Updated TSA Travel Tips for Global Entry and TSA Precheck

Update: Some offers mentioned below are no longer available. View the current offers here.

The TSA has just released an updated list of tips for travelers enrolled in expedited security, trusted traveler programs like Global Entry and TSA Precheck, and I want to pass them along to you—along with a few reminders of my own.

Airlines That Participate in TSA Precheck

The TSA says that you'll receive TSA Precheck on a consistent basis as long as you have a Known Traveler Number (KTN)—also known as your PASSID, which generally starts with 98—and add it to your airline frequent flyer profiles. However, the TSA now recommends that you also add your KTN to your profiles on the 11 airlines that participate in TSA Precheck.

For each of these 11 airlines, enter your confirmation number/name to access your booking info:

Air Canada. In the “Update Passport Information (APIS)” field, include passport info, and in the "NEXUS PASS ID" field, enter your KTN. (NOTE: TSA Precheck is only available at U.S. airports.)

Alaska Airlines. Under “Traveler Documentation,” click “Enter Known Traveler/Redress number” and enter your KTN. If your KTN has already been added, you'll see the message, “Known Traveler number has already been collected for this traveler.”

American Airlines. Under the “Passenger Summary” tab, click “Add/Edit Passenger Information” and verify your name and KTN in the “Known Traveler ID” field. (Passengers won't be able to edit this information online after check-in.)

Delta Air Lines. Under the “Secure Flight Passenger Data & Contact Information” tab, verify gender/date of birth/KTN. (Passengers won't be able to edit this information online within 72-hours of departure.)

Hawaiian Airlines. Under the “Additional Passenger Information” tab, click “Make Changes.” Verify name/date of birth, click “Add Known Traveler #,” and enter your KTN.

JetBlue Airways. Click “Itinerary options,” then “Add/Edit TSA Precheck,” and enter your KTN.

Sun Country Airlines. You may add your KTN during the check-in process if not provided previously.

United Airlines. Click “Edit traveler information,” and enter your KTN in the “Known Traveler Number/Pass ID” field.

US Airways. You may add your KTN during the check-in process if not provided previously.

Booking/Changing Reservations

Note that entering your KTN on your frequent flyer profile won't automatically update previously booked reservations. If you make reservations via a third-party website (that is, not directly on the airline's website) and/or travel agency, your KTN may not be shared with the airline. Remember to always enter your KTN when booking/changing your reservation, even when using your frequent flyer profile.

TSA recommends you contact your air carrier directly to add your KTN to your reservation, either by calling them or contacting them via Twitter to verify that your Secure Flight data (e.g., your KTN, first/middle/last name, gender, correct date of birth).

Update: Some offers mentioned below are no longer available. View the current offers here: Citi Prestige

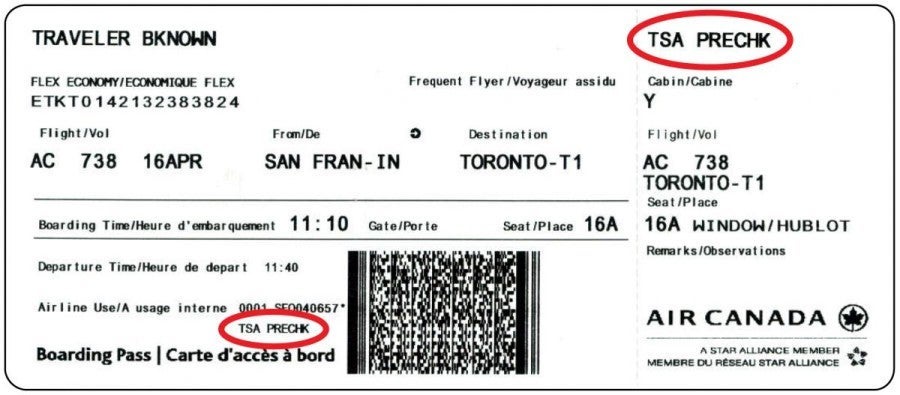

If You Don't Receive TSA Precheck on Your Boarding Pass

If you check-in online before your flight and don’t see a TSA Precheck indicator on your boarding pass, contact your airline or check your airline accounts online to ensure that your Secure Flight information is updated right away. If you have flights with multiple TSA Precheck-participating carriers, ensure that your KTN is listed with each individual carrier, as they submit this data to the TSA for TSA Precheck verification starting 72 hours prior to departure.

If everything matches, you'll be able to re-print your boarding pass again, hopefully with TSA Precheck this time!

How to Get Global Entry Paid For With Credit Cards

A Global Entry application costs $100 and includes TSA Precheck. If you didn’t already know, several credit cards enable you to get the $100 Global Entry fee credited or refunded:

The Platinum Card® from American Express. The personal, The Business Platinum Card® from American Express and Merecedes-Benz Platinum versions of this card offer a statement credit for the Global entry fee, even for additional cardholders.

Citi Prestige, the flagship card of the ThankYou Rewards program, will also refund your Global Entry fee. Check out this post for more on the benefits of this card, which includes airline transfer partners, free hotel nights, air travel credit, lounge access at 9 airports, and a 3x bonus category for airlines, hotels, and travel agencies.

Advantage Aviator Silver Card. Offered only to existing US Airways Barclaycard cardholders, this card provides a credit for the Global Entry fee. Note that once US Airways and American Airlines merge, Barclaycard won’t be able to accept new applications for American Airlines co-branded cards, so they're offering Aviator Red and Silver products as upgrades to existing cardholders. If you want to be able to have one of these Aviator cards, you must apply now through the US Airways card, and then you’ll be converted.

Also be aware that while United elites (those with Global Services, Premier 1K or Platinum status) used to be refunded for the Global Entry fee, United MileagePlus discontinued this benefit as of February 1, 2015.

Still don't have Global Entry (which includes TSA Precheck)? The TPG team and I have written extensively on the subject, so take a look at these posts to learn more—and go get Global Entry, already!

Global Entry, Nexus and Precheck: A Comprehensive Guide & FAQ

Top 12 Things You Didn't Know About Global Entry

6 Reasons Why Global Entry Rocks

How to Apply & Get Approved for Global Entry

How Can I get Global Entry if I Already Have TSA Precheck?

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.