Two Hotel Owners Suing Marriott and Starwood Over Upcoming Merger

The Marriott and Starwood saga continues — this time, though, it's not a Chinese insurance firm that's trying to outbid Marriott.

Now, the owners of hotels in Chicago and New York are suing Marriott and Starwood on the grounds that the merger would violate exclusivity agreements. Cityfront Hotel Associates Limited Partners, the owner of the Sheraton Grand Chicago, and Dream Team Hotel Associates LLC, which owns the Westin New York at Times Square are suing the two hotel corporations. The grounds for the suit? The merger would unfairly eat into their business, as both of the properties represented are Starwood hotels (more on that below).

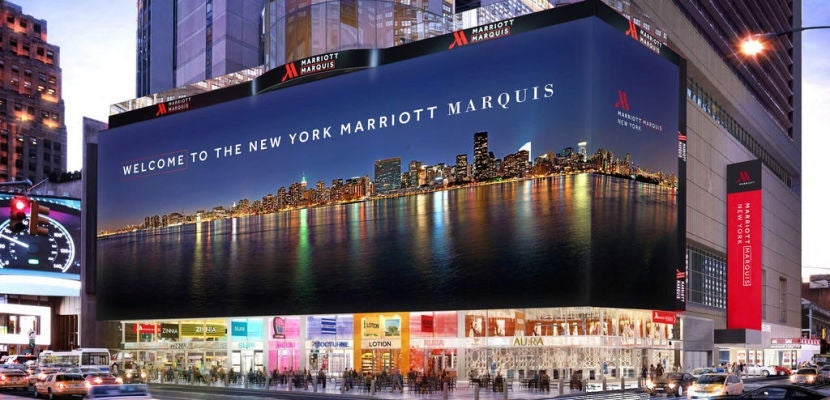

The plaintiffs in the case are suing on the grounds that the merger violates clauses in their contracts that prohibit Starwood from owning, franchising, operating or managing other hotels within a specific geographic area surrounding the two hotels. The Westin New York at Times Square is located within two blocks of one of the largest hotels in the city, the Marriott Marquis, which would become one of its biggest competitors, and also under the same umbrella of Marriott-Starwood when the merger is finalized.

Only time will tell if this lawsuit as any affect on the upcoming merger, which is expected to close in the middle of this year. If anything, this merger seems to be running into more roadblocks than expected.

To recap everything that's happened to date regarding the merger, check out these posts below:

May 1, 2015 — Rumors of IHG preparing a bid to acquire Starwood

October 28, 2015 — Starwood CEO Adam Aron mentions the possibility of a sale during an earnings call

November 16, 2015 — Marriott announces its intention to acquire Starwood

November 20, 2015 — Marriott CEO Arne Sorenson addresses questions about Marriott and SPG

January 22, 2016 — TPG chatted SPG with Marriott's Vice President of Loyalty

February 24, 2016 — TPG shares plans to attend a Marriott loyalty forum in Los Angeles

March 14, 2016 — Starwood and Marriott acknowledge Anbang's bid

March 18, 2016 — Starwood accepts Anbang's bid

March 18, 2016 — Starwood CEO Tom Mangas addresses the latest acquisition news

March 21, 2016 — Marriott Outbids Anbang with Latest Offer for Starwood

March 28, 2016 — Marriott Isn't Submitting a Higher Bid for Starwood Hotels

March 31, 2016 — Anbang Won't Be Acquiring Starwood After All

April 19, 2016 — Marriott's Integrating Some SPG Benefits Long Before the Merger

H/T: Bloomberg

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app