Why AA Ditched Its A350 Order in Favor of the Dreamliner

In case you missed the news Friday night, American Airlines and Boeing announced that the world's largest airline would be buying an additional 47 Dreamliners. This massive order is valued at $12.3 billion at list price, but — as with all aircraft purchases — the airline will likely only pay a fraction of that.

As part of this order announcement, AA also stated that it'd cancelled its Airbus A350 order. In all, this announcement is a huge win for Boeing and a sharp blow to Airbus. But, the question many might be asking is "why?"

Could this decision be American Airlines taking an "America First" or "Buy American" stance? Is the airline afraid that an escalating trade war could make Airbus aircraft more expensive? Or, could it be that the Dreamliner provides better reliability and passenger comfort?

All of those may or may not be factors, but they certainly aren't the primary factor. The simple answer to why AA ditched the A350 and ordered more Dreamliners is: simplicity.

And you don't have to take my word for it, American Airlines released an internal podcast last night after the announcement was made public speaking to the reason behind the change. "America First," tariffs, passenger experience... none of that came up in the podcast. Instead, phrases like "[avoiding] adding complexity to the fleet" and "from a commonality standpoint and an operations standpoint" were the reasons given by AA's Chief Financial Officer Derek Kerr.

https://soundcloud.com/american-airlines-internal-news/13-apr-6-2018-decisions-to-make-with-our-fleet-derek-kerr

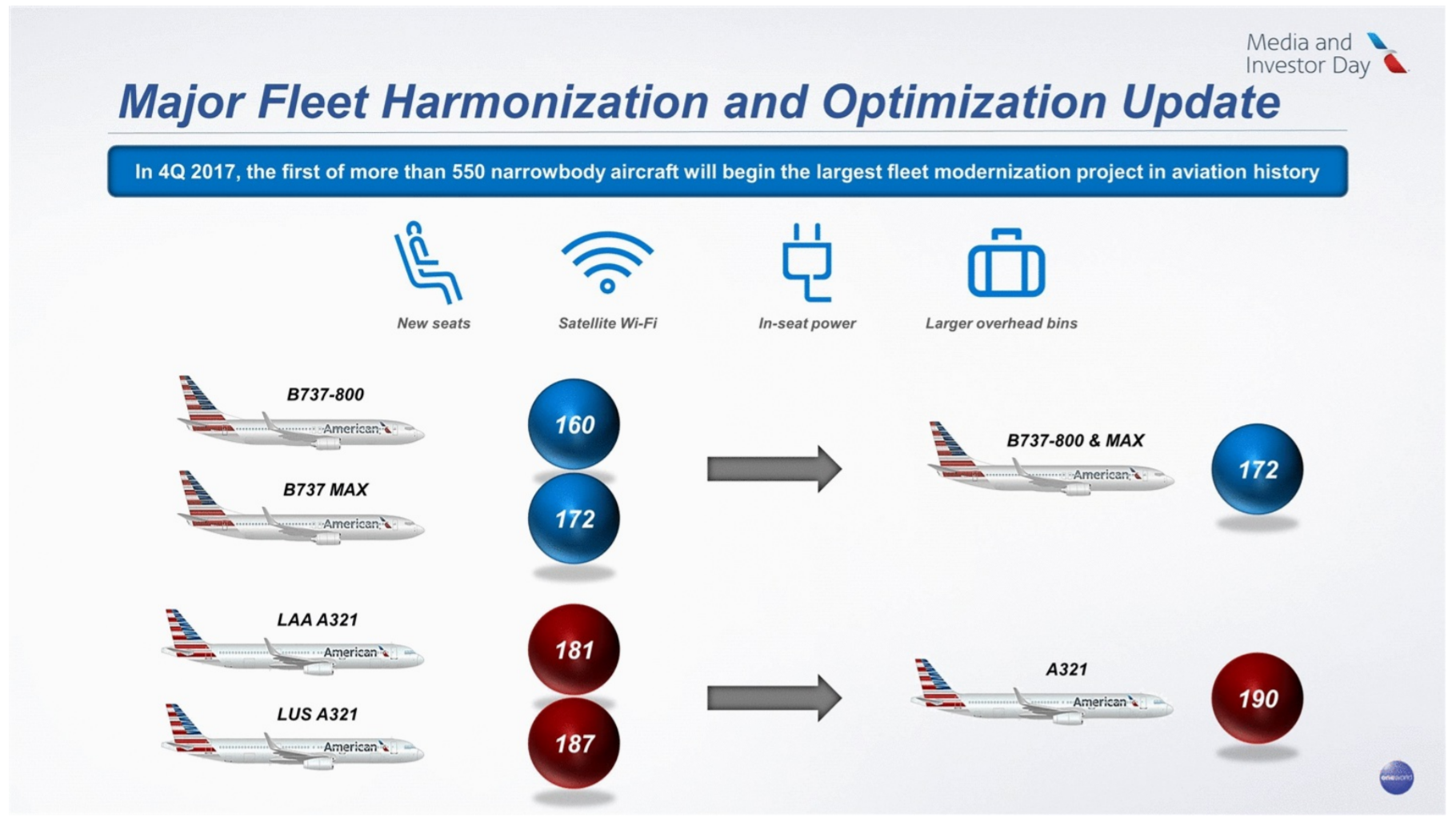

From a fleet planning perspective, American Airlines management is currently obsessed with one thing: operational simplicity. That's why AA is about to spend a lot of money on its "Project Oasis" — AA's euphemism for reducing seat pitch in economy on its Boeing 737 and Airbus A321s.

AA's goal is clear: the airline wants to have the exact same number of seats on each of its aircraft types. Rather than having 304 Boeing 737-800s with 160 seats and another 100 Boeing 737 MAX with the exact same fuselage but 172 seats, AA would much rather have 400+ Boeing 737s with 172 seats that it could use interchangeably. Ditto with its fleet of 219 Airbus A321s. That way, if a 737 MAX has a mechanical problem, AA can swap in a 737-800 without having to potentially bump 12 passengers.

In addition, AA wants to reduce its total number of sub-fleets. As of Media & Investor Day in late September, AA reported having 52 different aircraft configurations, and that management wanted to drop this number to 30. With that being the goal, bringing on a new aircraft type (such as the A350) just doesn't make sense, but doubling down on the Dreamliner definitely does.

As of late January, AA's widebody fleet schedule looked like this:

| MAINLINE | YE2017 | YE2018 | YE2019 | YE2020 |

|---|---|---|---|---|

A330-200 | 15 | 15 | 15 | 15 |

A330-300 | 9 | 9 | 9 | — |

A350 | — | — | — | 2 |

B767-300 | 24 | 24 | 24 | 24 |

B777-200ER | 47 | 47 | 47 | 47 |

B777-300ER | 20 | 20 | 20 | 20 |

B787-8 | 20 | 20 | 20 | 20 |

B787-9 | 14 | 20 | 22 | 22 |

TOTAL | 149 | 155 | 157 | 150 |

Hopefully we will get a full update of this schedule soon. However, from what we know so far, here's the plan for each of these:

- A330-200 (15 aircraft in current fleet): Maintain fleet

- A330-300 (9): Retire in 2020

- A350: order cancelled

- B767-300 (24): Retire by 2022

- B777-200 (47): Replacing some older aircraft, but maintain the remainder

- B777-300 (20): Maintain fleet

- B787-8 (20): More than doubling the fleet starting in 2020

- B787-9 (15): More than doubling the fleet starting in 2023

As you can see, the choice to double down on the Dreamliner instead of the taking delivery of A350 or ordering A330neo aircraft simplifies AA's fleet significantly. By the end of 2022, the current plan would mean AA would have just five types of widebodies: Airbus 330-200, Boeing 777-200, Boeing 777-300, Boeing 787-8 and Boeing 787-9.

But it could get even simpler than that. In the details of yesterday's massive order, AA also has options to buy more Dreamliners. The airline could do so as replacements for its A330-200s, leaving an all-Boeing widebody fleet.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app