Why you should pay attention to your elite status progress — even if you aren't chasing status

I've never been one to chase elite status. I'm a budget traveler, and my flight and hotel decisions are almost always made with price in mind, not brand. Because of that, I've never paid much attention to the elite status trackers in any of my apps ... and that cost me elite status for next year.

Want more travel news and advice from TPG? Sign up for our daily newsletter.

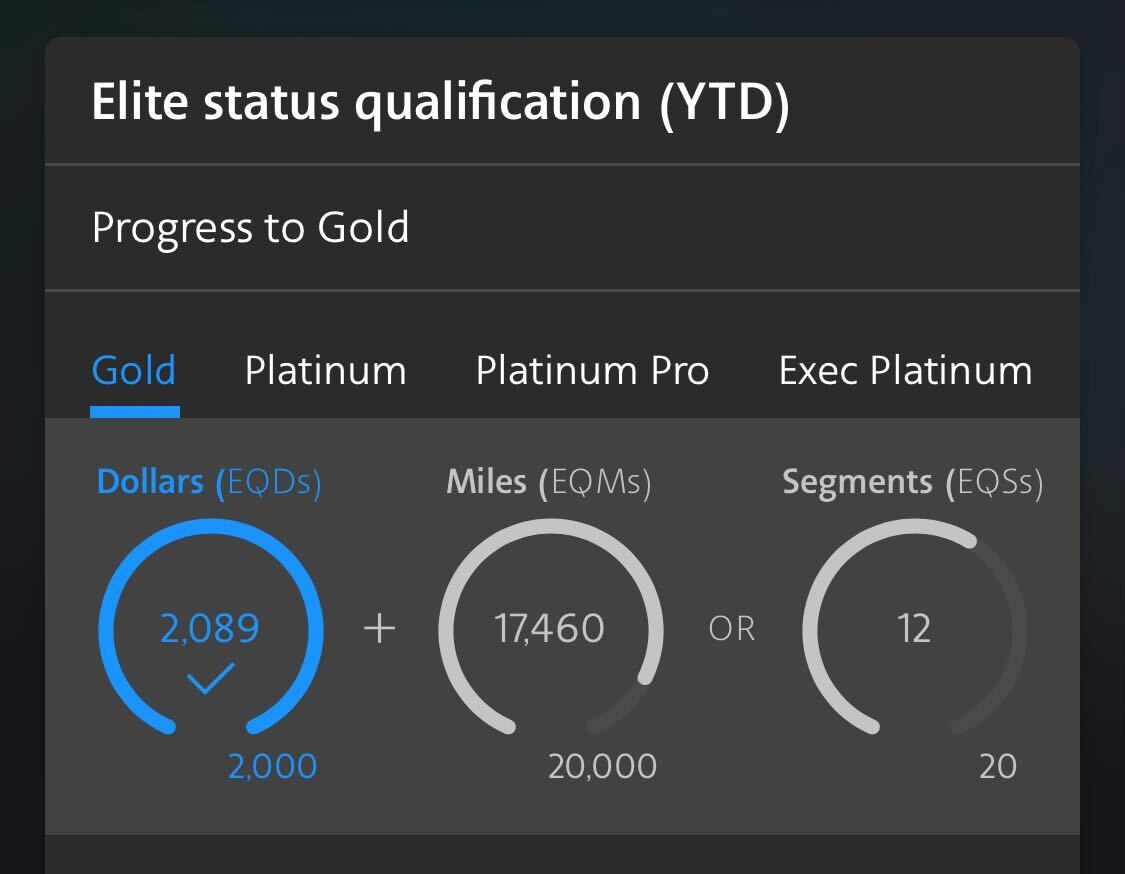

After a recent flight on American Airlines, I realized that I'll end up missing gold elite status by under 3,000 Elite Qualifying Miles (EQMs). I hit the Elite Qualifying Dollars (EQD) threshold needed through work travel, and I am pretty close to hitting the EQM requirement.

While I don't find gold elite status worth a last-minute mileage run before the holidays, knowing I was so close to hitting status may have shifted my strategy on my most recent work flights.

Just last week, I flew Delta from New York City to Phoenix, Arizona, for a work retreat. I could have just as easily flown American Airlines (in fact, many coworkers did). That round-trip flight alone could have been enough to get me over the EQM threshold for gold elite status.

Now, losing out on gold elite status for 2022 isn't the end of the world. While TPG values AAdvantage gold elite status at $855, I wouldn't use the benefits frequently enough to get that much value out of it. I almost never check a bag, I get priority boarding regardless on work trips and flying out of New York, I'd rarely (if ever) get upgraded in favor of higher-tier elites.

The only benefits I would likely use regularly are complimentary access to preferred and Main Cabin Extra seats.

But still, it would have taken one otherwise inconsequential flight change on my part to hit status for next year if only I had paid any attention to the elite status tracker on my American Airlines app earlier on in the year.

And this situation could have easily applied to elite status with other brands — say, Explorist status with Hyatt.

I was surprised to find that I'd hit Discoverist status with Hyatt earlier this year because I never paid attention, and I'm not too far off from Explorist. I definitely would have made more of a concerted effort to stay at Hyatts during my last couple of trips had I realized I could hit that next tier of status (which comes with a 20% point bonus on stays and room upgrades) without a mattress run.

We're coming up on the end of the year, which means the clocks will soon restart on elite status for 2022 and beyond. Even if you aren't someone who strives for elite status, make sure you're checking in on your loyalty apps throughout the year. You may find yourself closer to hitting status than you would otherwise think, and a couple of minor changes in which airlines or hotel brands you book throughout the year could help you score status for 2023.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app