Southwest Just Made It Really Easy to See if Your Flight Cost Changed

Family-friendly airline Southwest is beloved by many for the most flexible change policies in the industry, which allow you to change your flights at any point before the time of travel with absolutely no fees. You'll simply pay the price difference in cash or points – or even better, you'll receive a refund (if paying with points) or travel credit (if paying with cash) if the new price is lower than what you originally paid. However, it can be a little bit tedious to track what you originally paid for a flight because you'll have to dig through each individual booking or check your booking confirmation email in order to figure that out.

#firstworldproblems, I know, I know. But Southwest now even has a fix for that. The website has a new feature that allows you to see the updated price points for alternative routes on your booked trip.

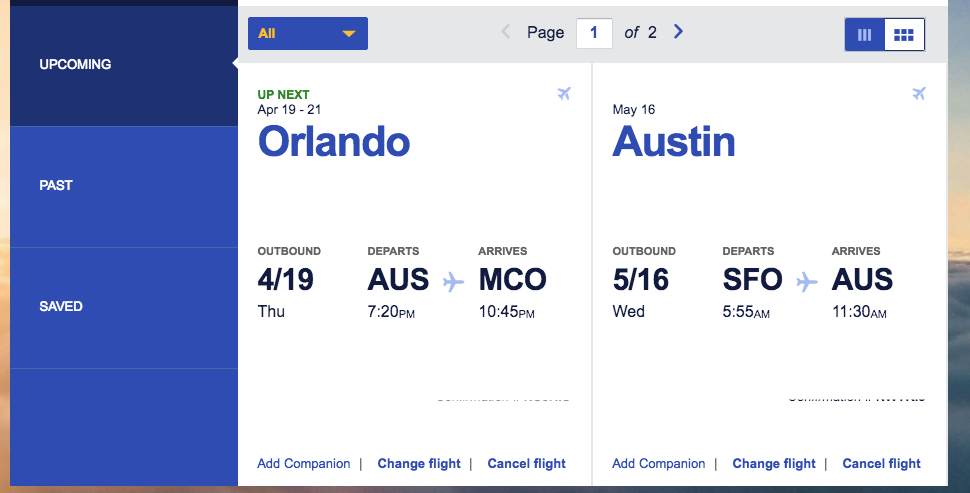

I tested out the new tool with a few upcoming itineraries of my own. I'm going to Orlando (MCO) this week, departing Austin (AUS) on Thursday and returning on Saturday. To double check on the price point for this trip, I logged into my Rapid Rewards account on the Southwest website, then selected "Upcoming Trips" under the "My Accounts" tab. Once there, I clicked on the "change flight" link at the bottom of the trip summary. From there, I once again clicked on "change reservation" toward the top right of the trip summary, which led me to a page that allowed me to select the relevant leg of the trip because you can opt to change both inbound and outbound flights or just one of them.

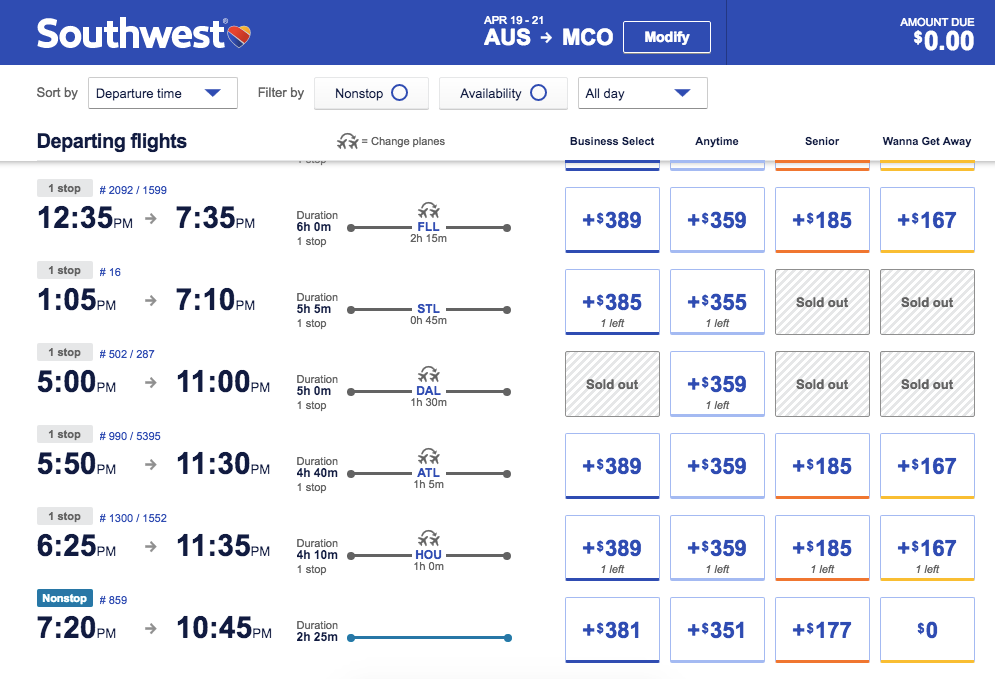

This link led me to a page that displayed all of my alternate travel options for the dates selection. It also showed that the current option I booked for my nonstop 7:20pm flight has a fare difference of $0, meaning the price has neither gone up nor down. You'll see that every other route costs at least $167 more. My return flight showed the same results, so I know that I booked the best rate available, then and now.

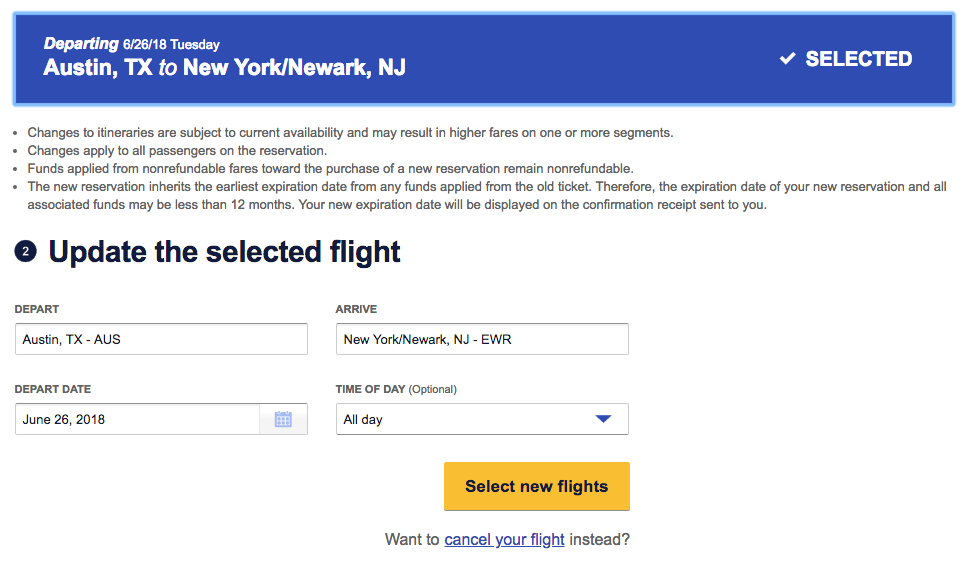

I also tested out the new tool with a points-booked flight for June. For this flight, which I'm using to position myself for an awards flight booked to Europe, I wanted to see if changing my flight time would save me some points. So once again, I logged in and selected "change reservation."

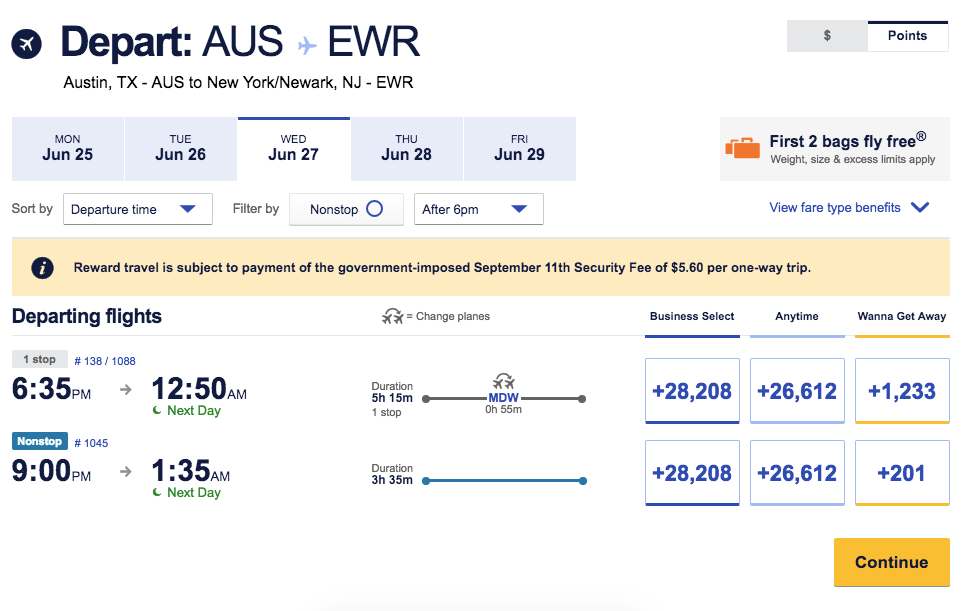

The early morning nonstop I already booked now costs an additional ~3,500 Rapid Rewards points for the same route, while the 9:00pm nonstop route is only 201 points more.

It's important to remember that if you choose to modify a cash fare for an Anytime or Business Select fare on Southwest, you can no longer receive a refund – the money you originally paid will only be able to be used as a travel credit that is valid for one year from the original booking date. You'll still be able to change the ticket for different times and dates, but those funds won't ever go back to your credit card. Thus, it makes more sense to just cancel Anytime or Business Select fares outright because you can immediately rebook them to the updated price point and/or schedule that you want.

H/T: Frequent Miler

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app