How to use your American Express Uber benefits for rides and meals

Editor's Note

At first glance, credit card annual fees can feel steep, especially if you're new to the points and miles world. But dig a little deeper, and the built-in perks and benefits on certain cards can easily offset — or even exceed — the upfront cost.

Take American Express Platinum Card®, for instance. While it carries a sky-high $895 annual fee (see rates and fees), the value of the card's benefits, in the form of numerous travel and lifestyle statement credits, is more than double the cost of the annual fee. And that doesn't even include other great perks that don't have a specific dollar value, such as lounge access and hotel elite status.

One standout benefit is the Uber Cash perk that comes with both the American Express® Gold Card and Platinum.

Here's how to use your Amex Uber Cash for rides and meals.

American Express Uber Cash overview

One of the most straightforward benefits of both the Gold and Platinum is Uber Cash automatically added to your account each month. But there's a little nuance to exactly how this perk works, especially if you're a new cardmember.

With the Gold, you'll receive up to $120 in Uber Cash each year (valid in the U.S.):

- $10 each month

Meanwhile, the Platinum offers up to $200 in Uber Cash annually:

- $15 each month

- An extra $20 in December (for a total of $35 that month)

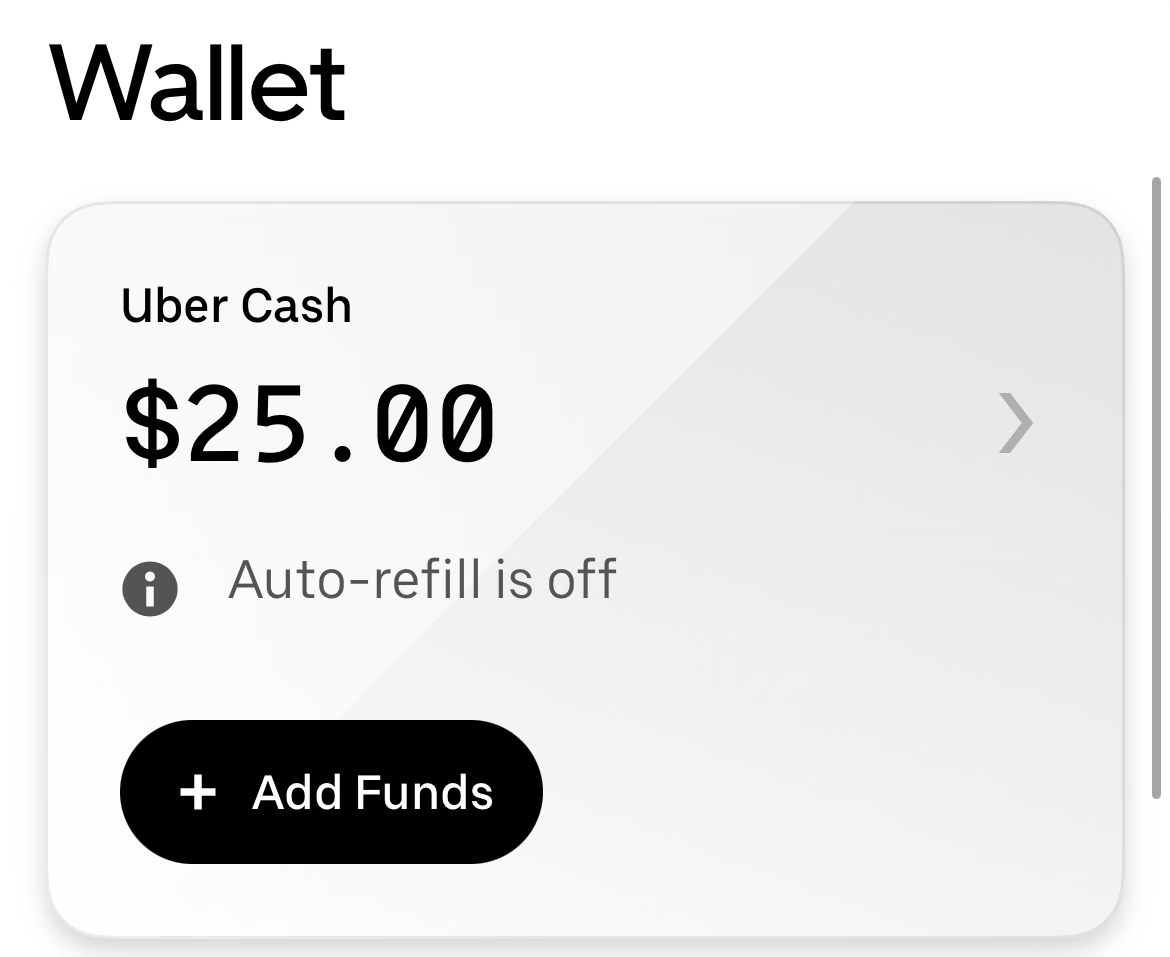

To get your Uber Cash, you'll first need to link your card(s) to your Uber account. To do this, go to your wallet in the Uber app and add your Gold and/or Platinum card as a payment method.

From there, the Uber Cash should automatically appear in the Uber balance section of your wallet. As long as your card remains linked to your Uber account, your Uber Cash will be automatically deposited into your wallet every month.

Typically, Uber sends an alert the evening before the first of each month when your Uber Cash is deposited. If you hold both the Gold and Platinum, your monthly benefits will be combined into a single Uber Cash balance.

It's important to remember that this Uber Cash will expire at the end of each month. In other words, if you don't use your credits one month, they won't roll over into the next month.

Platinum cardmembers also receive up to $120 in statement credits annually for an Uber One membership, which fully covers an auto-renewing $9.99 monthly or $96 annual plan (enrollment required).

Uber One offers members:

- $0 delivery fees on eligible Uber Eats orders and reduced service fees

- 6% back on rides in the form of Uber One credits

- Discounted delivery and pickup orders

- Discounted rides

Related: Frequent Uber or Lyft user? These are the best credit cards for you

How to use Uber Cash for rides

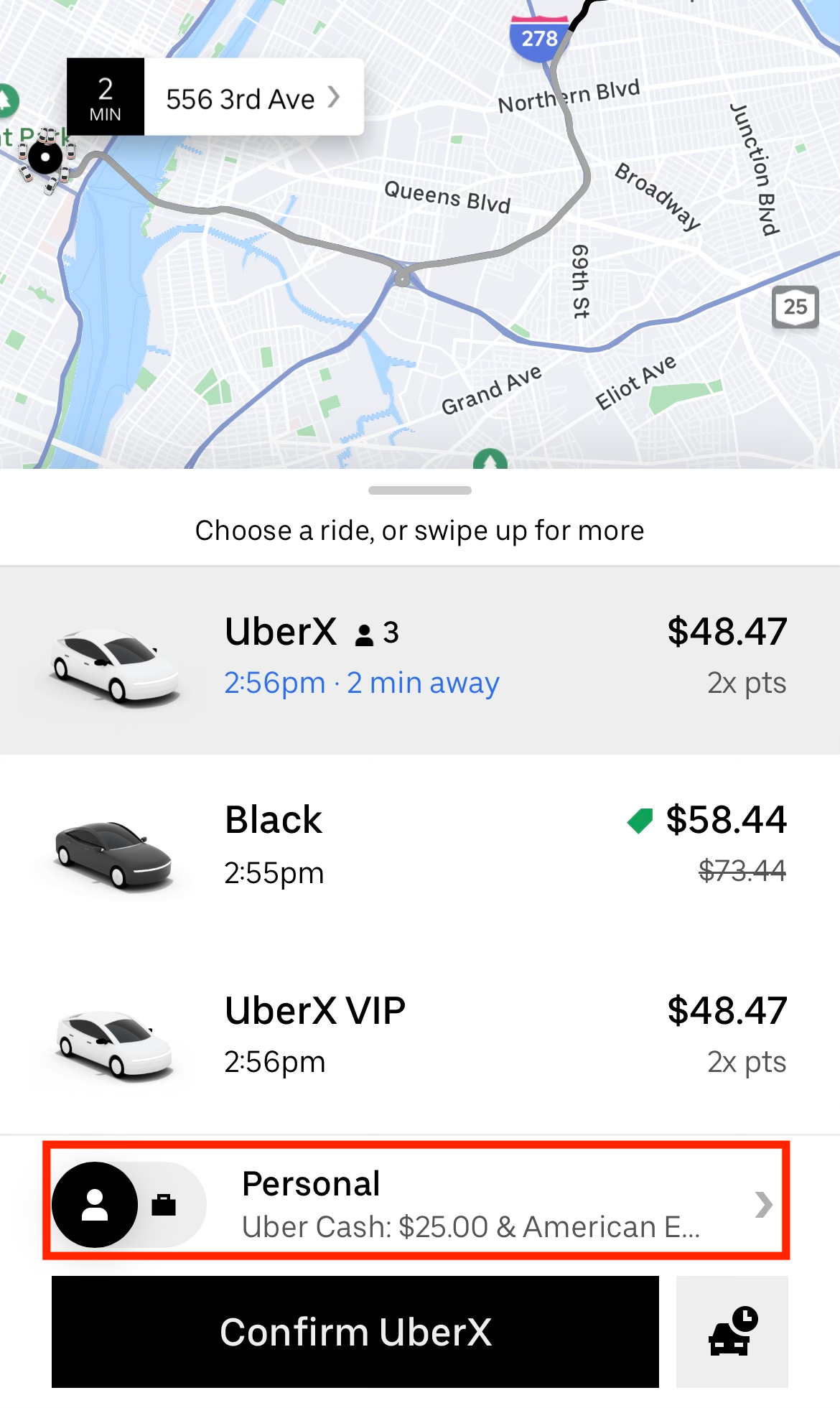

When you're ready to take a ride, you can find the payment information right before confirming the ride (this can be edited mid-ride as well).

In the example above, my Uber Cash balance will be depleted, and the additional fare will be charged to an Amex card I have on file.

You must have an eligible American Express card set as your payment method to use Uber Cash.

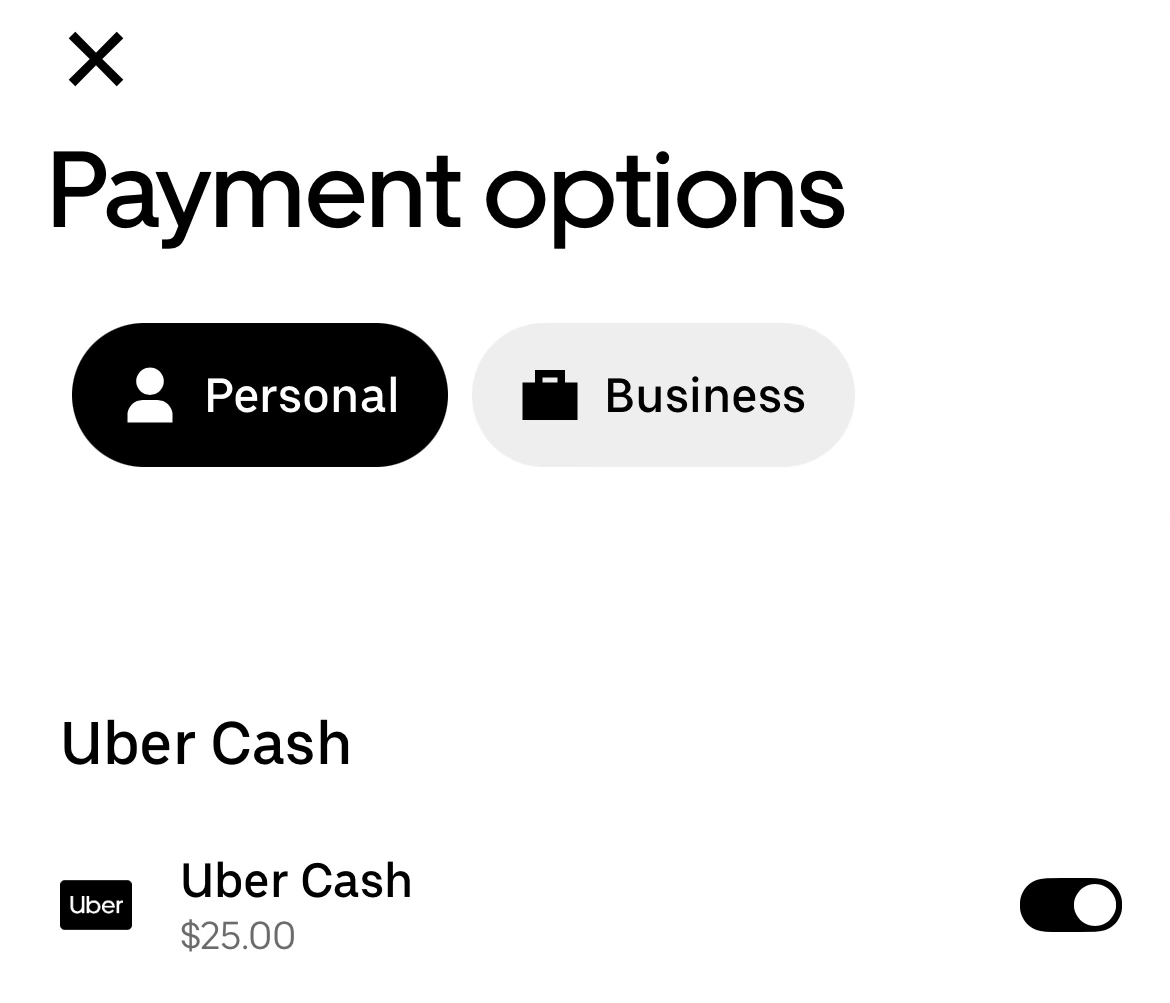

To ensure you use your Uber Cash, make sure it is toggled on as your payment method before requesting a ride.

However, there are some instances where you may not want to use your card's Uber Cash benefit. For instance, if you're traveling for work, you may not want to use the balance on a ride that your company will cover.

Related: Forgettable statement credits checklist: Perks and benefits not to be overlooked

How to use Uber Cash for meals or groceries

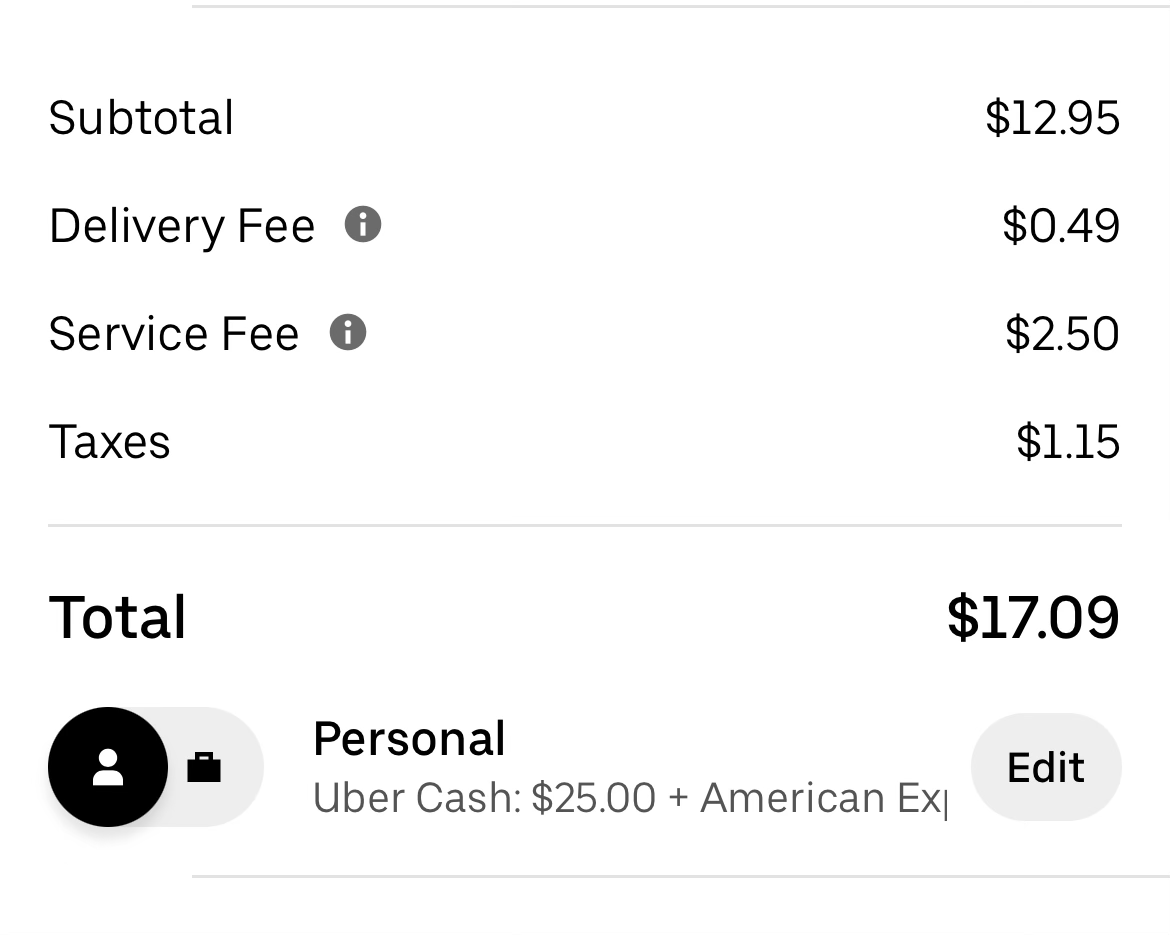

To redeem your Uber Cash for Uber Eats or Uber Grocery, the process works similarly to when requesting a ride. After deciding on your order, you'll see your payment method right before confirming the order. You'll have to use an Amex card as your payment method in order to use your Uber Cash.

Again, you'll want to confirm that your Uber Cash is toggled on in your wallet if you do, in fact, want to make use of this balance.

However, again, if you plan to expense a meal through work, for instance, you may not want to use Uber Cash. In this case, ensure Uber Cash is toggled off, and you're using a credit card on file.

Related: How to maximize benefits with the Amex Platinum card

Bottom line

The monthly Uber Cash benefit on both the Amex Platinum and Amex Gold is one of the easiest for cardmembers to use and it can quickly help offset each card's annual fee. However, remember that this is a "use it or lose it" benefit, meaning your Uber Cash won't roll over into the next month.

The good news is that you have many use cases, including on Uber rides and Uber Eats orders, so you can easily get the most out of this benefit.

To learn more, read our full reviews of the American Express Gold and Platinum.

Apply here: American Express Gold

Apply here: American Express Platinum

For rates and fees of the Amex Platinum, click here.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app