United gives customers more time to use travel vouchers and flight credits

Update 9/1/21: United now allows customers to redeem Electronic Travel Certificates (ETCs) for flights operated by partner airlines, as long as your itinerary includes at least one segment operated by United or United Express. The text below has been updated to reflect this change.

United Airlines issues two types of travel credits, which customers can use to offset the cost of flights. I explain how each certificate works in this guide, and I'll run through the basics below.

The most common type, called a "future flight credit," is linked to a flight reservation — if you cancel your itinerary or move to a lower-cost flight, the balance remains intact until the expiration date. These particular credits can only be used by the original traveler, but they're valid for flights operated by both United and partners.

The other type of credit, Electronic Travel Certificates (ETCs), are typically issued as compensation for limited flight delays, cancellations and customer service issues. If you get "bumped" from a flight, for example, you'll be getting an ETC. These credits can be shared with other travelers, and can be used to book partner flights as long as your itinerary includes at least once segment operated by United and United Express.

Related: AA is making it much easier to redeem your existing travel credits

Now, United is extending both of these credit types, giving travelers more time to book a flight.

As the airline explains, "As part of an ongoing effort to offer more flexibility, we've extended the validity of eligible tickets and travel credits through Dec. 31, 2022. Tickets purchased January 1, 2022 and beyond will have a 12-month validity from the date of purchase."

Future flight credits issued between May 1, 2019, and Dec. 31, 2021, will now be valid through Dec. 31, 2022. Similarly, ETCs expiring between Aug. 1 and Dec. 31, 2021 will be valid through Dec. 31, 2022. Partially used tickets will remain valid for 12 months after the first flight in an itinerary.

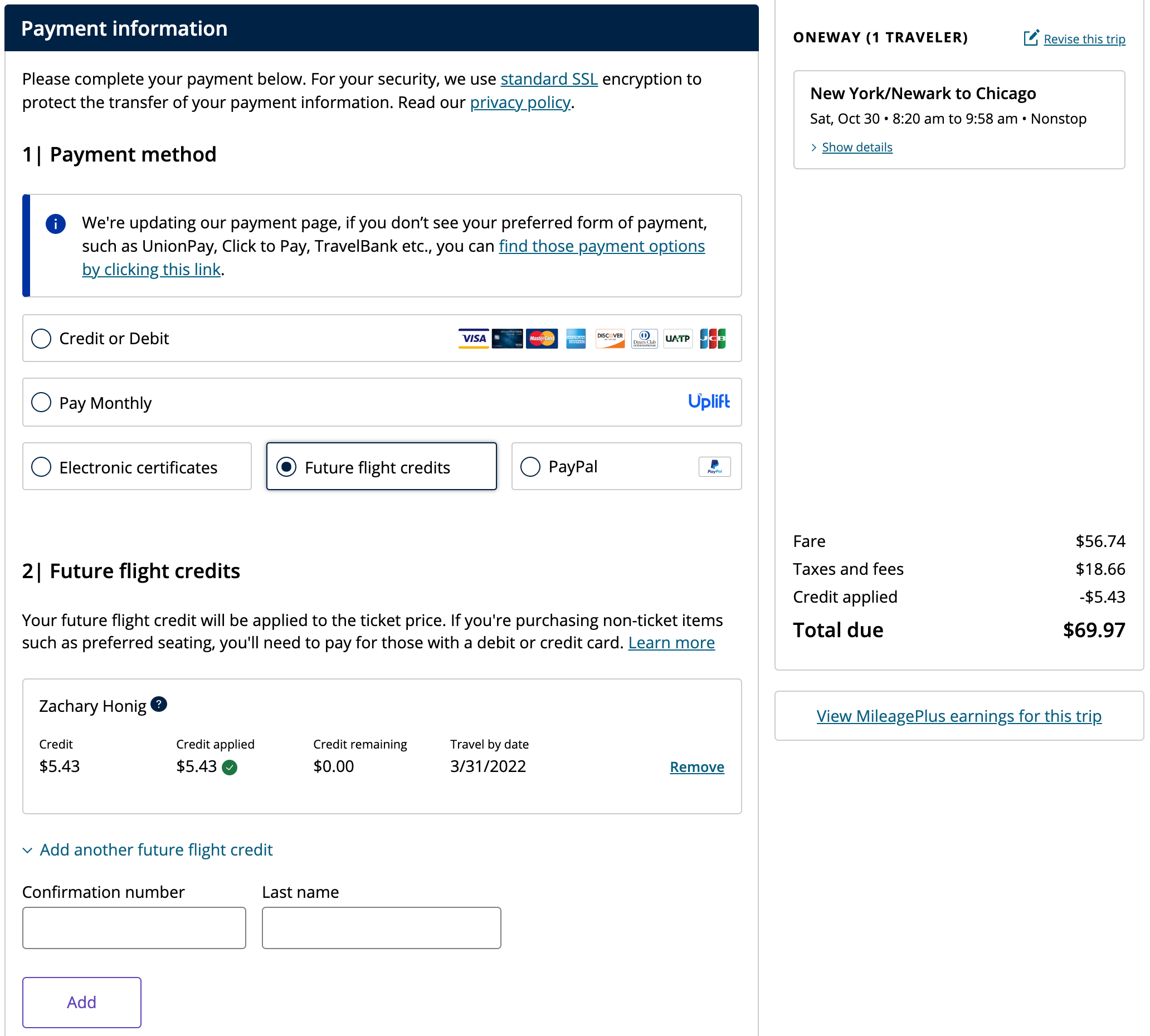

United recently made it easier to redeem credits online or via the airline's mobile app. Begin by selecting the flights you'd like to book — on the checkout page, you can select "Electronic certificates" or "Future flight credits" to apply the amount to your purchase.

Note that you can't mix these credit types for one booking, but you can combine multiple ETCs or multiple future flight credits to purchase one ticket. For the latter, you'll need to make sure the passenger's name matches exactly.

As a reminder, if the airline cancels your flight, you may be eligible for a full refund to your original form of payment. While carriers prefer that you accept a travel credit, you'll have more flexibility by requesting a full refund if it's due.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app