How Chase Pay Over Time is helping me pay off a large purchase interest-free

When I decided to buy a couch, I knew I'd need to pay the cost off over time. After all, furniture is a big-ticket item.

The easiest and (to me) most obvious answer was a 0% APR card. Most 0% APR cards let you pay off a charge over 12 to 18 months, but some cards have an introductory 0% APR period that lasts for as long as 21 months. This would give me more than enough time to pay off my couch without feeling financial strain.

Unfortunately, my plans for a 0% APR card ended in a rejection.

Since issuers often frown on applying for another card right after getting rejected, I didn't want to apply for a different card right away. Insert Chase Pay Over Time.

Here's why I plan on checking Pay Over Time for all of my future large purchases — and why you should, too.

What is Chase Pay Over Time?

Some issuers offer cardholders special payment plans for large purchases. These plans may have a special annual percentage rate (APR) or a monthly fee in exchange for no interest. The latter is how Chase Pay Over Time works.

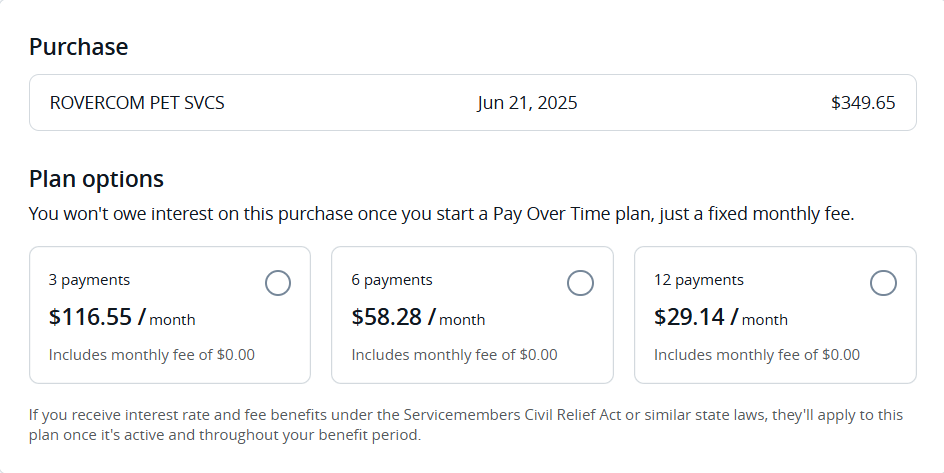

When you make a purchase of $100 or more, you may see the option to put the charge on a Pay Over Time plan.

Chase will give you a few different options to choose from, allowing you some flexibility in how large your monthly payments will be and how long you have to pay off the entire charge.

Chase often charges a monthly fee, but you won't pay any interest as long as you pay the charge off by the end of your plan.

However, as I found in my recent experience, sometimes you'll get lucky and receive an offer for a no-fee plan.

Why I chose Pay Over Time

As I mentioned earlier, I needed a couch for my apartment. Anyone who's furnished a home knows that furniture is expensive, so it's a good idea to try to find a way to pay those charges off over time.

I originally tried to apply for the Wells Fargo Reflect® Card (see rates and fees). Wells Fargo rejected me for having too many new accounts in the past 24 months, echoing the frustrations that points and miles enthusiasts often encounter with Chase and their 5/24 rule.

I was counting on this card for my new couch, since the Wells Fargo Reflect offers a 0% introductory APR for 21 months on purchases and qualifying balance transfer (then a variable APR of 17.49%, 23.99% or 28.24%). While I don't expect it to take me that long to pay off my couch, having the safety net is always nice in case extra unexpected expenses come up.

I thought I'd have to postpone my couch purchase, but then I remembered Pay Over Time. I hadn't used it before, so I wasn't certain if I could get a no-fee plan like some Reddit users said they'd received. But I was willing to take the risk.

Worst case scenario, I'd have to pay a little extra in fees, but I'd have a piece of furniture I needed.

My experience with Pay Over Time

I have four cards from Chase that are eligible for Pay Over Time:

- Chase Freedom Flex® (currently closed to online applicants)

- Chase Freedom Unlimited® (see rates and fees)

- Chase Sapphire Preferred® Card (see rates and fees)

- United℠ Explorer Card (see rates and fees)

The information for the Chase Freedom Flex has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

I chose my United Explorer since it's the Chase card I use the least right now. It's easier for me to get a quick glimpse of what I have left to pay if my couch is one of the only (or the only) charges on my statement.

I could've used my Freedom Unlimited for 1.5% cash back on my purchase, but I don't have a high credit limit on that card. Putting my purchase on my Freedom Unlimited would've held over 30% of my credit line hostage while I worked to pay it off. I use that card for a lot of purchases, so that was a no-go.

Most of Chase's cards offer Pay Over Time, so you don't have to open one of these cards to take advantage of this benefit.

Once the charge went through, I selected Pay Over Time to see my options. Moment of truth: Would I luck out with a no-fee plan?

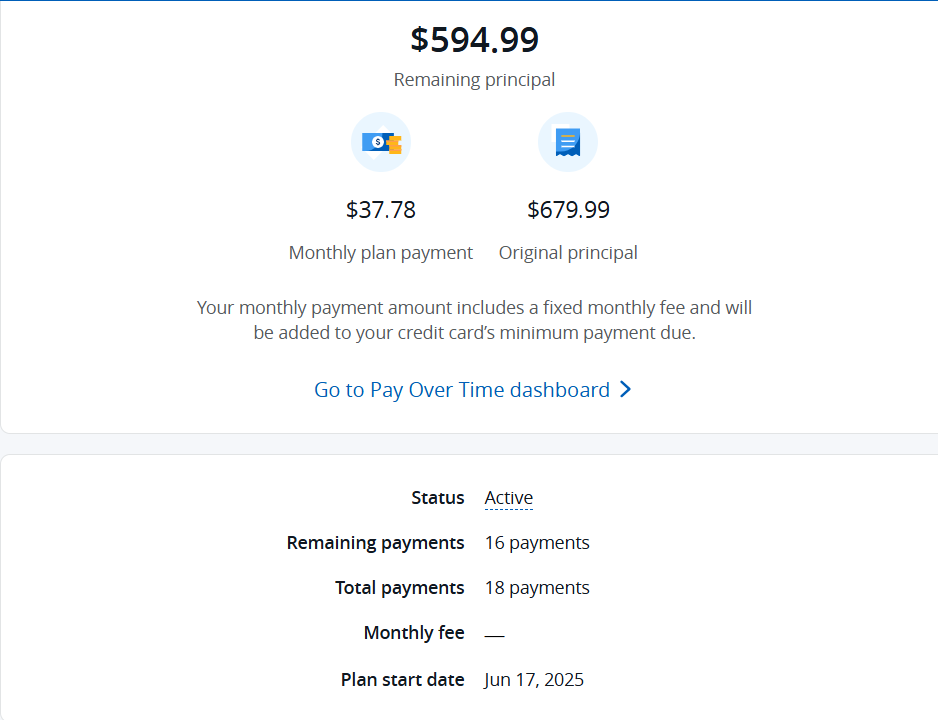

Fortunately, that's exactly what I got. I had a few options for how long I wanted my Pay Over Time plan to be. I chose the 18-month plan; like I said earlier, I like longer plans because they give me greater peace of mind.

Even if additional expenses come up, I know I can make the minimum payment each month. And if they don't, I can pay off my couch sooner than 18 months.

Chase Pay Over Time vs. Paying in Full

Chase Pay Over Time is a great tool for purchases you need, but can't afford to pay for all at once. I aim to follow TPG's golden rule of only charging what I can afford to pay, but every now and again, times like this come up where that isn't possible.

But what about if you know for certain you can pay off a large purchase in one go? Is Pay Over Time still worth considering?

I believe it is. If you're offered a plan with no fee, it might be worth parking the money you have on hand in a high-yield savings account. Then, you can either pay off the monthly charge with other income or pay it off slowly from the money you've stashed away.

Regardless of which strategy you choose, once your savings have generated some interest, you can always opt to pay your plan off early, penalty-free.

Bottom line

I'm very grateful that I was able to secure a no-fee Pay Over Time plan.

It allowed me to get my couch despite not being approved for a 0% introductory APR card. I plan on checking it more regularly going forward, especially for any emergency expenses that arise.

Given that you aren't guaranteed to get a no-fee Pay Over Time plan, I still recommend trying to open a 0% introductory APR card first for any expenses that you don't have the ability to cover entirely.

But if you get rejected or aren't in a position to open a new card, this is a great alternative.

Related: How I earned almost 30,000 Amex Membership Rewards points with help from Rakuten

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app