An even faster way through airport security: Here's what it's like using touchless ID

Biometric screening, or touchless ID, is coming to an airport near you, and it will speed up your journey — especially through airport security.

I'm a huge fan, and now that more airports are rolling out this technology, I want to share what it's like to use it.

Essentially, the new technology allows facial recognition software to confirm your identity, check you in, print out your bag tags, and even let you walk through security without showing a boarding pass or pulling out identification.

For example, at Hartsfield-Jackson Atlanta International Airport (ATL), Delta Air Lines operates a biometric screening lane that is often the fastest way through security. I've used it in Atlanta, as well as at LaGuardia Airport (LGA) and John F. Kennedy International Airport (JFK). I've found it to be faster than the TSA PreCheck lines and the Clear lines.

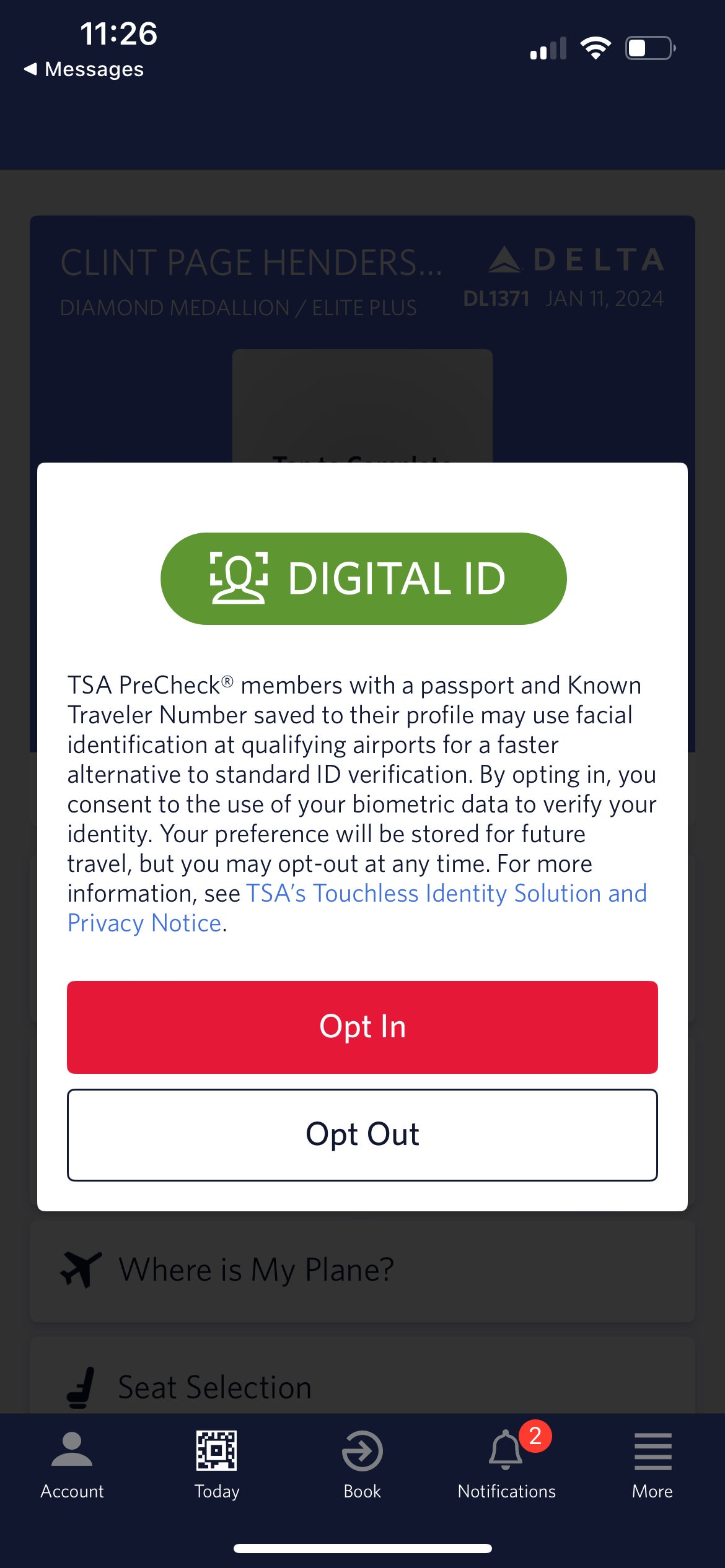

American Airlines recently announced that it would join Delta and United Airlines, both of which already operate biometric screening at select airports. The version Delta uses is called "Delta Digital ID," and it lets TSA PreCheck members use facial recognition to pass through TSA PreCheck security in just a few seconds.

Airport security screening of the future is here

Touchless ID is the future of airport security, and it's already here. It means passengers can speed through bag drop-off, Transportation Security Administration screening and — at many airports — the plane boarding lines, all without showing a boarding pass or even an ID in some cases.

"It whizzes people through," TSA Administrator David Pekoske said in an interview with TPG. "It makes security better. It makes it faster, and it's just a much better experience for people."

Both Delta and United also use biometric bag drop, which speeds up the wait to check luggage where it's deployed.

The technology is spreading, revolutionizing the airport experience for the travelers who are already using it.

It's also becoming more common internationally. Facial recognition is increasingly being used to screen passengers at ports of entry with biometrics-enabled electronic gates such as those greeting passengers at Rome Fiumicino Leonardo da Vinci Airport (FCO).

The TSA has been experimenting with the technology since 2019. Already, biometrics are deployed at more than 30 airports across the country, though they've been mostly used at boarding gates to speed up the often-slow process of getting passengers onto planes. A screen snaps your picture and matches it to a photo of your identification or, alternatively, your actual travel document, like a passport.

Here's how biometric security screening works

I'll use Delta as my example because that's the airline I have the most experience with. Delta Digital ID is currently available as part of a pilot program at seven U.S. airports: ATL, JFK, LGA, Detroit Metropolitan Wayne County Airport (DTW), Los Angeles International Airport (LAX), Salt Lake City International Airport (SLC) and Ronald Reagan Washington National Airport (DCA).

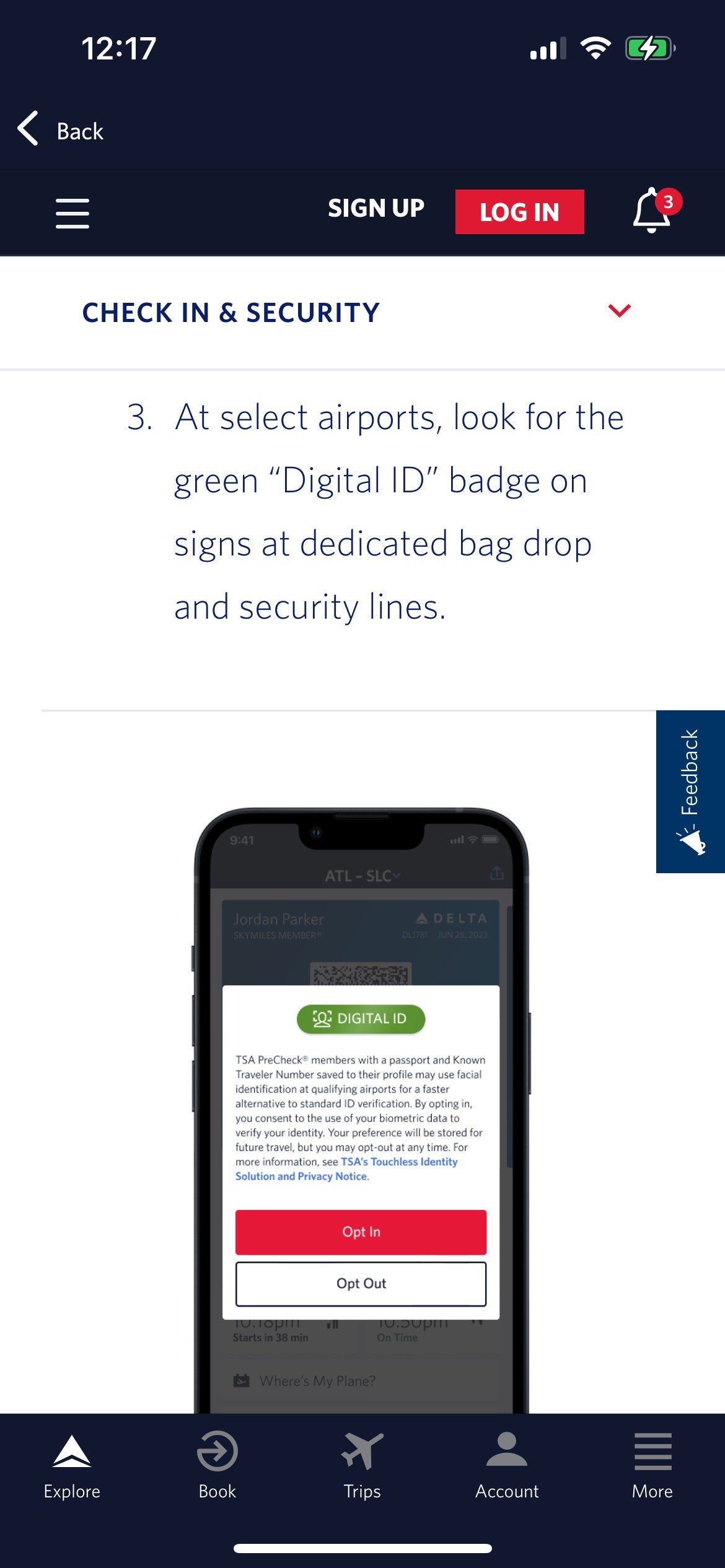

Select Delta SkyMiles members with TSA PreCheck and a valid U.S. passport are eligible. To enroll, you should see a banner ad in the app.

You'll need to opt in to the new technology. I received the offer in my Delta Air Lines app when I logged in for a flight because my TSA PreCheck and passport numbers were already in my customer profile and because I was traveling from an airport that was among the first to offer biometric security screening.

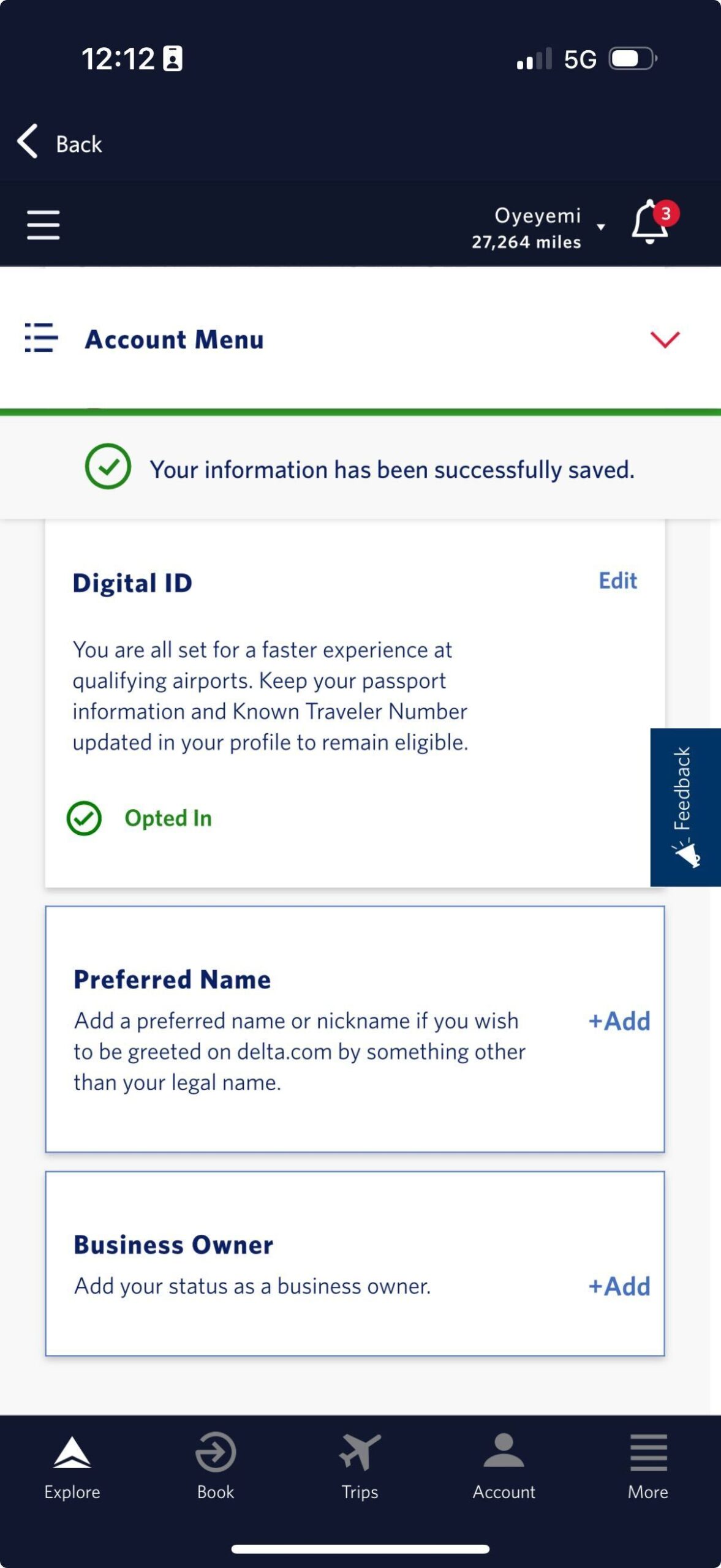

Once you've opted in, you'll get a confirmation, as my colleague Yemi Kolawole did.

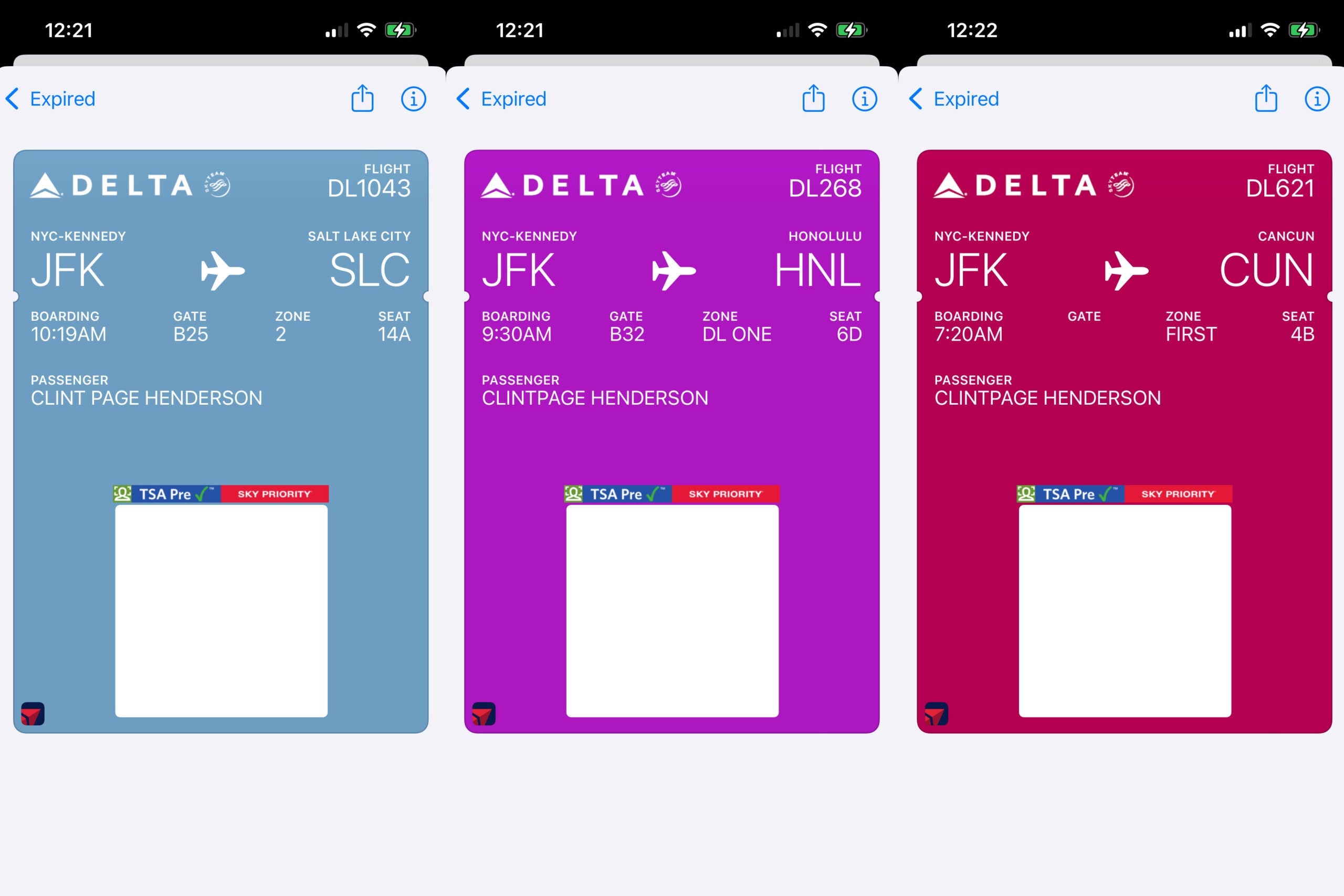

Once you've completed these steps, your future boarding passes should show a tiny green box with a rough outline of a profile to the left of the TSA PreCheck symbol.

Next, you'll need to keep an eye out for the prominent "Digital ID" badges on signs at bag drop and security lines at participating airports.

Here are some photos of the signage at various airports, including in Chicago, New York City and Atlanta.

I've now used touchless ID multiple times at ATL as well as at JFK and LGA in New York City. I've found it's the fastest method of going through security; it puts me in a special lane and dumps me ahead of the crowd every time. I often get priority over TSA PreCheck and Clear members, and I get expedited access to the screening machines. At JFK, for example, the lines for PreCheck and Clear can be quite long in Terminal 4, but there's never been a line for the Digital ID line when I've traveled.

You end up in front of everyone who is in line for Clear or TSA PreCheck screening.

I also noticed the signs are now up in Terminal B at LGA, where I hope American Airlines will soon allow touchless security screening.

I'm thrilled with the spread of biometric screening, and I'm excited to see more airlines roll it out at more airports in the coming years. But of course, not everyone is as happy.

What about privacy concerns with touchless or biometric screening?

The head of the TSA told me that many people are skeptical of touchless screening "because they assume that ... at some point we're going to surveil people with biometrics, which we are not going to do. We have a sole use case. No other use case other than identity verification."

Pekoske continued by explaining the program's commitment to privacy. "That's in our privacy impact statements. It's in all of our messaging. And if anybody did an investigation of our practices, you'll see us never using it for a purpose other than identity verification," he said.

Related: Why you should get TSA PreCheck and Clear — and how you can save on both

Others are worried that the TSA stores facial images forever and people may be giving up their privacy protections. However, Pekoske told me that as soon as a passenger walks away from identity verification, that data is erased the same day. "We don't keep it," Pekoske said.

He said the TSA prioritizes privacy protections in the development of facial recognition technology. "We don't retain your data, and it's audited," Pekoske said.

U.S. Customs and Border Protection also says it protects the data of the passengers it screens arriving in the U.S. during border checks. According to the CBP, images of Americans are deleted within 12 hours, but they store the photos of all noncitizens for up to 75 years.

What about racial or ethnic profiling?

There have been concerns over the years that the TSA or the U.S. Department of Homeland Security sometimes racially or ethnically profiles people. Pekoske insisted that is not true, and it is an issue that the government is very sensitive to overall.

"Some people still feel that the technology performs differently for different traveler demographic groups — you know, dark complexion individuals," he said. However, Pekoske said that has never been the case. "They probably are reading articles from five, six, seven, eight years ago that there was differential performance in certain algorithms that we never used."

Pekoske continued: "We do testing on that all the time. When I say we, it's not TSA. It's the Department of Homeland Security. So it's at an arm's length from me because I want it that way. I don't want to be my own tester, and all of the studies we've done on this show that there's no statistically significant difference across demographic groups."

He said the TSA puts privacy protections first, and also said there is no differential performance across the system.

Bottom line

Ready or not, the age of biometrics is here.

Touchless security screening is already available at several major airline hubs, and it's on its way to even more. Having used it now over the past year or so, I've been thrilled with the speed with which it gets me through security (and customs). I'm looking forward to the tech rolling out to more airports, and I can't wait until American Airlines begins using it more next year. I'll be among the first to sign up.

Related reading:

- TSA to pilot self-service security screening in Las Vegas

- I tried touchless ID at O'Hare and its a game changer

- Delta Air Lines hopes to speed passengers through airports with biometrics

- 8 ways to get free or discounted TSA PreCheck, Global Entry and Clear

- Is TSA PreCheck worth it?

- Known Traveler Number: What is it, and should you get one?

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.