Southwest unveils extra-legroom perks for credit card holders, new names for all fares

It's been a dizzying few months for Southwest Airlines, from its shift away from open seating to its new checked bag fees that take effect next month.

And the changes aren't done.

On Monday, the Dallas-based carrier announced a handful of new perks for its frequent flyers and credit card holders that'll take effect once the airline launches assigned seating in 2026.

Southwest is planning to rename all of its fare products once assigned seating begins — not just its hallmark Wanna Get Away fare, which will become the airline's new Basic (aka basic economy) class next month.

Plus, the airline revealed its highest-end credit card holders — like its elite status members — will be able to select its new Extra Legroom seats in the not-too-distant future.

Meanwhile, TPG has learned Southwest is mulling new "soft product" services it'll offer flyers who select its more spacious seats.

And one of the airline's top executives is shedding light on why Southwest decided to ditch its one-of-a-kind boarding process.

Here's a rundown of all the changes to know about.

New fare products

For starters, Southwest on Monday announced it will rename all of its fare classes once it shifts to assigned seating.

We already knew Wanna Get Away would become Basic. That will happen when the carrier starts charging checked bag fees, which will apply to flights sold from May 28 onward.

Then, later this year:

- Wanna Get Away Plus will become Choice.

- Anytime will become Choice Preferred.

- Business Select will become Choice Extra.

The three "choice" fares will go on sale sometime between July and September, when Southwest starts selling assigned seats for flights departing in early 2026.

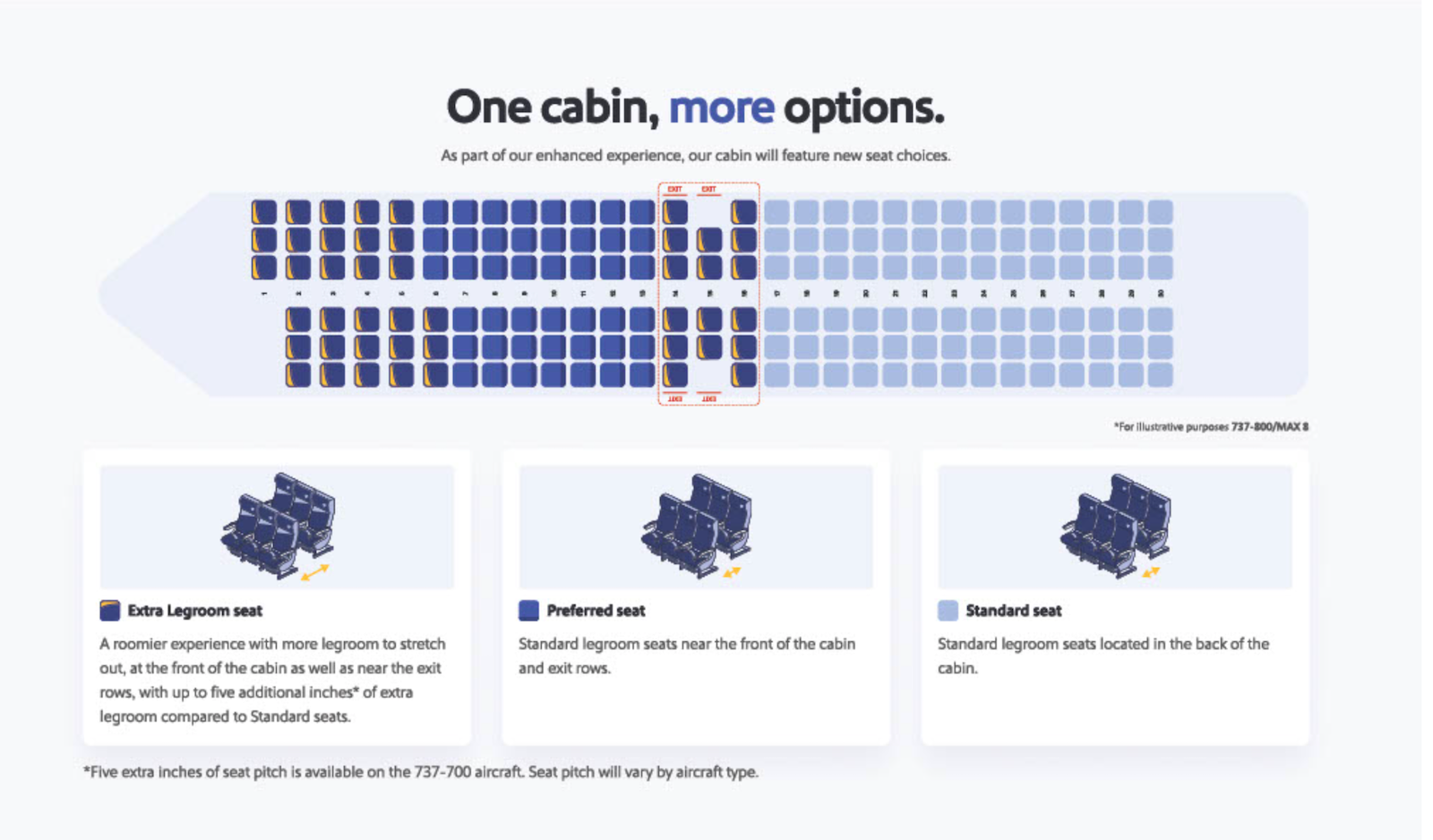

New seat types

The benefits you'll get with Southwest's renamed fare classes will actually look quite similar to the benefits of its current fare products — that is, the revamped fare classes the airline announced last month when it pivoted to bag fees and shook up Rapid Rewards earnings rates.

The fare you select will dictate the row of the plane you'll be able to access.

Starting next year, Southwest plans to designate three types of seats:

- Extra Legroom (first five rows of the aircraft, and three rows around the midcabin exit door)

- Preferred (standard rows situated closer to the front of the aircraft)

- Standard (the seats in the back of the plane)

The seats themselves will all be standard coach seats, so we're not exactly talking about the difference between economy and lie-flat business class — but this will figure into how much legroom, or how close to the front of the aircraft, you'll be.

Here's the full picture of Southwest's updated fares and benefits:

| Benefit | Choice Extra | Choice Preferred | Choice | Basic |

|---|---|---|---|---|

Previously | Business Select | Anytime | Wanna Get Away Plus | Wanna Get Away |

Effective | Goes on sale in the third quarter of 2025, for 2026 flights | Goes on sale in the third quarter of 2025, for 2026 flights | Goes on sale in the third quarter of 2025, for 2026 flights | Goes on sale May 28 |

Seat selection | Extra Legroom (or any seat) | Preferred (or any standard seat) | Standard | Not included; standard seat assigned at check-in |

Checked bags (starts May 28) | Two free | Costs extra | Costs extra | Costs extra |

Rapid Rewards earnings (same as what TPG reported in March) | 14 points per dollar | 10 points per dollar | 6 points per dollar | 2 points per dollar |

Boarding | Early | Earlier group within general boarding | General boarding | Last to board |

No cancellation fees | √ | √ | √ | √ |

Refundability | Fully refundable | Fully refundable | Transferable flight credit | Nontransferable flight credit |

Flight credit expiration | 12 months | 12 months | 12 months | Six months |

Itinerary changes | √ (fare difference) | √ (fare difference) | √ (fare difference) | - |

Same-day changes/standby | √ | √ | √ | - |

Free inflight entertainment | √ | √ | √ | √ |

Priority/express lane access | √ | √ | - | - |

Free premium drink in flight | √ | - | - | - |

Free inflight Wi-Fi | √ | - | - | - |

Credit card benefits

As part of Monday's announcement, Southwest revealed a few new perks with its credit card portfolio.

Once assigned seating begins, members with the Southwest Rapid Rewards® Priority Credit Card (see rates and fees) and Southwest® Rapid Rewards® Performance Business Credit Card (see rates and fees) will be able to upgrade an Extra Legroom seat within 48 hours of departure (when available).

But all Southwest cardholders will, at a minimum, be able to select a seat for free on every flight within 48 hours of departure (when available).

That goes even for passengers flying on a Basic fare. Remember, for standard passengers, basic economy won't come with seat selection in the future.

Here are the updated card benefits:

| Card | Extra Legroom seat selection | Preferred seat selection | Standard seat selection |

|---|---|---|---|

Within 48 hours of departure | At booking | At booking | |

- | Within 48 hours of departure | Within 48 hours of departure | |

| - | - | Within 48 hours of departure |

The information for the Southwest Rapid Rewards Premier and Southwest Rapid Reward Plus Business has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Checked bag benefits, too

Plus, effective May 28, every Southwest cardholder will get a free checked bag, and so will up to eight companions traveling on the same reservation.

Larger card 'refresh' to come

Expect more card-related announcements to come soon; the airline is framing these card changes as part of an overall "refresh" of its card portfolio, after recently reaching an amended deal with Chase.

The airline didn't rule out an annual fee increase in the near future — but also teased new bonus categories that could allow cardholders to earn more points for everyday spending.

"That's an area of our card that we feel like we can do better at," Southwest Executive Vice President of Customer and Brand Tony Roach told TPG. "If you use your card for your top-of-wallet purchases, you're going to earn more."

A-List elite status

As TPG reported in recent months, elite status at Southwest will come with a few new perks related to the airline's updated seating, baggage and boarding policies.

Here's a reminder of how A-List and A-List Preferred baggage and seating perks will shake out:

| Status | Baggage benefit | Extra Legroom seat selection | Preferred seat selection | Standard seat selection |

|---|---|---|---|---|

A-List Preferred | Two free checked bags | At booking | (included) | (included) |

A-List | One free checked bag | Within 48 hours of departure | At booking | (included) |

Begins | When checked bag fees launch May 28 | When assigned seating begins (flights in 2026) | When assigned seating begins (flights in 2026) | When assigned seating begins (flights in 2026) |

Most other A-List perks will remain unchanged, from priority lane access on the ground to up to two free premium inflight drinks for A-List Preferred members.

Boarding benefits

One additional benefit for both A-Listers and cardholders: They'll get access to earlier boarding groups.

In recent weeks, Southwest revealed plans to shift away from its classic single-file boarding process — and ditch those silver, numbered posts in the boarding area. That's after airline executives told me in January the carrier hoped to keep the spirit of its unique boarding procedures in place.

The process, Roach said, will now look quite similar to those found at other airlines, with eight groups now planned.

"Just kind of what everybody else is used to," Roach said, explaining the thinking. "We expect there will be a lot of customers that will be new to Southwest, because, frankly, they've told us, 'Once you go to assigned seating I'll consider you.'"

What about Companion Pass?

Rapid Rewards members who earned the airline's coveted Companion Pass will be able to extend their boarding, bag and seat selection privileges to their designated companion.

Additional services in the Extra Legroom section?

Southwest executives have maintained the new Extra Legroom seats are not meant to resemble a full first-class cabin with hot meals and the like.

But Roach told TPG the carrier is mulling some new, elevated benefits for its more spacious rows.

"We are looking at things like enhanced snacks, a more elevated experience for customers that choose to buy the extra fare," he said. "You can expect it to be not just extra-legroom seats, but come with something extra in all the soft products."

No restrictions on full-size carry-ons

Checked bag fees are a sizable change for customers, on their own. At least for now, Southwest is not implementing restrictions on full-size carry-on bags — something a handful of its competitors have done, historically, on basic economy fares (United Airlines still does it).

"We looked at it," Roach said. "But it wasn't something that we decided to do."

So, if you're not an A-List member, a cardholder and want to fly basic economy, you can always carry your bag onto the plane ... assuming, of course, that everything inside meets the Transportation Security Administration's 3-1-1 liquids rules.

Related reading:

- Your complete guide to maximizing Southwest Rapid Rewards

- The best Southwest Airlines credit cards

- How to quickly earn the Southwest Companion Pass

- Southwest A-List status: What it is and how to earn it

- Maximize your airfare: The best credit cards for booking flights

- The best credit cards to reach elite status

- How to change or cancel a Southwest Airlines flight

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app