Using Points.com to Combine Miles and Points: A Good Deal?

Update: Some offers mentioned below are no longer available. View the current offers here.

Points.com is a points exchange and clearing house that allows members to trade one kind of points and miles for another and to track your balances and see certain promo offers. You can also redeem your points or miles through it for retail gift cards or for Paypal credits. It's free to join and its interface is easy to use.

However, before you go signing up and swapping your points all over the place, I wanted to cover why that might not be such a good idea. The gist of it is: the values Points.com gives you for your points and miles tend to be horrendous because of transaction fees and terrible exchange ratios, so in general, this is not the way to consolidate, exchange or redeem your points.

To be fair, there are some instances when using Points.com might make sense - such as when you need to keep some miles from expiring and there is no quicker, cheaper option like purchasing something through an online shopping portal or if you need miles to post in a very short amount of time and have no other option such as transferring from a points program such as Amex Membership Rewards or Chase Ultimate Rewards. That said, I still think these only make sense when we're talking about very few points since the transfer ratios are so small.

However, for the most part, Points.com transactions will leave you with just a fraction of the value your points are worth. I have had a lot of readers asking me about it lately, so I just wanted to run through a couple examples to show you what I mean.

Two of the biggest US airline frequent flyer programs are United MileagePlus and American Airlines. Unfortunately, there's no way to swap or consolidate miles between the two since they are completely separate entities, they belong to different alliances and don't have the same partners on which you can do so in any substantial way. So let's say you had a few orphaned American miles but a lot of United miles and you wanted to combine them so you could book an award.

Right now, Points.com is offering a variety of trading options among members at various rates:

As you can see, the ratios range from 2:1 to 5:1 depending on whom you trade with and you're stuck paying a transaction fee of $50-$150. Let's say you had 6,000 miles to trade and wanted those 2,000 United miles - you'd end up with just a third of the miles you started with and would pay a $100 transaction fee. However, if you just purchased those United miles outright, you'd be paying $75!

So always do the math for yourself because it doesn't always add up.

You could also just exchange for free through Points.com itself, but the ratio is also a dismal 5:1:

In this case, you'd literally end up with 22% of the points you started with, even though you're not paying any transaction fee at least.

Redeeming for Paypal

You could also redeem your miles for retail gift cards from places like 76 gas, Amazon, AMC Theatres, Applebee's, Barnes & Noble, Banana Republic, Best Buy and more, as well as for credit on Paypal.

Here's another quick example. Let's say you had some extra IHG Rewards points floating around and just wanted to cash them out with Paypal. In order to get just $10 worth of credit on PayPal, you'd have to redeem 5,000 IHG Rewards points.

That's a miserable value of just 0.2 cents per point! You can do better - especially considering that IHG's PointBreaks discounted award nights start at 5,000 points and can be used on hotel rooms that cost hundreds of dollars in some circumstances, like I was able to redeem at the Intercontinental Phnom Penh last year where my room would have cost $180 - a much better value of 3.6 cents per point.

Transferring/Sharing Miles

Points.com also lets you share or transfer your miles to another account, but again, the rates can be horrible. For example, to transfer Delta miles to another person, the rates start at 1,000 miles for $40 and go up to 30,000 miles for $330. So you're looking at paying between 1.1-4 cents per miles to transfer.

Whereas on Delta.com you can transfer for a flat rate of 1 cent per mile, no matter if your transferring/sharing 1,000 miles or 30,000.

As with all points and miles-related matter, I cannot stress how important it is that you always do the math for yourself and determine whether a transaction makes sense for you and for the value you get out of your miles. In general, the things you can do on Points.com - trading, exchanging, buying, transferring miles and points - do not thanks to horrible exchange ratios and high transaction fees.

If you're just looking for a quick account top off, you can consider just buying miles outright, or transferring them through an airline rather than Points.com since you'll most likely get a better exchange rate.

Another Reason Transferable Points Are Best

This is also why I always say that transferable points programs like Amex Membership Rewards, Chase Ultimate Rewards and Starwood Preferred Guest points are the best. These programs accrue your points into a central account, and then when you want to redeem them, you can transfer to any number of their airline or hotel partners and you can top up your balances for specific redemptions. That way you, even if your points and miles balances are a bit scattered, you can still take advantage of them without having to make value-draining exchanges.

Here is a list of the travel partners of the three major transferable points program, the ratios at which their points transfer and the credit cards that will earn you each kind of points as well as helpful posts about each of these points programs and how to maximize their value.

American Express Membership Rewards

American Express Membership Rewards has 17 airline transfer partners and four hotel programs.

The Amex cards that accrue transferable Membership Rewards include cards like the American Express® Gold Card and Business Gold Rewards card as well as The Business Platinum Card® from American Express, personal and Mercedes-Benz versions of the Platinum Card.

Airlines:

Aeromexico 1:1

Aeroplan 1:1

Air France/KLM 1:1

Alitalia 1:1

ANA 1:1

Asia Miles 1:1

British Airways 1:1

Delta 1:1

El Al 50:1

Frontier 1:1

Hawaiian 1:1

Iberia 1:1

JetBlue 1.25:1

Singapore 1:1

Virgin America 2:1

Virgin Atlantic 1:1

Hotels:

Best Western 1:1

Choice Privileges 1:1

Hilton HHonors 1:1.5

Starwood 3:1

For more information, check out these posts:

The Ultimate Guide To American Express Membership Rewards Airline Transfers

Analyzing Membership Rewards Star Alliance Partners

Top 10 Lesser Known Amex Membership Rewards Transfer Partners

Transferring Amex Membership Rewards to British Airways Avios Versus Cathay Pacific Asia Miles

ANA Award Taxes and Fees Roundup

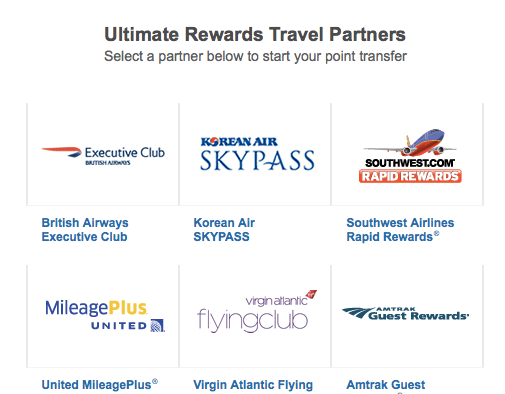

Chase Ultimate Rewards

Chase Ultimate Rewards has ten transfer partners including five airlines, four hotels and Amtrak. The three cards that accrue transferable Ultimate Rewards points (as opposed to those that can be redeemed for cash back or directly for travel through pay with points) are the Sapphire Preferred, the Ink Bold and the Ink Plus.

Airlines:

British Airways 1:1

Korean Air 1:1

Southwest 1:1

United 1:1

Virgin Atlantic 1:1

Hotels:

Hyatt 1:1

Marriott 1:1

Priority Club 1:1

Ritz-Carlton 1:1

Other:

Amtrak 1:1

For more information on Chase Ultimate Rewards, check out these posts:

The Ultimate Guide to Chase Ultimate Rewards Airline Transfers

Ranking the Chase Ultimate Rewards Transfer Partners

Ranking the Top Chase Travel Credit Cards

Why I Love Chase Ultimate Rewards

Starwood Preferred Guest

In addition to being a hotel points program, Starwood Preferred Guest also has 31 airline partners, most of which points transfer to at a 1:1 ratio - and when you transfer an increment of 20,000 points, you get a 5,000-point bonus.

Both the personal and business versions of the Starwood Preferred Guest card from American Express are offering 25,000-point sign-up bonus offers when you spend $5,000 in 6 months.

Airlines:

Aeromexico 1:1

Aeroplan 1:1

Air Berlin 1:1

Air China 1:1

Air New Zealand 65:1

Alaska Airlines 1:1

Alitalia 1:1

ANA 1:1

American 1:1

Asia Miles 1:1

Asiana Airlines 1:1

British Airways 1:1

China Eastern 1:1

China Southern 1:1

Delta 1:1

Emirates 1:1

Etihad Airways 1:1

Flying Blue 1:1

Gol Smiles 2:1

Hawaiian 1:1

Japan Airlines 1:1

LAN 1:2

Miles and More 1:1

Qatar Airways 1:1

Saudia 1:1

Singapore 1:1

Thai Airways 1:1

United 2:1

US Airways 1:1

Virgin Atlantic 1:1

Other:

Amtrak 1:1

For more information, check out these posts:

The Ultimate Guide to Starwood Preferred Guest Airline Transfers

Maximizing Starwood Cash & Points Awards

Starwood "Enhances" Cash & Points Awards

Major Starwood Preferred Guest Elite Enhancements

Maximizing Starwood Preferred Guest Airline Transfers

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app