Super Typhoon Lan Could Make Direct Hit on Tokyo

Update: Some offers mentioned below are no longer available. View the current offers here.

2017 has seen more than its fair share of highly destructive natural disasters, with neither the Atlantic or Pacific cyclone regions out of the woods yet. Currently brewing in the Eastern Pacific is Super Typhoon Lan, which could make landfall in Japan as early as October 22.

Packing sustained winds of 130 knots (150 mph) — with gusts up to 160 knots (184 mph) — Super Typhoon Lan is forecasted to make a direct hit on Tokyo around 8am local time Monday morning. The center of the storm is currently expected to pass 18 nautical miles (21 miles) away from Tokyo's Narita Airport (NRT).

The storm will likely wreak havoc on flights in and out of the region, including Tokyo-bound US flights departing on Saturday and Sunday. Many airlines have issued travel waivers allowing free flight changes.

Remember: If you are stuck somewhere due to a storm, airlines aren't responsible for paying for meals or hotels in the case of weather-related delays/cancellations so take advantage of this offer.

We recommend paying for flights with cards have flight delay/cancellation insurance that will reimburse you for weather issues, including the Citi Prestige ($500 per ticket for 3+ hour delay), the Chase Sapphire Reserve ($500 per ticket for 6+ hour or overnight delay) and Chase Sapphire Preferred ($500 per ticket for 12+ hour or overnight delay).

My Citi Prestige card personally came in handy earlier this season when I got stuck in Nagoya, Japan due to a typhoon-related flight cancellation, netting me $1,000 on a flight delay insurance claim.

As of publishing, here are the waivers issued for Super Typhoon Lan:

American Airlines

- Travel dates: October 22

- Airports affected: Nagoya, Japan (NGO); Okinawa, Japan (OKA); Osaka Kansai, Japan (KIX)

- Must have ourchased your ticket by October 20

- Rebook travel anytime between October 21-23

- You can't change your origin or destination city without being assessed a fare difference. Must rebook in same cabin or pay the difference.

- Travel dates: October 23

- Airports affected: Nagoya, Japan (NGO); Tokyo Haneda, Japan (HND); Tokyo Narita, Japan (NRT)

- Must have purchased your ticket by October 20

- Rebook travel anytime between October 22-24

- You can't change your origin or destination city without being assessed a fare difference. Must rebook in same cabin or pay the difference.

Delta

- Travel dates: October 22-24

- Airports affected: Fukuoka, Japan (FUK); Nagoya, Japan (NGO); Osaka, Japan (KIX); Tokyo Haneda, Japan (HND); Tokyo Narita, Japan (NRT)

- Rebooked travel must begin no later than October 27

- When rescheduled travel occurs beyond October 27, the change fee will be waived. However, a difference in fare may apply. Final travel must be completed by end of ticket validity, one year from date of original issue.

- If travel cannot be rescheduled within these guidelines, customers may cancel their reservation and apply any unused value of the ticket toward the purchase of a new ticket for a period of one year from the original ticket issuance.

United

- Travel dates: October 22-24

- Airports affected: Fukuoka, Japan (FUK); Nagoya, Japan (NGO); Osaka, Japan (KIX); Tokyo Haneda, Japan (HND); Tokyo Narita, Japan (NRT)

- The change fee and any difference in fare will be waived for new United flights departing on or before October 31, as long as travel is rescheduled in the originally ticketed cabin (any fare class) and between the same cities as originally ticketed.

- For wholly rescheduled travel departing after October 31, or for a change in departure or destination city, the change fee will be waived, but a difference in fare may apply. Rescheduled travel must be completed within one year from the date when the ticket was issued.

ANA

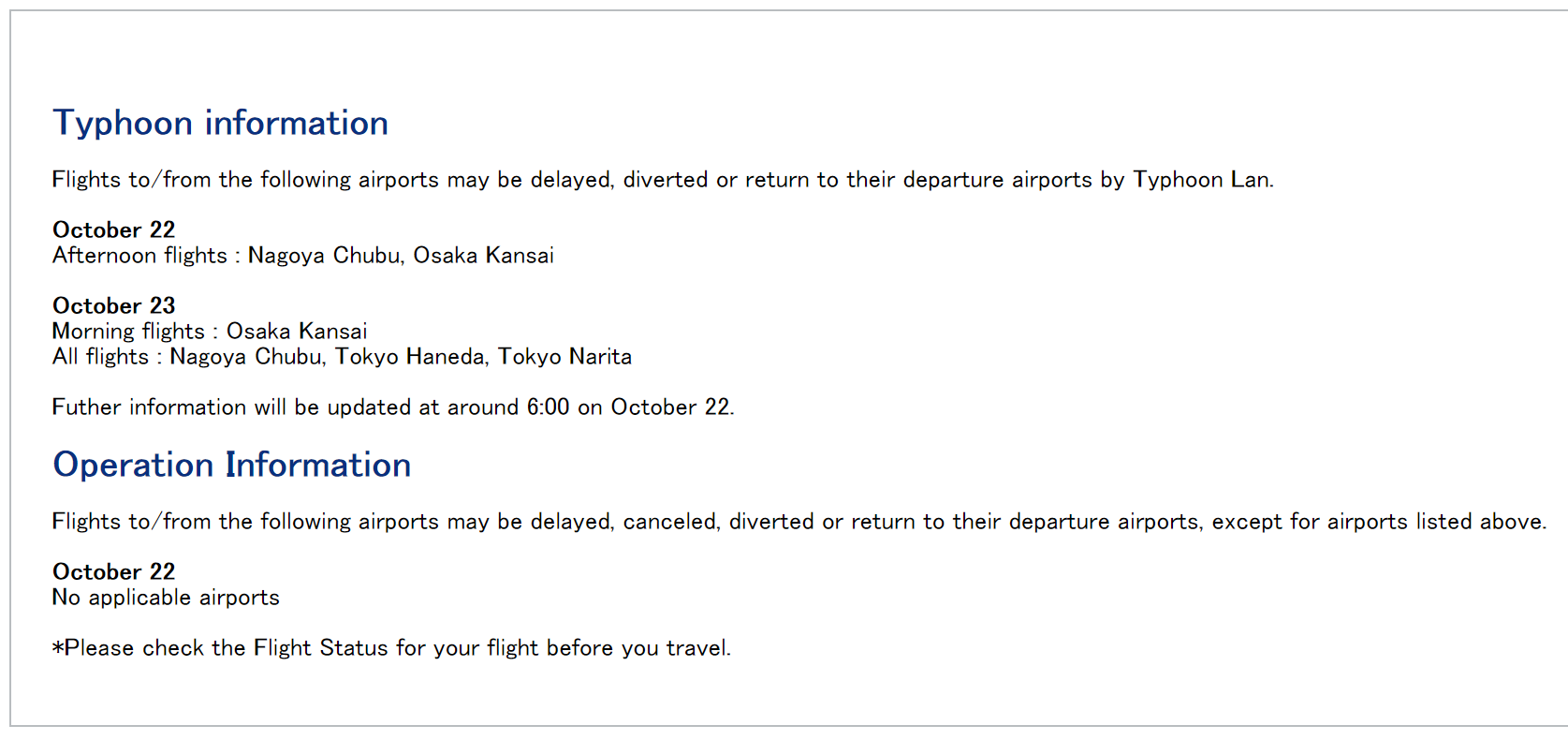

ANA isn't allowing free flight changes at this time. It's merely noting which airports "may be delayed, diverted or return to their departure airports by Typhoon Lan."

Japan Airlines

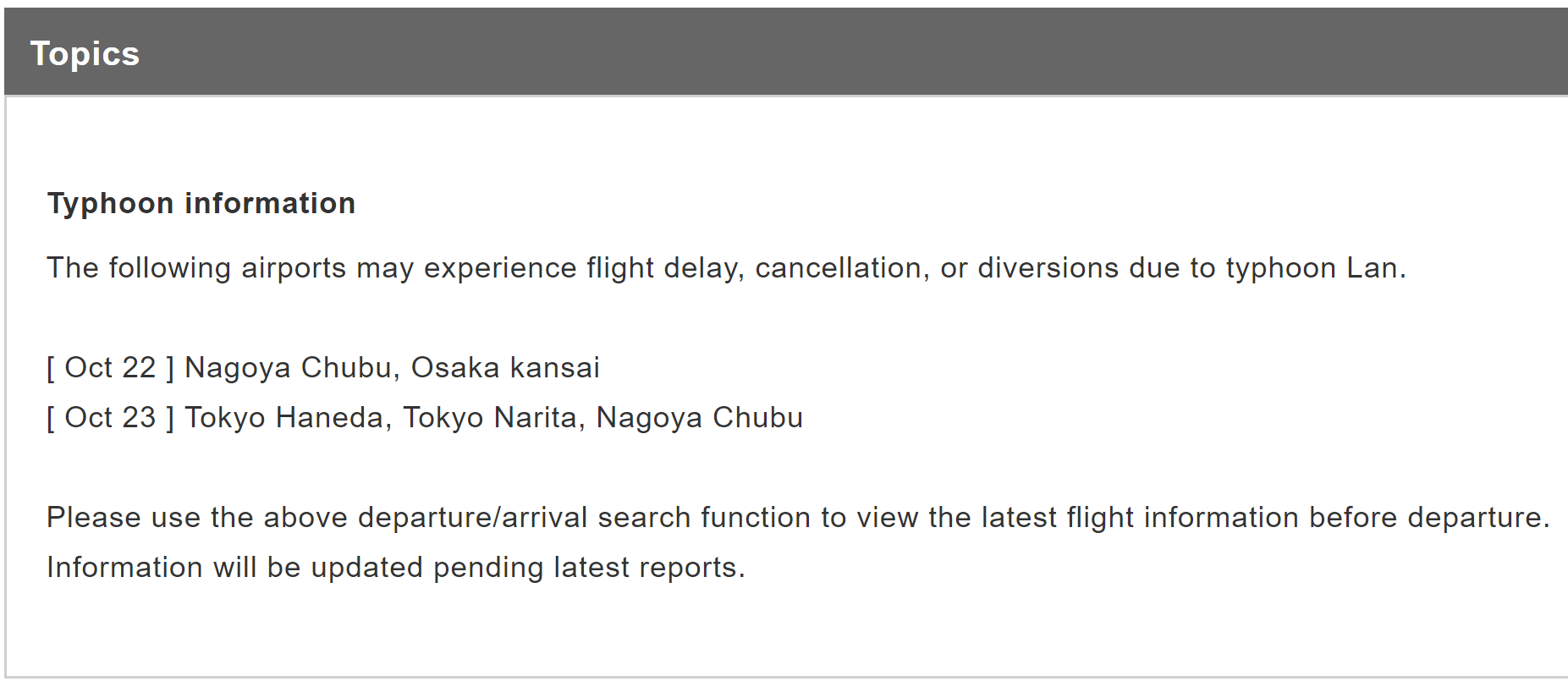

Similarly, Japan Airlines isn't allowing free flight changes at this time. It's merely noting which airports "may experience flight delays, cancellations, or diversions due to Typhoon Lan."

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app