How fast are we going? How pilots deal with a loss of airspeed indications

The evening of May 31, 2009, was like any other in Rio de Janeiro. As the crew of an A330 prepared for departure, it would have been like any other flight home. A long stretch over the deep black of the Atlantic, dodging thunderstorms as they made their way back to Paris. Tragically, a few hours later the aircraft would enter a deep stall and fall into the ocean.

After a lengthy investigation, it was found that the pitot tubes which help detect the airspeed had momentarily frozen. This gave the crew conflicting and confusing information on the screens which ultimately led the speed to drop so low that the wings were not generating enough lift to keep them flying.

If anything positive came from this awful event it's that it served as a wake-up to the industry to the dangers of unreliable airspeed and how it is handled by crews. It forced manufacturers and operators to review their procedures and improve training for pilots.

How the problem is dealt with very much depends on the aircraft type and how the airspeed is sensed and presented in the flight deck. As a result, when training on a new type of aircraft, it is important that we as pilots know exactly how the pitot-static systems works and what to do should they fail.

Why airspeed is important

Contrary to popular belief, aircraft fly not because of the engines but because of the wings. Air flowing over the surface of the wing creates lift, the engines merely provide the forward thrust to create that airflow. If the airflow gets too low, not enough lift will be generated and the wing will "stall" -- very different from the engine of a car stalling.

Consequently, the speed of the air over the wings, or the airspeed, is critical to the safety of the flight. In fact, should all engines fail in the cruise, the pilots can trade altitude for airspeed and glide the aircraft well over 100 miles.

As a result, having accurate and reliable indications of the airspeed in the flight deck is probably the most important piece of data on our screens.

Pitot tubes

When driving your car, sensors on the wheels detect how fast they are spinning. This information is then calibrated and displayed on your dashboard in mph/kph. In an aircraft it's similar. Kind of.

Even though there is no ground from which to detect the speed, there is something that can be used when 35,000 feet up in the sky -- air molecules. At the front of the aircraft, normally just below the flight deck, are a number of sensors called pitot tubes.

Whilst the aircraft is moving forwards, both on the ground and in the sky, the rate of airflow into these tubes is measured and this represents the speed at which the air is moving over the wings.

Read more: Fly like the wind: Pilots are about to cross the Atlantic in a whole new way

The fundamentals of this system are the same from the smallest two-seater propellor aircraft up to large airliners. How they differ is what goes on between the air flowing into the pitot tube and when it is displayed in the flight deck.

On a small propellor aircraft, there is normally just one pitot tube. Air flowing into this, through a series of mechanical linkages, directly moves the needle on the airspeed indicator in the cockpit.

However, on commercial airliners, we love to have back-up systems. For the really important systems, such as the airspeed indications, we like to have a back-up for the back-up. So, on the 787 Dreamliner, we have three pitot tubes.

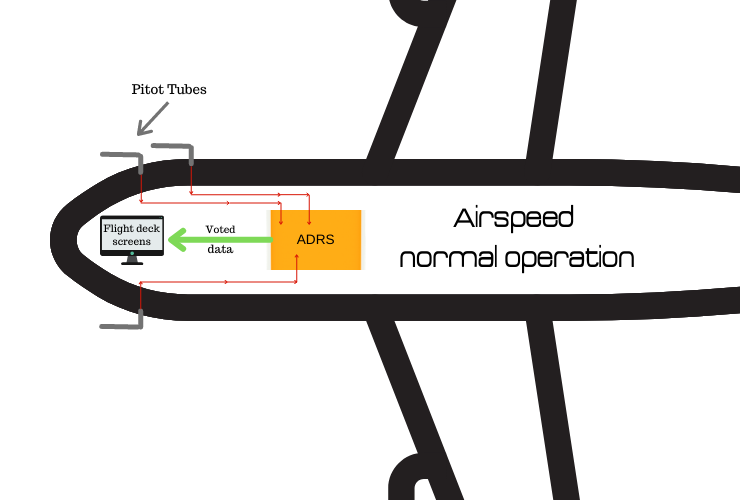

The Dreamliner system

When air flows into the three pitot tubes on the 787, the data each one generates is sent to a master computer, the air data reference system (ADRS). Here, the three inputs are automatically voted on and trusted data is sent to the screens in the flight deck.

In normal operations, all three inputs will be the same so the voting process is quite straightforward. The problem comes when one of the three pieces of data is different from the other two. This could be caused by a blockage to the pitot tube, potentially from ice or, as it has been known, insects.

In this situation, the computer is able to determine that one of the pieces of data is incorrect so as long as the other two are the same, it votes out the odd-looking data and sends correct information from the other two sources to the flight deck. All this is done without any notification to the pilots.

Read more: Snow, cruel winds and ice: How pilots operate safely during freezing weather approaches

You may now be thinking, what if there are faults detected in all three sources of pitot data? Surely it's game over? On some other types of aircraft, this would indeed be the case and the pilots would have to carry out the unreliable airspeed checklist.

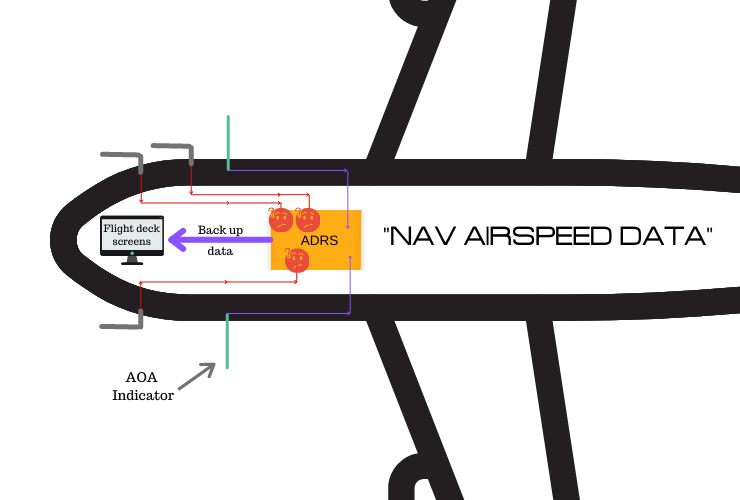

However, even in this situation, the 787 has more back-up systems. The pitot tubes are not the only probes on the outside of the aircraft. On either side of the fuselage, close to the pitot tubes, there is an angle of attack sensor. This measures the angle at which the aircraft is flying. Using clever computing, the ARDS is able to take this data and calculate the airspeed and feed this to our screens in the flight deck.

As this is a non-normal situation, the systems alert us with a message saying "NAV AIRSPEED DATA", prompting us to open the associated checklist. Just below the speed tape, it also shows "AOA SPD" to tell us that the speed data is now coming from the back-up data source.

This is still a fairly complicated situation, forcing us to fly the aircraft without the autopilot, autothrottle and flight directors. Ideally, we'd be looking to land at an airport where the weather is not too challenging.

Airspeed unreliable

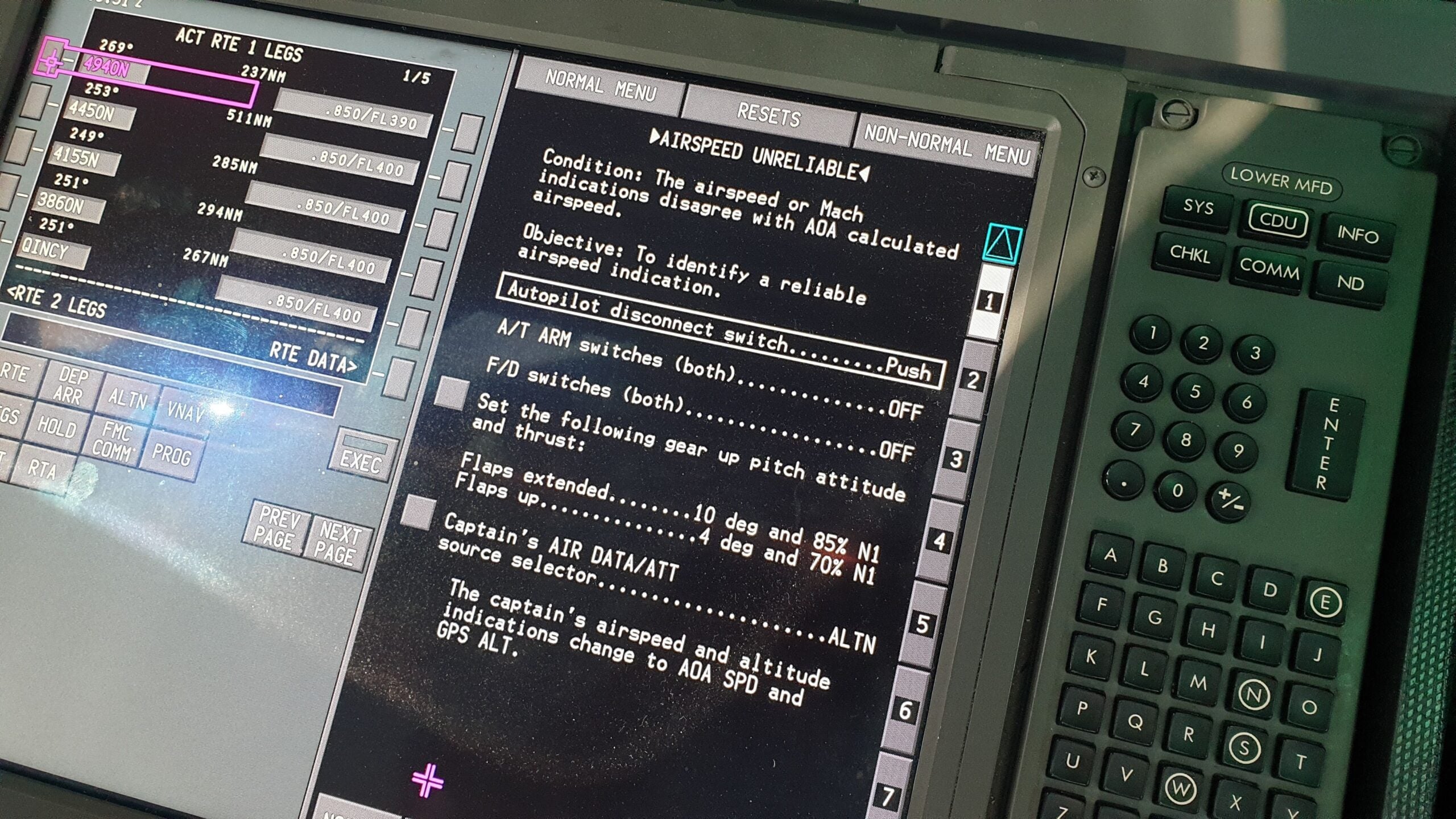

However, if there are no faults detected in the data from the pitot system but the computers detect a difference between the pitot generated data and the AOA generated data, we have a problem.

At this point, the computer is unable to work out what is going on as it can not determine what is reliable data and what is not. It is now up to the pilots to solve the problem with the indication of "AIRSPEED UNRELIABLE".

Memory items

Should the unlikely happen and we do end up in this situation, the first thing we do is ensure the aircraft is flying safely.

When a non-normal event occurs, the first thing we must do is ensure that the aircraft is flying safely. As the fateful crew of Eastern 401 discovered, there's no point in trying to fix a problem if you crash into the ground whilst doing so.

When a crew first becomes aware of a developing situation, usually from a warning or caution alert, the pilot responsible for flying the aircraft (PF) will state out loud: "I have control." Whilst this may seem obvious, this clear and unambiguous statement immediately resolves any confusion over who is doing what.

Next, the PF will confirm not only what the aircraft is doing, but make sure that it is doing what they actually want it to be doing. In this situation, it involves completing the first few steps of the checklist.

Read more: How pilots keep their skills sharp during COVID-19 downtime

However, because these steps are so important in the unreliable airspeed situation, we commit the "initial actions" to memory. As the auto flight system will respond to speed indications, even if incorrect, the first thing we must do is disconnect the autopilot system and fly the aircraft manually.

This involves pressing the autopilot disconnect button, disarming the autothrottle system and turning the flight directors off. With this done, we must then stabilize the flight path.

With no way of knowing what our correct speed is, the biggest danger is getting too slow and stalling the wing. At the other end of the scale, if we got too fast there's a chance that we may cause structural damage to the aircraft. The problem is made worse by the fact that the weight of the aircraft can vary significantly, giving a wide range of speeds which could result in a stall or an overspeed.

Pitch + power = performance

Anyone who has flown a light aircraft will have heard the phrase "pitch + power = performance". In simple terms, if you set a certain nose pitch altitude and a certain power setting, it will give you a fixed performance; be it level flight at a certain speed or a climb at another speed. The same principle applies in large jets.

However, what we need in this scenario is a setting that will keep us safe at all altitudes and aircraft weights. Fortunately, manufacturers carry out extensive research on this topic and are then able to present us with two sets of pitch and engine data - one with the flaps extended and one with them retracted.

If the flaps are extended, we fly 10 degrees nose up and set 85% power. If the flaps are retracted it's 4 degrees nose up and 70% power. Both of these are for "gear up" flying so if it occurs with the gear down, we must retract them as soon as possible.

These power settings may result in a slight climb, but the aircraft will not stall so long as these settings are maintained.

Run the checklist

With the aircraft now flying safely, we can turn our attention to running the checklist. As it mentions at the top, the objective is to identify a reliable airspeed indication or to continue the flight with information published in the aircraft manual if this isn't possible.

At this stage, we must remember that we have two sources of airspeed data — the normal source from the pitot tubes and the AOA sensor. One of these will be correct, we just have to work out which one.

By turning a switch in the flight deck, we can change the source of data displayed on one of our screens to that from the AOA indicator, for example on the captain's side. We can then compare this to other sources of speed, such as the ground speed which is generated by other aircraft systems. Finally, we then compare both of these with the pitot generated data on the first officer's screen.

We can then deduce which is the most accurate source of data, the normal pitot data or the AOA data and continue to use that for the rest of the flight.

Bottom line

Knowing how fast we are flying is the most important piece of data in the flight deck. Consequently, if there is a fault with the system, we need to be able to solve the problem and continue flying safely.

Whilst this is a rare event, modern airliners like the 787 have a number of back-up systems in place. Even if these backup systems don't work, the pilots are trained to handle the situation.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app