I was anti-Southwest until I got one of their credit cards — now I’m a convert

I've been living in the U.S. for almost a decade, and one of the strongest opinions I encounter among travelers here is about Southwest Airlines. It seems that the only people more vocal than the airline's haters are its loyal fans.

I think there are valid arguments on both sides of the coin. And, indeed, I was more of a Southwest hater for most of my time living here — until I got one of its cobranded credit cards.

At TPG, we don't push credit cards just for fun; we promote the ones that offer the best value to our readers. An airline credit card can make your travels more comfortable — and save you money in the process.

So, if you live near an airport with a Southwest presence, it might be worth getting one of its credit cards. Here's how I became a Southwest convert after opening the Southwest® Rapid Rewards® Performance Business Credit Card (see rates and fees) in 2023.

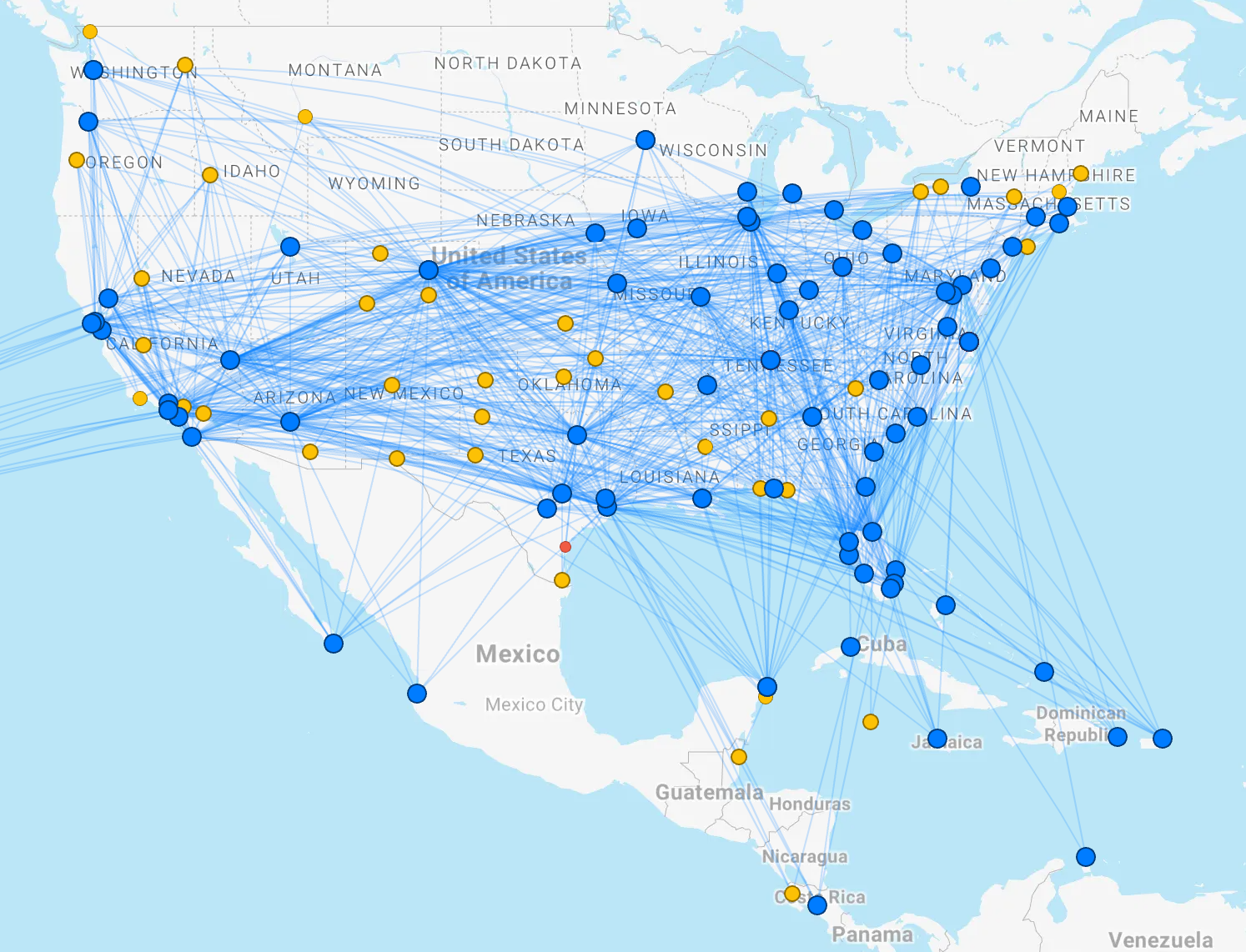

Huge domestic route network

First of all, Southwest has a broad domestic network, making it easy to fly across the country.

The airline has a particularly strong presence in the eastern half of the U.S., Texas and California, covering a large portion of the country's population. It also flies to Hawaii and a number of destinations in Mexico, the Caribbean and Central America.

Since I live in Austin, Southwest is an easy choice for me; it operates almost 40% of flights in and out of the airport. Plus, it's just a short hop to Dallas Love Field (DAL) and Houston's William P. Hobby Airport (HOU), Southwest's fifth- and seventh-largest hubs, respectively, for easy one-stop connections throughout the carrier's network.

Unparalleled flexibility

Southwest prides itself on having no cancellation or change fees, which can come in handy for award travelers and those who change plans at the last minute.

Case in point: This summer, I am taking a break from the heat in Texas to spend June in Chicago, July in Europe and August somewhere else in the U.S. I'm not 100% sure where I want to be for my final month, so I have booked several Southwest reward flights to spend time in either Chicago or Portland, Maine.

I can cancel any flight up to 10 minutes before departure, which is an extremely generous policy, giving me the power to adjust my flights as my plans firm up.

Easy-to-redeem flights

I aim to get at least 2 cents in value out of each frequent flyer point or mile I redeem across various programs. This is approximately the value that we peg the major issuers' currencies at, including Chase Ultimate Rewards points and Capital One miles.

Southwest Rapid Rewards points' fixed redemption value of 1.3-1.5 cents per point may not offer outsize value, as the redemption rate is tied to the cost of a revenue fare. However, it's easy to understand, and I appreciate knowing that I will almost always get the same value out of my Southwest points, no matter which flight I use them on.

Priority boarding

One of the main gripes travelers have when flying on Southwest is the uncertainty about which seat they will be in. The carrier has an open-seating policy with no preassigned seats. However, every Southwest credit card allows you to board a select number of flights early each year.

The lower-tier Plus card, Premier card and Southwest® Rapid Rewards® Premier Business Credit Card (see rates and fees) each offer two EarlyBird Check-Ins per year through Dec. 31, 2025. These allow you to automatically reserve your boarding spot 36 hours before your flight. They also mean you don't have to remember to check in right at 24 hours before departure.

The higher-tier Priority and Performance Business cards offer four upgraded boardings each year through Dec. 31, 2025. I find this perk to be valuable because even if I forget to check in right at 24 hours before departure, I can still get an A1-A15 boarding position (when available), which increases my chances of snagging one of the best seats on the plane.

Frequent sales

Southwest is pretty generous when it comes to flash sales for both cash and award flights.

Most flights I book with Southwest cost 10,000-15,000 points each. However, by keeping an eye on the Southwest website and app, as well as deal alerts on TPG, I can often get a discount on new flights — and even ones I've already booked.

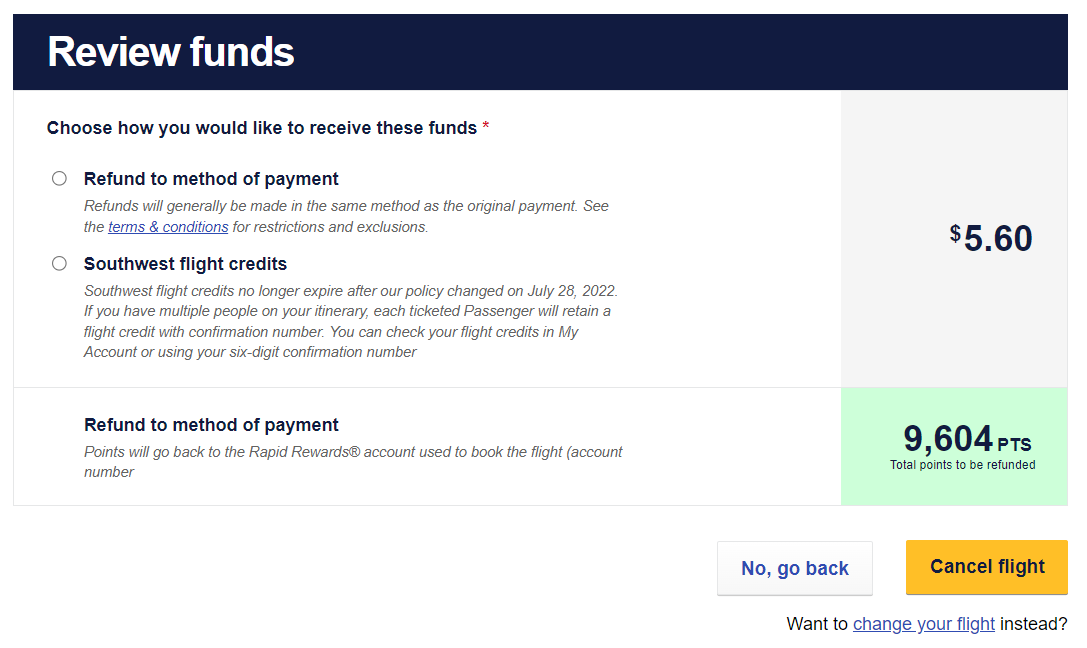

For example, I originally booked one of my flights to Portland mentioned above for 8,021 points plus $5.60 in taxes. Then, a week later, Southwest announced its 50%-off birthday sale. The route and date I had booked were eligible for the discount, so I canceled my original flight and then immediately rebooked it for the lower price, saving myself almost 4,000 points to use on a future flight.

Bonus anniversary points

Apart from the large 80,000-point welcome bonus I received when opening my Performance Business card and meeting the minimum spending requirement, I think it's worth holding on to a Southwest card into future years — if you fly Southwest at least a few times yearly. Currently, the Performance Business is offering 80,000 points after spending $5,000 on purchases in the first three months from account opening.

In addition to all the perks mentioned above, I receive 9,000 bonus anniversary points each year I hold the card; those points are worth $126, according to TPG's October 2025 valuations. That covers a little less than half of the card's $299 annual fee.

The other four cards offer 3,000-7,500 bonus anniversary points.

If you're thinking about applying for a personal card, these are their current welcome offers:

- Southwest Rapid Rewards® Plus Credit Card (see rates and fees): Earn a Companion Pass (valid through Feb. 28, 2027) plus 20,000 bonus points after spending $3,000 on purchases in the first three months from account opening.

- Southwest Rapid Rewards® Premier Credit Card: Earn a Companion Pass (valid through Feb. 28, 2027) plus 30,000 bonus points after spending $4,000 on purchases in the first three months from account opening.

- Southwest Rapid Rewards® Priority Credit Card (see rates and fees): Earn a Companion Pass (valid through Feb. 28, 2027) plus 40,000 bonus points after spending $5,000 on purchases in the first three months from account opening.

The information for the Southwest Premier has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: How to decide if a credit card's annual fee is worth paying

Bottom line

Sometimes, it's important to admit you were misguided and make a correction. I am so happy I finally applied for a Southwest credit card, as it's proven to be very useful in booking flexible flights and upgrading my travel experience with Southwest.

If you want a Companion Pass, the best time to apply is in February-March, when the issuer tends to offer bonus points plus a temporary Companion Pass, or in the last quarter of the year, when you can time your application to maximize your points earning for the Companion Pass the following year. If you just want bonus points, the middle of the year (May-June) is your best bet.

To learn more, read our full reviews of the — in order of lowest to highest annual fee — Southwest Plus, Premier, Priority, Premier Business and Performance Business cards.

Apply here: Southwest Plus

Learn more: Southwest Premier

Apply here: Southwest Premier Business

Apply here: Southwest Performance Business

Related: Comparing the Southwest Rapid Rewards Priority, Premier and Plus credit cards

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app