earn you 4 miles per dollar on your purchase — and that's on top of any other rewards you'll earn from your credit card. Also keep in mind that most shopping portals offer elevated bonuses for a variety of stores during specific holidays such as Valentine's Day and Mother's Day, and some also run limited-time bonus promotions when you spend a specific amount in a certain timeframe.

In general, focus on the shopping portal that earns you the points or miles you most value, though don't be afraid to use more than one — especially if you find a particularly high earning rate through one site. If you're looking for the best option for a given store, don't forget to check EVReward.

4. Maximize Dining Programs

Much like shopping portals, these programs offer you the opportunity to "double-dip" on purchases by earning extra rewards. Most major airlines and hotel chains partner with third-party dining programs, and once you enroll you'll earn extra rewards each time you eat at a participating restaurant. Depending on the program, you might even earn a bonus for your first visit or for meeting a certain spending threshold.

When it comes to choosing the best dining program(s) for you, as always, take into account which travel rewards you value the most, as well as which programs have the largest selection of restaurants in your area. Finally, make sure to maximize your purchases by registering a card that earns bonus points on dining with your program of choice. One solid pick would be the Chase Sapphire Preferred Card, which earns 2x points on all travel and dining spending.

5. Follow TPG for Deals and Tips

Learning the ins and outs of your favorite loyalty programs is half the battle; once you have the basics down, it's crucial to stay up to date on the latest program changes, travel deals and more. That's our bread and butter here at TPG, so follow along with us on Facebook and Twitter to learn how to maximize your travel.

If cheap flights are your scene, make sure to follow our TPG Alerts account on Twitter as well — we post airfare deals to Asia, Europe and beyond. Finally, sign up for our daily and weekly newsletters to catch all our top posts. As you'll see, the saying "Knowledge is power" has never been more true than when talking about the award travel hobby!

What are your favorite tips for getting started with earning points and miles?

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app