United, American up the ante in battle for Chicago supremacy

Chicago's O'Hare International Airport (ORD) is a hub for two of the largest U.S. carriers: American Airlines and United Airlines.

And while airlines frequently compete at key airports nationwide, hometown carrier United wants travelers to know that it's the best choice for people based in Chicago.

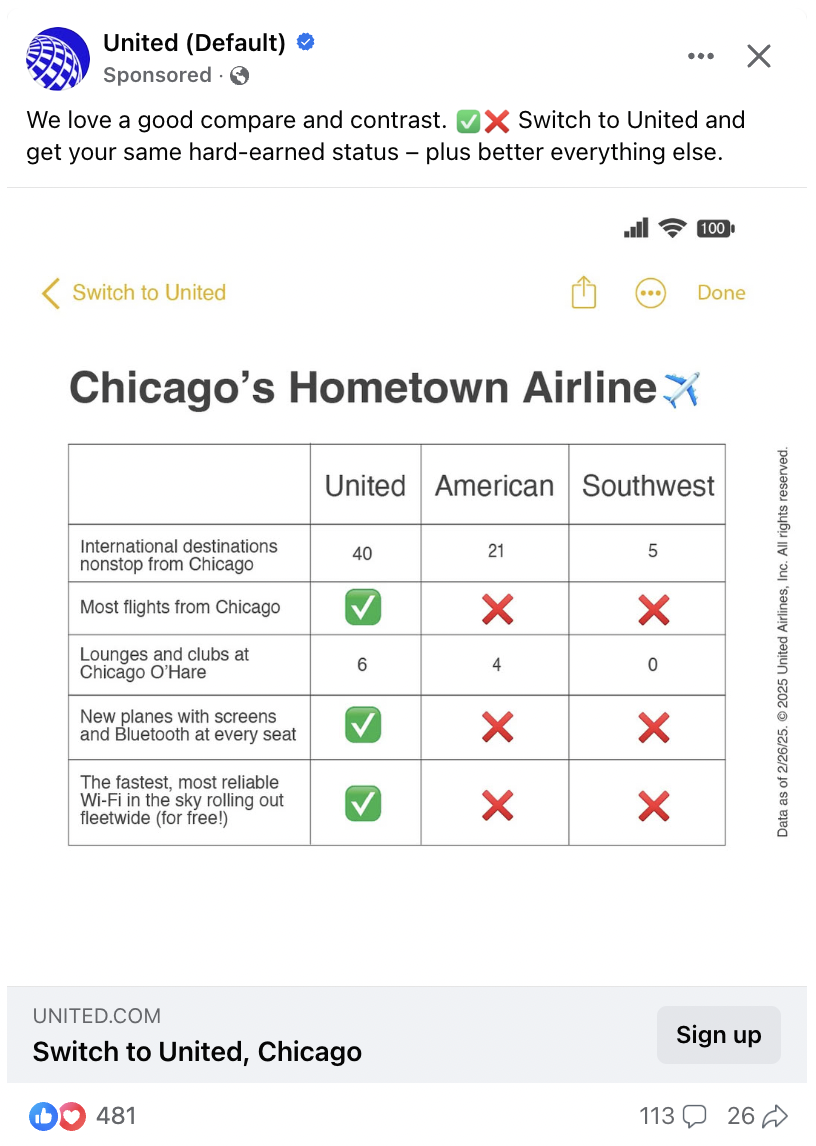

The airline recently rolled out an all-new localized marketing campaign that takes aim at American (and the rest of United's competitors in the city).

Landing gear in the kitchen? Touring United's renovated Chicago headquarters in the Willis Tower

It starts when travelers drive up to the airport and see United's prominent sign draping a pedestrian bridge telling travelers that it's the No. 1 airline in the city.

The carrier has also embarked on a digital campaign to inform travelers that it has more flights, international destinations and lounges than American or Southwest in Chicago. United even published an Instagram post that cites an American Airlines press release about American's double-digit growth in Chicago this year. (United says it has more.)

United's latest ad campaign is designed to woo flyers to choose it over American (or any other airline flying from Chicago). To that end, the airline is promoting its Premier status challenge program that awards competitor flyers temporary status with a shortcut to unlocking the full suite of elite benefits for a longer duration.

Depending on your status with American, United will match all the way up to Premier 1K.

Interestingly enough, American said just last week that it would add another new domestic flight in Chicago (to Idaho Falls, Idaho). The airline will also offer extended seasons to Kalispell, Montana, and Wilmington, North Carolina, giving leisure seekers access to more mountains and beaches from the city.

With this new service to Idaho Falls, American's Chicago flyers will have access to 10 new destinations in 2025. This joins a broader capacity increase by deploying larger aircraft with premium-cabin options on every flight from ORD. That growth brings American's ORD operation to 480 daily flights from this summer, with 25% more seats and 22% more departures than last year.

Meanwhile, United says it will fly more seats from Chicago than it has in the past 20 years. That translates to up to 585 flights per day to more than 200 total destinations — including 48 international and 17 long-haul flights.

But United's stats are poised to grow even more over the next few months.

The city of Chicago also preliminarily awarded United six additional gates at ORD earlier this year after it applied for the (hotly contested) real estate as part of an annual review of the airline's capacity and flying patterns. This lease will be firmed on June 1, but an airline spokesperson told TPG that it'll use the gates for additional growth, including two new long-haul destinations in the near future.

Andrew Nocella, United's chief commercial officer, elaborated on Wednesday's first-quarter earnings call:

"Our current facilities [in Chicago] are very full, and we know people want to fly in peak periods so these six gates will allow us to continue to execute on the United Next plan... We've been very consistent in our strategy here in Chicago, and as a result of that, we've got the six gates, and we're going to continue to grow. We think the economics of the hub look really darn good right now."

American Airlines, however, isn't happy about ceding ground in Chicago to United. For its part, the airline told TPG in a statement:

"American is committed to keeping O'Hare competitive, as our presence yields more extensive flight schedules for our Chicagoland customers and travelers from across the world, making the city a more desirable destination for business development. That's why we're rejecting the Chicago Department of Aviation's (CDA) improper trigger of the reallocation of gates at O'Hare — it's not only a violation of the agreement signed in 2018, but it stifles the competitive essence of the dual-hub by inhibiting our continued growth."

The airline said that this "improper trigger" relates to ORD's ongoing expansion project in the L gates that wasn't officially completed until late last month. American claims that under the terms of the master lease agreement, the airport authorities can't reallocate gates until this construction is finished.

Aside from rejecting the reallocation of gates, American is also taking a stab back at United — but without calling the carrier out by name. In a recent Instagram post of its own, the airline is touting why travelers should choose it from Chicago.

This isn't the first time United has run a localized marketing campaign to try to beat a competitor. The airline did a similar thing a few years back in Denver when it trolled Southwest's free-for-all (and soon-to-be-retired) boarding process in another targeted ad campaign.

Airlines don't often attack one another by name in advertising, but when they do, I always enjoy seeing what happens next.

Related reading:

- United Airlines MileagePlus: Guide to earning and redeeming miles, elite status and more

- Best United Airlines credit cards

- United Premier status: How to earn it — and is it worth it?

- Maximize your airfare: The best credit cards for booking flights

- The best credit cards to reach elite status

- United basic economy: What you need to know about bags, seats, boarding and more

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app