Check your MileagePlus account: United deposits PQPs in Premier accounts

Editor's Note

If you qualified for United Premier status last year, this one is for you.

When United Airlines announced it would be harder to qualify for Premier status in 2023, it softened the blow by promising its Premier members a one-time deposit of Premier qualifying points for those who qualified in 2022. The offer then returned in February 2024 for status earned in 2023. Now, the offer is back for another year.

United has begun depositing these one-time PQPs for 2024 Premier members in their MileagePlus accounts for 2025.

How do the United PQP deposits work?

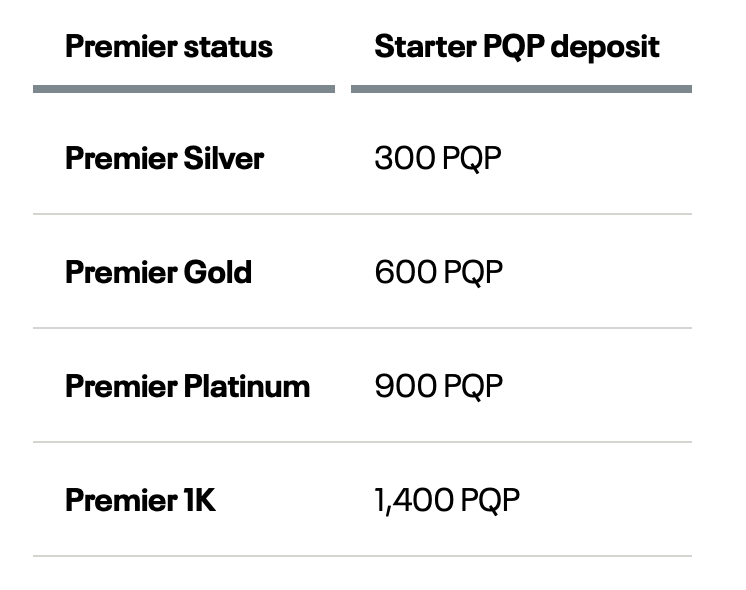

United is making one-time PQP deposits. Here's what you can expect, based on the status you qualified for in 2024:

- Premier Silver: 300 PQPs

- Premier Gold: 600 PQPs

- Premier Platinum: 900 PQPs

- Premier 1K: 1,400 PQPs

If you held full Premier status as of Feb. 1, 2025, you're eligible for a PQP deposit according to your status level.

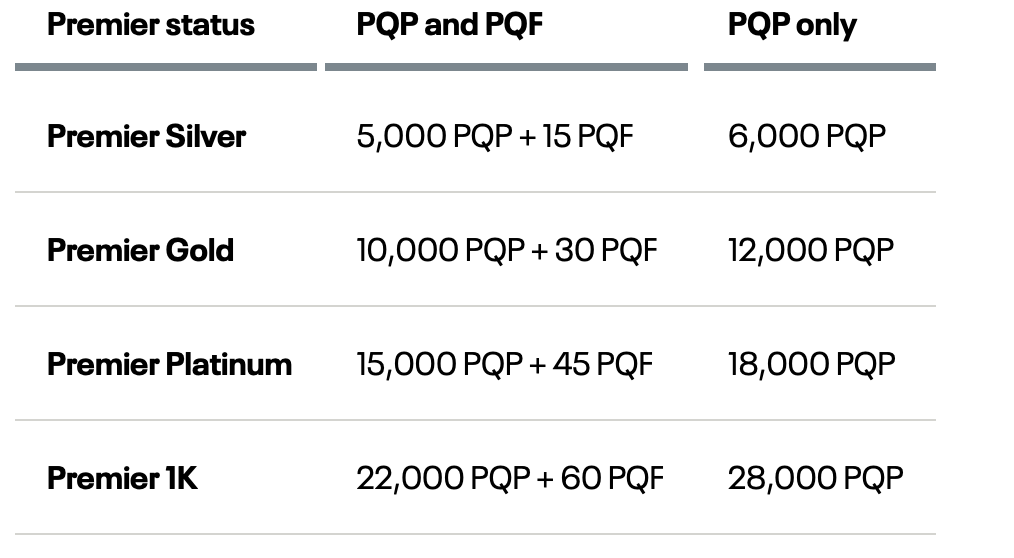

It's worth noting that these PQP deposits are slightly higher in 2025 than they were in 2024 across all four status levels — but the requirements to earn Premier status have also changed this year.

The above status qualifications also require flying a minimum of four segments during the calendar year.

Earn PQPs through eligible credit cards

You can also earn PQPs on spending with an eligible cobranded United credit card. United has changed the earning frequency, with 1 PQP earned per $20 spent on all eligible cards (this was previously $25) except the United Club℠ Card (see rates and fees) and United Club℠ Business Card (those two earn 1 PQP per $15 spent).

The information for the United Club Business Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: United's best-kept elite status secret: How to earn PQPs faster with partner flights

What if I buy up for United elite status?

While we generally don't recommend buying up to the next United status tier, how many PQPs will United deposit in your account if you do?

According to United's website, you'll earn the PQP deposit based on your Feb. 1, 2025, status. So, if you purchased the status buy-up before then, you'll receive the PQP deposit from your new status. Otherwise, expect a PQP deposit from the status you qualified for in 2024.

If you participated in a status match or challenge, you should receive a PQP deposit if you successfully qualified for Premier status before Feb. 1, 2025, per United's website. However, members who hold a trial status or those who have a challenge in progress are not eligible.

Related: The ultimate guide to earning elite status with United cards

What does this mean for Million Milers?

If you're a United lifetime Premier member, you'll receive a PQP deposit based on your corresponding status, even if you didn't fly in 2024.

Related: Is it worth pursuing lifetime elite status?

Bottom line

If you qualified for any level of United status last year, the airline has given you a "boost" toward status this year with some bonus Premier qualifying points. To find out what you've earned, check your United MileagePlus account for an entry labeled "Starter PQP."

Related reading:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app