United’s dropping yet another US city, its 39th in just over 3 years

United is pulling out of yet another U.S. city, but this one is unlike many of the other 38 airports the airline dropped during the pandemic.

The Chicago-based carrier filed plans over the weekend to stop serving Westchester County Airport (HPN) as of June 30, as first seen in Cirium schedules and later confirmed by an airline spokesperson.

Over the years, a mix of United Express regional affiliates — including SkyWest Airlines, ExpressJet and Air Wisconsin — have served Westchester County from O'Hare International Airport (ORD) and Dulles International Airport (IAD). United stopped serving the IAD-to-HPN route in June 2012, leaving just one route from the airport to Chicago.

The airline is now cutting the Chicago flight in just about six weeks, and United will then close its HPN station, as shared in the following statement:

Since we have a limited number of regional jets and pilots to fly them, we regularly evaluate how best to use those resources to provide convenient service to smaller airports across the country. Based on this analysis, we have decided to suspend service between White Plains and Chicago starting 7/1. We've already begun proactively contacting our customers to offer them alternative flights to Chicago from LGA, EWR and other nearby airports.

United will cede all traffic on the ORD-to-HPN route to American Airlines, which continues to operate up to three daily flights under the American Eagle brand using the CRJ-700 regional aircraft, per Cirium schedules.

Both American and United operate hubs in Chicago, so American can continue offering flyers plenty of one-stop connections beyond O'Hare Airport.

Interestingly, American seems to have performed better than United in the ORD-to-HPN market, at least according to last year's Department of Transportation data. American carried 60% of passengers flying between the two airports at an average gross fare of $213; United carried the remaining 40% of flyers at a $202 gross fare.

As for United, White Plains is the latest city to lose service from the airline since the pandemic began.

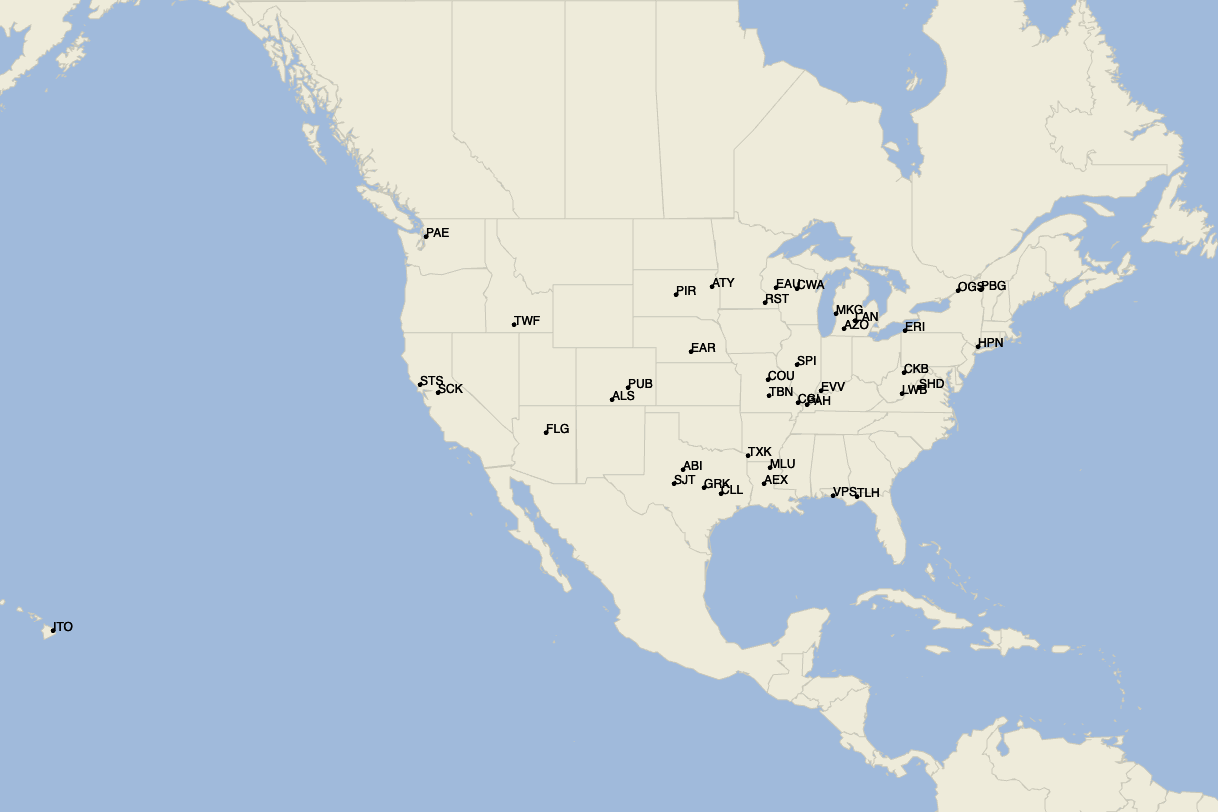

United has now dropped 39 pins from its domestic route map since March 2020. However, Westchester County is a pretty unique airport because its catchment area includes some parts of Connecticut that would otherwise require a two-hour car ride to the major New York City-area airports.

Moreover, HPN is a breeze to navigate, and many locals living within a few miles radius of the airport choose to fly from the airport — and possibly even add in a connection to their trip — instead of flying from the larger airports in the region.

Many other airports that United dropped during the pandemic include markets with significantly smaller population centers, such as Erie, Pennsylvania, and Mosinee/Wausau, Wisconsin.

That said, United has warned time and again that the pilot shortage is especially challenging for regional affiliates that have historically served as a stepping stone for budding aviators looking to jump-start their careers and eventually work at major U.S. carriers.

Airlines are working hard to develop a pipeline of future pilots, but the shortage isn't something they can fix overnight. Faced with no other choice, carriers — particularly United — have resorted to pulling out of small cities.

Since March 2020, American, Delta and United have all pulled out of a whopping 72 U.S. cities, according to network analysis conducted by the firm Ailevon Pacific Aviation Consulting. Of the "Big Three" U.S. airlines, United garnered the most headlines for what's been a major pullback in regional connectivity — now at 39 markets nationwide.

This includes a mix of cities like Destin-Fort Walton Beach, Florida; Lansing, Michigan; and Santa Rosa, California. The cuts even extend outside the continental U.S. to Hilo, Hawaii. Below is the full list.

United's 39 city cuts during the pandemic

Here is a list of all the U.S. cities United has exited during the pandemic, according to Cirium and Ailevon Pacific data:

- Abilene, Texas.

- Alamosa, Colorado.

- Alexandria, Louisiana.

- Cape Girardeau, Missouri.

- Clarksburg, West Virginia.

- College Station, Texas.

- Columbia, Missouri.

- Destin-Fort Walton Beach, Florida.

- Eau Claire, Wisconsin.

- Erie, Pennsylvania.

- Evansville, Indiana.

- Everett/Paine Field, Washington.

- Flagstaff, Arizona.

- Fort Leonard Wood, Missouri.

- Hilo, Hawaii.

- Kalamazoo/Battle Creek, Michigan.

- Kearney, Nebraska.

- Killeen/Fort Hood, Texas.

- Lansing, Michigan.

- Lewisburg, West Virginia.

- Monroe, Louisiana.

- Mosinee, Wisconsin.

- Muskegon, Michigan.

- Ogdensburg, New York.

- Paducah, Kentucky.

- Pierre, South Dakota.

- Plattsburgh, New York.

- Pueblo, Colorado.

- Rochester, Minnesota.

- San Angelo, Texas.

- Santa Rosa, California.

- Springfield, Illinois.

- Staunton/Waynesboro, Virginia.

- Stockton, California.

- Tallahassee, Florida.

- Texarkana, Arkansas.

- Twin Falls, Idaho.

- Watertown, South Dakota.

- White Plains, New York.

Related reading:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app