What it's like flying between the Hawaiian Islands right now

I just got home from my third pandemic-era trip to Hawaii, and I wanted to share a bit on what it's like to travel by air between the Hawaiian Islands.

I've written before about what it was like going to Hawaii during the resort bubble era, again when all flights still required a test for entry and, finally, what it's like now that there is an exemption for fully vaccinated travelers, but I never really touched on interisland travel.

In short, now that there's a vaccine exemption, there are also very few restrictions on interisland travel — despite what you might read when checking in for your flights between the Hawaiian Islands.

[table-of-contents /]

Interisland travel rules

Officially, the restrictions on interisland travel were lifted on July 8, which was the same day Hawaii implemented new rules allowing visitors from the mainland who were fully vaccinated to get out of the testing requirement.

My previous trips

I've been to Hawaii several times in the past few years.

I was there in February 2020 right before the world shut down from COVID-19. I was back in January of this year trying out the Kauai resort bubble for visitors, and then I went back in March for visits to Oahu and Hawaii (the Big Island) which included two trips between islands.

When I was in Kauai back in January, it was completely different. They were, perhaps, the strictest island. I tested out the resort bubble, but I was barely able to leave the resort let alone travel between islands.

Related: Everything you need to know about traveling to Hawaii right now

That's totally changed now. I flew from Kauai (LIH) to Maui (OGG) and back with no Safe Travels checks at all.

Checking in for my interisland flight and almost panicking

While I didn't have any trouble flying between LIH and OGG, I did have a few moments of panic when I checked in for my flight.

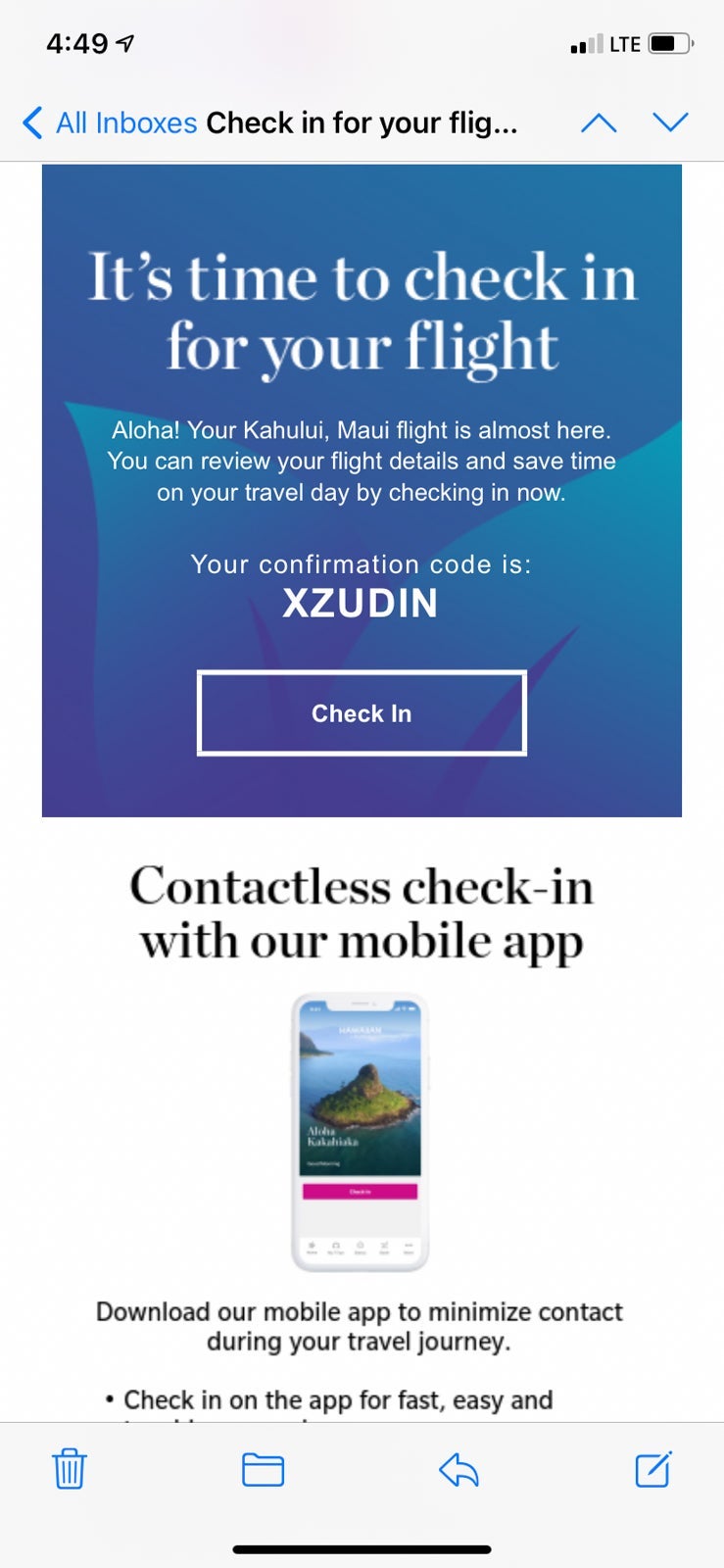

I got the check-in screen as normal, but when I continued following the prompts, I got this scary message:

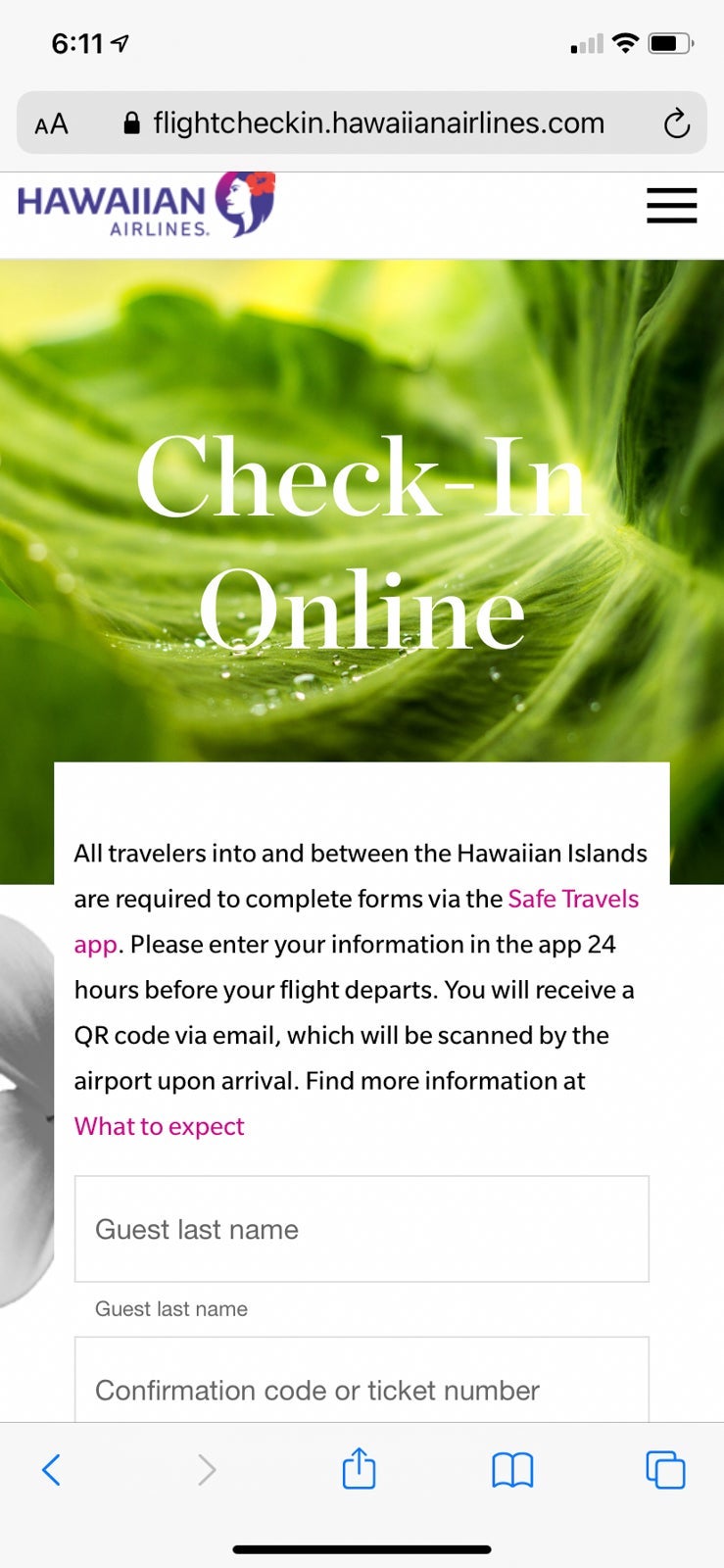

To me, that suggests I would have had to complete another Safe Travels Hawaii form, and I was worried they would want to see a new COVID-19 test.

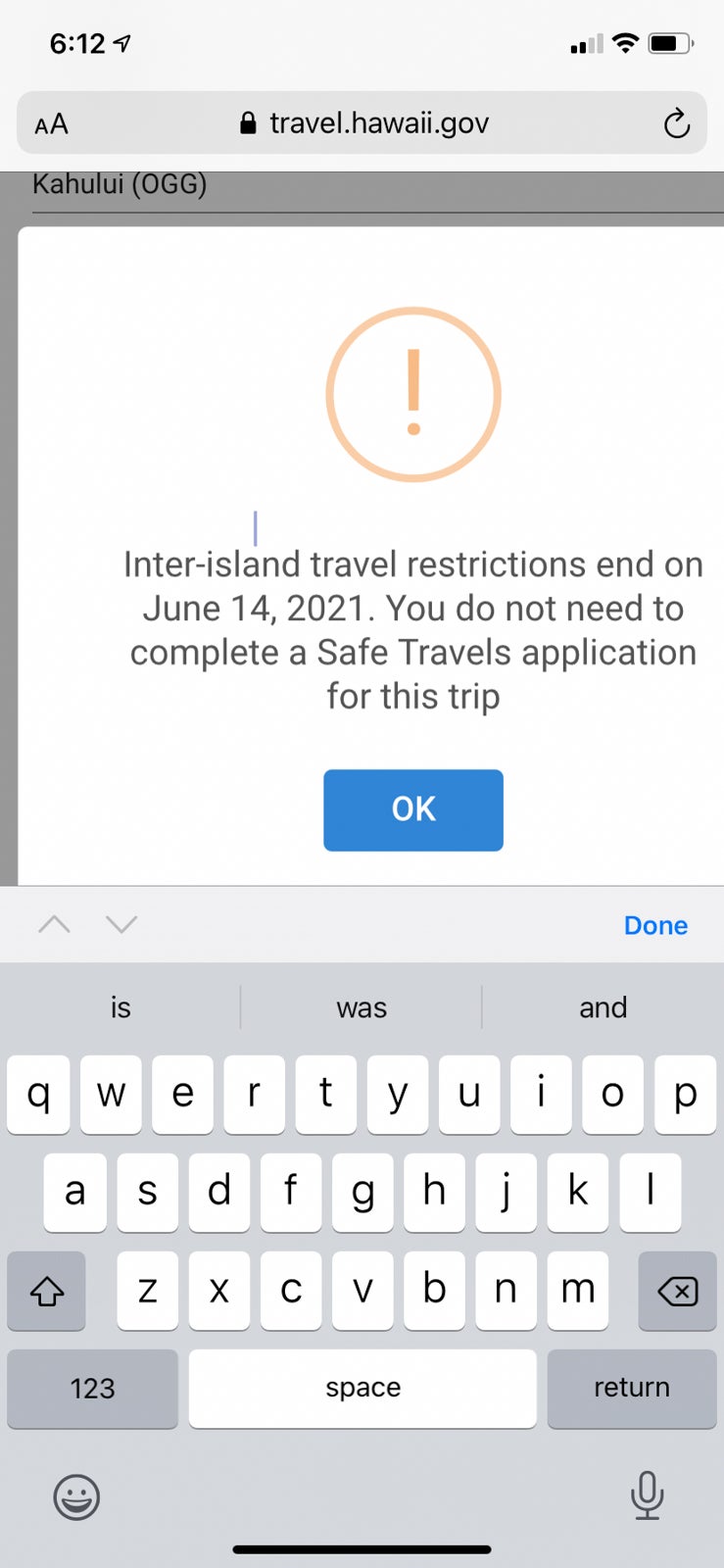

However, after several attempts at filling out another Safe Travels form, I got this message:

That's when I realized that I'd be OK. In fact, once I got to the airport, no one asked to see any of my Safe Travels or other travel documentation. Essentially, once you are in Hawaii and have been screened at the initial landing airport, you are good to go.

The weird thing is that the hotel I was staying at in Maui did ask for proof of Safe Travels documentation for my arrival in Maui, but once I explained to them that I'd been cleared in LIH, they were fine with it.

I don't think everyone is aware yet that most of the restrictions have been lifted.

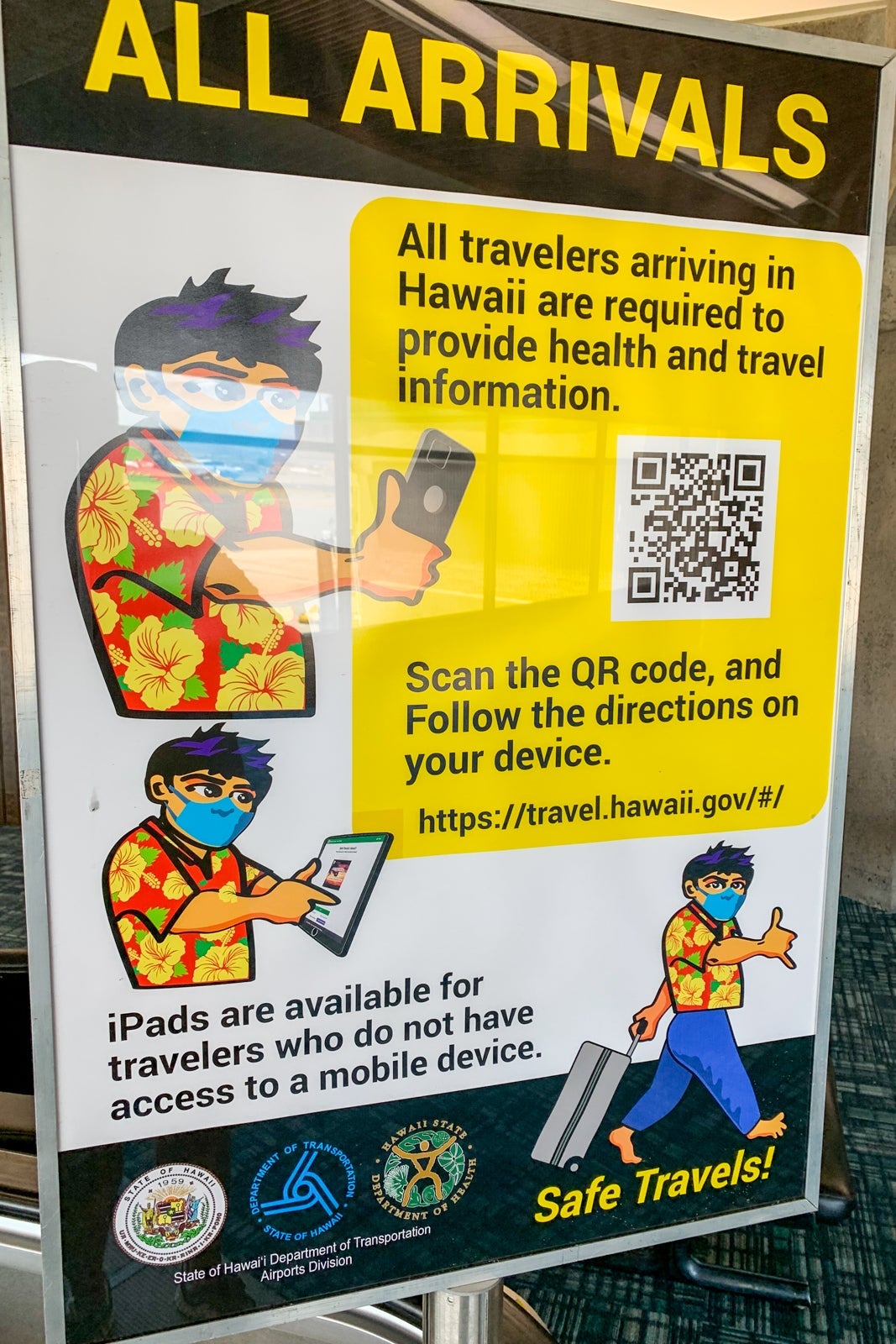

In fact, many signs at the airports suggest outdated rules and requirements.

Once onboard

There are no document checks or instructions once you are onboard your interisland flights. Hawaiian Airlines is even doing a limited beverage service for short 40-minute flights.

You are required, of course, to wear your mask. Crew members constantly reminded folks to wear their masks and wear them properly, and they also handed out disinfectant wipes. That was pretty much the extent of the onboard precautions.

What to know if you are flying to Hawaii or between islands

There are a few things to keep in mind if you plan on traveling to Hawaii, whether from the mainland or between the islands. The airports are crowded, TSA checkpoints are understaffed and lines are super long.

Related: Fair warning, some Hawaiian islands are again packed with tourists

In fact, most locals are telling tourists to get to the airport at least two hours ahead of time. Thank goodness for TSA PreCheck at both LIH and OGG. It only took me about 15 minutes to get through security at both airports thanks to the open PreCheck lines.

Meanwhile, I saw some people who were waiting for an hour or more.

There are also long lines for people getting off planes coming from the mainland. You need to show that you've been pre-cleared by the state of Hawaii. You need to have that QR code handy (I would suggest printing it out, too) and make sure your phone is charged.

Just be sure to pack your patience.

Related: What it's like traveling to Hawaii fully vaccinated

If you are coming from the mainland, there are still a few required steps

Visitors to Hawaii will still need to take the following steps, according to the State of Hawaii:

- Upload one of three vaccination documents to their Safe Travels Hawaii account prior to traveling to Hawaii. One of the following documents must be uploaded:

- A CDC COVID-19 vaccination record card.

- VAMS (Vaccination Administration Management System) printout.

- DOD DD Form 2766C.

- Sign the online legal attestations on Safe Travels Hawaii, confirming the uploaded documentation is true and accurate.

- Bring a hard copy of their vaccination documentation to show screeners at the gate prior to boarding and/or upon arrival in Hawaii. Screeners will review/verify the vaccination documents, match photo IDs, name and date of birth, as well as confirm that the attestations are signed.

We've covered the full run-down of what you need to know prior to visiting Hawaii here.

Visit TPG's Hawaii destination hub for more stories about getting to the islands, staying on the islands and what to do while you're there.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app