Here's What Marriott Plans to Do with Starwood Preferred Guest

Update: Some offers mentioned below are no longer available. View the current offers here.

This week, the Starwood merger/acquisition saga continued when Marriott responded to Anbang's bid with a higher offer of its own. To recap everything that's happened to date, check out these posts below:

May 1, 2015 — Rumors of IHG preparing a bid to acquire Starwood

October 28, 2015 — Starwood CEO Adam Aron mentions the possibility of a sale during an earnings call

November 16, 2015 — Marriott announces its intention to acquire Starwood

November 20, 2015 — Marriott CEO Arne Sorenson addresses questions about Marriott and SPG

January 22, 2016 — TPG chatted SPG with Marriott's Vice President of Loyalty

February 24, 2016 — TPG shares plans to attend a Marriott loyalty forum in Los Angeles

March 14, 2016 — Starwood and Marriott acknowledge Anbang's bid

March 18, 2016 — Starwood accepts Anbang's bid

March 18, 2016 — Starwood CEO Tom Mangas addresses the latest acquisition news

March 21, 2016 - Marriott Outbids Anbang with Latest Offer for Starwood

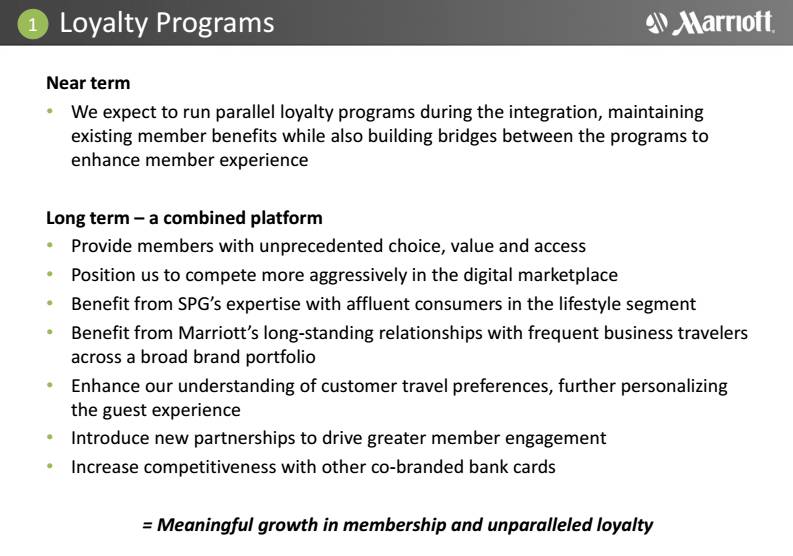

While Anbang is expected to respond with its own boosted bid, Marriott is moving forward with business as usual — the company held a conference call for investors yesterday, during which executives detailed some of the chain's post-merger plans. As Gary Leff notes, Marriott has for the first time acknowledged that it will combine Marriott Rewards and Starwood Preferred Guest.

As you can see in the slide above, Marriott plans to run Starwood Preferred Guest as its own program shortly following the merger, as you might expect. Eventually, however, the two programs will be combined, at which point members of either program will have access to both brands' properties around the world. It sounds like there's even a chance that we could see multiple co-branded credit cards stick around, including the Marriott Rewards Premier Credit Card and perhaps even a version of the Starwood Preferred Guest® Credit Card from American Express.

Finally, Marriott addressed some of Starwood's brands on the call — according to Skift, brands like W and St. Regis will stick around, while Luxury Collection properties may become part of Marriott's "Autograph Collection," according to Marriott CEO Arne Sorenson (as Skift reports):

We look at what's happened at [Starwood's] The Luxury Collection and compare that to our launch of the Autograph Collection just about five years ago — a brand which already has 100 hotels — and we think we can bring that similar kind of growth to The Luxury Collection.

That means by the time Starwood's two new Luxury Collection properties open their doors in Cuba, they could be part of the Autograph Collection, instead. Or they might not.

How do you feel about a combined Marriott/Starwood loyalty program?

H/T: View from the Wing

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app