No, Southwest didn't devalue its Rapid Rewards program overnight

Each month TPG publishes a comprehensive set of valuations for most loyalty programs. We're constantly tweaking the metrics we use to inform the values, and we always take into account recent news or devaluations in our updates.

On the surface, Southwest seems to have changed the value of its points yesterday, March 28. But when you dig deeper, you realize that nothing's actually changed.

An eagle-eyed TPG Lounge member posted that they were looking to use their points for an upcoming flight. When they searched a few days ago, the price was either $49 or 2,468 Rapid Rewards. Today, when they looked, the fare dropped to $45, but the cost in points climbed to 2,652 Rapid Rewards.

Related: How to redeem points with the Southwest Rapid Rewards program

If you compare the value in each case, you'll notice what appears to be a steep decline in value.

| Date of price quote | Fare in dollars | Fare in Rapid Rewards | Value of Rapid Rewards |

|---|---|---|---|

March 27 | $49 | 2,468 + $5.60 | 1.76 cents per point |

March 29 | $45 | 2,652 + $5.60 | 1.49 cents per point |

Though Southwest points have always been a variable currency (meaning that the value isn't fixed at a certain number), this alleged overnight devaluation was concerning.

Well, there's an explanation for this that's not the airline's fault. Instead, it lies squarely with the U.S. government.

Related: 7 ways the big US airlines should help customers after a bailout

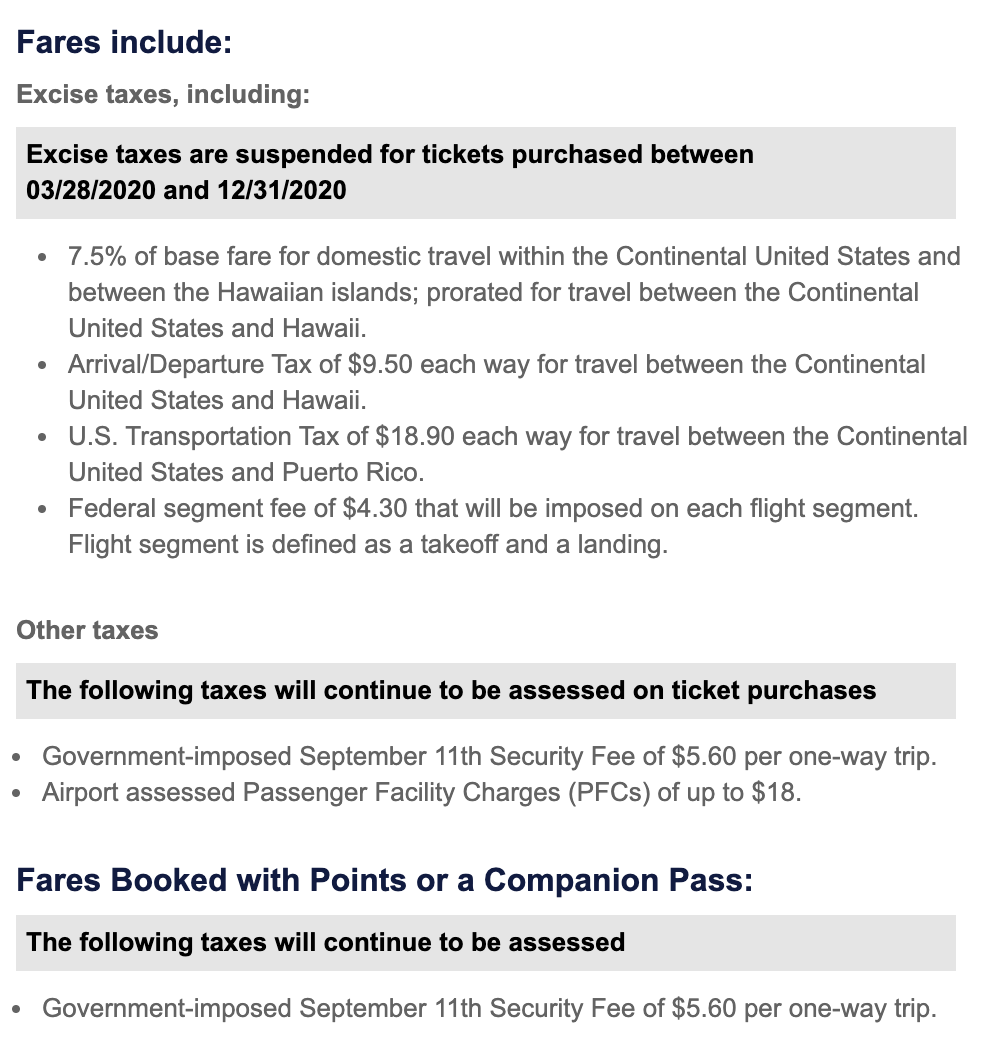

To help the airlines struggling financially amid the coronavirus pandemic, the feds have suspended some of the excise taxes for tickets purchased between March 28 and Dec. 31.

Though there's still a security fee of $5.60 per one-way trip, as well as possible airport-assessed facility surcharges, most of the other government taxes have been paused.

And there's one other unique peculiarity to Southwest points purchases: the number of points required has always been tied to the base fare sans government imposed taxes (except the $5.60 security fee). That's why it's most valuable to redeem points for the cheapest tickets, where the base fare is low relative to the fixed taxes.

For more travel tips and news, sign up for TPG's daily email newsletter

So now let's look back at the two pricing examples from above. Last week, when the reader priced the flight, the total fare was $49, which included lots of taxes. And since the number of points required is tied to the base fare without taxes, the cost in points was just 2,468.

And now that most airfare taxes have been suspended for the rest of the year, the total fare of $45 is actually much closer to the base fare of the ticket. So even though the fare decreased by $4 over the course of a week, the cost in points actually increased. That's because the base fare has increased, as there's much less tax included in the total fare.

Bottom line

Though it appears that the value of Southwest Rapid Rewards has decreased overnight, that's not actually the case. Instead, the government's suspension of most excise taxes has changed the cost structure of tickets.

The cost of points tickets is tied to the base fare on Southwest, excluding most taxes. And now that the feds have lowered the tax on airfare, the prices you see on Southwest.com are actually much closer to the base fare than before.

As such, the cost of Rapid Rewards tickets has increased on paper, since the points required is tied directly to the base fare.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app