Why the Hilton Surpass won me over as someone who didn’t want a cobranded card

Editor's Note

When I first got into the credit card rewards hobby, transferable points made the most sense to me.

My travel style has always been flexible. I don't necessarily love any hotel chain more than another, and I've lived near hub cities for multiple airlines.

Rewards that I could use anywhere, any time — by transferring to a loyalty partner or booking through a travel portal — were my natural choice. I didn't see how a cobranded card fit into my strategy.

That changed when I decided to apply for the Hilton Honors American Express Surpass® Card. Despite what you might think, I didn't apply because I'm now a Hilton loyalist.

Since I hadn't booked hotels yet for trips I'd planned this year, I was curious about how the card's benefits could elevate my upcoming travel. What if I tested out loyalty to a worldwide chain with thousands of properties across multiple price points?

Here are six reasons why the Hilton Surpass finally won me over as someone who wasn't interested in cobranded cards.

An annual fee that's right for me

I could've picked up the no-annual-fee Hilton Honors American Express Card (see rates and fees). However, I didn't want to simply dip my toes into a cobranded card membership.

Instead, I wanted to see how the Surpass' elite status and statement credits could elevate my travel experience. The card's $150 annual fee (see rates and fees) seemed like a completely reasonable rate to me considering its benefits.

Sure, it wouldn't have as many perks as the top-tier Hilton Honors American Express Aspire Card, which charges a $550 annual fee (see rates and fees), but I don't have the appetite for such a high annual fee at this point.

I also wasn't as impressed with the similar cards offered by competing hotel chains at comparable annual fee rates, such as the Marriott Bonvoy Boundless® Credit Card (see rates and fees), the World of Hyatt Credit Card (see rates and fees) and the IHG One Rewards Premier Credit Card (see rates and fees).

Thus, I landed on the Surpass.

Related: Is the Hilton Surpass Amex card worth the annual fee?

My first elite status

Because I've historically been a free agent, I've never experienced elite status perks with any program. Receiving automatic mid-tier Hilton Gold status from a card with a modest annual fee was attractive to me.

Hilton Gold status comes with the following perks:

- A daily food-and-beverage credit or continental breakfast (depending on where you stay)

- Elite rollover nights

- The fifth night free on reward stays

- Space-available room upgrades

- An 80% points earning bonus on stays

- 10,000 bonus points every 10 nights after you've stayed 40 nights in a calendar year

I saw myself enjoying the bonus points, daily food-and-beverage credits and space-available room upgrades the most. The fifth-night-free perk intrigued me, too, even though it also comes with lower-level Silver status.

If you spend $40,000 in a calendar year, you also get upgraded to Diamond status through the end of the next calendar year. While I don't plan to spend that on this card, I still think spend-incentivized status for people who spend that much in a year is a nice perk.

Hilton statement credit

Statement credits are a major part of the credit card rewards hobby, and maximizing them is the best way to ensure you're getting the most value for the annual fee. The Hilton Surpass is no exception.

The card's up to $50 quarterly Hilton statement credit (up to $200 each calendar year) covers a wide range of purchases made directly with Hilton, including room rates, incidental charges, room service, restaurant and spa purchases and other charges at establishments within a property, like gift shops.

I felt that would be easy for me to use, and it would essentially wipe away the card's annual fee before the year was over. I got the card in early March and already had plans to take a trip to Louisville, Kentucky, this spring, so my credit in the first quarter went toward booking three nights at Tempo by Hilton Louisville Downtown NuLu with cash.

I'm taking a trip to Europe later this spring and plan on using the second quarter's credit on dining and drinks at the Canopy by Hilton London City. In the fall, I'm going to Las Vegas and will use my credit at the Conrad Las Vegas at Resorts World.

Related: How to maximize the statement credits on the Hilton cobranded credit cards

Bonus categories not covered by my other cards

I love maximizing bonus categories. I use my American Express® Gold Card to buy groceries, my Chase Sapphire Preferred® Card (see rates and fees) for streaming subscriptions and my Capital One Venture X Rewards Credit Card to cover purchases outside of bonus categories.

Though my wallet covers many bonus categories, I didn't have a card that earned extra on gas or online retailers. Lucky for me, the Hilton Surpass earns 6 points per dollar spent on gas purchases at U.S. gas stations and 4 points per dollar spent on U.S. online retail purchases.

TPG's July 2025 valuations place Hilton points at 0.5 cents per point. The points earned with my transferable rewards cards are more valuable, so I won't be using the Surpass to pay for purchases where I earn bonus points by using other cards (such as dining and grocery purchases).

However, since I regularly spend on gas and online purchases, I'm excited to now earn more than 2 points per dollar in those categories.

Related: 5 reasons to get the Hilton Surpass Card

National Car Rental status

One of the card's more underrated perks is its complimentary National Rental Car Emerald Club Executive status. Enrollment is required, and terms apply.

Since I often travel domestically, I see value in Executive status perks, like access to the Executive Area for full-size reservations and above in the U.S. and Canada. Plus, the status grants guaranteed upgrades and no second driver fees, which is another solid benefit for me since I often travel with another person.

I rent cars multiple times a year, so I'm excited about how this perk could amplify those experiences.

Related: Best rental car rewards programs you need to know about

Welcome bonus and redemption options

While the welcome offer varies depending on when you apply for the card, I ultimately applied when the card offered an enticing offer.

At the time, new cardmembers could earn 130,000 bonus points plus a free night reward after spending $3,000 on purchases in the first six months of card membership. This offer is no longer available.

Currently, new cardmembers earn 130,000 bonus points after spending $3,000 on purchases in the first six months of card membership.

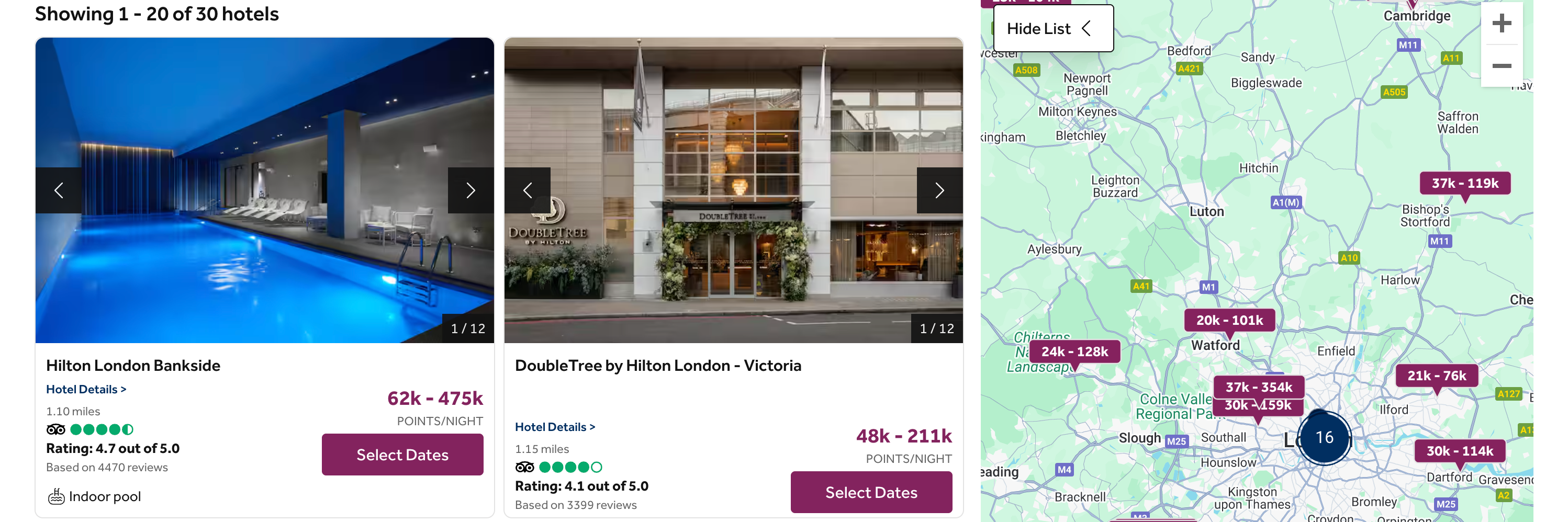

Once I met the minimum spending requirement to earn the bonus, I started daydreaming about how I would redeem these rewards for an upcoming two-night stay in London. I used the Points Explorer tool to search for availability for properties with rates up to 65,000 points per night. Two nights would use up the 130,000-point bonus.

Because Hilton uses dynamic pricing, the value of your points can vary greatly depending on when you're planning to take a trip. However, there is plenty of value to be found in the Hilton Honors program, especially if you have some flexibility.

For instance, I used all 130,000 bonus points from my Surpass' welcome offer to book two nights at the Canopy by Hilton London City this spring. Then, I held onto the free night reward and decided to use it to book one night at Cosmopolita Hotel Rome, Tapestry Collection by Hilton. The standard room I booked with this certificate was worth almost $629 or 80,000 Hilton Honors points.

Related: Current Hilton Amex card offers

Bottom line

A few years ago, I wasn't sure I could ever be convinced to apply for a cobranded card. Multiple factors, such as the ones I outlined above, made the Hilton Surpass the best option for me.

In this process, I learned you don't have to be fiercely loyal to a particular brand to find value in a cobranded card's benefits. You just have to see how they fit into your overall card strategy.

Consider your priorities and spending habits before applying for a new card. At TPG, we encourage you to earn transferable points thanks to their value and flexibility, but you don't have to prioritize earning this currency all the time. Diversifying your rewards portfolio is just as important.

To learn more, check out our full review of the Hilton American Express Surpass Card.

Apply here: Hilton Honors American Express Surpass Card

For rates and fees of the Hilton Surpass Card, click here.

For rates and fees of the Hilton Amex card, click here.

For rates and fees of the Hilton Honors Aspire Card, click here.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app