Do Southwest A-List Bonus Points Count Toward the Companion Pass?

"Reader Questions" are answered twice a week — Mondays and Fridays — by TPG Senior Writer Julian Mark Kheel.

There are fewer ways nowadays to earn the 110,000 points required to get a Southwest Companion Pass. But TPG reader Alex wondered if having Southwest elite status might make things a little bit easier?

[pullquote source="TPG Reader Alex"]Do the double points from A-List Preferred count toward Companion Pass?[/pullquote]

When you purchase a ticket on Southwest, you'll normally earn more points per dollar by buying more expensive fares. The cheapest Wanna Get Away fares earn 6 points per dollar, while the more pricey Anytime tickets get 10 points per dollar and Business Select fares earn the most at 12 points per dollar.

But if you have either A-List or A-List Preferred status on Southwest, you'll get extra bonus points on top of those base points. A-List members get a 25% bonus on points earned from flying, while A-List Preferred elites earn a full 100% bonus on each flight. So if you're A-List Preferred and earning double points on all your Southwest flights, you would think that'd mean you'd earn a Companion Pass in half the time, right?

Well, not quite. While Southwest Rapid Rewards is a single loyalty program, within that program are essentially three distinct types of points: redeemable points, Tier Qualifying Points and Companion Pass-qualifying points. And just because a particular activity counts as one type of point doesn't mean it always counts as the others as well.

In this case, what we're interested in knowing is what types of points count as Companion Pass-qualifying. We can find out by taking a close look at the Southwest Companion Pass terms and conditions:

Companion Pass qualifying points are earned from revenue flights booked through Southwest®, points issued on Southwest Rapid Rewards® Credit Cards, and base points earned from Rapid Rewards Partners in a calendar year. Purchased points, points transferred between Members, points converted from hotel and car loyalty programs, and e-Rewards, e-Miles, Valued Opinions, and Diners Club, points earned from Rapid Rewards program enrollment, tier bonus points, flight bonus points, and Partner bonus points (excluding bonus points earned on the Rapid Rewards Credit Cards from Chase) do not qualify as Companion Pass qualifying points. [emphasis added]

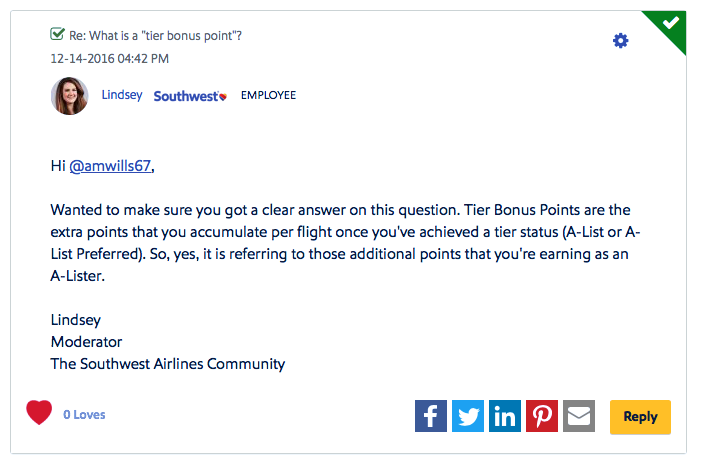

And if there's any confusion about what constitutes tier bonus points, Southwest has clarified that in its community forum:

So unfortunately the answer is no — your A-List or A-List Preferred bonus points will not count toward the Companion Pass. As of now, the only points that do count are the base 6-12 points per dollar spent from flying, base points earned from Southwest partners like Rapid Rewards Dining and the Rapid Rewards Shopping portal, and points earned from the Southwest Rapid Rewards credit cards.

While you won't be able to get a Companion Pass any faster with your A-List Preferred status, Alex, in the meantime you can always use those extra bonus points you're earning to book award tickets for your companion. Thanks for the question, and if you're a TPG reader who'd like us to answer a question of your own, tweet us at @thepointsguy, send us a message on Facebook or email us at info@thepointsguy.com.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app